Preface

On August 15, 2023, Singapore finalized its final regulatory framework for stablecoin, becoming one of the first jurisdictions in the world to bring stablecoin into the local regulatory system. As a crypto promising land, Singapore has never stopped exploring and working on the regulation of the crypto industry. In this article, we will elaborate and analyze the development of Singapore's crypto legislation and important decrees.

Key Insights

♦ Singapore initially embraced the crypto industry with an attitude of financial openness, but since the downfall of many crypto giants in 2022, the regulatory policies of MAS have tended to tighten up, maintaining a friendly but not lax attitude towards crypto assets, especially unfavorable to the speculative trading behavior of the crypto market.

♦ On August 15, 2023, MAS finalized its regulatory framework for stablecoin, setting out detailed requirements on regulatory scope, reserves, and redemption periods, such as that reserves backing stablecoin must hold low-risk and highly liquid assets, and that these reserves must equal or exceed the value of stablecoin in circulation at all times. This regulatory framework is good news for large corporations and banks and unfriendly to SMEs with high compliance costs.

♦The Payment Service Act (PSA) comes into effect in January 2020, and the requirements involving cryptocurrencies are mainly in the area of e-money and digital payment tokens (DPTs), such as Bitcoin and ETH, which are both DPTs, and stablecoin, which is not e-Money. The supervisory framework applicable to stablecoin will be decided according to the actual situation.MAS takes a different regulatory approaches, e.g. eMoney focuses on consumer protection while DPT focuses on anti-money laundering and counter-terrorism financing.

♦ Singapore's policies related to crypto exchanges are also getting more stringent. In July this year, MAS said it would require DPT service providers to place client assets in the custody of statutory trusts by the end of this year to help minimize the risk of damage to client assets and to facilitate the recovery of client assets in the event of DPT service provider insolvency, preventing a repetition of the tragedy of the FTX.MAS will also restrict DPT service providers from providing lending and collateral services to their retail clients.

1. Background

As some of the world's largest economies, such as China, the United States and the United Kingdom, continue to tighten their crypto regulations, a large number of crypto companies have chosen to move to Singapore, which has become a safe haven for the crypto industry, with many of the industry's biggest names, including Ether founder Vitalik Buterin and CoinSecure founder Zhao Changpeng, having moved or residing in the country. Initially, Singapore had the courage to swim against the tide of "financial openness", with regulators expressing a friendly and open attitude towards cryptocurrencies and the blockchain industry, and attracting many crypto firms through its friendly regulatory environment and low-tax policies, but at the same time, it also fostered potentially illegal activities and financial risks, especially since the start of the crypto winter in 2022. Crypto Winter 2022, Singapore, once a crypto hotspot, has begun to revisit cryptocurrencies and blockchain, and regulatory policies have been repeatedly tightened. We can clearly observe the subtle shift in Singapore's attitude from the regulatory policy trajectory below.

Since 2014, the Monetary Authority of Singapore (MAS), as Singapore's central bank and integrated financial regulator, has been constantly alerting investors to the significant risks associated with virtual currency trading and providing the necessary regulation of the web3 industry.In August 2017, the MAS gave its opinion that ICOs are subject to existing securities laws designed to protect investors if the tokens are structured as securities. In a consumer advisory issued jointly with the Ministry of Commerce on August 10, 2017, MAS also advised investors to conduct due diligence to understand the potential risks of ICOs and investment schemes involving digital tokens. However, at the time, while the MAS regulated virtual currency intermediaries in Singapore specifically for potential money laundering and terrorist financing risks, it said that it would not otherwise regulate virtual currencies per se.In an interview with Bloomberg in October 2017, Ravi Menon, Managing Director of the MAS, had said, "So far, I don't see a desire to regulate cryptocurrencies on the basis of that." On November 14 of the same year, MAS issued Guidelines for the Offering of Digital Tokens, which stipulate that digital tokens will be regulated by the Monetary Authority if they are Capital Markets Products (CMP) under the Securities and Futures Act (SFA), and that Capital Markets Products (CMP) include securities, bonds, derivative contracts, collective investment schemes, etc. In December 2017, as the price of Bitcoin soared from US$1,000 to nearly US$20,000, and there was a growing market appetite and sentiment for cryptocurrencies, the MAS further emphasized at this time that the public should proceed with "extreme caution" and be aware of the significant risks that accompany such investments. In particular, the MAS warned that the surge in cryptocurrency prices is likely to be driven by speculative activity, and therefore the risk of a sharp price decline is high, and that there are no regulatory safeguards in place for cryptocurrency investments.On January 14, 2019, Singapore passed the Payment Services Act (PSA), and the PSA bill puts in place the Account Issuance, Domestic Remittances, cross-border remittances, merchant payments, e-Money issuance, digital payment token DPT services and currency exchange, which are the seven types of payment services under the scope of payment license regulation.

