This article serves to:

-

Chronicle David Duckworth’s 12 public responses, in sequence,

-

Highlight contradictions, omissions, and deflections in his communications,

-

Show how this pattern misled RWN investors,

-

And how it was used to rug Rowan Energy’s blockchain without accountability.

A recent article titled “The Unfortunate Scam of Rowan Energy by CEO David Duckworth” provides a recap of Rowan Energy’s collapse, highlighting the lack of accountability, the empty reassurances by leadership, and the final abandonment of the token. It reflects the growing outrage among investors and the absence of transparency from Rowan’s team.

That article builds upon a technical expose published on Mirror, which meticulously revealed that Rowan Energy’s token contract contained a hidden minting function allowing unlimited creation of RWN tokens, contradicting all public claims of a fixed token supply. The whistleblower’s findings were verifiable, and their test mint of 1 billion RWN triggered a full scale abandonment from the Rowan team.

This report now focuses specifically on the 12 official communications made by CEO David Duckworth in the aftermath of that disclosure, analyzing how they misled token holders, delayed accountability, and ultimately laid the groundwork for a disgraceful exit from the project.

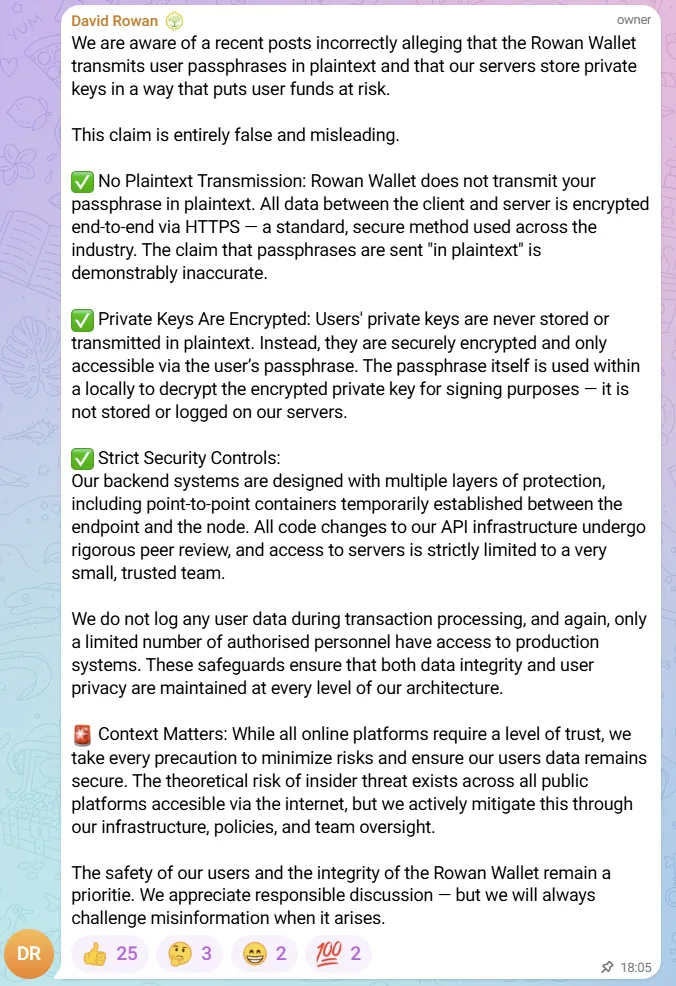

Response #1 - April 16, 2025

David Duckworth’s response addressing allegations that Rowan Wallet transmits user passphrases in plaintext and stores private keys insecurely.

He categorically denies those claims, outlines technical safeguards, and calls the accusations “entirely false and misleading.”

