This is the Baby Bear equivalent article and is needed for BearGate and InfinityGate.

Henlo, please note everything written after this statement may, or may not be, psyops. This is written for education and entertainment purposes only and does not constitute financial advice. Most of this was written by Napzilla who has a lot of bear jpegs and edited by Janitooor who also has a lot of bear jpegs and is also a seed investor in Berachain. Remember anon, do your own psyops.

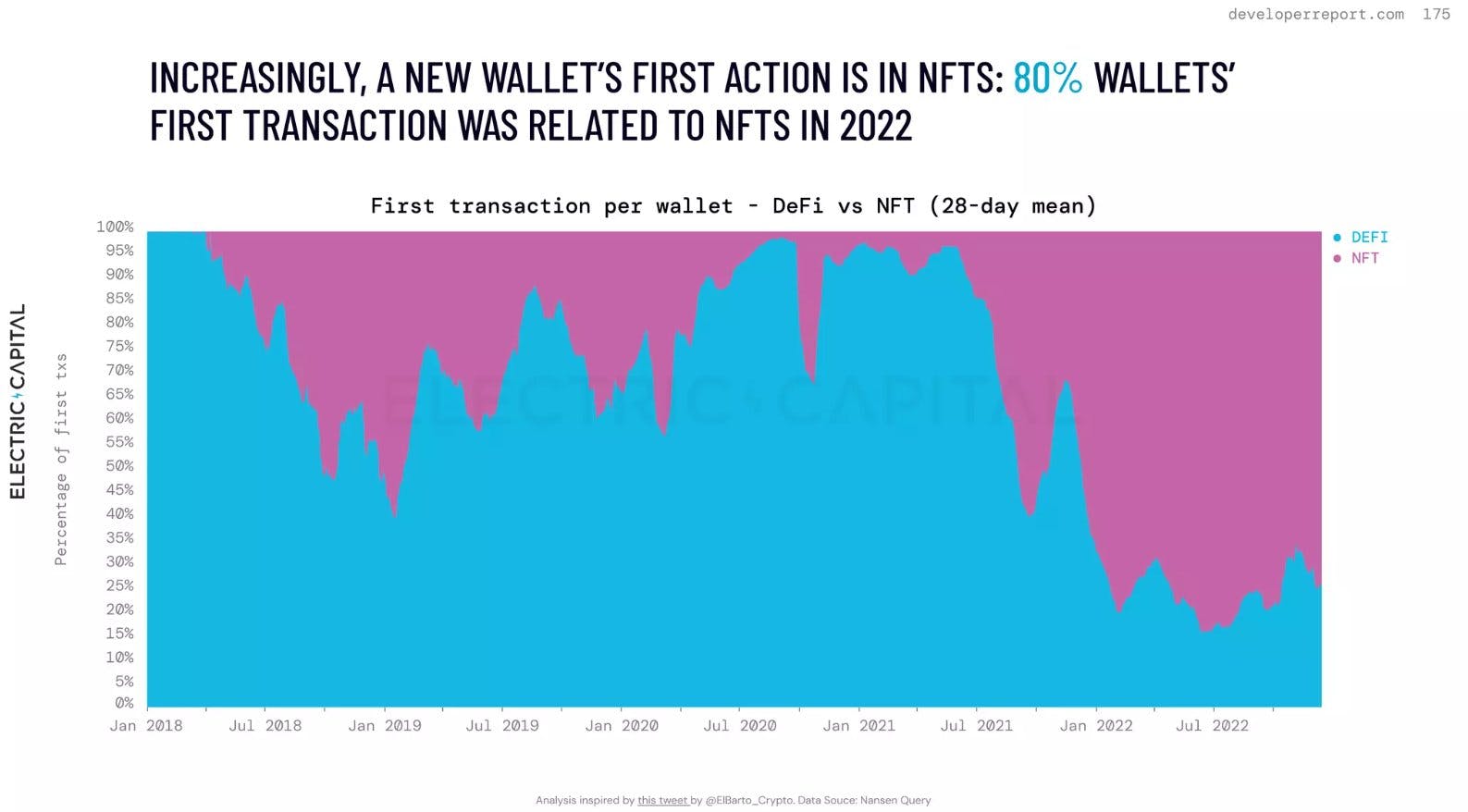

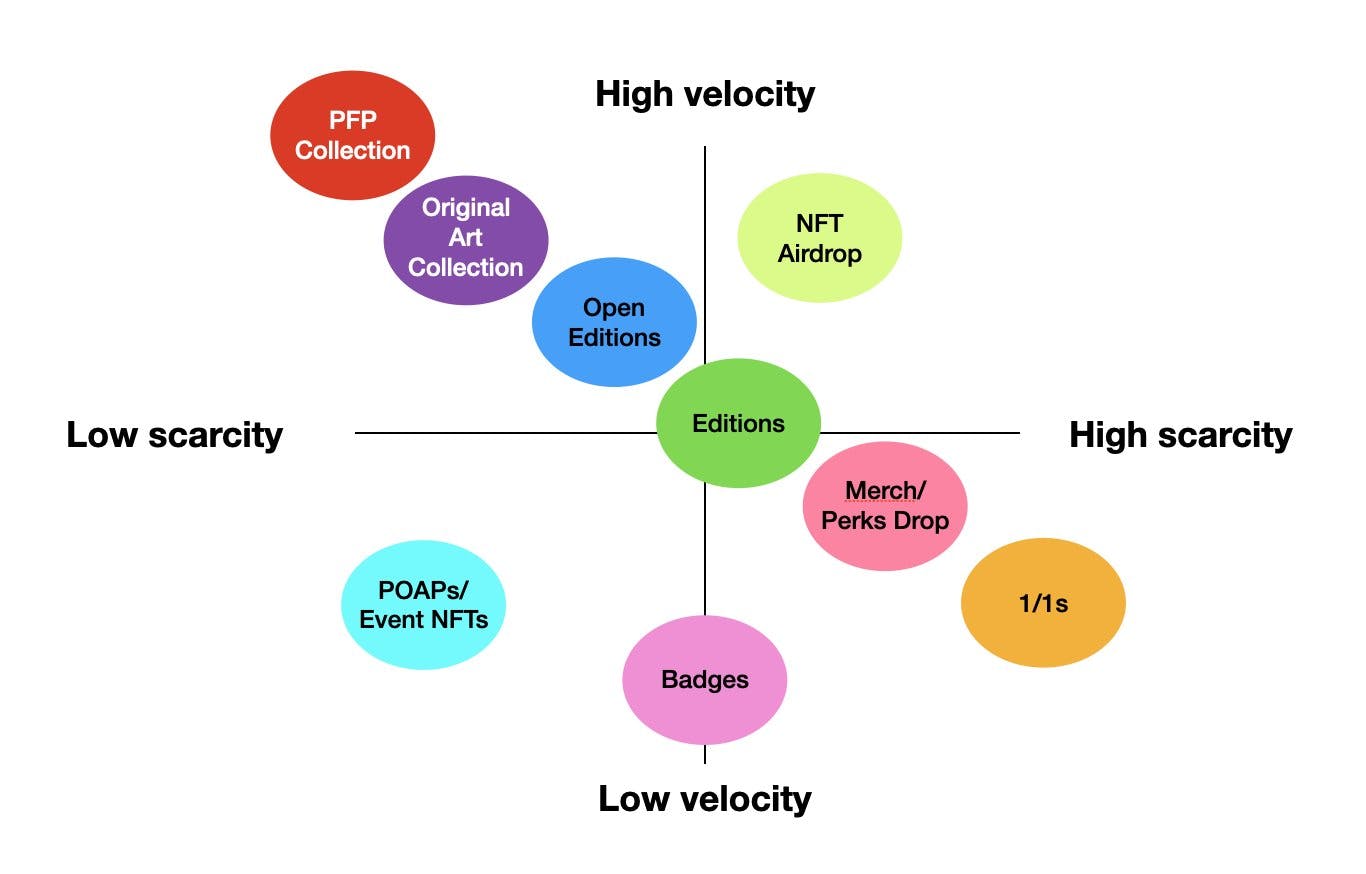

Research by Ryan Watkins of Syncracy Capital has shown that 80% of wallets created in 2022 first interacted with NFTs. With this explosion of NFTs over the past two years, there has been a common thread between many of them. Projects start with an NFT, then if they have success in that endeavor, they look to add value for their communities. As we pointed out in Honey Jar 101, the majority of these types of collections offer limited and specific functionality for their jpegs. Twitter legend @evabeylin of e-girl capital and The Graph, published a thread breaking down a view of the NFT landscape in a post royalties-era saying those projects deploying lower velocity and higher scarcity would be less affected than higher velocity lower scarcity projects. We also happen to think the landscape as presented further illustrates our point. In addition to the strategies visualized in Eva’s image, collections may also produce derivative collections, and in a small number of cases they may branch out into DeFi functionality like staking. But these instances are rare and have not yet penetrated the mainstream imagination