**Author: **Dawn Xue(MetaCat)

**Translator: **Charlotte Cheung

From the PFP-type NFT BAYC, to the token ApeCoin to the metaverse Otherside, Yuga Labs, the parent company of the boring ape, has only been established in February 2021 for just one year and three months, but every time it appears in the Web3 field, it has Extraordinarily eye-catching,and earn a lot of money.

1. Development of Yuga Labs History

Yuga Labs was established in February 2021 by the 4 founders Gargamel, Gordon, Tomato and Sass.Let’s briefly sort out which Web3 products this company has launched in the past year or so.

BAYC:On April 23, 2021, a total of 10,000 NFTs in the BAYC (Boring Ape Yacht Club) series were launched, which did not receive much attention at first.After the well-known collector Pranksy tweeted on May 1, it was all sold out in just two hours.

**BAKC:**On June 18, 2021, BAKC (Boring Ape Kennel Club) was launched, and every Bore Ape owner can get one.

MAYC:On August 28, 2021, MAYC (Mutant Ape Yacht Club) was launched, and each Bored Ape owner will receive a serum that can be used to mutate their Bored Ape into a mutant ape with corresponding characteristics.In addition to this, an additional 10,000 MAYC NFTs were minted.

ApeCoin:On March 17, 2022, Yuga Labs launched ApeCoin, a total of 1 billion tokens.

Otherside:On May 1, 2022, the sale of Otherdeed, the land of the metaverse platform Otherside, was launched.The total supply is 200,000 plots, of which 55,000 are sold this time. In addition, BAYC/MAYC holders are airdropped 30,000, and contributors hold 15,000.

In addition, Yuga Labs also acquired several head NFT projects in March 2022, such as CryptoPunks, Meebits, etc.The launch of its own star products and the blessing of head NFT projects made Yuga Lab once popular.

2. Yuga Labs Product Data Performance:

What is the** data performance** of each Yuga Labs project?

The latest was the public sale of Metaverse Otherside. The following table shows the sales quantity and sales amount of Otherdeed on the day of sale on May 1:

The sales in the primary market on May 1 alone provided the project with USD 355 million, and the total sales in the primary and secondary markets in one day exceeded the sum of the total sales of the top six Metaverse platforms in the previous days.

Let’s take a look at the overall transaction situation of several projects under the company. The data as of May 23, 2022 is as follows. If you only look at sales, you may think it is the income of which listed company?The floor price is prohibitive (except for ApeCoin).

3. From NFTs to Tokens & Metaverse

NFT, Token, and Metaverse seem to be the typical representatives of the Web3 field.

NFT

NFTs are also called digital collectibles in China. Art can take many forms, it can be physical or digitally native, and it becomes a type of NFT when it is minted on the blockchain. The essence of digital collectibles is collectibles, which can be used as pure collections or as investment items (can be speculated). As a collectible, it can attract a small number of artists or collectors, but as an investment, it can attract more people to enter. The most popular ones on the market are “10,000 avatars”, that is PFP-type NFTs, like BAYC in the table above. Although the floor price of BAYC is already very high, 94.99 ETH on May 23, the number of NFTs is limited after all, even if several additional series are issued, such as BAKC, MAYC, the total number of the three series add up to less than 40,000.

Token

What is the difference between tokens and NFTs?

In terms of form, the former is replaceable, and the number is very large. For example, Yuga Labs provides a total of 1 billion Apecoin, and the current market circulation has reached 284 million, which is completely incomparable to the previous NFT series; The large supply results in more holders, and the token holders are several times as many as the thousands of holders of NFTs. It can be seen from the total sales column in the above table that although ApeCoin has the lowest unit price of $8.14 each, its circulating market value has reached 2.3 billion. If the uncirculated part is included, the total market value of ApeCoin is as high as $8.14 billion. (Market value) is much higher than several other NFT projects with higher unit prices.

From the perspective of value, NFT mainly carries some expressions of the project party, such as pictures, music or text, etc. Of course, it is not ruled out that many project parties are not for expression but only for the purpose of making money; the existence of tokens is mainly For governance voting, medium of exchange, investments (like stocks).

