In March, the Ethereum Foundation officially announced that the Shapella (Shanghai + Capella) upgrade will be activated on April 12 at block 194,048. After the upgrade, Ethereum will stop using the previous one-way staking model, and validators will be able to withdraw their staked ETH from the Beacon Chain. Therefore, the Shapella upgrade is seen as the first major upgrade for Ethereum since the Merge last year.

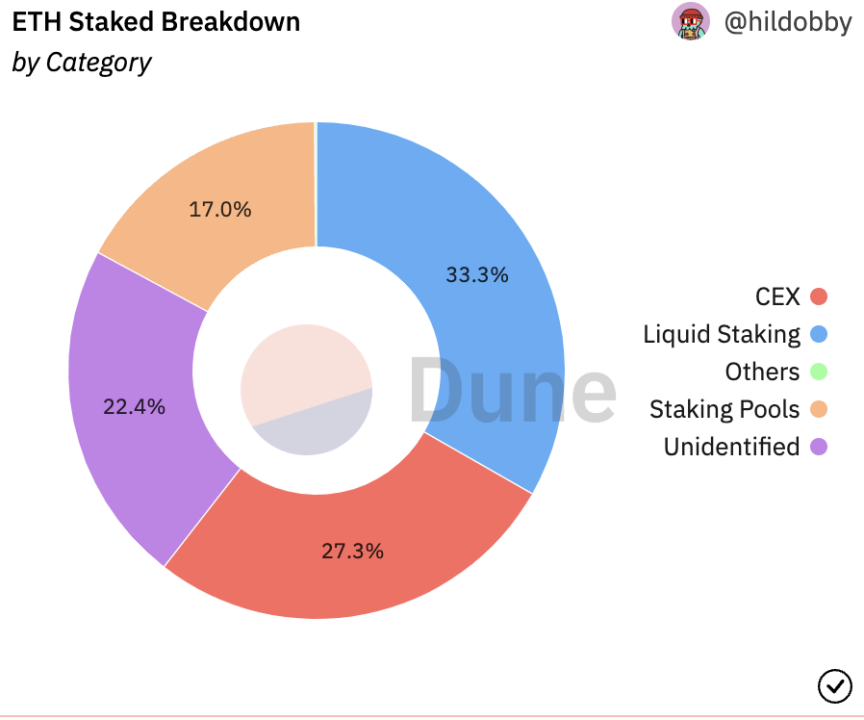

Source: Dune

Since the Beacon Chain went live in December 2020, over 560,000 validators have staked 18 million ethers, accounting for 15.08% of the total ETH supply, according to Dune. Over the last two months, liquidity staking and related derivatives have also sparked market enthusiasm. As the Shapella upgrade approaches, what cryptos should investors keep an eye on?

Distributed Validator Technology

Distributed Validator Technology (DVT), which is at the heart of decentralized staking, improves the security of validators. Similar to the multi-signature mechanism of crypto wallets, DVT allows nodes including individuals and groups to jointly run a validator. With DVT, even if a node malfunctioned during the validation process, other nodes could keep running the validator, which avoids security incidents such as single-point failures and forks, and reduces centralization risks. ssv.network, for instance, is an iconic DVT project.

1.ssv.network (SSV)

As an infrastructure based on DVT, ssv.network provides a secure way to split a validator key between non-trusting nodes or operators, while enabling the distributed control and operation of Ethereum validators. The network insists on an open-source, community-driven approach, distributing the ETH staked to multiple operators instead of relying on a single operator, which keeps Ethereum secure and decentralized.

ssv.network eliminates single-point failures in validation. By allowing offline validators to generate and store keys, the network achieves efficient node maintenance. Currently, ssv.network mainly provides technical support for businesses and has built close partnerships with Ethereum staking service providers such as Lido and Ankr.

Liquidity Staking Protocols

Ethereum’s transition to PoS catalyzed growth for the entire staking industry. On a PoS network, users need to lock up their tokens to maintain nodes, which keeps the network secure. However, this also means that the locked tokens cannot be traded or lent, triggering the appearance of a new staking solution called liquidity staking.

Liquidity staking allows users to acquire liquidity while staking. For instance, when users put ETH into a liquidity staking protocol, the protocol will stake on their behalf and mint derivative tokens in a 1:1 ratio. Data from Dune indicates that liquidity staking protocols now occupy the largest market share in Ethereum staking, accounting for about 33.3% of the total ETH staked.

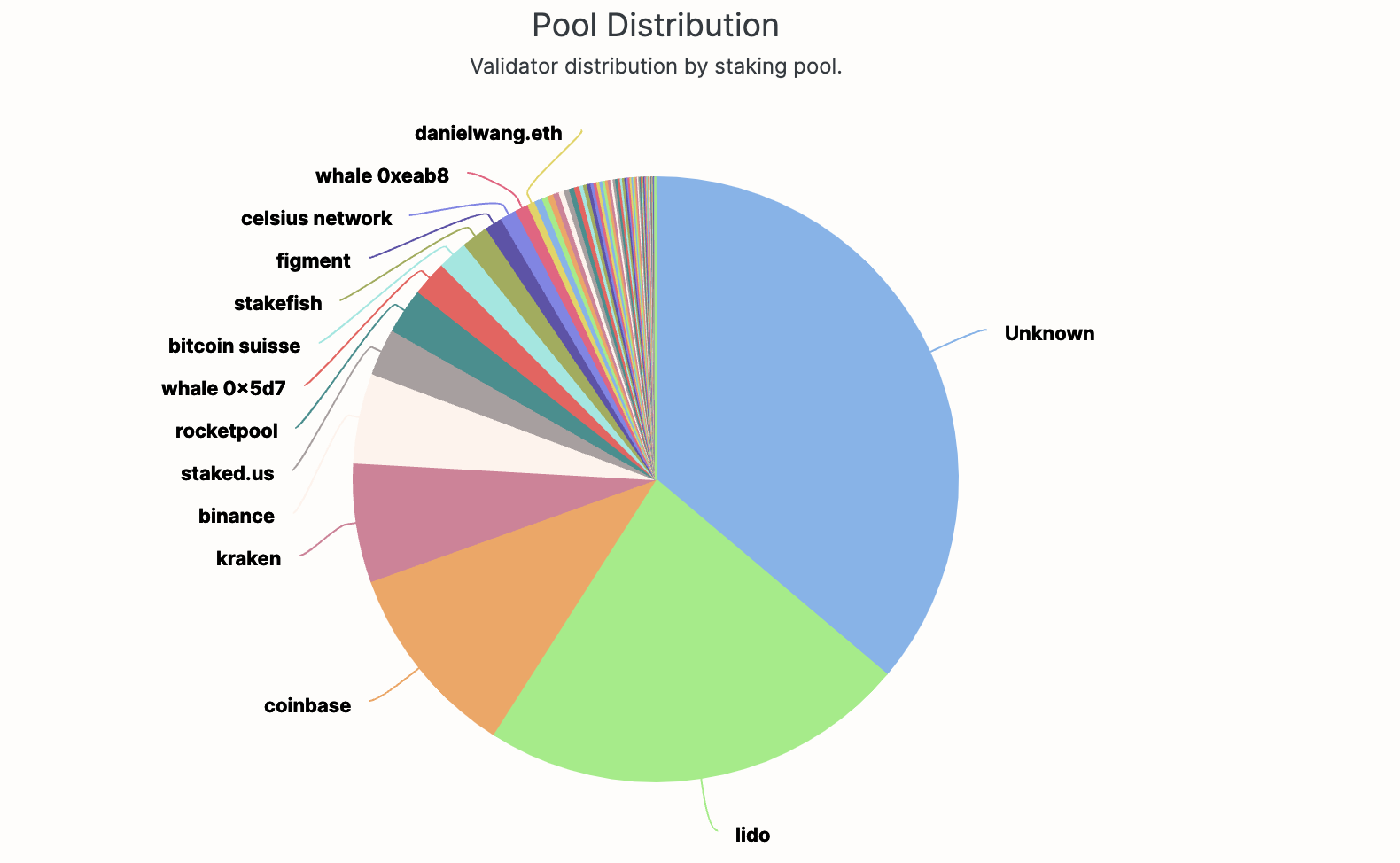

Source: Dune

- Lido (LDO)

Lido, an Ethereum liquidity staking solution, is the largest Ethereum staking service provider on the market. According to beaconcha.in, Lido currently holds 22.89% of the market share, while Coinbase, the second-largest player in the category, only accounts for less than half of Lido’s market share.

Source: beaconcha.in

With Lido, users get to stake their ETH while using stETH to engage in on-chain borrowing or trading. This allows them to earn additional profits from other protocols and improves Ethereum’s network security. When staking ETH on the Beacon Chain using Lido, users receive stETH, which represents their staked ETH at a 1:1 ratio. As the staked ETH generates rewards, users’ ETH balance on the Beacon Chain will also go up. Lido updates the stETH balance daily. Users may also trade stETH like ETH or use it as collateral to borrow crypto loans. Once the Shapella upgrade is activated, users will be able to exchange stETH for ETH.

Apart from ETH, Lido also supports liquidity staking of other cryptos such as MATIC, SOL, DOT, and KSM.

- Rocket Pool (RPL)

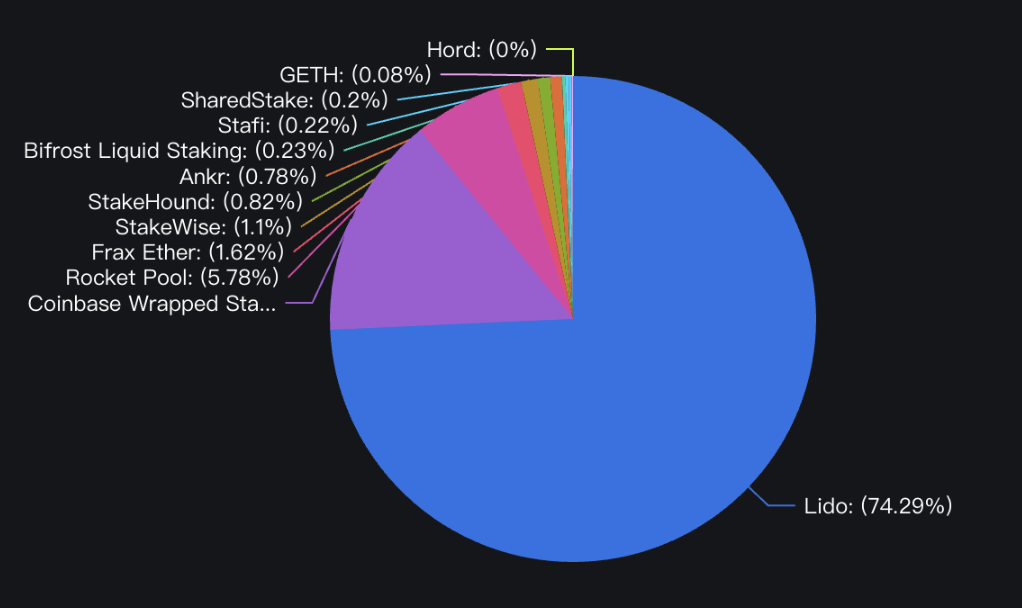

Rocket Pool, an ETH staking pool running on the Beacon Chain, now ranks as one of the top three liquidity staking protocols, with a market share of 5.78%, according to DeFiLlama. Compared to Lido, the Rocket Pool community demands a greater level of decentralization, which somewhat restricts its market share in the ETH staking market.

Source: DeFiLlama

Rocket Pool aims to reduce the capital and hardware requirements for staking ETH, thereby making Ethereum safer and more decentralized. To that end, it allows users to stake on the node operator network without any permission. When a user makes an ETH deposit, the smart contract of Rocket Pool allocates the deposit to node operators, issues and tracks RPL/rETH, and then processes the interaction with the Beacon Chain.

- Frax Finance (FXS)

Frax Finance was originally an algorithmic stablecoin protocol aiming to provide users with a highly scalable and decentralized algorithmic currency. Last October, Frax introduced an Ethereum liquidity-staking product, allowing users to lock up ETH on its platform and receive fxsETH.

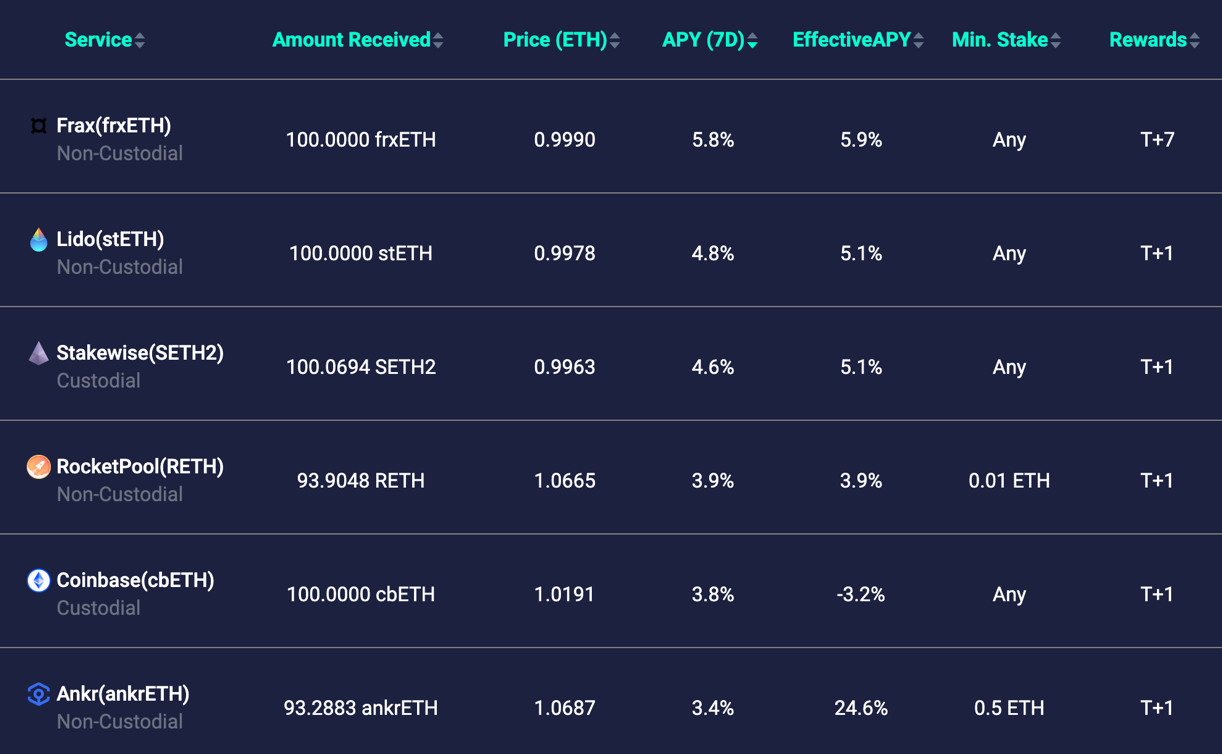

On Frax, users can choose to provide liquidity for frxETH/ETH to earn rewards, or they may also stake frxETH to get sfrxETH. Frax uses an arbitrage mechanism to adjust the yield ratio between frxETH and sfrxETH, yielding returns higher than those offered by other liquidity staking protocols. According to Chain Eye, as of April 6, Frax’s average 7-day APY stands at 5.8%, significantly higher than Lido’s 4.8%. The handsome returns have sent Frax’s liquidity-staking product record soaring within less than six months since its launch. At the moment, Frax ranks third in market share after Lido and Rocket Pool.

Source: Chain eye

- Ankr (ANKR)

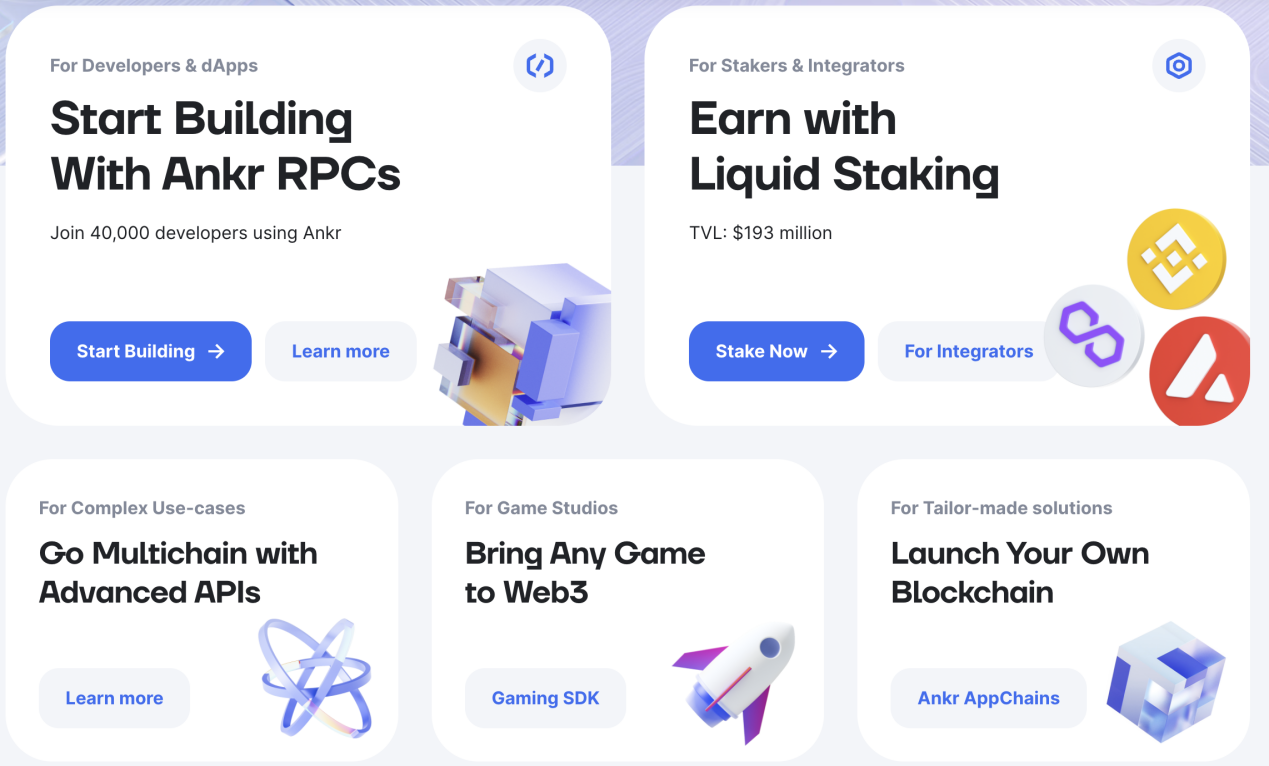

Ankr is a decentralized Web3 infrastructure provider that strives to lower the entry barriers of blockchain ecosystems for individuals, companies, and developers. The project offers five services, including RPC services, instant connection to the APIs of major protocols, Web3 gaming SDK, Ankr AppChains, and liquidity staking.

Ankr resembles Lido in terms of ETH staking: Users stake ETH and receive liquidity tokens aETH in return. Aside from ETH, Ankr also enables liquidity staking of cryptos including MATIC, BNB, FTM, AVAX, DOT, and more. Ankr’s TVL now stands at $193 million.

Source: the Ankr website

- StaFi (FIS)

As a decentralized and scalable cross-chain staking derivatives protocol built on Substrate, StaFi aims to solve the contradiction between mainnet security and token liquidity in PoS consensus. When staking PoS tokens through StaFi, users receive rTokens (reward tokens) of the equivalent value. For instance, rATOM is given for staking ATOM. rTokens allow users to receive staking rewards and use liquidity at any moment.

Right now, StaFi focuses on the Cosmos ecosystem and supports liquidity staking of tokens including ETH, FIS, BNB, DOT, ATOM, SOL, MATIC, KSM, and more.

- Tranchess (CHESS)

Tranchess is a leveled fund protocol with varied risk-return solutions. On this protocol, users get to pick different risk levels according to their risk appetite. Tranchess consists of tokens at three different levels (QUEEN, BISHOP, and ROOK) and governance token CHESS. This leveled design meets three different user demands, respectively, demands for stable returns (BISHOP), leverage (ROOK), and long-term holdings (QUEEN).

In December 2022, Tranchess released its qETH liquidity staking product that provides users with liquidity token qETH when staking ETH on the platform. Besides ETH, Tranchess also offers BNB liquidity staking. Currently, Tranchess’ TVL is at $56 million.

- Stader (SD)

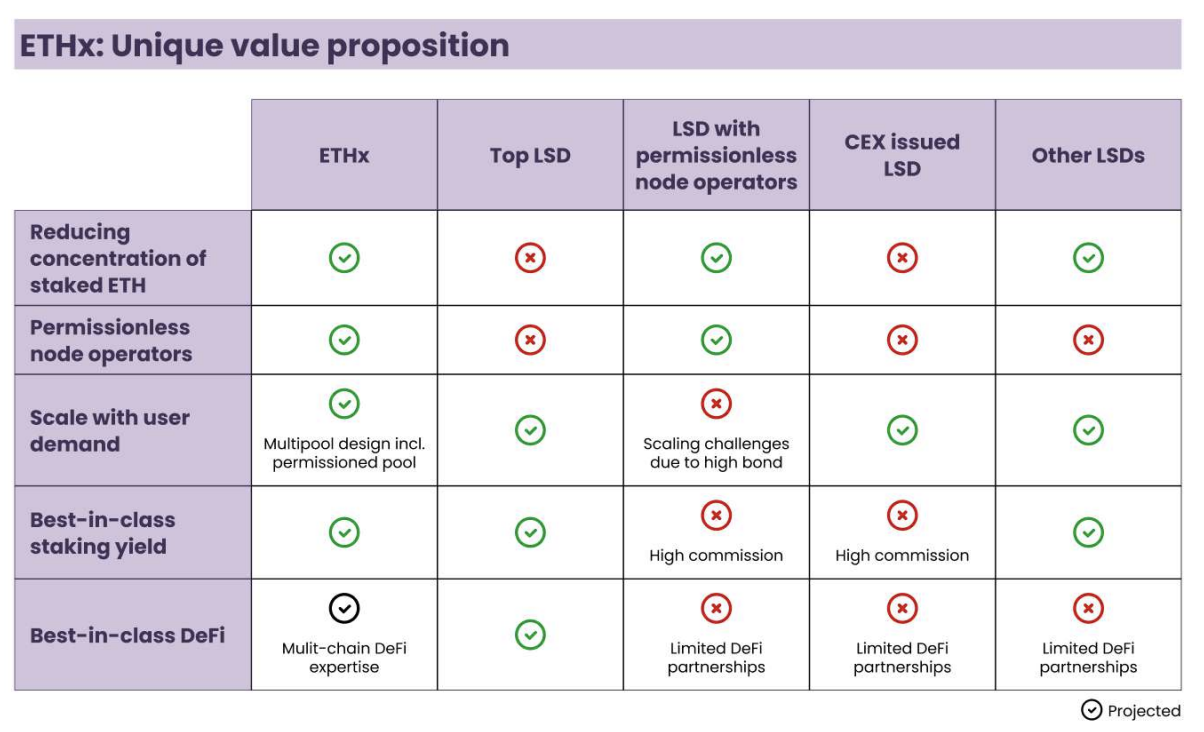

Stader, a multichain liquidity staking platform, now provides liquidity staking solutions for blockchains including Polygon, BNB Chain, Near, Fantom, Hedera, and Terra 2.0. With a total TVL of $110 million, the platform kickstarted the testing of ETHx liquidity staking on the Goerli testnet in March 2023.

According to the Stader whitepaper, ETHx makes ETH staking less centralized, compared to other liquidity staking protocols. It supports permissionless node operators and scales itself in response to user demand while providing best-in-class staking yield and DeFi protocols.

Source: The ETHx whitepaper

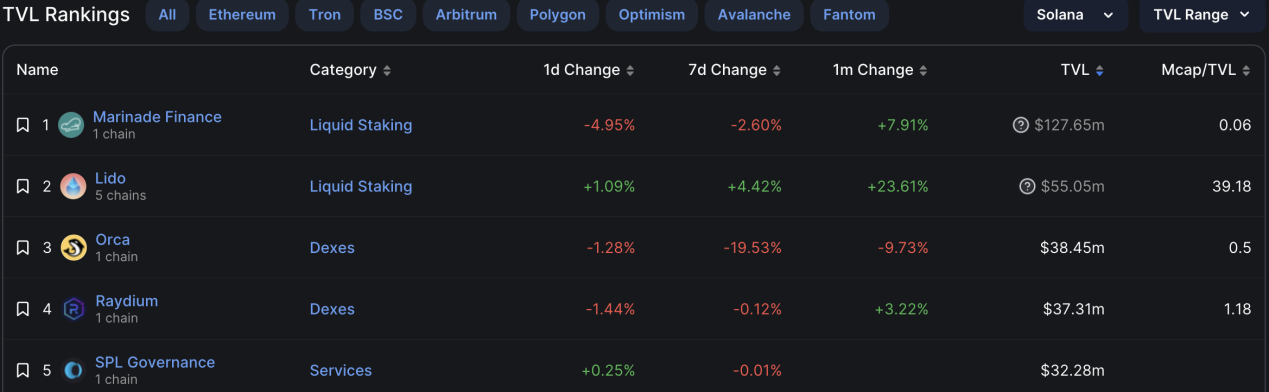

- Marinade (MNDE)

Marinade is a non-custodial liquidity staking protocol built on Solana. According to DeFiLlama, Solana boasts a TVL of $280 million. Marinade is also the largest liquidity staking protocol on Solana, accounting for 45% of Solana’s total TVL.

Source: DeFiLlama

On Marinade, users can stake SOL through automatic staking strategies and receive marinated SOL (mSOL). The mSOL price will increase relative to SOL, as staking rewards accumulate in the underlying SOL staked, which allows users to use mSOL in DeFi while still earning staking rewards.

- pSTAKE Finance (PSTAKE)

pSTAKE is a liquidity staking protocol where holders can deposit PoS tokens to mint 1:1 pegged unstaked tokens called pTOKENs (e.g., pATOM). Additionally, Users can convert pTOKENs into 1:1 wrapped ERC-20 staked representatives called stkTOKENs by staking the underlying deposited PoS tokens.

stkTOKENs (staked tokens) accrue staking rewards in the form of pTOKENs. pSTAKE allows its users to utilize stkTOKENs in various DeFi protocols to earn additional yields on top of their staking rewards. The platform now supports liquidity staking on blockchains that include Cosmos, BNB, and Ethereum.

LSDFi

As the LSD thrives, the concept of LSDFi has gained traction. To be more specific, LSDFi refers to DeFi products based on LSD that promise to improve the capital efficiency and yield of LSD tokens such as stETH.

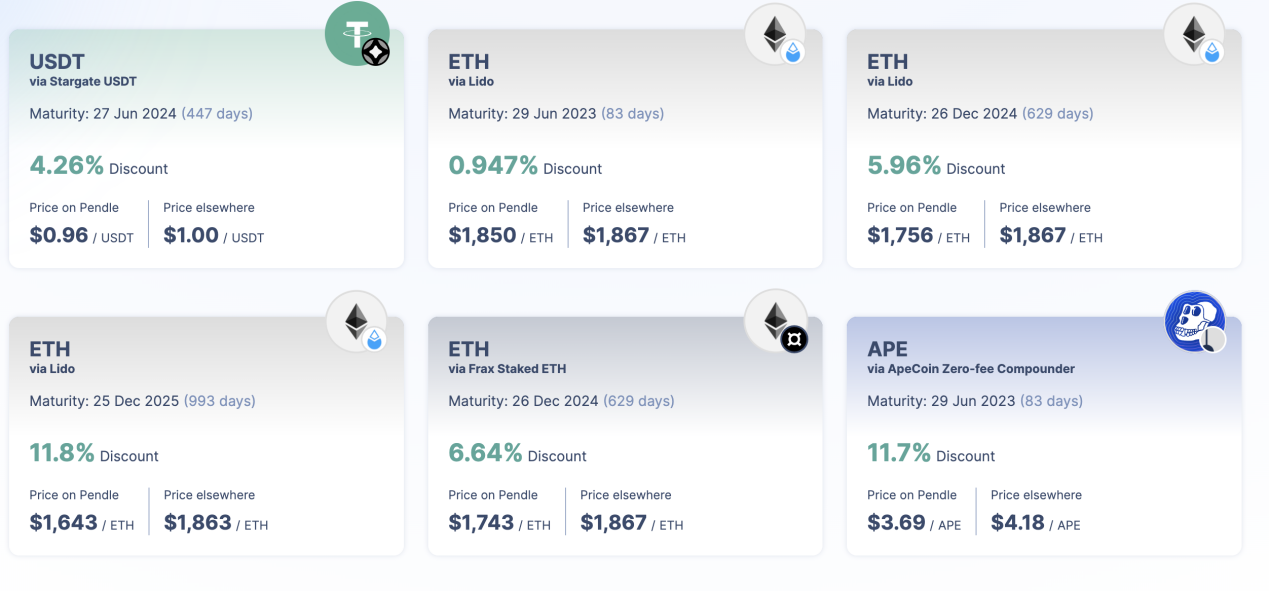

- Pendle (PENDLE)

As a permissionless yield-trading protocol, Pendle makes clever use of the interest-bearing feature of LSD. It wraps liquidity staking tokens into standardized yield tokens (SY). Then, SY is split into principal and yield components, principal tokens (PT) and yield tokens (YT). More specifically, PT is the equivalent of zero-coupon bonds, while YT is like coupon payments.

For example, as shown in the figure below, you can buy stETH, which is supported by Lido, at a discount of 5.96%, to get stETH PT, which can be redeemed as stETH on December 26, 2024 (maturity date). Through this approach, investors get to purchase future assets at a discount and execute advanced arbitrage strategies.

Besides, users can also lock up their interest-bearing assets (e.g., staking ETH to obtain PT stETH and YT stETH) and sell YT stETH to cash out in advance.

- Aura Finance (AURA)

Aura Finance is a protocol built on top of the Balancer system to provide maximum incentives for Balancer liquidity providers and BAL stakers. Aura separates BAL’s rewards and governance through auraBAL and veBAL. This allows BAL stakers to earn more revenue, but the Aura team owns the governance rights of Balancer.

At the moment, Balancer provides AMM innovation and composable LP for LSD. In addition, Aura Finance has partnered up with top LSD protocols including Lido, Rocket Pool, Frax, Stader, Ankr, and StaFi. Through the combination of Aura and Balancer, LSD assets such as rETH, sfrxETH, and wstETH are able to circulate in the market more efficiently.

Conclusion

Once the Shapella upgrade is officially activated, users will be able to withdraw their ETH staked. Right now, users with locked-up ETH can only acquire liquidity via LSD, which is also an important reason why many investors are taking a wait-and-see attitude when it comes to ETH staking. After ETH withdrawal becomes available, more crypto users may venture into ETH staking. By then, the competition for liquidity staking and its derivatives might continue to intensify.

All assets mentioned herein are available in CoinEx’s Ethereum Shanghai Upgrade section (https://www.coinex.com/markets?tab=65&sort=circulation_usd&page=1); the article is for reference only and offers no financial advice.