Singapore's regulatory policies have tightened in recent years. 2022 saw the collapse of the algorithmic stablecoin TerraUSD, crypto lending firms Voyager Digital, Celsius Network and BlockFi, and crypto giants such as Singapore-based crypto hedge fund Three Arrows Capital and later FTX, fall. With Temasek losing $275 million on its investment, and over 4% of Singapore's citizens having traded on FTX, these extreme events have undoubtedly clouded Singapore's image and come close to posing a systemic risk. MAS is also determined to combat the evil doers who disrupt the market order, and will never allow any irresponsible behavior or innovation to undermine its credibility, after all, credibility is crucial to Singapore's financial system, and Singapore's orderly and stable policy is the main reason why people like to start a business in Singapore. In January 2022, MAS introduced measures to restrict crypto practitioners to market and advertise cryptocurrency services in public places, and practitioners can only do so on their own social media platforms and prohibited from describing cryptocurrency transactions in a manner that downplays the risks.On October 26, 2022, approximately two weeks before FTX filed for bankruptcy on November 11, 2022, MAS issued two consultation papers proposing measures to mitigate the risk to consumers in cryptocurrency transactions ("Digital Payment Token Services Consultation Paper on Proposed Regulatory Measures), as well as proposed measures to support the development of stablecoin in Singapore's digital asset ecosystem (Consultation Paper on Proposed Regulatory Approach to Stablecoin-Related Activities). On August 15, 2023, MAS announced the final version of its regulatory framework for stablecoin, making it one of the first jurisdictions in the world to bring stablecoin into the local regulatory system, and its regulatory framework will most likely be the basis for the future template and trend for other countries and regions regarding stablecoin regulatory regulations. In addition, Singapore's policies on crypto exchanges have also become more stringent. In July, the Monetary Authority (MAS) said it would require digital payment token (DPT) service providers to place client assets in the custody of statutory trusts by the end of this year to help reduce the risk of damage to client assets and to facilitate the recovery of client assets in the event of DPT service provider insolvency, preventing a repeat of the tragedy of FTX. MAS will also limit the lending and collateralization services provided by DPT service providers for their retail clients. While this measure has not yet been formally decreed, and Binance has proposed a variety of flexibility measures in its eight-page feedback letter and reminded the authorities of the risks associated with third-party custodians, increasingly stringent requirements for DPT service providers are the order of the day. Below is a detailed analysis of stablecoin regulation and the PSA Order.