Metaverse

Finally, there is a special NFT, the virtual land NFT, whose macro performance is the on-chain metaverse. Virtual Land NFT is the most important asset in the metaverse. Due to its spatial properties, it can carry various business models or social functions, and the metaverse can transfer various 2D NFTs similar to BAYC and some 3D NFTs ( For example, KODA who launched with Otherside) can take it all in, and Apecoin can be used as the currency of circulation of the entire ecological economy in its metaverse Otherside. That is,** the Metaverse connects all the previously launched products in series, and its future imagination space is even greater.**

4. Comparison of Traditional Enterprise IPO and Web3 Issuance

4.1 Comparison of Traditional Enterprise IPO

As a certified public accountant who has been engaged in auditing for many years, i has also witnessed the ups and downs of the company’s listing.

Policy hard indicators: First, the policy will stipulate some hard indicators such as revenue, profit, and main business (these will be different depending on the main board, GEM, etc.);

Hire intermediaries for verification: Although the company may have reached the standard on the data, it is still necessary to hire securities companies, auditors, lawyers and other intermediary agencies to enter the market to conduct detailed verification of the company’s history, business, finance and other aspects, issue various reports, and finally The process of forming a prospectus can be as short as a few months, or as long as half a year or even longer;

Inspection by regulatory authorities: After the prospectus and some related report materials are submitted to the CSRC, there is still a long queue to wait for inspection. Answers to queries can take hundreds of pages or more, and the process also takes months.

In addition, due to the half-year validity period of the financial report, if the financial report expires in any link, an additional audit (that is, re-review for at least one quarter and update the relevant reports) is required, which is another round of audit for one or two months.

**Although all the above processes are completed, it may be rejected by the regulator and the listing will fail. **This shows how difficult the IPO of traditional companies is.

4.2 Decentralized Distribution in the Web3 Era

In contrast to the Web3 field, decentralization is indeed its very distinctive feature. In addition to its decentralized storage, governance, etc., the other is its decentralized issuance, which includes the issuance of NFTs and the issuance of tokens.

From the establishment of the team, the project party can issue NFT (such as BAYC) within two months or even less. The project party only needs to design the NFT (idea and picture content), program development, mint them on the chain, and then it can be promoted and distributed. and the currently popular PFP NFTs are all 2D, without complicated and cumbersome 3D modeling.

It is easier to issue tokens, because they are interchangeable and do not even need to be designed.**You can issue only after determining the quantity.The only difficulty is to consider the rational use of tokens. **Of course, some projects may not consider how to use them directly. **The exchange does not strictly supervise the business situation of the company behind the issuance of the currency like the stock market, and the exchange can completely independently decide which coins can be listed. **What is the responsibility of the exchange? They just need to wait and collect a steady stream of transaction fee income to share another big piece of the cake.

For virtual land NFT, the project has not been developed, the land has not been released, and the virtual space cannot even be entered. A promotional PPT and some pictures are imagined, and the project can be easily sold. For example, The Sandbox has more than 100,000 plots of land. It has been two and a half years since the first round of pre-sale in December 2019. Even though only a few parcels may be accessible now; Otherside is also not allowed to enter the virtual space at the time of public sales.

It can be seen that in the Web3 era (tokens and NFTs) issuance, in addition to eliminating the tedious hiring of intermediaries to verify and review by regulatory agencies, it is also zero-based. A new company can directly sell 10,000 avatars, tokens, and virtual land without any business. Those people who bought NFTs and tokens are not “shareholders” in the Web3 field? It’s just that most of these “stocks” are not supported by actual products.

5. Web3 Community and Consensus

Web3 Community

**Community is a very important part of Web3. **After Boring Ape was launched, the team used its strong marketing capabilities to build a cohesive community and continue to expand its business section.

First, **the team created a club-like community around BAYC NFT. **The initial distribution of the team’s subsequent NFT series BAKC and MAYC was also airdropped around BAYC holders, and the distribution of tokens Apecoin and metaverse Otherside was also distributed to the aforementioned NFTs. The holder of the series has enough privileges.

In addition, the team fully delegated the commercial copyrights of the three series of NFTs BAYC, BAKC, and MAYC (unlimited authorizations for adaptation, copying, distribution, etc.), holders can jointly develop and sell a single NFT they hold, such as printing On T-shirts, on skateboards, on shoes. Recently, Li Ning also announced a joint event with BAYC#4102 NFT through the official account of the social platform.

