This research paper aims to share insights on the evolution of yield farming strategies, targeting crypto professionals and DeFi amateurs. For those who need explanations of basic DeFi concepts, please check out Finematics’ introduction to yield farming and liquidity pools.

Yield farming, also known as liquidity mining, is a crypto innovation that started a few years ago. It is a concept of liquidity pools (LPs)¹ incentivizing yield farmers² to provide liquidity in exchange for some rewards in the form of interest (trading fees) paid on the loans by borrowers on the other side of the LPs. Yield farmers also receive LP tokens that represent their share of the pools. While their LP tokens are locked, they will earn the extra yield offered by the platform. When they want to withdraw their funds, they would need to return the LP tokens in exchange for their deposited funds and accrued rewards.

Yield farming was fashionable and attracted mainstream attention at lightning speed because it offered insanely high yields. According to Google Trends, the word “yield farming” generated “interest”³ as high as 86 in the second half of 2020.

Compared to interest rates earned from traditional bank savings accounts, the passive income earned from the yield on LPs was hundreds of times more. In the early days, yield farming yields easily went over 100%. Some platforms even offered an annual percentage yield (APY) of over 1,000%. For instance, Yearn Finance ($YFI) gave as high as a 1,600% yield back in 2020.

When the LPs were still nascent and yield farming was still a new idea, financial, operational, rug pulls and smart contract risks were high. But the outsized returns usually make them veiled and Defi users could experience huge losses with yield farming. Like Mark Cuban said,

“yield farming is not much different than buying high-dividend paying stocks or high-yield unsecured debt or bonds.”

After a few months, as more people knew about the strategy, the yield declined. That is why yield farmers are usually secretive about their strategies. As of now, the yield of LPs is around 2–10%. According to Uniswap, the LP yield of $YFI has plummeted to 10% or lower (as of Jul 4, 2022).

How leveraged yield farming had begun and evolved is truly fascinating. Through experiencing and interacting with protocols first-hand from the very beginning of the DeFi era, re:base ventures has developed insights into the evolution of yield farming in crypto. Overall, yield farming products and strategies have gone through multiple “generations”.