2. Regulations of Stablecoins

The Financial Stability Board (FSB) defines stablecoins as a crypto-asset designed to maintain a stable value relative to a specific asset (usually a unit of fiat currency or commodity or commodities), a pool of assets, or a basket of assets. In addition, like other cryptocurrencies, stablecoin is an instrument that can be transferred on a peer-to-peer basis, either using a private crypto wallet for peer-to-peer transfers or through a third-party service provider. The Monetary Authority of Singapore (MAS) released a consultation paper on e-money and digital payment tokens (DPTs) on December 23, 2019, which was an early attempt by MAS to regulate stablecoins used as payment instruments. Subsequently, on October 26, 2022, MAS issued a consultation paper on the proposed regulatory policy for stablecoins, in which the MAS stated that, if well regulated, stablecoins have the potential to play a reliable role as a digital medium of exchange. Under the Payment Services Act (PSA), stablecoins are considered DPTs. Therefore, entities that provide stablecoin trading and/or facilitate stablecoin exchange services would fall within the scope of regulated DPT services. As the PSA had not previously introduced regulatory measures to ensure that stablecoins maintain a high degree of value stability and any associated stabilization mechanisms, on August 15, 2023, MAS formally published a regulatory framework for stablecoins along with feedback on the aforementioned consultation paper. In June this year, the UK passed a law giving regulators the ability to oversee stablecoins, but there are no specific rules yet. Meanwhile, Hong Kong is conducting a public consultation on stablecoins and aims to introduce regulation next year. Singapore, on the other hand, has led other regions to become one of the first countries in the world to formally incorporate stablecoins into its own regulatory system, which has significant implications.

2.1 Scope of Regulation

In the consultation paper, MAS categorizes stablecoins into single currency linked stablecoins (SCS) and non-SCS (e.g., stablecoins linked to a basket of currencies or other assets/commodities). Stablecoins pegged to a single currency have a stronger use case for payments and settlements. This response clarifies that the regulatory scope of the Singapore Stablecoin Framework only includes Singapore Stablecoins pegged to the Singapore Dollar or G10 currencies issued in Singapore, and that other types of Stablecoins (such as Algorithmic Stablecoins) will not be prohibited from being issued, used or circulated in Singapore. These stablecoins, including those issued outside Singapore or pegged to other currencies or assets, will continue to be subject to the existing DPT regulatory regime. Currencies are symbols of national sovereignty that other countries do not have the authority to regulate, and it is an important regulatory innovation for MAS to include stablecoins pegged to G10 currencies in its scope of regulation.

In addition, MAS has included "stablecoin issuance services," an additional regulated payment service that refers to the necessary activities of a stablecoin issuer, including the safekeeping of stablecoins issued by the issuer and the management of reserve assets backing the stablecoin. To its credit, MAS has been very flexible in categorizing stablecoin issuers into bank and non-bank SCS. With respect to non-bank SCS issuers, SCS issuers with SCS circulating up to S$5 million are not required to comply with the requirements under the SCS framework, and any SCS issuer that anticipates or intends to have its total SCS circulating in excess of S$5 million and wishes to have its SCS accredited, is required to comply with the requirements under the SCS Framework and apply for an MPI license to carry out "stablecoin issuance services". For bank stablecoin issuers, MAS recognizes that there are differences in the value stabilization mechanisms used for fully reserve asset-backed stablecoins and tokenized deposits (which are bank liabilities), and therefore MAS will exclude bank tokenized deposits from the SCS regulatory framework. Banks would also be required to issue 100% asset-backed stablecoins, but it is important to note that banks are not required to apply for an MPI license. MAS will retain the flexibility to treat certain tokens as stablecoins if the bank SCS issuer designs tokens that meet the same criteria under the SCS regulatory framework.