In addition, **celebrities buy BAYC to catch up with the trend.**The influence of this community has also grown. Such as well-known pop star singer Justin Bieber, Universal Music Group and producer Timbaland, three-time NBA champion Stephen Curry and so on.

If CryptoPunks is the originator of avatar NFT, then BAYC makes the influence of avatar NFT more widely spread. Yuga Labs has built such a famous community through the above series of operations.

Web3 Consensus

What consensus does a community based on NFTs, tokens, and metaverses like Yuga Labs have?

The artistic value of NFT, the trust in the project party, the investment value of NFT, and the status symbol.

Art value. A series of NFTs may initially be due to their artistic value and collectible features. But a non-artist like me couldn’t get the beauty of these apes from the very beginning. Even if I watch it a lot now, at most I feel that the overall design is stronger, and each boring ape is designed uniquely. Of course, this does not prevent some holders from buying NFTs for artistic purposes. Those who hold NFTs for this artistic starting point must be rare among Opensea’s huge buyer group.

Trust in the project. Just like an investor investing in a project, if a project party is a reliable project party, for example, it has excellent products, excellent marketing capabilities, etc., and has produced some sensational outputs, then the project party’s next steps Actions, such as issuing new NFTs, tokens, etc., will also attract more people to hold them within their ability, thus becoming part of this excellent community.

Investment value (just to earn the difference). The investment value of NFT is partly due to its inherent artistic value, believing that it has room for appreciation, and partly because of the trust in the project party, believing that the price of the product may be higher in the future or there are other opportunities for airdrops, and of course it may also be due to the popularity Just for short-term speculation.

Status symbol. In addition to art and interests, there are some people who hold it because of the status symbol. When the floor price of BAYC has reached a level beyond the reach of ordinary people, some entertainment stars and NBA stars still spend huge sums of money to buy BAYC and replace avatar for own social platform. It is nothing more than to catch up with fashion and trends, a unique identity, not to speculate to earn the difference.

The Web3 community based on the above consensus may be fragile.

Holding for artistic value is benign. But this part is a minority, a niche holder.

Consensus that makes money solely from speculation is unhealthy. However, without the supervision of regulatory agencies, the current projects on the market are mixed, and there are many projects for the purpose of making a fortune rather than the purpose of art/products. There is no need for regulatory review to go online, and there is no need to worry about later income or profit after the successful issuance. Not enough to face delisting, do not need to bear too much pressure. It seems that (NFT, tokens) have been issued and sold to make money, and the project seems to be not far from the end. Some people may also know that the project is relatively bad, but it does not affect the early access to a piece of the pie.

The consensus of status symbol may also be a plausible reason, just like Hermes in the bag industry, brand effect, but the “Hermes” in the NFT world with 100 ETH at every turn, those who have the ability to hold it are even rarer. However, the trend may change direction. An ape appeared yesterday, and a bird may appear tomorrow. Can this trend be guaranteed to last?

In terms of trust in the project party, it seems that every move of the project party will be paid attention to. A slight error will cause a violent discussion, and will also cause the public to question the project party.

Let’s take a look at the May public sale of Yuga Labs’ new metaverse, Otherside.

6. The current state of the metaverse Otherside

Otherside is more like a multiplayer game

Before May, a circulating PPT about Yuga Labs had introduced its grand blueprint. Among them, it talks about the planned metaverse. The background of the story is “the huge energy generated by the big bang, the birth of the gods”, “operable large-scale multiplayer games”, “blockchain-based game economy”, “10,000 A Koda person” (new series of NFTs). Let’s look at the land in the design shown in the PPT (below) and find that whether it is the description of the key phrases or the land Koda people in the given design, Otherside is more like a game than a game like OG platforms like Decentraland and Voxels (formerly Cryptovoxels) may have a metaverse planned with multiple economic models.

Expensive Land , Expensive gas

The auction method of Otherdeed was initially set to be a Dutch auction, starting with 1ETH (that is, the price drops from 1ETH over time until someone buys it or reaches the set lower limit to withdraw the auction). However, on April 29, two days before the sale on May 1, Project Convenience announced on its official media platform (Mirror) that it had changed the auction method to a fixed price of 305Ape, because “Dutch auctions cannot be used in a single multi-person auction. Addressing the Gas Fee Surge in the Mint Campaign”.