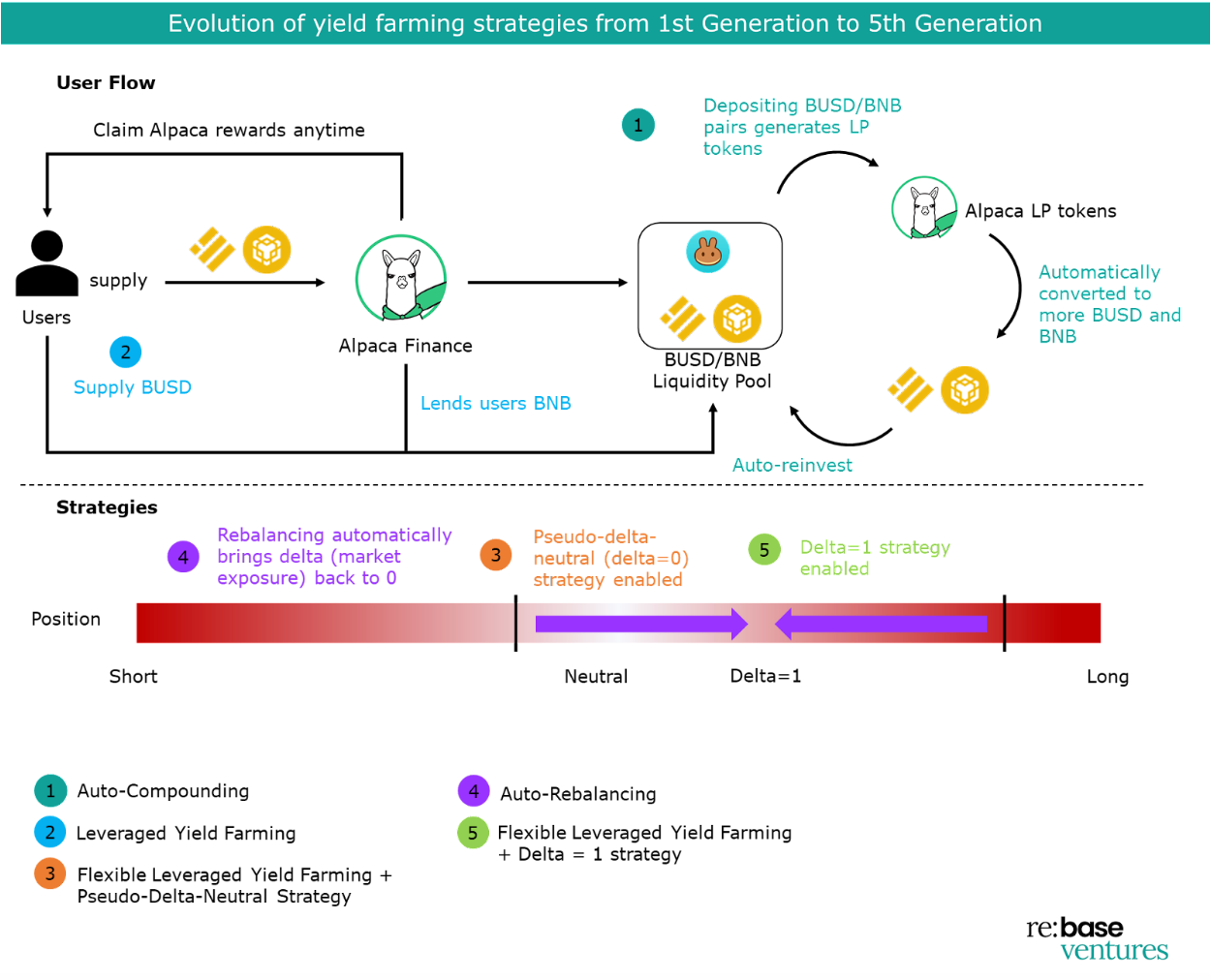

In summary, the evolution of yield farming strategies from 1st Generation to 5th Generation is depicted below:

1st Generation — Auto-Compounding

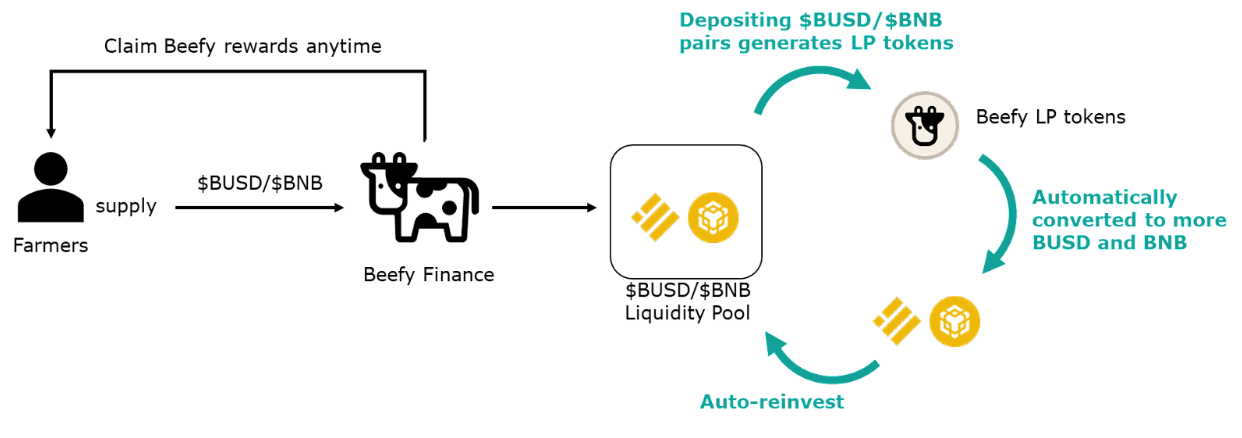

Instead of collecting your LP tokens and letting them sit idle or manually reinvesting them into the pool, you can passively earn income indefinitely on yield aggregators like Yearn Finance and Pickle Finance, which automate the process and alleviate position maintenance for you. With the compounding effect, the yield earned by farmers is changed to APY⁴ from APR⁵. On top of that, you save transaction costs. Yield aggregators combine your funds with other yield farmers’ funds before depositing the total sum into liquidity protocols, hence the transaction fee is spread among the yield farmers in the same vault. Everytime the protocol or the third-parties auto-reinvest for the farmers, they take a share of the farming yield as an incentivizing fee. Generally, as long as the farming yield is larger or equal to the incentivizing fee, then it makes sense for the farmers to re-invest their yield.

Some of the representative protocols are Autofarm and Beefy. Autofarm runs on 15 EVM-compatible networks while Beefy supports blockchains including Ethereum, BNB Chain, Polygon, Avalanche, and Fantom.