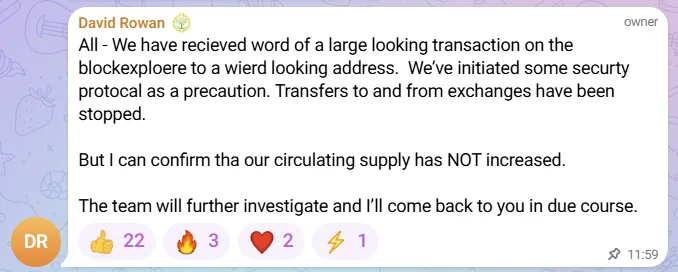

Response #2 - April 21, 2025

David acknowledges an unusual large transaction seen on the block explorer.

He claims the circulating supply “has NOT increased”, says transfers to/from exchanges have been halted, and states that the team will investigate further.

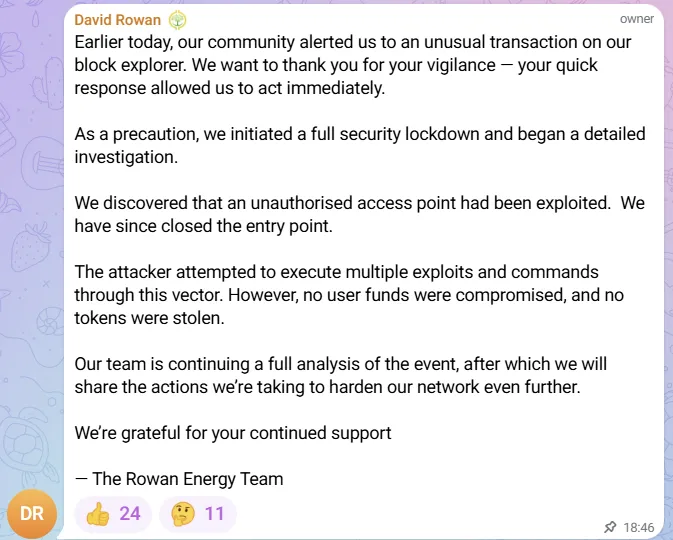

Response #3 - April 21, 2025

David provides a follow-up claiming a “security lockdown” was initiated after discovering an exploited unauthorized access point. He asserts:

-

No user funds were compromised.

-

No tokens were stolen.

-

A full investigation is ongoing.

This message attempts to reframe the suspicious transaction as an external attack, despite prior denial of any supply impact.

Response #4 - April 22, 2025

Another short update from David.

-

Investigation of the breach is still ongoing.

-

Blockchain is reported to be “fully operational.”

-

No new findings or clarifications about the circulating supply or minting functionality are addressed.

This appears to be a placeholder message aimed at calming users while avoiding technical details.

Response #5 - April 25, 2025

David Conner Duckworth gives another vague status update.

-

Claims “progress” in investigation.

-

Declines to share specific information “to avoid compromising” the investigation.

-

Says next steps will be communicated “early next week.”

This appears to be further stalling with no material explanation of:

-

The 1 billion token mint,

-

The hidden mintToken function,

-

Conflicting supply numbers.

Response #6 - April 30, 2025

David Duckworth promises a comprehensive statement is almost ready, pending “one final piece of information.”

Still:

-

No technical rebuttal of the mintToken function.

-

No explanation of the inflated supply.

-

No transparency around blockchain access.

This is a continuation of the delay narrative while avoiding the heart of the controversy.

Response #7 - May 3, 2025

David reassures users that “Rowan is still here,” reiterates commitment to transparency, and delays again by referencing an upcoming meeting with a “key third party” on Tuesday (May 6).

Still:

-

No denial or explanation of the

mintToken(address, uint256)function. -

No technical refutation of evidence presented.

-

No report, just continued stalling.

This continues a now weeks-long pattern of non-response dressed in corporate reassurance.

Response #8 - May 7, 2025

David states that they had an initial conversation with a third-party audit provider, but a second meeting is needed before finalizing the engagement. Still no substance on:

-

The original exploit or its impact,

-

The hidden mint function,

-

Blockchain transparency,

-

Investor compensation.

This is now nearly three weeks of prolonged deflection and process talk.