The announcement on April 29 caused the price of Apecoin to increase by 30% compared with the previous day, reaching a peak; at the same time, the new sale price of the primary market plot on May 1 was 305Ape (about 5,900 US dollars). It is also as high as 2 times the original price of 1ETH (about 2900 US dollars); and what is the result of canceling the Dutch auction method to avoid serious gas? On the day of the sale, the gas fee for a single transaction was as high as thousands of dollars, and the overall gas fee was as high as 180 million US dollars, which once caused the Ethereum network to be congested. And the average transaction price of the secondary market parcels is also as high as 10ETH.

With such a high price, the “ape” universe is beyond the reach of ordinary people, and even ordinary people can’t afford the gas fee, not to mention its land. So far, other “ape” products except ApeCoin have become games that only the rich can play.

Mint Problem

Temporarily changing the plan, Mint gas is expensive, these are the two problems with mint that have been mentioned earlier. After the above problems occurred, Yuga Labs did not apologize in time to take responsibility, but instead blamed the whole problem on Ethereum, and considered that a Yuga Labs own chain seemed to be needed, and to encourage Dao to think in this direction (picture 1).

This statement aroused disgust and doubts from community members or Gas losers ( picture 2), and some comments even pointed to the pain points:** “Not taking responsibility for yourself”, “Releasing bad and unoptimized contracts”, “This is Ethereum It’s your fault”, “Consider your own chain, are you serious?”**

We don’t see them thinking about the problem from the perspective of the buyer (mint side), analyzing and solving the problem from the essence, but from the perspective of naked interests — considering publishing a chain of their own.

picture 1

picture 2

When will the Otherside be accessible?

