A simple guide to Autonity Tokenomics

Tokens are the lifeblood of any ecosystem, they serve as the medium of exchange between service providers and service consumers, they act as incentive rails, confers governance powers on holders and lots more. In this article,we go over the token economy of Autonity

As per their website, Autonity is a public, EVM based, proof-of-stake blockchain for decentralized clearing of smart derivatives contracts.

That is it public,it means anyone anywhere can contribute to secure and develop to or use the network, EVM based meaning developers who are already familiar with Ethereum or EVM based development can easily pick up building on Autonity.

The network is composed of 4 components, the Autonity Protocol, The oracle, the DAX and CAX.

The network comprises 3 different tokens :Auton (ATN) , Neutron (NTN) and Liquid Neutron (LNTN).

Auton : It is a decentralized stablecoin similar to DAI in the Ethereum ecosystem, to get your hands on ATN, a user either has mint it through a collateralized debt position( that is deposit NTN to mint ATN) or a user has buy already minted ATN from exchanges.

Neutron : As earlier mentioned, Autonity is a proof of stake blockchain, NTN is the token validators have to stake to secure the network. Staking or delegating ATN will also enable users get ATN as staking rewards. NTN is a volatile asset unlike ATN, it can be traded on centralized exchanges, users can mint ATN with NTN. NTN also serves a a governance token

Liquid Neutron : It is the liquified version of NTN, Liquid stake tokens (LSTs) are answer to the liquidity challenge on many blockchains. Users are torn between going for juicy rewards obtained only by DeFi or secure their beloved network for less rewards compared to DeFi yields. Another challenge is that staked tokens are locked away, unusable for any operation.

Liquid NTN is a way for users to stake and secure the network as well as have the flexibility of engaging various DeFi primitives for their benefits.

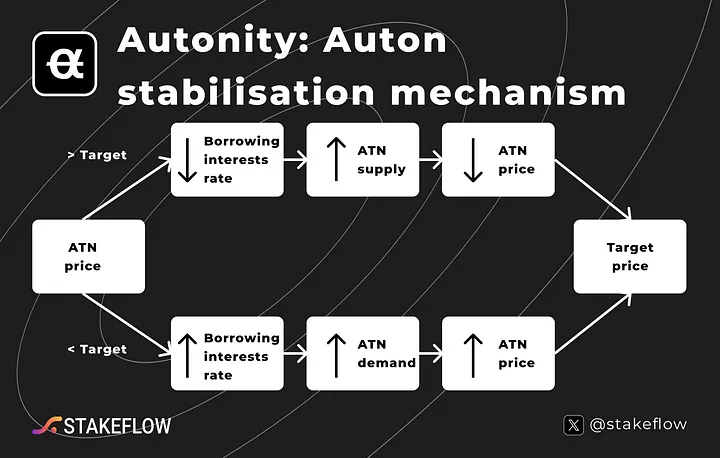

As earlier mentioned, ATN is a stable currency, it is pegged to a basket of 7 currencies. Since it’s a form of money, it subjected to various economic and market forces.Since ATN is minted through a CDP, the price of ATN is regulated market forces, when ATN price goes to high, the protocol will raise interest rates in a bid to achieve price balance and when the prce of ATN is below a certain, the interest rate is lowered to achieve high borrowing which in turn reflect on the price.

Learn More