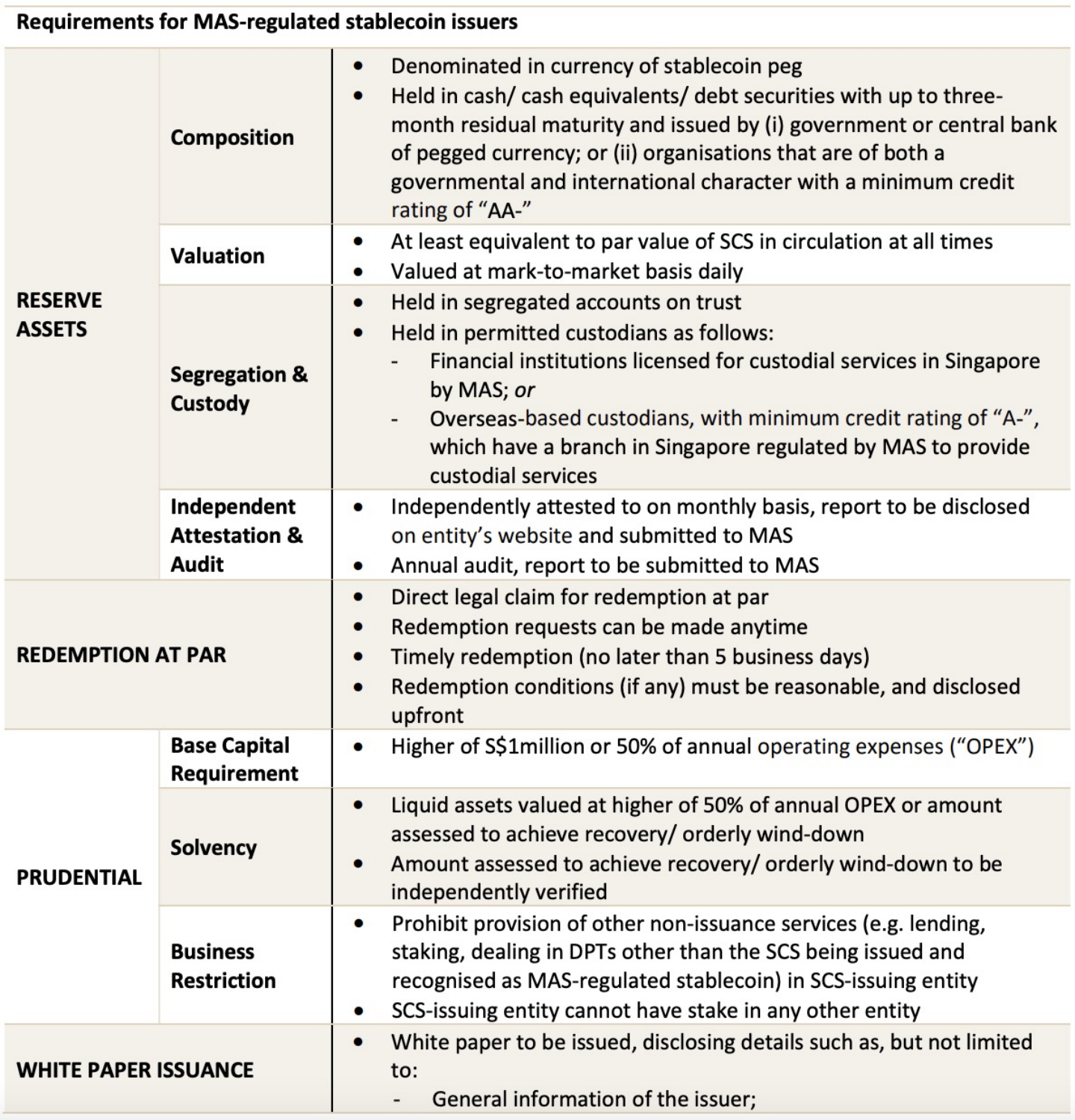

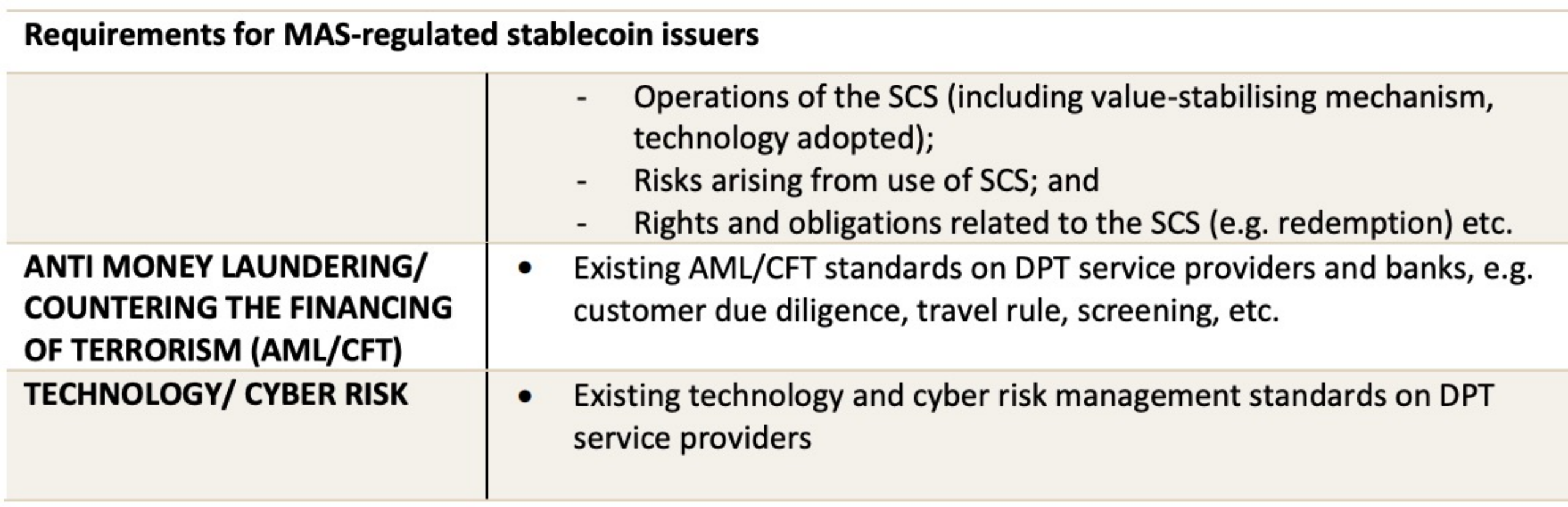

2.2 Reserve requirements

MAS requires that at all times the SCS issuer's reserve assets be valued at at least 100% of the outstanding SCS circulating size and that the issuer is prohibited from providing other non-issuance services (e.g., lending, betting, trading digital payment tokens) or holding shares in any other entity, which is intended to guard against and mitigate the risk of the SCS issuer. That being said, the above prohibited activities can in fact still be carried out from other related entities (e.g. sister companies in which the SCS issuer has no shares). All reserve assets used to back SCS must be held in segregated accounts, isolated from self-owned assets that are not part of the reserve assets. In addition, MAS has agreed that it may allow assets to be held in custody by overseas custodians, provided that such custodians have a minimum credit rating of "A-" and have a MAS-regulated branch in Singapore to provide custody services.

In terms of the composition of reserve assets, reserves are only allowed to be invested in cash, cash equivalents and bonds with a remaining maturity of not more than three months, where cash equivalents exclude money market funds. Actions like USDC investing 90% of its assets in money market funds and USDT investing in some commercial paper do not satisfy MAS regulatory requirements. Stablecoin issuers Tether and Circle have both welcomed the new rules. Reserve assets are subject to annual audits and monthly independent validation, with monthly reports to be published on issuers' websites.

For redemptions, SCS issuers regulated by the Monetary Authority of Singapore (MAS) must return the face value to holders within five business days. The redemption timeframe aims to strike a balance between remaining responsive to user requests and ensuring that issuers have sufficient time to conduct redemptions in an orderly manner under various stressful situations. Redemption conditions, if any, must be reasonable and must be disclosed in advance.