for what is possible. It may seem like that is the case for the evolution of the Bong Bears, but in reality it is quite the opposite. Read our Bong Bears 101 article for a deep dive into the origin of the beras and how this venture differs from all other NFT projects.

If you’re too damn lazy (or illiterate) to read the article, I’ll give a brief explanation on why the beras are special. The origin of the Bong Bears is rooted in DeFi. The founders, Smokey and Papa, were DeFi addicts long before cooking up the idea for the beras. The project initially gained traction in the Discord of a DeFi project: Olympus DAO, but very quickly expanded to become an entirely new kind of project. The degenerates residing in the off-topic channel were the ones to initially ape into the project and propel it to success. It’s safe to say that from its very beginnings, the Bong Bears was an NFT project with a DeFi soul. So what? I’ll tell you what.

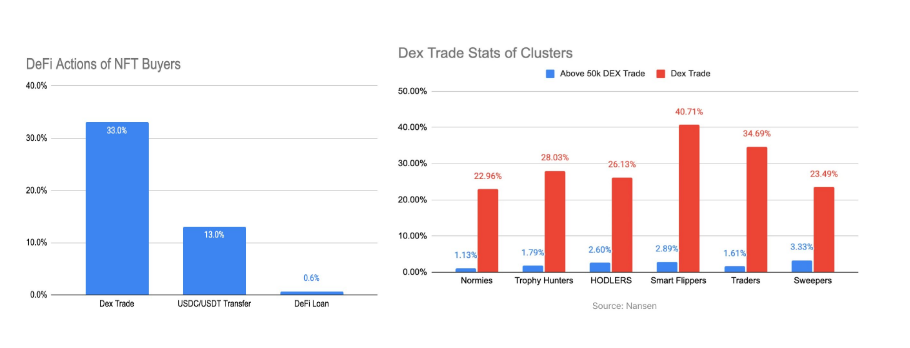

Up to this point, there has been very limited overlap between NFT users and DeFi users. Twitter user ElBarto_Crypto, a researcher at Block119, put together a very informative thread looking into how these two types of users essentially live in different universes. As noted earlier, throughout 2022, 80% of new wallets’ first action was NFT related. Out of those users, the ones who have branched out into DeFi tend to interact with NFT-adjacent coins such as $LOOKS and $APE, and not the types of tokens and protocols that have been traditionally linked to DeFi usage. About 30% of wallets with an NFT have made a DEX (decentralized exchange) trade, only 13% have made a stablecoin transfer, and less than 1% (!) have deposited an NFT as collateral and borrowed funds against it.