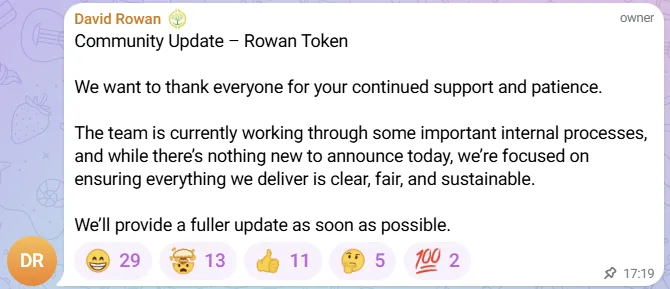

Response #9 - May 12, 2025

Another non-substantive update from David Duckworth.

-

Says “internal processes” are underway.

-

No progress disclosed.

-

Still no address of the core technical allegations.

We’re now three weeks post-disclosure with no audit, no transparency, and a growing pattern of delay.

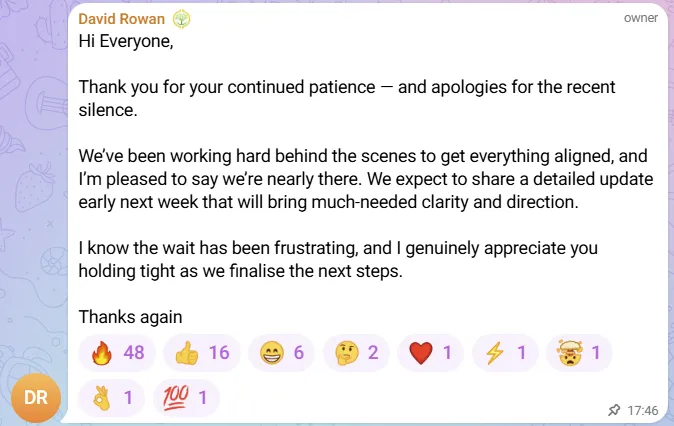

Response #10 - June 6, 2025

David Duckworth breaks a long silence to again promise that a detailed update is coming “early next week.” He acknowledges frustration but provides no new facts, no timeline, and no answers.

At this point, we’re approaching 7 weeks since the original technical whistleblower post, and still no substantive rebuttal, no independent audit, no tokenholder remediation, and no verification of on-chain activity.

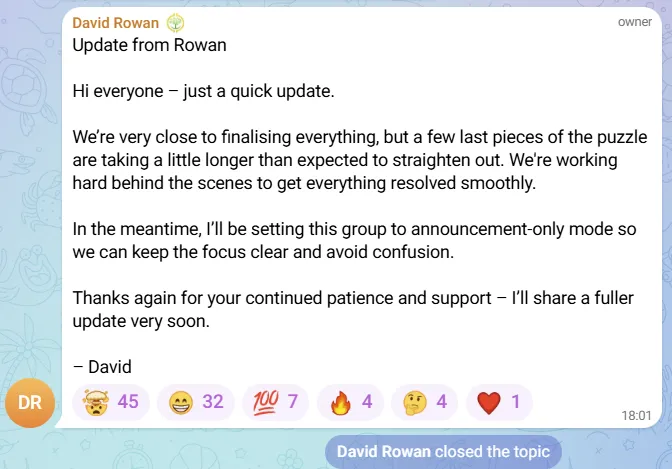

Response #11 - June 21, 2025

(Closed the project discussion group for token investors)

June 21st is a major inflection point.

David Duckworth announces:

-

They are “close to finalising everything,” but with more unspecified delays.

-

The community discussion group will now be locked down to announcement-only mode, cutting off investor dialogue.

-

He again promises a “fuller update soon”, now nearly two months after the whistleblower’s expose.

This removal of transparency and community input is a significant escalation in what appears to be a pattern of strategic obfuscation and damage control.