2nd Generation — Leveraged Yield Farming

Leveraged yield farming means you can borrow money to farm yield in LPs. Being able to use external liquidity for yield farming is a gigantic step forward in crypto yield farming because it has significant implications and benefits: it vastly multiplies your farming principles and resulting profits in proportion by borrowing under-collateralized loans and increasing capital efficiency. More importantly, borrowing allows you to take directional bets on your position.

Leveraged yield farming is a highly competitive space because the high promotional yields from liquidity mining programs do not often last for a sustainable period of time. Farmers often employ the strategy of getting in early, draining the yield, and getting out. Rarely do they hold the LP tokens for the long term. Because of that, they leverage to drain more yield and faster.

Even though leveraged yield farming gives high returns, there was one major bottleneck: the number of tokens and the tokens used for collateral and loans were heavily restricted. As a result, investors usually could only take an overall long position in their portfolios. In other words, investors were limited to taking market exposure when they participated in yield farming. Leverage also comes with an additional risk: Liquidation. When the debt ratio (debt value to the overall position) exceeds a certain threshold, your collateral will be liquidated. If your position gets close to liquidation, you need to either close it or post more assets as collateral.

Alpaca Finance (built on BNB Chain), Rabbit Finance (built on BNB Chain), and Alpha Finance (built on Ethereum) were the few pioneers of leveraged yield farming at that time.

3rd Generation — Flexible Leveraged Yield Farming + Pseudo-Delta-Neutral Strategy⁶

Gladly, the inflexibility problem of the number of tokens and the tokens used for collateral and loans was quickly solved. The 3rd generation protocols enabled flexible borrowing and collateral. You can adjust the contribution proportion of each coin in the LP pair and decide any amount of token input from being restricted on the number of input tokens. With that came powerful implications: You can build your own strategy with your target delta⁷ exposure in your portfolio, entailing that you can hedge your market exposure by combining long and short positions. When market exposure is hedged to 0, it is called a “pseudo-delta-neutral” strategy.

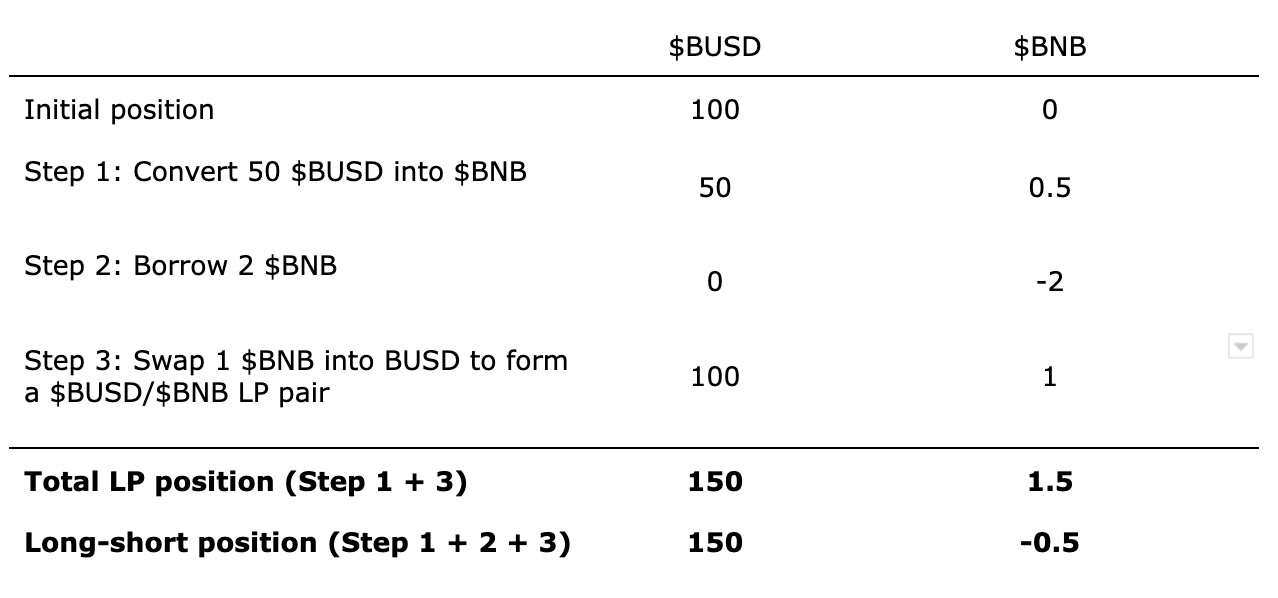

The following examples will show you how a “pseudo-delta-neutral” strategy is done ignoring other factors such as IL, slippage, fluctuations in exchange rate, transaction fees, etc.:

Example 1: Long $BUSD and short $BNB strategy. Suppose $BNB is worth $100. You have 100 $BUSD and wish to form a 3x leveraged strategy.