This builds a strong case suggesting that the public has bought into the idea of NFTs, but are either unaware, or not sold on the use-cases of DeFi, or do not have the technical skills and understanding necessary to succeed in the DeFi world. On the other hand, the research shows that 70% of DeFi users do not buy NFTs! A shocking revelation to those of us who are so entrenched in the crypto world that we assume that everyone is taking advantage of all that crypto has to offer. At the end of the thread, ElBarto_Crypto questions the conclusion that in the future there will be high demand for NFTFi (NFT x DeFi), since there appears to be such a large gap between the two user bases. While we find the analysis brilliant, we couldn’t disagree more with the conclusion, ser! We feel that this scene hasn’t even gotten started yet, and that The Honey Jar is well positioned to be this bridge - to be an NFT gateway to DeFi.

The Honey Jar has come to the following conclusion: The Bong Bears x Berachain is the logical intersection of these universes with undeniable growth potential. The Honey Jar will integrate some of our beloved DeFi tools like swaps and borrowing/lending right into our website, and will even offer a 50% discount on our NFT mint if DeFi coins are used to purchase, as well as some more integrations in future versions.

So we know that the beras are deeply ingrained in DeFi, and also enjoy some gud jpegs. Already, this puts the community in an advantageous position - a group of apes, or beras, already fluent in NFTFi. But let’s examine just how degenerate they are.

