Good day everyone,

I hope you are all well and having a great day, welcome to CryptoGod-1's blog on all things crypto. There has been much media attention in the recent days and weeks regarding one of the largest Crypto exchange around, Binance, and how Forbes has been dragging up information regarding the exchange to show similarities between Binance and FTX. Not the sort of news anybody involved in Crypto wants to hear, as the last thing required is another major CEX to collapse. Here I will look in detail at the story so far and what could result from these accusations as Binance has faced more and more scrutiny of late.

Claims of Wrong Doing at Binance

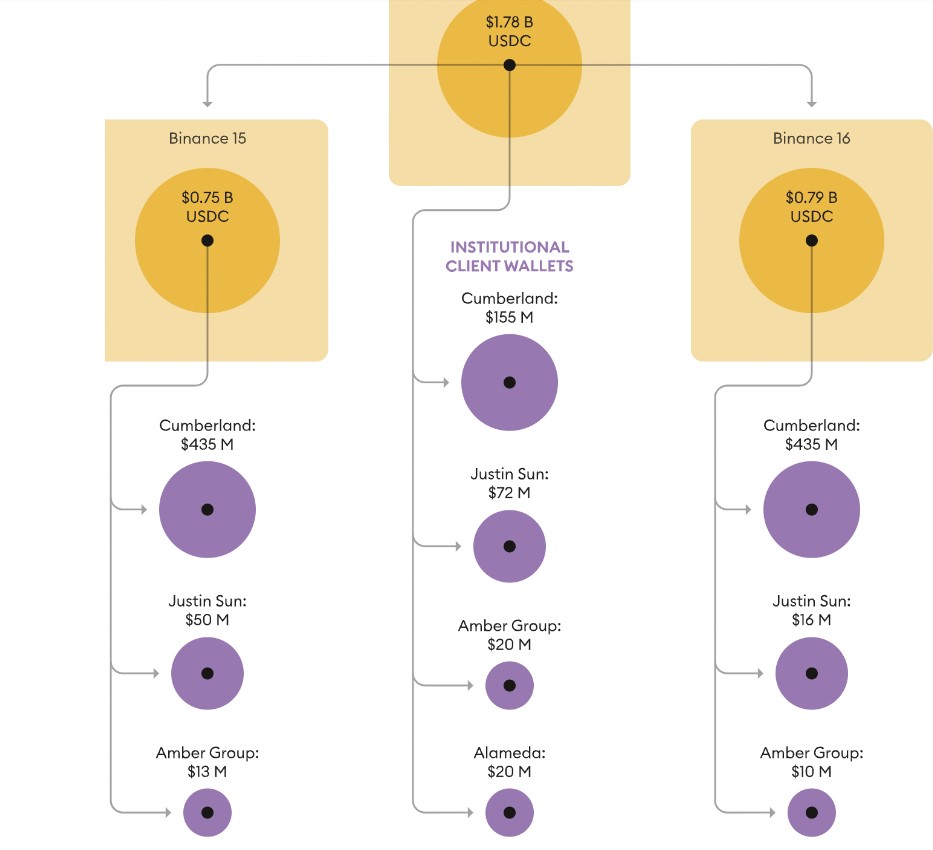

There has been a lot of drama recently regarding Binance, with it feeling like the curtains may be coming down on one of the worlds largest cryptocurrency exchanges. On the 27th of February it was claimed by Forbes that Binance had taken $1.78 billion of its users’ funds and transferred it into various hedge funds via stablecoins. The stablecoin in question was USDC, in which the claims make out that Binance, under the direction of its CEO Changpeng Zhao, emptied its collateral for B-peg USDC without reducing its supply.

What is B-peg USDC? Well like many exchanges, Binance issues its own BNB chain variant of others chains tokens, so for USDC it had the B-USDC. The standardised way this works is that the exchange must match every token issued with a 100% equivalent collateral token. So for every 100 B-USDC issued by Binance, it must have 100 USDC in storage as collateral.

However, the report outlines that on the 17th of August 2022 Binance went against its own standard rules and withdrew $3.63 billion from its peg wallet into Binance's own Binance 8 cold storage wallet. From there, $1.85 billion was returned to the peg wallet but the remaining $1.78 billion was sent to the Binance 14 cold storage wallet. It was stated in January 2023 that those funds had been mistakenly moved into the cold storage wallet, according to Patrick Hillmann, the Chief Strategy Officer of Binance. However, those funds were distributed across multiple locations, including to a trading firm, Cumberland, Amber Group, Alameda Research, and Justin Sun (the founder of TRON).

