The excessive amount of content about crypto out there is overwhelming.

With only 24 hours in the day, it’s virtually impossible to test everything.

Trial and error takes time, effort and money.

So how to sort through the clutter?

I strongly believe that looking closely at the behavior of successful people is a great starting point.

One of the advantages of blockchain is that you can verify results.

There is no need to trust.

So in this piece, I decided to hunt for the best alpha wallets I could find and look for patterns I could learn from.

To follow along, here are the research tools you’ll need:

The Arkham one is a referall link, you can skip the waiting queue and get free access using it. You can do everything I’ll show here without Arkham though, it’s definitely not a requirement. But I recommend you give it a try because it has charts(e.g. balance over time per chain, profit over time per chain) and features DeBank does not have.

What is the goal?

The goal is basically to find profitable wallets with a great track record and decent activity to model and learn from.

Specifically, I’m looking for wallets that invest/trade low-caps.

I rank utility projects higher than memes but there are some profits made with memes on this list too.

Investing in higher caps like Bitcoin and Ethereum is relatively safer, but they are unlikely to pull a 10x in months like microcaps do.

How to find those wallets?

Through 2 simple methods:

-

Check the top holders of a specific Token on the Block Explorer.

-

Backtrack transactions on Arbiscan to see who were the early buyers.

If a wallet is in the top holders list, it does **not **necessarily mean it’s successful.

If a wallet bought early, it does not necessarily mean it’s successful.

But this is where people lose a big opportunity.

They check a couple of wallets and maybe they find something useful here and there.

But they stop too early in the process.

I made this mistake too.

See, you could go for hours without finding a decent wallet, but believe me, it’s worth going the extra mile and keep looking further.

Superficial effort = superficial results.

All right, so with the intro out of the way, let’s take a look at the list of wallets.

Wallet #1

Address: 0x83179a13e3124ec4ab2d59c1d20c89172b85f104

Value: $486k

Description: Early $RAM buyer.

Results:

- $SHARKY closed at a 60% loss.

