Author:MetaCat

Translator:Yanyi

2022was a year of ups and downs in the metaverse field: the virtual real estate fever climbed rapidly at the beginning of the year, Otherside sold out in the middle of the year, and the market returned to rationality at the end of the year. The metaverse quickly went through a cycle. The ecological pattern consisting of capital, market, products, users and other elements have all undergone profound changes. This article tries to summarize in five perspectives. Please criticize for any shortcomings.

1. Logic of Location-Based Virtual Real Estate Value Is Collapsing

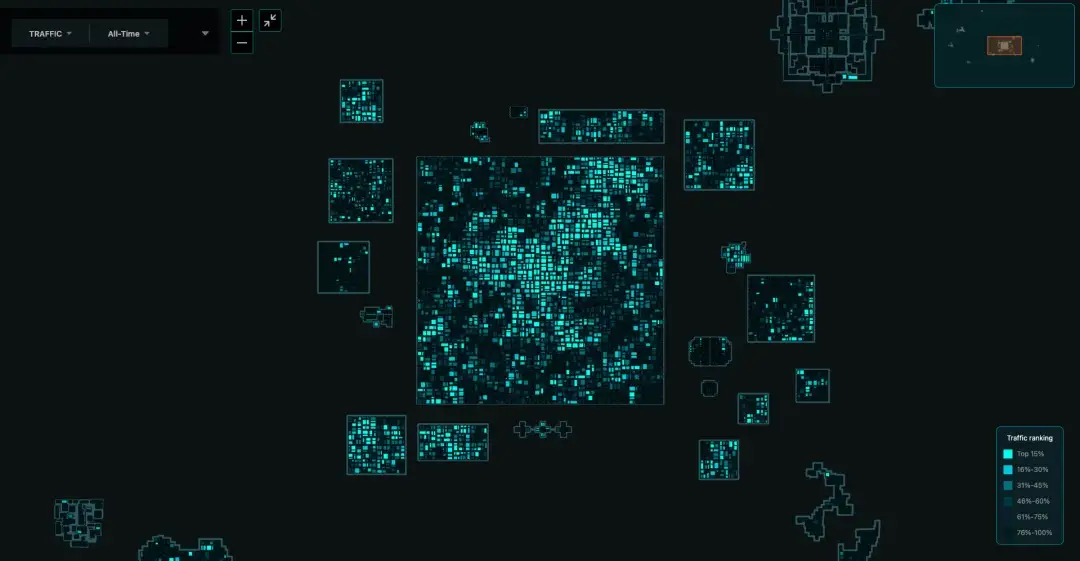

Decentraland, The Sandbox and other projects have guided and constructed the purchase logic of “the value of virtual real estate depends on location, and the traffic spillover will be obtained when it is close to the big traffic”, but from the actual effect, the traffic spillover effect is not commonly seen. On the one hand, we can see from the traffic heatmap (Figure 1) that the traffic spillover effect is almost zero; on the other hand, the distance between any two points in the metaverse is zero (reachable by mouse click) and the hotspot is variable, which is not the same as the logic of traffic and value in the physical world.

The good news is that in the process of constructing the value logic described above, the market has explored other practical areas of virtual real estate, as follows:

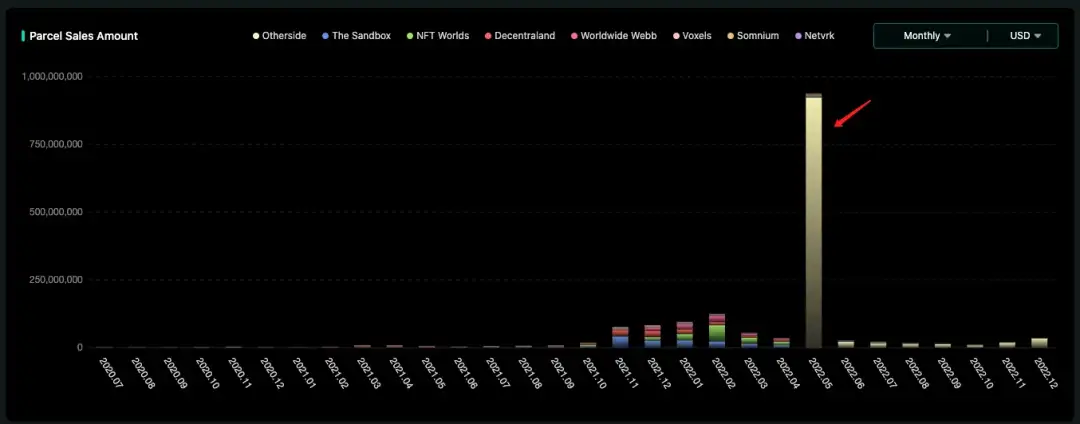

From another perspective, the metaverse project Otherside did not emphasize location-based value logic when it went on sale in May 2022, but it’s Lands still sold out (see Figures 2 and 3 for details). Clearly buyers were focused on the wealth effect, even if there was no practicability.