It is also worth noting that if an issuer wishes its stablecoin to be recognized as a "MAS-regulated stablecoin" under the SCS framework, its SCS can only be issued in Singapore, and is not permitted to be issued in more than one jurisdiction. MAS is of the view that, given that regulation of stablecoins globally is in its infancy, it is difficult to establish regulatory equivalence and cooperation with other jurisdictions, and therefore difficult to monitor and determine the adequacy and availability of reserve assets held in overseas jurisdictions that could be used for redemption requests in another jurisdiction.

The official document released by MAS provides a good summary of the regulatory framework for stablecoins below:

In terms of the existing regulatory framework, one of the controversial points at this point in time is the requirement for SCS issuers to only issue stablecoins in Singapore, where some stablecoins have now become globally-available stablecoins, issued in different regions and on different public chains. If issuers fulfill the above requirements of MAS, they may lose their competitiveness in the market. MAS has indicated that it will continue to monitor global regulatory and technological developments relating to stablecoins and may consider establishing formal regulatory cooperation mechanisms with other jurisdictions as stablecoin regulation matures.

Taken together, the finalization of the Stablecoin regulatory framework will provide greater clarity and certainty to Stablecoin issuers with respect to SCS regulatory requirements in Singapore, and serves as a model for global Stablecoin regulation in a far-reaching way. Given the evolving nature of stablecoins and the continuing development of the global stablecoin regulatory environment, the MAS has indicated that it will continue to monitor developments in the stablecoin space with a view to bringing other types of tokens under the SCS framework. Although compliant stablecoins can effectively avoid risks, boost user confidence and maintain financial stability, the compliance cost is still quite high to successfully issue compliant stablecoins in Singapore. It is a good measure for strong banks and large companies as their moat is further deepened and their competitive advantage is obvious, especially since banks do not need an MPI license to issue stablecoins; and for SMEs, especially start-ups, issuing compliant stablecoins is a good measure. For small and medium-sized enterprises, especially start-ups, the possibility of issuing compliant stablecoins is further reduced, and the current regulatory policy is not friendly. The application process for an MPI license can take 1-2 years, and the number of enterprises that can really get a license is not high.

3. Payment Service Act

The Payment Service Act (PSA), which came into effect in January 2020, regulates payment systems and payment service providers in Singapore. Payment services are a fast-growing industry, with new payment solutions making digital payments faster, cheaper and more convenient, however, they also bring new risks, so MAS saw the need to review and update its payments regulatory framework, which combines the requirements previously contained in the Payment Services (Operations) Act and the Singapore Currency and Payments Regulations into a single piece of legislation. The Payment Services Act expands MAS's regulatory scope to address new risks posed by existing payment services and to include new payment services. Through a modular and risk-based approach to regulation, the Payment Services Act establishes a flexible regulatory framework that can effectively mitigate the impact of payment service provider failures while facilitating the advancement of the payments industry in Singapore.

Under the Payment Services Act, any entity providing any type of payment service needs to be licensed before it is authorized to carry on the business of providing that type of payment service, unless otherwise exempted. The Act provides for seven types of payment services, which in relation to crypto-assets include "digital payment token services" (DPT) and e-money. Under MAS, the appropriate anti-money laundering and combating the financing of terrorism (AML/CFT) requirements will be enforced on the relevant licensees through notices to be published under the MAS Act. Upon the commencement of the MAS Act, all payment-based token issuers or exchange service providers in Singapore will be required to meet the AML/CFT requirements.

3.1 DPT Services

Under the PSA, a "digital payment token" (DPT) is any digital representation of value (excluding digital representations of value) that:

-

Is expressed in units;

-

Is not denominated in any currency and is not pegged to any currency by its issuer;

-

is a medium of exchange accepted by a section of the public as payment for goods or services or in satisfaction of a debt;

-

can be transferred, stored or traded electronically;

-

meets other characteristics specified by the Authority. Entities providing DPT services are required to obtain a Standard Payment Institution License or a Major Payment Institution License. DPT services include direct transaction services for DPTs (e.g. purchase, sale, fiat currency exchange, DPT services include direct DPT trading services (e.g. purchase, sale, fiat currency exchange, cryptocurrency exchange) as well as services facilitating the trading of DPTs (e.g. exchanges, custodians, wallet services etc.).