The major issues that is at play here is the fact that in moving the funds Binance did not decrease the supply of the B-USDC. The collateral fell to zero and the exchange did nothing to rectify the situation for four months. Through further research, Forbes discovered that Binance had left B-USDC deficit by over $1 billion on three different occasions. They therefore believe that Binance is misusing customers’ funds, similar to the bankrupt exchange FTX.

The news against Binance did not stop there however, as on the 2nd of March it emerged that the United States Senate have accused Binance of being a hotbed of unlawful financial activity. The exchange has been under scrutiny from legislators and regulators in the U.S. and an inquiry into the BUSD coin has been opened by the Securities Exchange Commission (SEC). This investigation mainly focuses on whether or not BUSD is sufficiently supported by reserves and meets the requirements to be considered a security under American law.

A group of three U.S. senators are spearheading the accusations against Binance, claiming that Binance had had deliberately sidestepped regulators and transferred money to criminals and sanctions violators. More so, they claimed Binance concealed basic financial information from its users and the general public. The three senators in question are Senators Elizabeth Warren, Chris Van Hollen, and Roger Marshall. The U.S. senators have requested for details regarding the company’s financial statements going back to 2017 along with any correspondence addressing Zhao’s alleged attempts to limit compliance procedures.

Binance has been given a deadline of the 16th of March 2023 to respond to the Senators’ request.

Binance Bites Back

With some much coming into the fore in a matter of days there has been plenty for Binance to ponder. Changpeng Zhao, the Binance CEO, took to Twitter on the 28th of February to dismiss the claims made by Forbes regarding wrongdoing. He accused the news outlet of “lots of accusatory questions, with negative spins, and intentionally misconstruing facts.”

The general sentiment from within the crypto community has been of Forbes deliberately spreading Fear, Uncertainty, and Doubt (FUD) against Binance. Some are very much on the side of Binance, claiming Changpeng Zhao was within his right to respond and quench the fires being started by the Forbes article.

Others expressed their views of how Forbes, the U.S. Senate, and even apparently the FBI are spreading FUD, while Binance responds by providing education.

However, there are also those who have noted the similarity of how Binance and Changpeng Zhao responded to the claims by contrasting them against Sam Bankman-Fried and his responses back prior to the collapse of FTX.

Forbes History with Binance

This is not the first time Forbes, or even the United States Senators, have taken issue with Binance and its CEO Changpeng Zhao. There has been a long running history between the two going back over a number of years. The crypto community will be well aware of this, having themselves seen first hand how Forbes had a somewhat 'soft spot' for Sam Bankman-Fried compared to how they portray Changpeng Zhao.

On top of that, in November 2022, after the FTX collapse, Forbes were still spinning a positive light on Sam Bankman-Fried. A crypto lawyer by the name of Irina Heaver brought it to light that all Forbes were doing, in her opinion, was spreading lies and misinformation. Anybody who followed the publications in the media around that time will be well aware of how Bankman-Fried was painted a good hearted Billionaire who simply made a mistake.

There was also an issue regarding a Bloomberg subsidiary, Bloomberg Businessweek’s Hong Kong publisher Modern Media CL, which translated an article into Chinese and within the translation made out that Changpeng Zhao was running a Ponzi scheme at Binance. It also claimed Binance was involved in money laundering, fraud, and hacking within the English version of the article, which led Changpeng Zhao to file a suit for defamation. It was not the only lawsuit Changpeng Zhao and Binance filed for defamation, having done so against venture capital firm Sequoia in 2019, and also Forbes in 2020. The Forbes lawsuit was later dropped, however that filing had been over an article by Forbes when purported to reveal regulatory evasion tactics employed by the global cryptocurrency exchange. Binance claimed the article had “contained numerous false, misleading and defamatory statements.” It caused quite the stir at the time as Binance and Changpeng Zhao had been known not to sue the media, and instead had often fought their battles in the 'court of social media.'

However it is also important to note that in February 2022 Binance and Forbes had apparently agreed a deal for a $200 Million Strategic Investment from Binance. This was to help advise Forbes’ Digital Assets and Web3 strategy going forward, while it was also expected to help Forbes maximize its brand and enterprise values in the use of its proprietary technology stack and analytics to convert readers into long-term, engaged customers of the platform. In June 2022 it was announced that the deal had been scrapped and cancelled altogether.

So there we have it. Allegations of wrong doing. Twitter rebuttals. A muddied history between Binance and Forbes. Just another week in crypto really, but it was an interesting week. Certainly there is much to ponder here for anybody with funds invested in Binance. Were they abiding by standard practice rules or have the U.S. Senators got real reasons to be investigation the exchange? Only time will tell, but certainly it is worrying times the crypto industry. The last thing that's needed is for another major exchange to collapse after the damage caused to the industry in 2022. Fingers crossed there is no foul play happening.

Have a great day.

Peace. CryptoGod-1.