Behind the speculative hubbub was a lull in innovation and a lack of product, and Otherside has not yet to deliver a basic usable product to this day. Other early metaverse projects are not much better, such as Decentraland and The Sandbox, which have not improved much in terms of product form and ease of use in the last year.

The old logic is collapsing and the new one is not yet established.

2. Content-Centered Consensus Is Rising

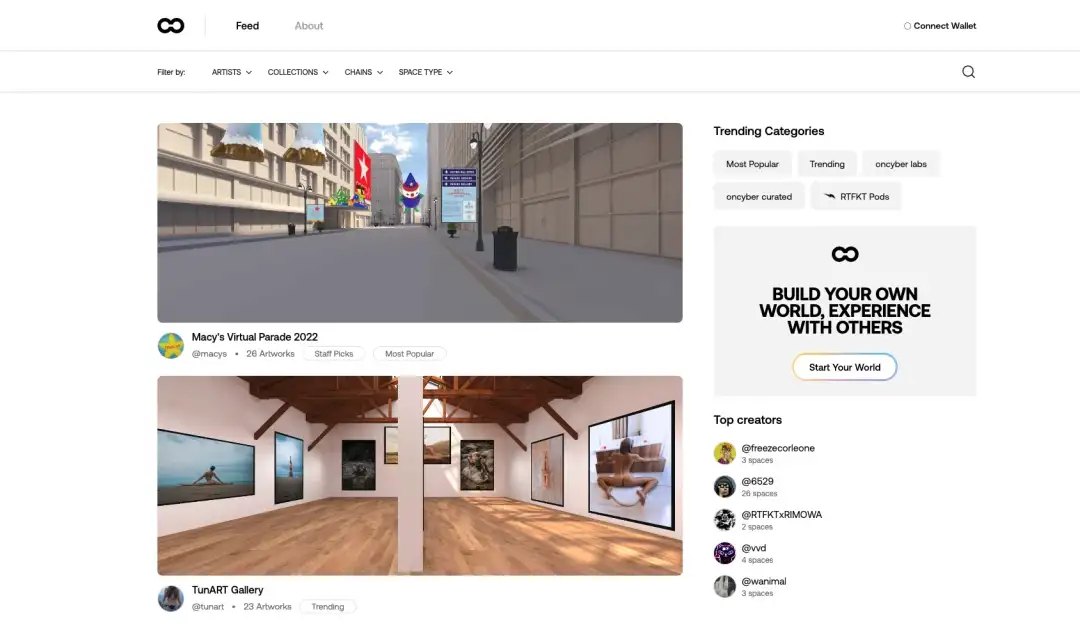

From the dimension of metaverse projects, Oncyber (Figure 4) and Mona, which do not emphasize location (no map) and focus on user experience, are attracting more users gradually.