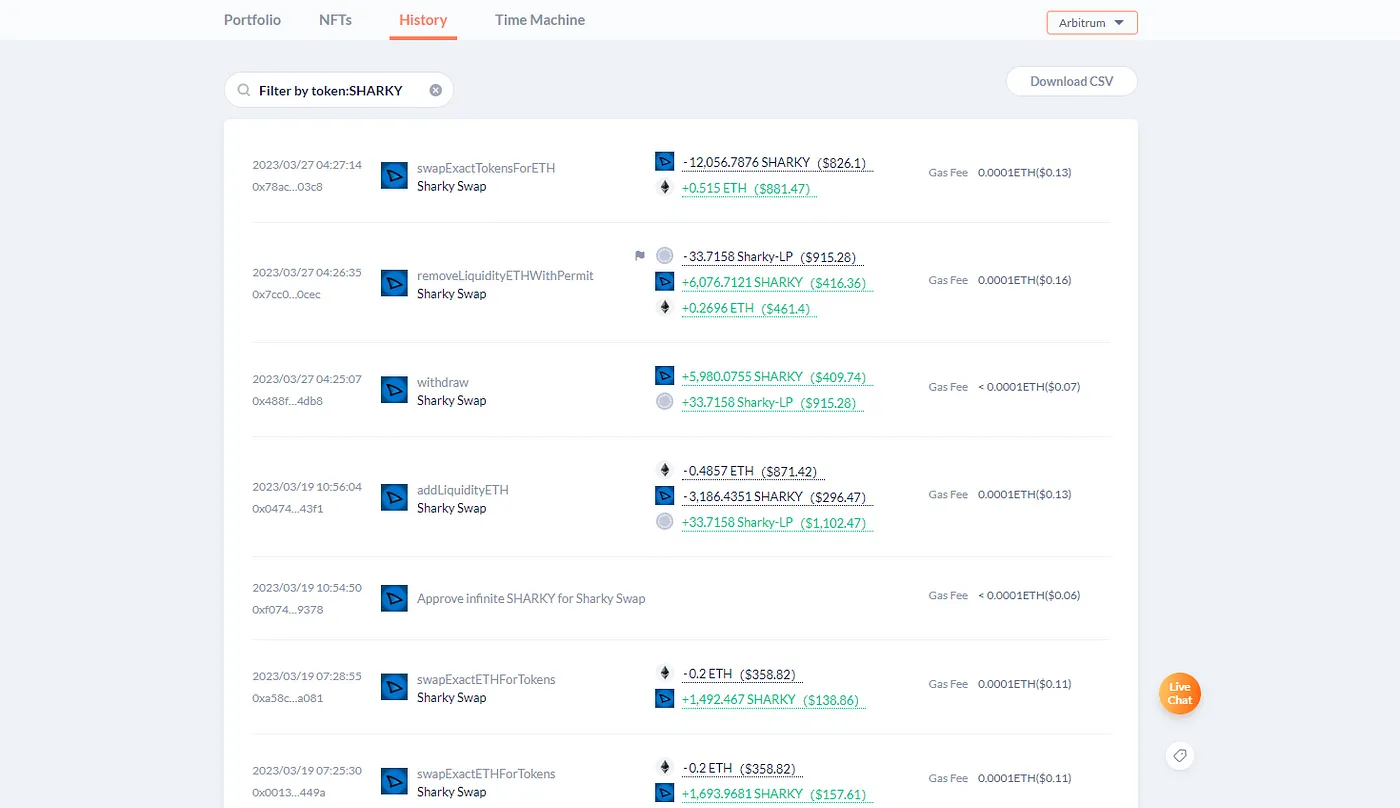

Looking at his history on DeBank we can see every single interaction involving the token.

By clicking on the word Sharky, DeBank will automatically filter so only the Sharky related transactions will be shown.

It can also be done by typing the name of the token you want to filter on the white bar at the top of the page (it only works when you select a specific chain).

In this case, he bought $SHARKY on March 19th and sold it on the 27th. Approximately a loss of 60%(not the exact percentage but enough to give us a notion of how much he made/lost)

The process is repeated to the other buys in his history.

-

$DCP down 90%

-

$MCR down 27%(still holding)

-

$ARBINU down 17% but it went up 100% since his buy. He is still holding.

-

$ARBPAD breaking even at the moment but it went up 150% since his buy. (Still holding it all)

-

$RAM — Bought at $0,12 on March 17th. It went down 50% since then but he is still holding and added more during this dip.

-

$ATA — It went up 70% since his buy but right now is breaking even. He is yield farming it.

-

$XCAL up 3,8x (Still holding)

-

$GRB up 27x on (Still holding)

-

$TND up 2x .

-

$OREO up 2x (Still holding)

-

$HEI down 80% on (Still holding)

Overall, $100 into each one of these trades would result in roughly $1756 profit.

He is also yield farming/staking. $18k of $MMT in a staking pool and $1,6k worth of $ATA(Atlas). Both are early protocols and $ATA staking APR is over 600% as I write.

This analysis is focused on Arbitrum but he has a bunch of other interesting coins on other chains too.

Wallet #2

Address: 0x1dde7b19fa3150a06e3307341e9b8cc5e95122d4

Value: $59k

Description: His biggest holdings are $JOE, $PSI(I wrote an article about TridentDAO here), $ARC.

I found this wallet looking at early $BFR buyers.

How?

To find early buyers of any token you like, follow the steps below:

-

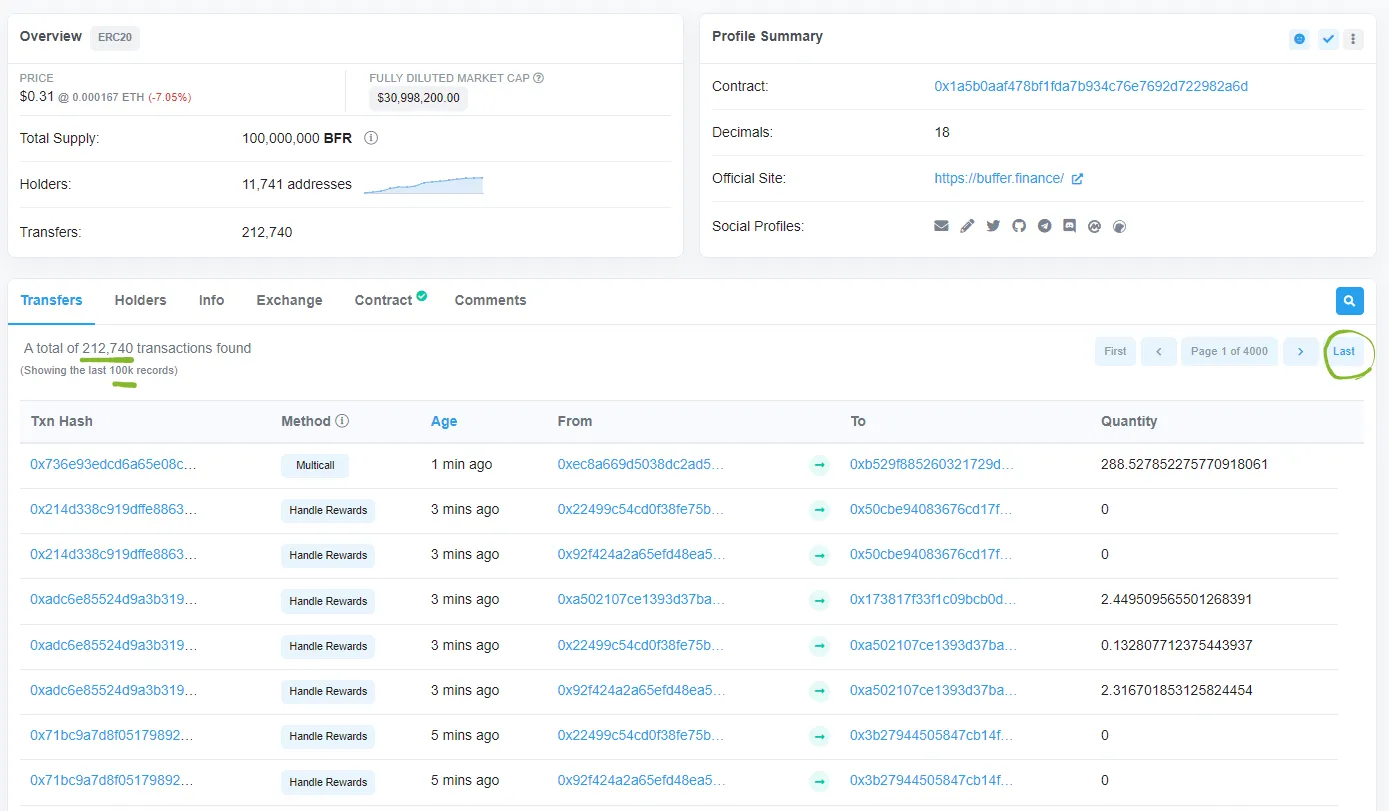

Go to the block explorer (in this case, Arbiscan).

-

Select the token you want, either by pasting it’s contract or name in the search bar

-

Go back to the earlier transactions by clicking on last

Note: Arbiscan only shows the past 100k transactions, but there is actually a way to see the transactions made before those.

This is useful to know who were the real sunrise supporters.