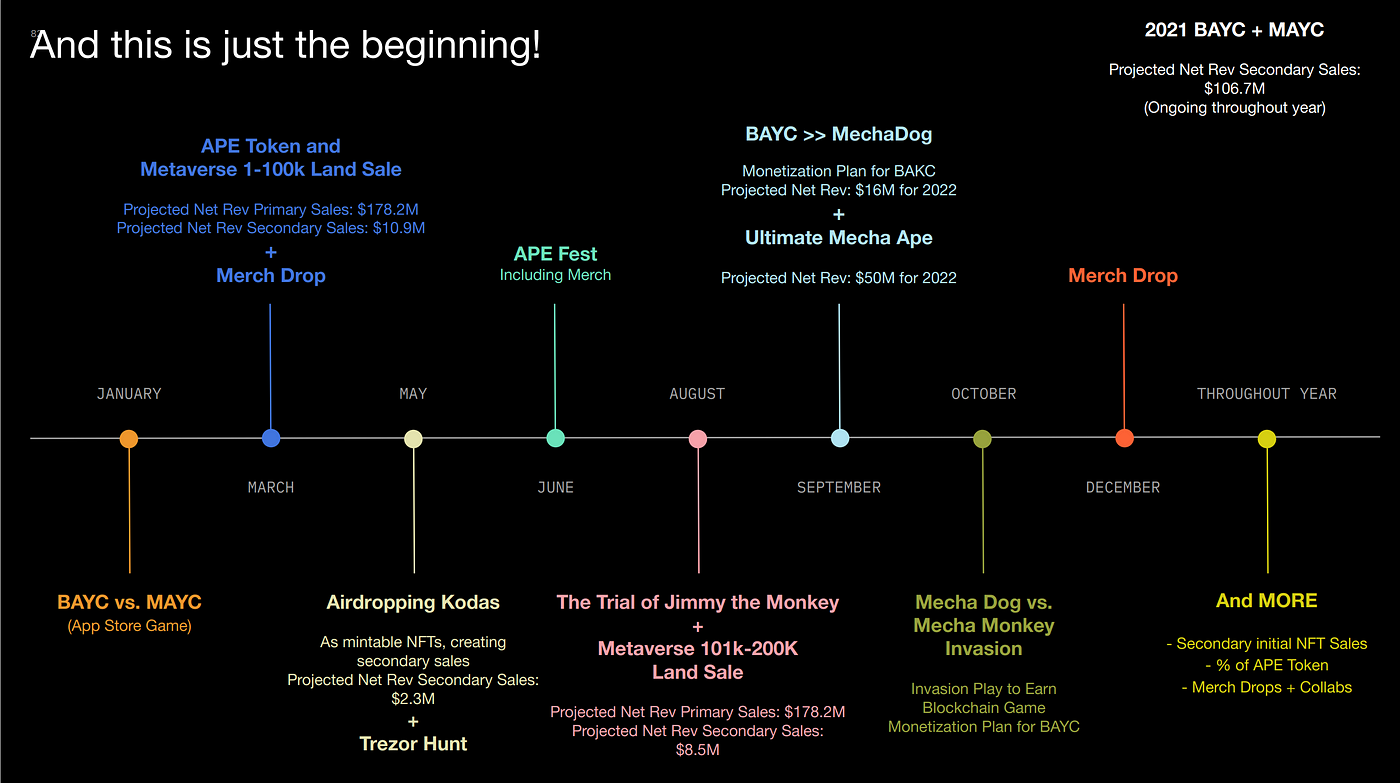

Price aside, let’s see what the product looks like. Whether it is from the PPT or the official website, we have not seen when the world will be officially launched. On the contrary, I have seen so many time nodes in the whole year’s planning (below), in March (actual sales in May) Metaverse 1–100k land sales, the airdrop of Keda people in May, and the Metaverse in August Sale of 101K-200K of land, airdrop of goods in December. On the contrary, October mentioned invasion games. Whether the metaverse will be officially launched in October, it seems that we cannot get more specific information with such a vague expression. At the same time, we can notice that along with the plan at each time point, there is also a clear estimated net income. Are the estimated income and benefits the core of the whole year planning PPT on this page?

If Sandbox was the metaverse project closest to capital before April, it may be time for Otherside to take over from May. After all, there is an Animoca company behind both of them, and Otherside has additional advantages. Yuga Labs, the parent company that operates it. Being backed by mountains and possessing abundant human, financial and other resources, should you submit a more detailed product plan?

On the morning of May 23rd, the Otherside project team tweeted the latest news, and **on July 16th, the first technical demonstration of Otherdeed will be brought , **but I don’t know how far this demo is from the actual open access.

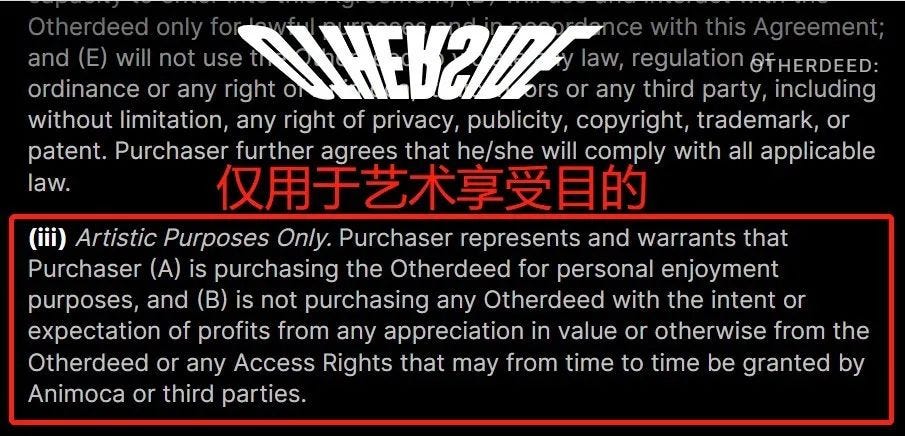

IP Problem

As mentioned earlier, the open commercial copyright of BAYC NFT granted by the project party is praised, then “Otherdeed virtual land is the first NFT without commercial rights in the Yuga Metaverse” [1]. After checking Otherside’s official website, we found that it is mentioned in the detailed description of the “NFT Purchase Agreement” at the bottom of the official website that the counterparty of the agreement is Animoca Brands, and the buyer holds Otherside “for artistic purposes only, for the purpose of personal enjoyment to purchase the land, and The purpose of the purchase is not to obtain an appreciation in value”, which is a non-commercial right. punk6529 mentioned, “If you have sold Otherdeed on Opensea, congratulations, you have violated the NFT purchase agreement.”[1]

Need KYC, is it Web3 Type?

Since Animoca is a Hong Kong company, in order to comply with the laws of Hong Kong, this land sale requires the buyer to complete a KYC process to achieve a manageable and moderate level of anonymity. KYC is a centralized mode of operation, and the Web3 era is open, private, and anonymous, so it seems that Otherside is not so Web3.