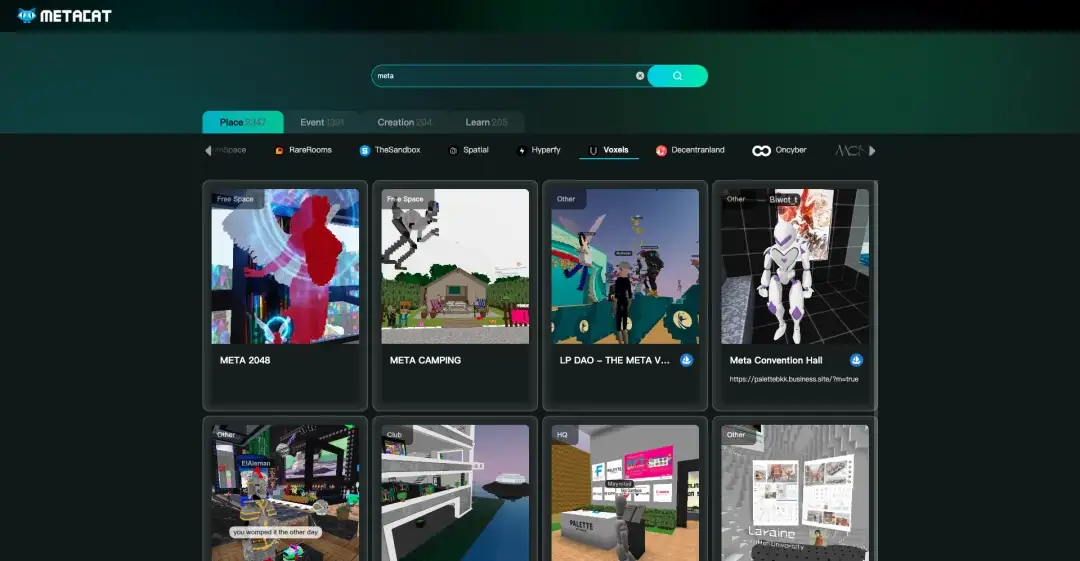

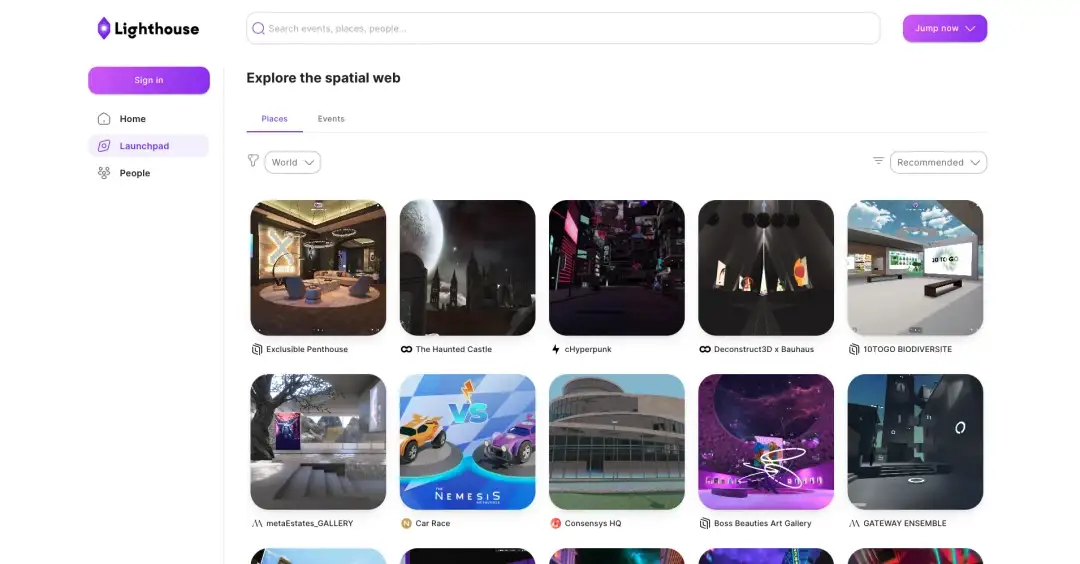

From the dimension of metaverse ecological projects, metaverse content navigation products continue to emerge, indicating that the industry’s emphasis on content is increasing. Among them, MetaCat Search (Figure 5) and Lighthouse (Figure 6) are representative, both of which have made a more complete collection of metaverse contents.

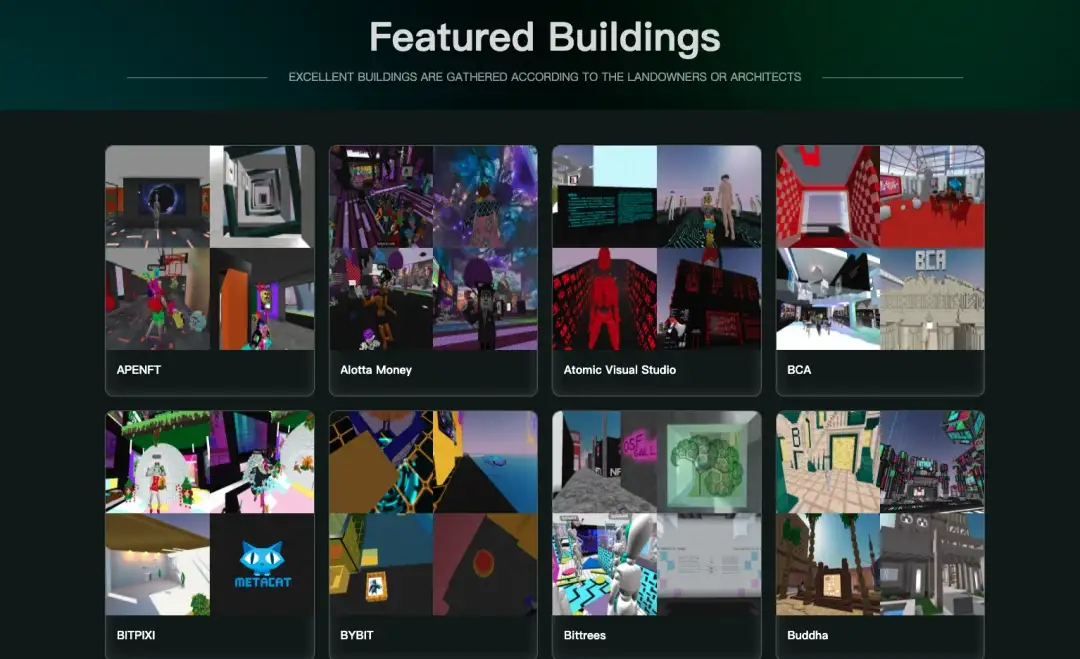

From the creator dimension, metaverse architecture and Wearable are the two major categories of metaverse content.