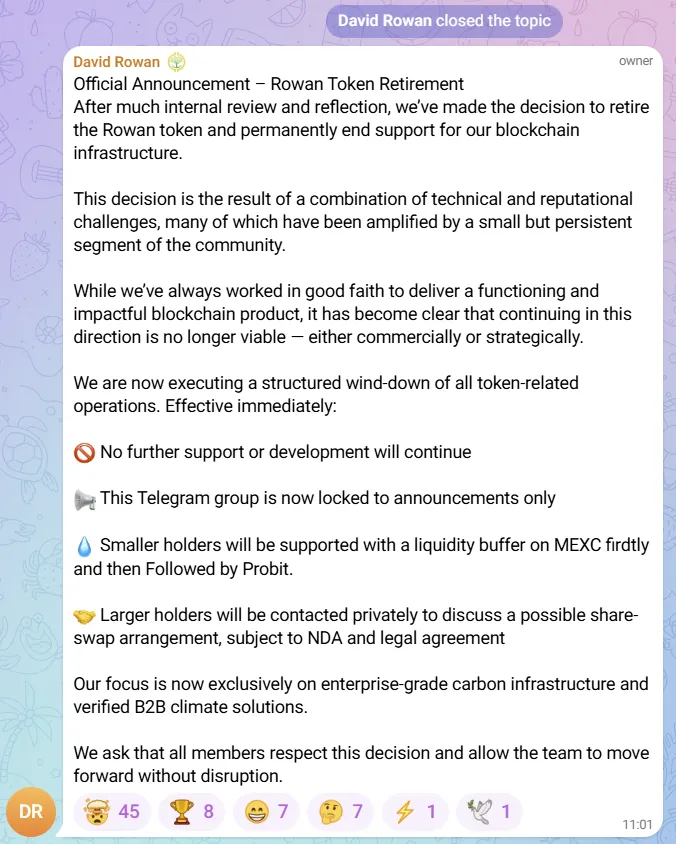

Response #12 - June 24, 2025

This is the final and decisive message from David Duckworth to RWN Investors:

-

Rowan Energy officially announces the retirement of the RWN token and the shutdown of their blockchain infrastructure.

-

No technical rebuttal is ever offered for the claims of hidden minting or inflated supply.

-

The failure is blamed vaguely on “technical and reputational challenges,” and criticism is characterized as coming from a “small but persistent segment.”

-

Smaller holders are given a vague promise of liquidity support, and larger holders are offered private deals under NDA.

This signals an effective project abandonment without accountability.

Summary

David Duckworth provided 12 updates between April 16th and June 24th. Across those 69 days, there were a series of consistent and inconsistent narratives and themes:

Consistent Themes:

-

No direct response to the central allegations about the mintToken function.

-

No public audit or independent verification of the blockchain or smart contract.

-

Vague and shifting narratives: from “circulating supply has not increased” → “unauthorized access point” → “structured wind-down.”

-

Delays & deferrals: promised updates repeatedly pushed weeks out.

-

Locking down communications: group silenced in June to prevent open discussion.

-

Blame shifting: critics called a “small but persistent segment.”

-

Exit under the guise of strategy: final post pivots the business away from blockchain entirely, avoiding accountability.

Inconsistent Themes:

-

Blamed an “unauthorized access point” rather than acknowledging the existence of the mintToken function.

-

Promised a “comprehensive update” or “next steps” multiple times, but never delivered any.

-

Repeatedly referenced third-party audits, yet never produced a single audit or report.

-

Stated the blockchain was “fully operational”, while simultaneously acknowledging ongoing “investigations” into major issues.

-

Maintained they were committed to transparency, while locking the Telegram group to prevent discussion.

-

Never addressed or denied the mintToken function. Avoided the core issue entirely.

-

Characterized widespread investor concern as coming from a “small but persistent” group, downplaying community sentiment.

-

Shifted messaging over time from denial → investigation → resolution in progress → silent shutdown.

-

Exited the project without any apology, audit, or technical clarification, blaming only “technical and reputational challenges.”