Wealth Centralization

Yuga Labs has been a series of operations to widen the gap between the rich and the poor from the beginning.

After BAYC, 100% of the BAKC was airdropped to BAYC holders, and 50% of MAYC was airdropped to BAYC holders;

What about the distribution of tokens? 15% to BAYC holders, 15% to Yuga Labs, 14% to project contributors, 8% to Yuga Labs founders; the remaining 48%, 1% donated to charity, 47% reserved To the DAO treasury. More than half of the 1 billion coins have already been destined for it.

What about the final distribution of virtual land in the metaverse? For the first 100,000 plots, 10% will be given to BAYC holders, 20% to MAYC holders, and 15% to project developers at Yuga and Otherside. Only 55% of the first batch was eventually offered for public sale.

Reminds me of a sentence in the Gospel of Matthew in the Bible: “Whoever has, will be given double to make him redundant; and whoever doesn’t have, even what he has will be taken away.” Isn’t that the case with Yuga Labs?

Since Otherside started selling the land, online articles or comments directed at Yuga Labs have been more negative than positive. The community’s trust in the project party will also be easily influenced by the actions and remarks of the project party in the middle of the stage. Once the trust in the community and these nihilistic “consensus” collapse, the bubble may also burst.

But even with the status, the decentralization, digital ownership, autonomous identity, immersion and other features of Web3 are still worth exploring in depth. At present, the best entrance is the Metaverse, not the Metaverse that only sells the land, but the Metaverse that develops the land with heart; not only the project side of the Metaverse platform, but also many people who are willing to go to the Metaverse to build and operate, to make more Individuals and companies with multiple experiences, ideas and technologies.

7. What Areas do Venture Capital Firms Focus on?

As for the specific exploration direction, some focus directions of venture capital companies seem to give us some guidance (this part of the information mainly refers to [3])

Hiro Capital, a European veteran investment beast game industry fund, hopes to bring game companies with an enterprise value of 400 million euros to 2 billion euros into the stock market;

Gladwyn, a partner at general fund Omers Ventures, is looking for games that can truly be social experiences;

FOV Ventures, a fund dedicated to early-stage metaverse startups, announced that it will invest in three different types of metaverse companies.** One is companies creating games and experiences in the metaverse, including digital fashion, shopping and concerts; two are digital twins focused on virtual meetings or factories; three are startups creating “tools” for the metaverse: platforms, avatars, Sound effects and backgrounds.** They claim that** FOV will not invest in cryptocurrencies and NFTs — although these are seen by some as an important part of the metaverse.**

The conglomerate Creadum is interested in virtual goods and fashion. Its director, Wizander, is skeptical about NFTs and cryptocurrencies, “I’m still looking for a use case that solves a real problem, and I wouldn’t want to invest in a speculative NFT project.”

LocalGlobe has invested in Improbable, a game engine that is trying to get thousands of people into the same game server at the same time. Improbable is the company that Otherside just mentioned on May 23 to provide technology.

Cambridge-based IQ Capital wants to invest in technologies that currently have confirmed demand, such as VR virtual training companies, immersive game studios, and technology companies that enable advertising in the metaverse.

Edge is focused on tools that can build a metaverse and is currently focusing on VR training and teaching

8. Concluding Remarks

When the new field of Web3 has not had time to take action, the project parties represented by Yuga Labs used NFTs and tokens to blow a huge bubble in Opensea and exchanges, so that NFTs and exchanges that should have become tools Tokens have become a kind of “product” that is produced in seconds, and** the real product should be polished with resources such as time, human resources, etc. **and I look forward to the arrival of this kind of product. At that time, as Sabina Wizander, a partner at investment firm Creandum, said, “Web3 and the Metaverse are here to stay — not just in one industry, but in all industries.”[3]

Reference articles and sources:

[1]Did you notice the Hidden IP license terms in Otherside?

[2]Yuga LabsHighlight Everything,That is Wrong in the NFT Space

[3]Europe’s top metaverse investors | Sifted

Contact Us

Website: https://www.metacat.world/

Discord: https://discord.gg/yRt6be237P

Mirror: https://mirror.xyz/0xE069160b21d23fB8Edad4F8B42f6b91f7b77F22A

Twitter: @Metacat007

WeChat: @metacat234