As a very important category of metaverse content, architecture reflects the release of creativity in the metaverse, metaverse architects are the stars shine in the age of digital navigation! Meanwhile, from the commercial point of view, metaverse architects have been rewarded to a certain extent by the high value of virtual real estate.

The potential of the Wearable category has not yet been unleashed, which showed a scene of creators’ solo dance. Most creators create wearables for fun, such as Voxels, because it is not tainted by commerce,

3. Open Metaverse Has Become the Industry Consensus

“Interoperability” is a term frequently mentioned in the metaverse in recent years. However, most people don’t understand its real meaning, part of the reason is the KOLs’ obscurantist. Acually, replacing “interoperability” with “openness” will be easier to understand, and easier to gather public consensus and participation.

The interoperability of Web3/Metaverse is largely based on openness, openness of data, openness of products, and openness of ecology are the key elements of openness.

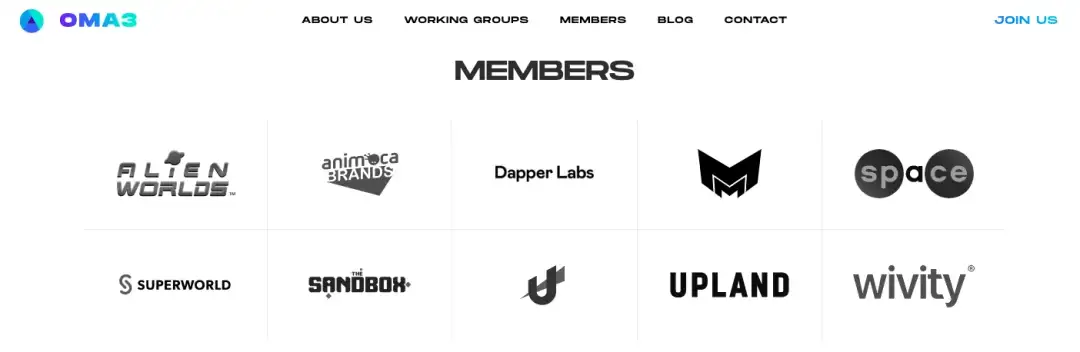

The Metaverse Standards Forum (Figure 9), established in June 2022, and The Open Metaverse Alliance (OMA3) (Figure 10), established in July 2022, both aim to advance the industry by building open metaverse industry standards.

The difference is that the “Metaverse Standards Forum” is mainly composed of Internet giants, representing the attitude of the “walled garden” vested interests towards the metaverse; The Open Metaverse Alliance (OMA3) represents the dissatisfaction and resistance of the Crypto native metaverse project parties to the former. However, the two are at least conceptually consistent in terms of the openness of the metaverse.

4. It Is Biased to Talk About the Metaiverse Aside From the Blockchain

At present, metaverse projects are divided into two camps: on-chain metaverse and off-chain metaverse.

The on-chain metaverse is represented by projects such as Decentraland, The Sandbox and Voxels, which realize the core assets ( virtual real estate) on the chain. Users autonomous own them(through a blockchain-based identity system), which is also a big reason for the popularity of virtual real estate in 2022.

Most of the off-chain** **metaverse emphasize immersive and AR/VR experience, Such as Horizon Worlds and Xirang of Baidu are among them. The essence is the virtual space under the “walled garden” model.

In the short term, each of the two types of metaverse projects meets the needs of some users, but from the long-term vision of metaverse, only based on blockchain can we realize a truly open metaverse. It is short-sighted and speculative to talk about metaverse without blockchain.

5. Clamour of Capital, Absence of Innovation

2022 Otherside’s virtual real estate first month sales reached $920 million (Figure XI), as a comparison The Sandbox virtual real estate cumulative sales of $160 million (see Figure XII); in addition, The Sandbox, Decentraland also frequently announced strategic cooperation with various traditional giants, the capital level can be described as lively.

However, in terms of product and user experience dimensions, update of OG projects such as The Sandbox, Decentraland, Voxels, Somnium Space, etc. are slow and nothing new; new projects such as NFT Worlds, Worldwide Webb, Nifty Island, Tz1and, Oncyber, etc, all of them are innovative at the micro level, but not enough to attract a large number of users to enter.

Looking back at the metaverse industry in 2022, too much capital operation and brand marketing, too little product innovation and user care are the vinternal causes of the industry’s coldness; hollow vision, lack of innovation and Crypto down cycle are the external causes of the industry’s coldness. Openness is a very good vision of metaverse, while the way is arduous and long.