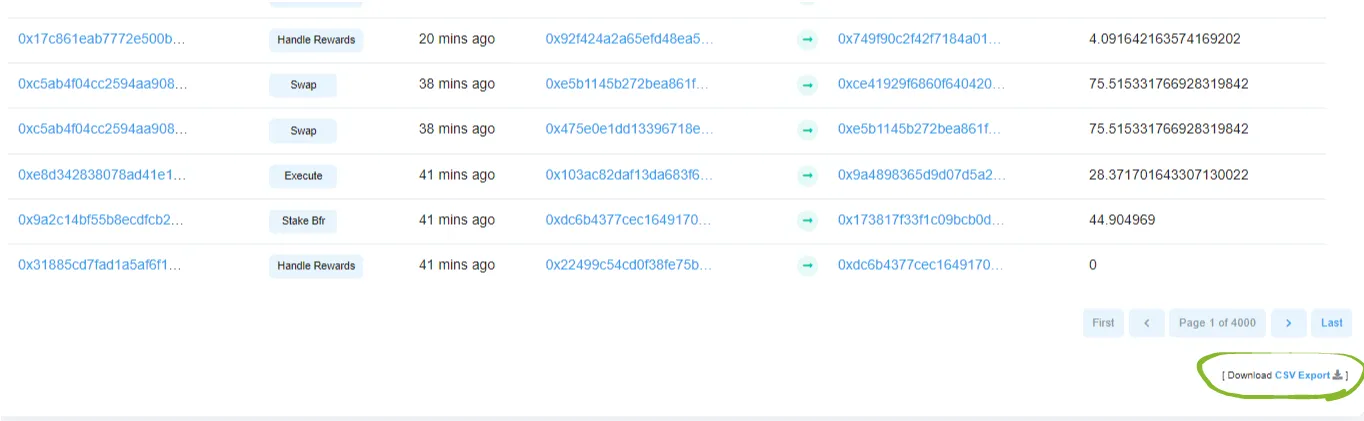

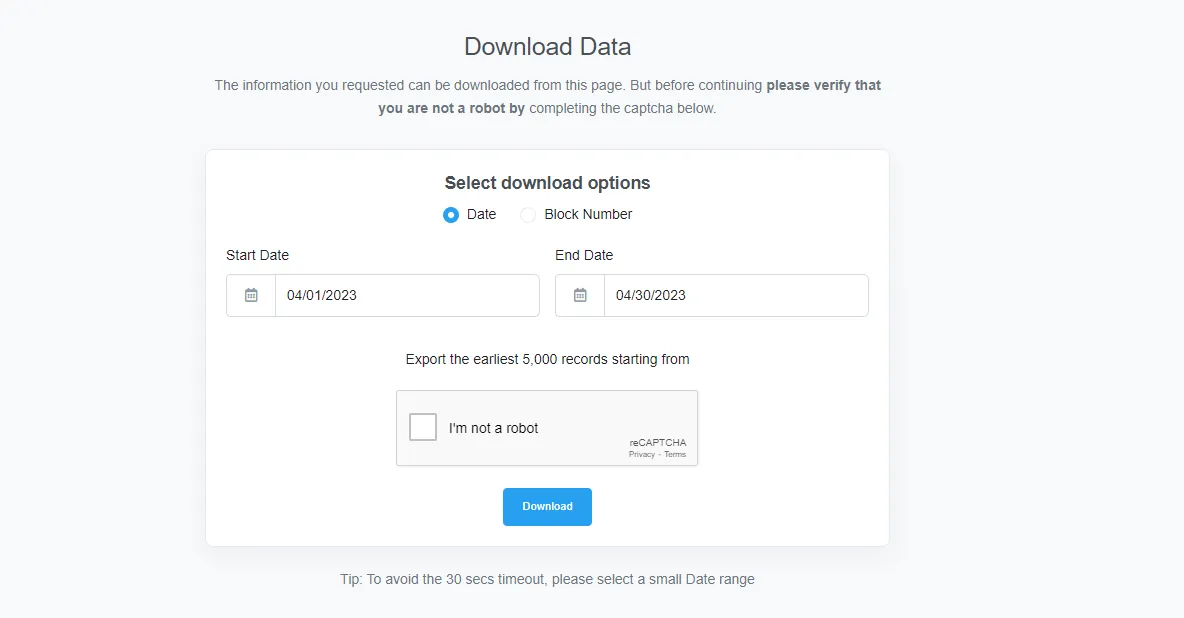

To do so, scroll down, and click on download CSV.

Then select the exact date interval you wish.

If you don’t have Excel installed, you can simply open the CSV using Gmail.

Go to your Gmail, click on Google apps on the top left > Click on Drive > Drag the CSV file over > Click to open when the upload finishes.

Results:

-

$HDX up 2,5x (Seems to be a really interesting protocol I didn’t know about. They claim to be the first Layer 3 DEX.)