In this case, you are essentially shorting $BNB and longing $BUSD.

Example 2: Long $BNB and short $BUSD strategy. Suppose $BNB is worth $100. You have 100 $BUSD and wish to form a 3x leverage strategy.

In this case, you are shorting $BUSD and longing $BNB.

Example 3: Delta-neutral strategy. Suppose $BNB is worth $100. You have 1 $BNB wish to form a 3x leverage strategy.

As a result, your total LP is tripled but your exposure to BNB becomes 0.

💡It is called a “pseudo” strategy because the delta (or market exposure) is affected by the impermanent loss⁸. As token price moves in either direction, you will be exposed to market risk. The more significant the change in token price from the initial price, the greater the impermanent loss.

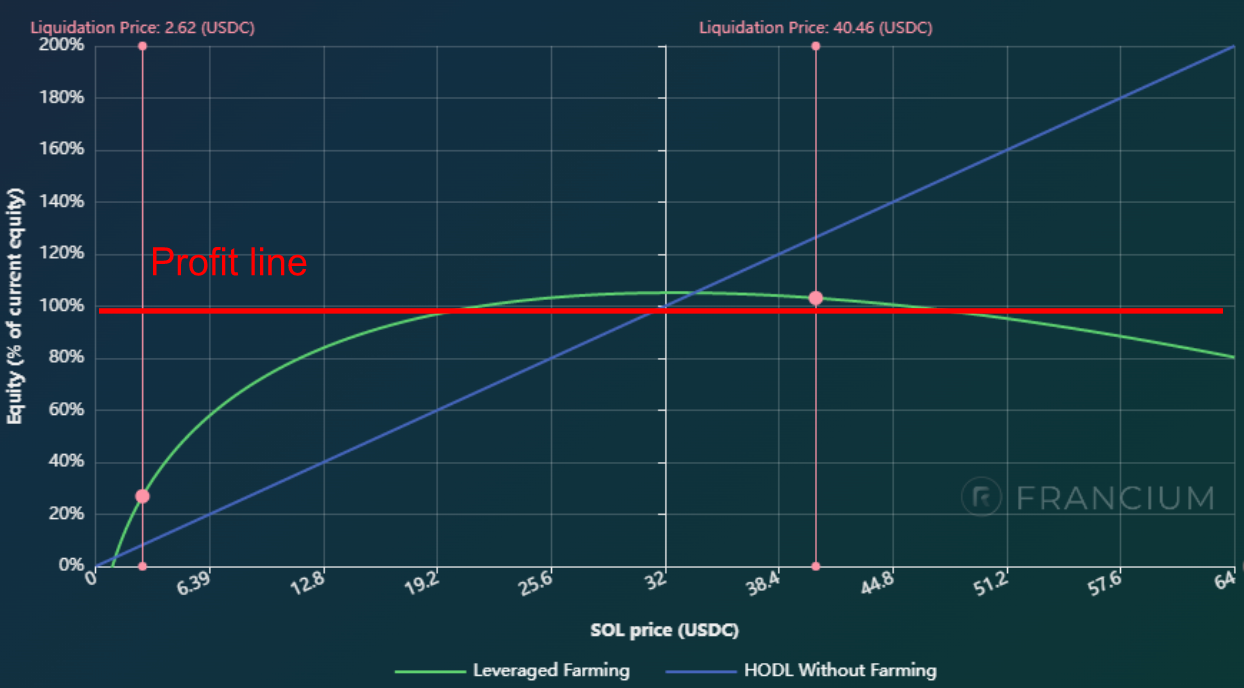

The profit-loss curve of a leveraged yield farming strategy generally looks like this:

When the debt ratio⁹ (debt value/total value) hits the liquidation threshold, your tokens will be liquidated.