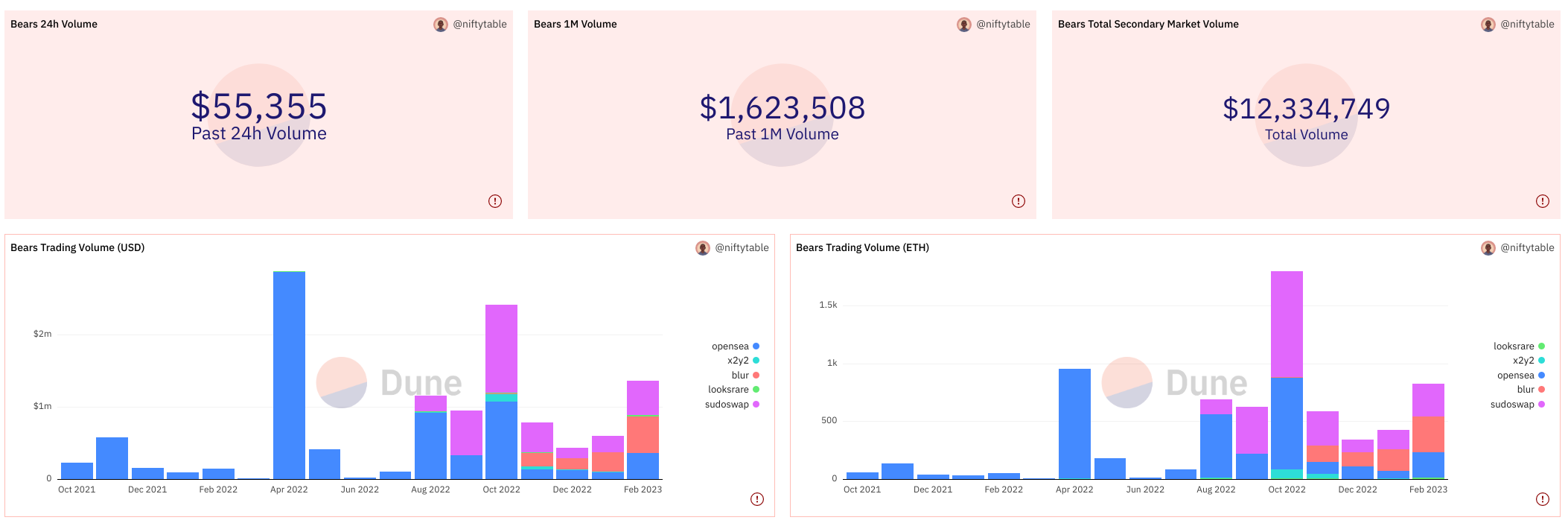

As we identified in Bonga Bera 101 the Bong Bears and all rebases can be considered a single ~10k drop which has been slowly released over sub-collections, or reberas as we like to say. Kofi has created an incredible dashboard that aggregates the trading volume of all the Bong Bear rebases, identifying that the bears are in the top 10% of all NFT collections by secondary sales volume, not taking into account OTC volume. Over the counter refers to when people trade person to person, rather than buying from an initial mint. When purchases are handled through NFT marketplaces this is also sometimes referred to as “secondary sales.” All this volume has come from fewer than 1,000 holders with $0 spent on marketing from the Bong Bear (or Berachain) team. In fact, it could be said that these jpegs ARE the marketing, but more on that in an upcoming article.

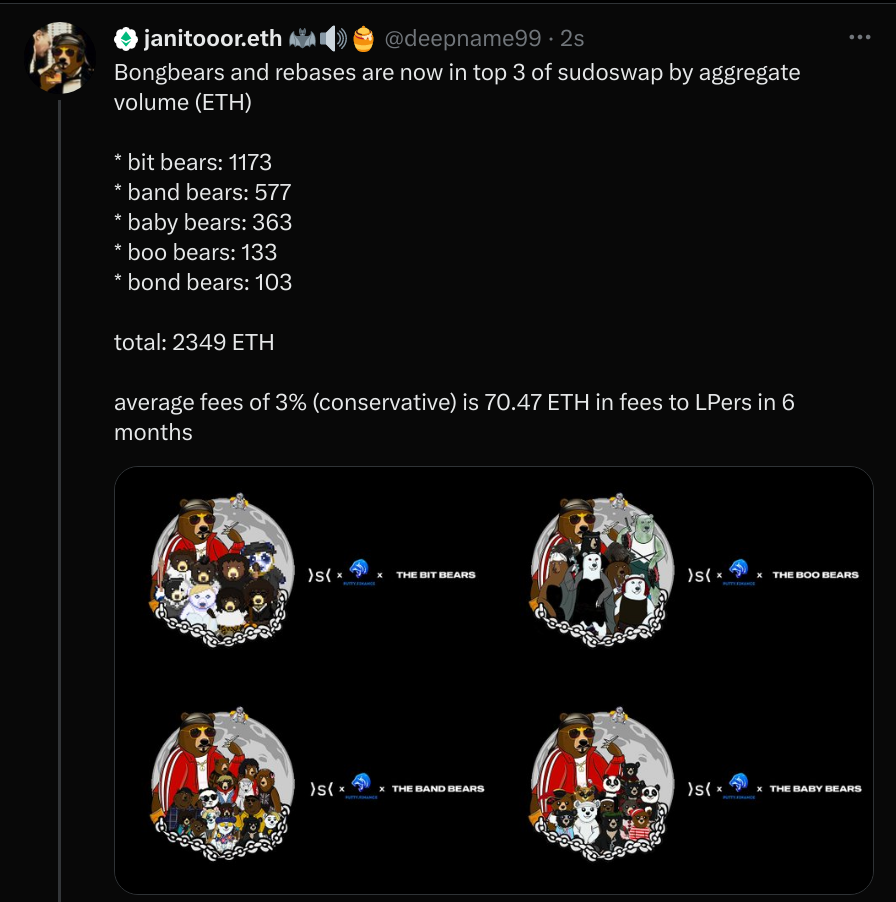

Back to the data. The results are astounding. Not only are new beras being onboarded from normie NFT marketplaces like OpenSea, but there are a significant amount of sales and trades coming from non-traditional avenues. At the time of writing, there have been over 729 ETH worth of bera trades from traditional user-to-user OTC, sudoswap OTC, and sudoswap pools just in January and February 2023. Compare this to the 802 ETH of secondary-sales volume done on OpenSea, Blur, LooksRare, and X2Y2 over the same time frame. Crypto users are acquiring beras through DeFi-adjacent means at almost the same rate as through traditional means. This is absolutely unprecedented! This community is not made up of normies, it is comprised of a demographic that appears to be the target of the next generation of protocols: NFTFi users.

But do the beras stop there? Do they grab up a picture of ursine David Bowie off of sudoswap and just sit on it? No, of course not… these are DeFi degenerates we are talking about here.

Let’s start with Llamalend. Llamalend is built by 0xngmi and team, some of the many Llamas behind DeFiLlama. DeFiLlama is public goods infrastructure, funded entirely by donations, which has fast become one of the premier tools utilized by the industry. If you have ever read a news article with a chart containing crypto stats, or a report coming from the government, some corporate entity, or a large exchange, it is very likely they got their analytics data from these Llama tools. So let's jump into this curious case of Llamalend!

The biggest downside of holding illiquid jpegs is just that - they are illiquid. Until recently, the only way to unlock the ETH held in NFTs was to sell them. You couldn’t have your honey and eat it too. But why not? Llamalend is a protocol that allows users to deposit their NFT and borrow ETH against them - the cornerstone of NFTFi. We call this using an NFT as collateral, just like you can take out a loan on a house. Users can deposit NFTs into isolated user-created pools in order to borrow ETH without risk of liquidation due to price fluctuations, as long as they pay off their loan by the due date. You can read their docs to learn more.

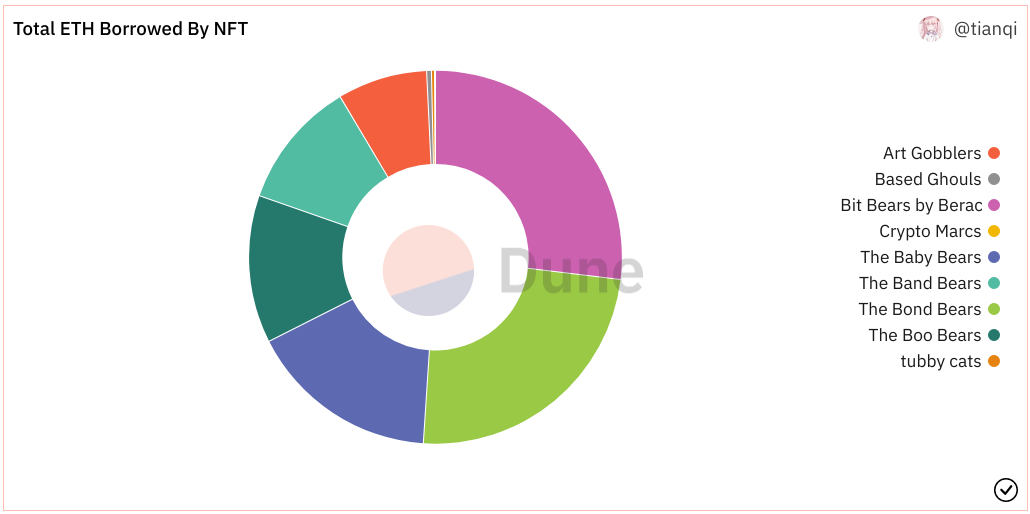

The beras LOVE the llamas. As the data has shown, the trading activity of beras is massive - but this has not always been recognized by the first generation of NFTFi projects which have tended to be permissioned. This means that the teams who build the protocols also elect which NFT collections those protocols will support, and they have generally only supported bluechip collections that have garnered mainstream attention. You can read more about some of these projects in this excellent thread by @GatheringGewi. But where were we? Oh yeah - bears LOVE the llamas as they built a tool that allows beras to provide services to other beras. This is the definition of permissionless - a tool which anyone can pick up and use - like a shovel!

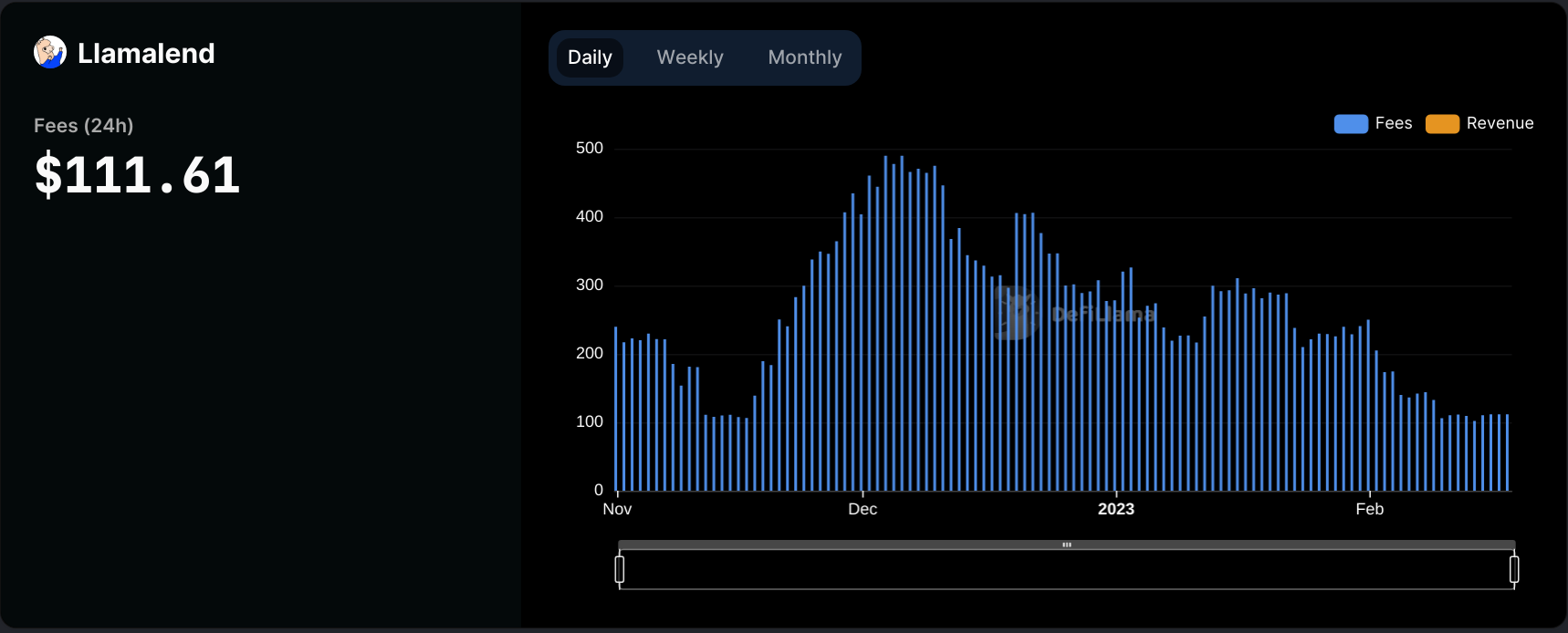

From day one, the beras aped into Llamalend and quickly amassed 100+ ETH volume in borrowing and lending, and the protocol volume has been dominated by the bear rebases ever since. To this day, the various bera collections make up about 75% of all volume on the protocol, an overwhelming percentage. This shouldn’t come as a surprise. DeFi natives with valuable jpegs are bound to find a way to make them productive. For more insights into what it looks like when the beras sink their teeth into something new and financially beneficial, take a look at the Llamalend dashboard. As the following image (which we got from DeFiLlama) shows the protocol is incredibly efficient in yielding higher fees than even AAVE. Those of us who know that bear jpegs are pristine collateral have been loving this shovel.

But how are bears so sure that their jpegs make such good collateral? For something to be considered good collateral it needs the following qualities according to Nasdaq:

“Good-quality collateral has the four characteristics of: (i) having an easily ascertainable value that is sufficient to cover the loans that it is securing; (ii) retaining its value through the entire period of the loan; (iii) being readily for foreclosure or of having its ownership easily transferred; and (iv) being liquid.”

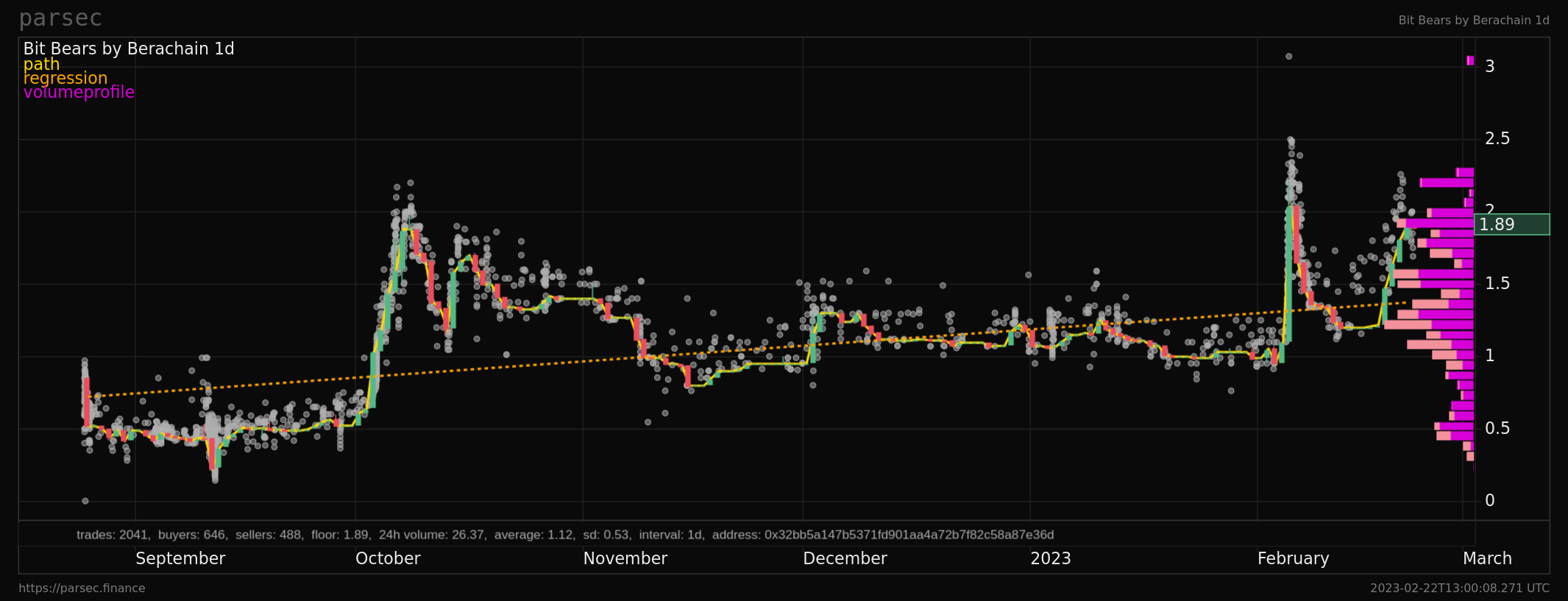

(i) As we have seen from the Dune dashboards, the bears have seen a large amount of price discovery by the market