-

POI$ON went up approximately 3,8x after his buy on February 16th. He sold and made over 2x. Very well timed. A project I like a lot, they tokenize stocks, gold, commodities, etc.

-

$HAMI Made 50% in a few minutes. Would’ve made 3,5x had he held longer.

-

$ARC down 35% since his $4,000 buy. He is still holding.

-

$PRY down 30% he cut losses.

-

$VOLTA +75%

-

$WAR is down +70% since his buy. Couldn’t find any information about the website on Dexscreener and it is not listed DeBank

-

$CRX went up more than 10x but then rugged. Token not listed on DeBank

-

$TND sold right before the 3x pump. Broke even.

-

$BFR bought before a 2x pump but held through it. Made around 30% profits in the end.

-

$NISHIB 2,8x in Nishib. Would’ve made +4x if held longer. Well timed.

-

$LEVI 4x on LEVI bought on the day it launched.

$100 invested in each one would be turned into approximately $650 of profit in total. These plays are from August 2022 till the end of March 2023.

Wallet #3

Address: 0x3875881f52c1b030d1cf9a3ca29ec05b16d196b2

Value: $48k

Description: $CyOp holder.

Results:

-

$EWW up 2,15x

-

$Polarsync up 3x

-

$ACR down 25%

-

$PSDN up 20%

-

$RocketAI down 50%

-

$ElonTC up 80%

-

$CyOp up 6,9x

-

$RUSH up plus 18X

$100 into each equals approximately $2290 in profit.

P.S. In this case, there are trades on the Ethereum network, so the fees would be substantially higher. Much less profitable for smaller trades under $100 but still would end up positive.

Wallet #4

Address: 0xa159a19d782cd638187387dbdb4d322dde86f2c7

Value: Over $400k

Description: $SHI Holder

This wallet DCA’d into Shina Inu from August to October 2022 and held it all till now.

Perfectly timed.

CoinGecko — Shina Inu Price Chart

Shina Inu is up 6,5x since then. Would be more than 10x considering the ATH.

Wallet #5

Address: 0xebc48e8db0d9203db04512ec4a8030cf2a43c384

Value: $484k.

Description: $PLS, $TND, $MAGIC, $PREMIA holder.

Results:

-

$PLS up 4x. Bought approximately $35k worth of $PLS during the accumulation in January 2023 and sold $50k of his bag on March 21st. It did 4x in this interval. Still holds $27k worth of $PLS

-

$TND: Made 2,5x. Considering ATH would’ve been 3,5x.Is still holding some $TND.

-

$MGN down 20%. Still holding a portion of the initial amount.

-

$MAGIC up 2x. Time the January pump almost pixel perfectly. Would have made 3,5x if held longer.

-

$KROM up 12%.

-

$VSTA: down 30%

Roughly $532 in profit considering $100 into each investment.

Insights

You can learn a lot from the right wallets. Being able to model someone who is already successful has enormous value. Trial and error can be painful, especially when it comes to money.

It’s also interesting to search for similarities. For instance, a recurring theme I noticed on Arbitrum focused wallets is:

They hold $PSI, $ARC, $WINR, and POI$ON. All low-caps with asymmetrical potential.

Alarms

A useful built-in functionality of explorers is the watchlist.

You can create a list with up to 50 wallets in your profile and get notifications on your email whenever they make transactions.

This helps to automate the process.

Arkham

If you are a visual learner like me you will like the charts available on Arkham.

Below is the Cumulative Profit & Loss of Wallet #5 on Arbitrum.

This feature is quite helpful to analyze portfolios.

Conclusion

It’s possible to get high-quality alpha from wallets with a proven successful track record.

This is a simple but tremendously powerful technique.

I encourage you to come up with your own unique list, come up with your own on-chain alpha.

But ultimately, it’s key to ask what motivates each trade or investment.

Look for patterns.

Questions such as:

-

What are the common themes between the projects this wallet buys?

-

Does this wallet get well-timed buys often? If so, why?

-

How can I apply what I’ve learned to my future investments?

Are useful to help us get the most out of on-chain analysis and start reaching our own conclusions about projects.