No Accountability

The case of Rowan Energy and the conduct of CEO David Duckworth presents one of the most systematically mismanaged exits in recent blockchain history. Across 12 public communications over 69 days, investors were led through a carefully choreographed sequence of delays, denials, shifting narratives, and ultimately, abandonment.

Despite technical evidence, investor pressure, and rising scrutiny, at no point did David Duckworth or Rowan Energy:

-

Provide an official explanation for the mintToken(address, uint256) function.

-

Release a smart contract audit, blockchain validation, or third-party review.

-

Offer a snapshot of token holder balances before or after the 1B RWN mint or 965m RWN token supply claims, preventing any assessment of who was diluted or enriched.

-

Disclose whether any insiders or affiliates benefited from the excess tokens or associated liquidity events.

-

Explain why such a critical function existed in a contract advertised as “fixed supply.”

-

Deliver on promised investor redress or even basic accountability for the project’s collapse.

Other Unaddressed Questions That Remain:

-

Was the mint function used prior to the whistleblower’s test run?

-

Why did the blockchain call show 420 million extra RWN tokens that were never communicated publicly?

-

Were Rowan’s exchange partners (e.g, MEXC, Probit) made aware of the hidden minting functionality?

-

Did any off-chain agreements, OTC swaps, or VC deals take place with an undisclosed inflated supply?

-

Why was no independent investigation ever commissioned if the allegations were truly “misleading”?

-

Why was exchange deposit/withdrawal activity re-opened, whilst these core issues still persisted?

Rowan Energy is an important case study in reputational containment masquerading as technical misfortune. If this pattern goes unchecked, it sets a dangerous precedent:

That any blockchain project can quietly mint millions, hide behind silence, and vanish, while rebranding a collapse as “strategic realignment”.

David Duckworth and Rowan Energy

David Connor Duckworth positioned himself as a visionary, someone who would lead a clean energy revolution through blockchain. He spoke of innovation, transparency, and community-driven transformation. But in the end, his actions spoke louder than words.

Instead of standing in front of the crisis, he stood behind silence.

Instead of addressing the central flaw, he deflected, delayed, and denied.

Instead of defending his investors, he retired the token and walked away, without accountability.

Rowan Energy, under his leadership, has become a symbol of how trust can be weaponized in Web3, and how an inspiring narrative can be used to mask opaque practices and questionable decisions that hurt investors.

The most dangerous thing about what happened here is not just that it was done, but that it was done quietly, with the hope that people would move on.

They won’t.

David Duckworth still owes RWN investors:

-

A direct answer about the mintToken function,

-

A full accounting of what happened to the excess tokens,

-

And a public admission of the decisions that led to this collapse.

Until that happens, this report stands as a documented record of what occurred, and as a commitment to those who were misled, diluted, and silenced.

Legal Ramifications

The Rowan Energy debacle demands:

-

Legal review under securities, fraud, and consumer protection laws.

-

Regulatory interest from the FCA (UK), as the company was UK-based and solicited public investment.

-

Journalistic exposure, so similar projects understand that this level of deception will not be quietly forgotten.

A Message to Rowan Energy’s Business Partners

If your organization currently holds a partnership, technology agreement, or service relationship with Rowan Energy Ltd, this report raises serious questions of integrity, security, and transparency that you must now evaluate.

Until these issues are independently investigated, continued collaboration may:

-

Expose your brand to reputational risk,

-

Signal tolerance of deceptive business practices, and

-

Undermine public trust in your own operations.

We strongly encourage any current or former Rowan Energy partners to reconsider those affiliations immediately.

Call for Whistleblowers & More Information

If you are:

-

A former employee, advisor, or contractor of Rowan Energy,

-

A recipient of internal communications about the RWN token supply,

-

Someone with documentation of internal decisions, smart contract revisions, or off-chain deals,

You are invited to reach out confidentially and securely.

📧 Secure Contact: fulanceanswer@protonmail.com

All submissions will be handled discreetly and used solely to pursue transparency, accountability, and potential restitution for affected parties.

The original article is linked below: