Solv Protocol, a leading issuer of yield strategies and wrapped assets, today announced a collaboration with Chainlink on the launch of the SolvBTC-BTC Secure Exchange Rate feed on Ethereum. The new feed is powered by Chainlink Proof of Reserve along with Solv Protocol’s institutional-grade bitcoin finance infrastructure, setting the industry standard for real-time collateral verification, marking a major milestone in the evolution of security for DeFi-wrapped assets. Rather than relying solely on market inputs, Secure Exchange Rate feeds combine exchange rate logic with real-time proof of reserves, producing an onchain redemption rate rooted in verifiable collateral.

SolvBTC: A Wrapped BTC Yield Instrument Secured by Chainlink

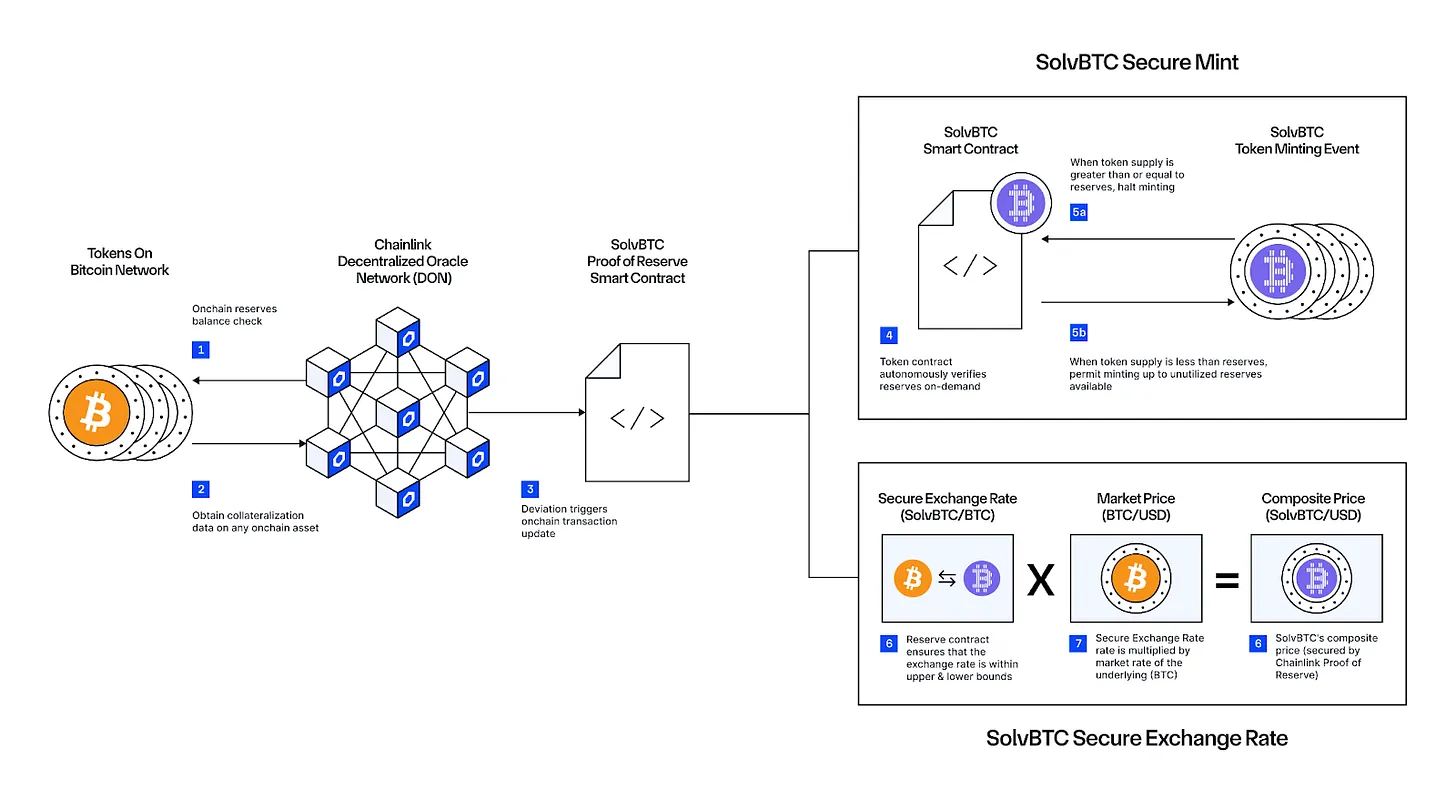

SolvBTC is a 1:1 Bitcoin-wrapped asset designed to unlock Bitcoin’s utility across the onchain economy. The SolvBTC-BTC Secure Exchange Rate feed is a feed that calculates SolvBTC’s redemption rate, leveraging the latest BTC reserve data delivered by Chainlink Proof of Reserve.

The Secure Exchange Rate feed includes built-in upper and lower bounds based on the proof of reserves data, making it resistant to manipulation and more secure for use in lending markets such as Aave. The verified rate can be composed with Chainlink’s BTC-USD Price Feed to derive a stable USD market price for SolvBTC, enabling transparent collateralization and underwriting. This gives lending protocols and users confidence that SolvBTC’s value is transparently backed and cryptographically verified.

How the Secure Exchange Rate feed Establishes a New Standard for Wrapped Asset Transparency

With billions of dollars in wrapped assets deployed across DeFi, transparent pricing has become a top priority for both protocols and institutions. While traditional price feeds offer robust market pricing, wrapped assets require an additional layer of assurance: a mechanism verifies the state of collateral.

Chainlink Proof of Reserve delivers that guarantee by providing automated, onchain verification of offchain or cross-chain reserves. By leveraging the Secure Exchange Rate feed and an existing CCIP integration, Solv enables its wrapped assets to be utilized as collateral across multiple chains without compromising on transparency or security.

The SolvBTC-BTC Secure Exchange Rate feed will be live on Ethereum mainnet, with plans to expand to other chains, including BOB, as Solv prepares for deeper lending market integrations.

This deployment builds on Solv’s position as one of Chainlink’s most active cross-chain users via CCIP. With Chainlink Proof of Reserve set to secure both the minting of SolvBTC via Secure Mint and provide pricing logic, the protocol is setting a precedent for how wrapped asset issuers can meet the highest levels of transparency.

“We’re excited to work with Chainlink to launch a Secure Exchange Rate feed. This marks a major evolution in DeFi security, allowing protocols to more accurately price wrapped assets by leveraging redemption rates rooted in verifiable collateral, powered by the Chainlink standard.” — Ryan Chow, Co-Founder and CEO of Solv

"We’re excited to see Solv set a new benchmark for wrapped asset transparency with the launch of the Secure Exchange Rate feed powered by Chainlink Proof of Reserve. By combining real-time collateral verification with exchange rate logic, this solution delivers a redemption rate rooted in cryptographic truth, raising the security standard for wrapped assets across DeFi."— Johann Eid, Chief Business Officer at Chainlink Labs

About Chainlink

Chainlink is the backbone of the blockchain industry, the global standard for connecting blockchains to real-world data, other blockchains, governments, and enterprise systems. Chainlink has enabled tens of trillions in transaction value across the blockchain economy, powering critical use cases across DeFi, banking, tokenized real-world assets (RWAs), cross-chain, and more. Chainlink is widely adopted by major financial market infrastructures, institutions, and top DeFi protocols, including Swift, Euroclear, Mastercard, Fidelity International, UBS, ANZ, Aave, GMX, Lido, and many more. Learn more by visiting chain.link.

About Solv

Solv is the Operating Layer for Bitcoin, transforming the world’s hardest money into capital that works. With over 25,000 BTC staked and $2.5B in TVL, Solv offers lending, liquid staking, and yield vaults designed for institutions and onchain users alike. Backed by Binance Labs and audited via Chainlink PoR, Solv is building the $1T Bitcoin economy with transparency, capital efficiency, and global access at its core. Learn more by visiting https://solv.finance/