The FOMC meeting has started, and the Wall Street is waiting for the decision on the interest rate. The current probability of raising interest rate by 75 basis points in June is 76.6%, and the probability of raising interest rates by 50 basis points before is more than 99%. The rapid changes have increased expectations of monetary tightening again. U.S. stocks closed sharply lower overnight, and the NDX fell 4.68%, hitting a new low since October 2020. The same thing happened to Bitcoin, a new low since December 2020. Risk market investors were forced to sell a large amount of assets to ensure adequate liquidity.

For crypto assets, there is still a certain structural selling pressure. These sold funds are not pessimistic about the future of the market, but due to lack of liquidity and risk hedging. Recently, more bearish news has also made the crypto market more questionable.

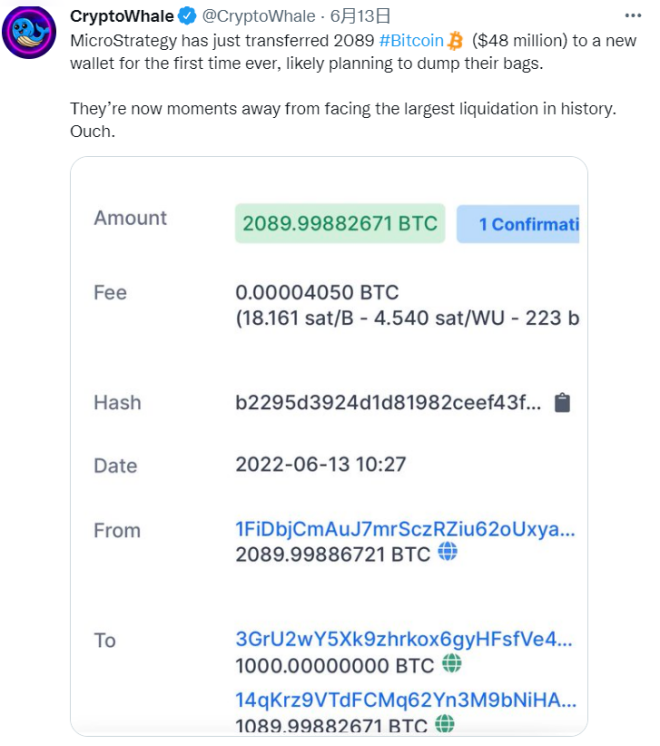

Bitcoin, which has fallen by nearly 70% from its high point, still has a lot of room to fall in the face of possible risk exposure. Celsius faced a liquidation risk of more than $400 million at $22,584 on June 14, and then topped up the margin in two installments, which reduced the liquidation risk to around $17,000, but the risk has not been lifted. Microstrategy transferred 2,089 BTC for the first time, which was interpreted by the media as a plan to reduce its holdings. So far, the company’s bitcoin book loss has exceeded $1 billion, and it is likely to lead to the additional collateral for this year's $205 million loan. If the collateral cannot be provided, a forced lightening will be inevitable.

Earlier this year, the sub company of MacroStrategy loaned $205 million from cryptocurrency bank Silvergate Bank, using bitcoin as collateral to buy more bitcoin. On the first-quarter earnings conference call in May, MicroStrategy Chief Financial Officer Phone Le confirmed that if the price of Bitcoin falls below $21,000, the company will be called for loan deposits due to the drop in the price of collateral assets, which means MicroStrategy must provide more collateral for the loan, or else it will have to sell part of the bitcoin holdings.

Cryptocurrency analyst CryptoWhale released on-chain data and pointed out that MicroStrategy transferred 2,089 bitcoins, worth $48 million, to a new wallet on the evening of the 13th, which is the first time MicroStrategy has ever transferred bitcoins. According to the CryptoWhale analysis, the move may mean that MicroStrategy is planning to sell its bitcoin holdings: “They are now just a few steps away from the largest liquidation in history.”

The founder of Bitmex said that Bitcoin and Ethereum would have huge selling pressure at $20,000 and $1,000. The reason is that a large number of traders are shorting put options. When the strike price is close, the spot must be sold to hedge the risk, so the spot is facing selling pressure.

At the time the HyperPay Research Institute wrote this article, Three Arrows Capital had been suspected that it had liquidated 8511+3346+2681 ETH, and sold 33,000 ETH repay its debts. According to some media, it was liquidated on the lending platform by up to 400 million US dollars. As an old blockchain investment giant established in 2012, it is inevitable to suffer the huge loss. So how should we, as an ordinary investor, deal with this round of bear market that BTC and ETH fell sharply and are still likely to fall lower?

How to deal with asset plunge risk

In the public eye, most of the crypto investors seem to be short-term speculative traders, who trade spot or futures contracts through leverage, and earn high profits but at all times facing the risk of liquidation.

However, this is not the case. There are also long-term investors and stable investors who pursue stable returns. Long-term investors represented by miners and asset management institutions usually do not care about short-term market fluctuations, but choose to hold the assets until the market reaches a long-term high before leaving the market properly. The type of stable investors are risk-averse, giving up short-term fluctuations and only in pursuit of stable returns.

Under the current circumstances, it is unwise to sell off crypto assets. We need to spend time and patience, and we are bound to usher in a new upward cycle. So, should we stand by while we wait? We don't have to:

HyperPay wallet, as one of the popular crypto asset wallets in the market, have a complete range of financial products in the off-chain wallet, including BitLoan, BitEarn, PoS staking, DeFi mining, HBT Vault, ultra-short and medium and long-term fixed investment, etc., in different forms and in different periods, but all with considerable returns. Among them, the most attractive part is that its stable coin’s financial return is relatively high, which is more suitable for the current market background.

HyperPay wallet also has its featured product HBT Vault. Users' funds are staked on the chain for mining to obtain HBT rewards. HBT can be exchanged for other assets. Users can get up to 8% annualized return by depositing USDT.

If you hold mainstream currencies, you can consider DeFi mining. The HyperPay DeFi mining section supports 8 mainstream currencies with higher returns.

How does HyperPay wallet create stable and secure incomes for users?

Since the launch in 2017, users of HyperPay have grown steadily. There are more than 500,000 users who use its off-chain wallet for crypto assets management. HyperPay has so far earned more than 6 million US dollars for these users.

The HyperPay off-chain wallet is in custody by HyperBC, which has obtained a compliance license, and is regularly audited by well-known security companies such as SlowMist Technology, KNOWNSEC, CERTIK, etc.

Moreover, a joint review team composed of financial analysts, actuaries, and fund investment managers under HyperPay will analyze the profit model and future development value of the specific project, and rigorously calculate the investment value of the project or the long-term investment value of the launched projects, to select the parts that meet the value investment to combine specific investment strategies that pursue long-tail value returns while ensuring the security of the funds.

The bear market is not scary. What is scary is that the concept of value investment is shaken in the process of prices falling, and the opportunity to catch up is lost due to the erosion of time. So be friends with time and strengthen the belief in value investment. If you hold many stable currency assets, HyperPay wallet’s wealth management section is a good choice in the bear market. Reducing unnecessary operations, saving enough bullets, and getting stable income, are right ways to survive and ride the bear.

HyperPay professional wealth management team is with you.

Attached:

HyperPay official website: www.hyperpay.tech

HyperPay wallet download: https://www.hyperpay.tech/app_down

HyperPay Telegram: https://t.me/HyperPay_En

HyperPay Twitter: @Hyperpay_tech