3.2 Electronic Money (eMoney) Services

Electronic Money (eMoney) is monetary value stored in electronic form, which is essentially an electronic form of legal tender with the following characteristics:

-

It is denominated in, or pegged to, legal tender;

-

Has been pre-paid so that payment transactions can be carried out through a payment account;

-

Is accepted by a person other than the issuer;

-

represents a claim against the issuer. According to the MAS distinction: (1) eMoney is a digital manifestation of a single fiat currency (e.g., the digital RMB), whereas a DPT does not need to be pegged to any fiat currency; and (2) eMoney is a claim against its issuer, whereas a DPT is not, and DPTs don't even need to be issued by the issuer (e.g., Bitcoin and Ether). In addition, MAS specifically mentions that stablecoins are not part of e-Money and that the regulatory framework applicable to stablecoins will be determined on a case-by-case basis.MAS takes into account that the two different payment services, eMoney and DPT, are subject to their own distinctive risks and therefore take a different regulatory approach to the two, e.g., eMoney focuses on consumer protection whereas DPT focuses on anti-money laundering and counter-terrorism financing.

According to the PSA, entities providing e-money issuance services need to obtain a standard payment institution license or one of the main payment institution licenses. An electronic money issuance service is the issuance of electronic money to any subject for the purpose of enabling that subject to carry out payment transactions. For e-money issuance services alone, if the total value of e-money issued in a single day exceeds S$5 million (based on a one-year average), a major payment institution license is required, otherwise a standard payment institution license is sufficient.

On January 17, 2022, MAS issued Guidelines on the Provision of DPT Services to the Public, stating that DPT is high risk and not suitable for public participation, and requiring DPT service providers to avoid publicizing DPT services in public places or on mass social media, and to promote their DPT services only on their company websites and apps, and on their social media accounts.In April 2022, Singapore's Parliament considered and passed the Financial Services and Markets Bill (FSM), which requires digital token issuers and service providers to obtain valid financial licenses and imposes higher anti-money laundering and anti-terrorist financing requirements.2022 On October 26, 2022, Singapore released a public consultation paper on regulatory measures for DPT services, with plans to further refine regulatory policies for DPT services to reduce risks in DPT transactions and protect investors. From the above rules and subsequent development, it can be seen that from 2022 onwards, MAS's regulatory policy on DPT is getting tighter, affected by the drastic fluctuation of the crypto industry, MAS will also introduce stricter measures to combat financial crimes, and the regulatory focus will continue to be in the direction of anti-money laundering and anti-terrorist financing.

4. Summary

Singapore's crypto regulatory policy in recent years has changed from its previous over-the-top open stance, maintaining a friendly but not lax attitude towards crypto assets, especially not optimistic about the speculative trading behavior of the crypto market. What Singapore is optimistic about and welcomes is responsible digital asset innovation. The government has been conducting investor education, suggesting risks and discouraging involvement of personal investors as a way to provide proper guidance, especially since the fall of many crypto giants in 2022. In order to avoid repeating the mistakes of FTX, Singapore's requirements for centralized exchanges and other DPT service providers have become more stringent, and its newly confirmed stablecoin regulatory framework is not exactly SME-friendly too. However, it is worth recognizing that MAS has been making effective attempts to regulate the crypto industry, rather than adopting a negative or one-size-fits-all attitude, and the increasingly perfect and transparent regulatory system has shown crypto practitioners a path to compliance. Singapore's provisions are also extremely flexible and innovative, and the stablecoin regulatory framework serves as a model for the global regulatory system. All in all, Singapore remains one of the more crypto-friendly countries globally in the near future.