4th Generation — Auto-Rebalancing

Auto-rebalancing adjusts the proportion of investors’ pairing assets back to the target delta exposure and debt ratio at optimal timing based on its algorithm. This alleviates the burden on investors to constantly check the debt ratio and volatility of their positions in case of liquidation. Given that cryptocurrencies are highly volatile assets, liquidation events are common.

That is why a rebalancing feature is necessary and it was developed shortly after. Without rebalancing your portfolio, your loss will also intensify at an increasing rate. By regularly settling debt and rewards, your portfolio will be reset to a state that’s similar to that of the opening. With the rebalancing feature, you do not need to monitor your position as frequently because by design liquidation is not likely to happen.

Currently, Alpaca Finance’s Automated-Vaults have incorporated this feature into their portfolios. Another representative protocol Single Finance, a marked-to-USD DeFi yield earning platform, runs on BNB Chain, Avalanche, Fantom, and Cronos.

5th Generation — Flexible Leveraged Yield Farming + Delta = 1 strategy

Alpaca Finance, the leader of the 4th Generation, also led the 5th Generation evolution in yield farming. They rolled out another innovative product: Delta = 1 vaults. Instead of employing a pseudo-delta-neutral strategy, the options in the vaults take the same level of market exposure as the holding underlying assets.

The following is an example:

Suppose 1 $BNB is worth $100. Other factors such as IL, slippage, fluctuations in exchange rate, transaction fees, etc. are ignored.

This is a strategy for investors who are bullish on the underlying assets. The benefit is the extra yield they get for participating in leveraged yield farming.

In a way, this strategy is beneficial to the ecosystem of stablecoin lending. Since this strategy requires investors to borrow stablecoins, the increased demand for stablecoins indirectly contributes to the stability of the crypto ecosystem.

Alpaca Finance is the representative protocol for the delta one strategy.

What’s next? — Going Forward

The evolution from 1st Generation to 5th Generation was only around a year. The pace of development in yield farming and DeFi is shocking.

Nevertheless, there are still many problems to be addressed. Even with auto-rebalancing, the lending rates and yield from LPs are still unpredictable. There is still a need for investors to closely monitor and actively manage their portfolios because auto-rebalancing materializes losses. Hence, it might not be the ideal passive income stream for retail investors. In comparison, stablecoin lending may be a better option because the value of stablecoins generally does not move. In addition, in DeFi, the overall development revolves mostly around yield farming, and less attention was focused on lending currently. There should be a more balanced development and effort on both sides.

Going forward, there will be more products that focus on higher leverage, expand on new blockchains, and develop new strategies. In June 2022, Alpaca Finance rolled out an 8x Automated Vault Allocation. PembRock launched on NEAR blockchain as the first leveraged yield farming platform. New strategies such as Abracadabra’s Degenbox also captured enormous success in late 2021. Moreover, the security of protocols is gradually improving, with better code vetting and third-party audits.

With the fast-changing dynamics and constant innovation in leveraged yield farming, it is riveting to see how the space will evolve in the coming year and whether Alpaca Finance and other pioneers in leveraged yield farming will continue to lead in the future.

Footnotes

- LPs are decentralized market makers that provide liquidity for traders and borrowers.

- Yield farmers are liquidity providers who provide liquidity to LPs in exchange for yield based on some incentives mechanism provided by the pools.

- Interest over time is the numbers that represent search interest relative to the highest point on the chart for the given region and time. A value of 100 is the peak popularity for the term. A value of 50 means that the term is half as popular. A score of 0 means there was not enough data for this term.

- Annual Percentage Yield (APY)is the real rate of return earned on an investment taking into account the effect of compounding earnings.

- Annual Percentage Rate (APR) is the yearly interest generated by a sum that’s charged to borrowers or paid to investors.

- A pseudo-delta-neutral position is a hedging strategy by taking a long and short position in an asset simultaneously to eliminate market exposure. This strategy is profitable when the price moves within a certain range but unprofitable when the price deviates a lot from its initial value.

- Delta (Δ) is a risk metrics that estimates how much a derivative price changes relative to $1 change in the underlying asset.

- Impermanent loss is the change in value of the deposited assets after they are deposited into LPs, compared to if investors hold the tokens and do nothing.

- Debt ratio is defined as the ratio of total debt to total assets. It can be interpreted as the proportion of total assets that are financed by debt.

Contact Us

re:base ventures website: https://www.rebase.vc/

For more info on collaboration opportunities with re:base ventures, please contact @gary_rebase or feiko@rebase.vc