(ii) Bears have been one of the best stores of value throughout this latest bear market

(iii) Bears in LlamaLend are held by smart contract until the end of the term

(iv) Liquidity - Let’s look a little deeper into this:

Beras simply cannot limit themselves to borrowing and lending. They can’t help but to throw themselves headfirst into any innovative NFTFi products. Sudoswap is another place where the beras are putting numbers on the board. Sudoswap is an automated market maker (AMM) that facilitates NFT-to-token and token-to-NFT swaps. Someone with a bear jpeg can deposit it into a pool and automatically accept crypto for that bear according to the pool’s configuration.

When you buy a bear jpeg with crypto, it is a bit like swapping USD to your local currency and back again, but with jpegs and crypto. Users can utilize pools of NFTs to easily buy, sell, or trade NFTs. How is this significant? BOL - Bear Owned Liquidity. Simply put, if someone supplied you with a bear jpeg with the click of a few buttons, you would be able to easily convert your bear into crypto. But why is this liquidity so thicc?

As noted in previous articles, all bong bear collections are unique in that there are no metadata traits assigned to each NFT, and therefore no differences in rarity. This has proved to be a major boon to their NFTFi adoption. Whereas holders of other collections may be hesitant to supply pools with their NFTs because there is no promise that they will be able to get an equally rare one back, the beras can be sure that if they so choose, they are guaranteed to get an equivalent NFT back. So the beras got down to business supplying pools and collecting the sweet, sweet yield that comes with it. When considered as a collective, the Bong Bear rebases are in the top three of all collections by volume on sudoswap. Not too shabby.

All of this can all be attributed to the DeFi nature of the beras. It is not enough for them to hold their beloved jpegs as they 10x, 100x, 1000x. They need more to satisfy their deeply held DeFi desires. They must turn it all into one big NFTFi game. They want to borrow against their bears so that they have liquidity to make big DeFi plays. They then take their winnings and buy more bears. They know what they have, and they make it work hard for them.

All in all, the Bong Bears are in the top 10% of all NFT projects by OTC volume. The beras are clearly NFTFi power users. And as extraordinary as all of the above data is, we still need to once again put it into context: All of this has been carried out by fewer than 1,000 unique holders of Bong Bear NFTs. 1,000 raucous holders. $0 spent on marketing, and the bera collections are doing 10% of the volume of Bored Ape Yacht Club. Can you imagine what might happen if more attention falls on the bear jpegs? If they start being mentioned alongside the bluechips that have penetrated mainstream attention? And what about when Berachain launches? If you don’t know about Berachain, learn about it in our Berachain, Cults and the Dawn of The Honey Jar article.

The degeneracy of the beras cannot possibly be overstated. One of the smaller (for the time being) communities has been putting the NFT world on notice. And all of this has been achieved before Berachain even exists! The Dawn of BeraFi is upon us, anon.

What’s Next?

The Bong Bears have always been programmed to be a top 1% bluechip project. It is nearly impossible to have observed everything that has occurred over the past year and a half and not see the writing on the cave wall. The beras live and thrive outside of the traditional crypto boundaries. They are coming for you, your ETH, your DeFi yield, and maybe even your wife and her boyfriend.

The stage has been set for a monumental shift in crypto. We have watched as normie NFT projects that attempt to branch into DeFi have not found much success. We have recognized how DeFi projects that extend into NFTs have not gained much traction. And most importantly, we have seen how NFTs have onboarded many new users into crypto, but there has not yet been that much-needed 0 to 1 innovation to convert them into full-blown DeFi users. Berachain is that innovation, with The Honey Jar providing the NFT gateway to DeFi. Berachain - a novel L1 with a meme name supported by a cult of the foremost NFTFi users in all of crypto. To paraphrase Bane from Batman:

Oh, you think DeFi is your ally. But you merely adopted DeFi; The beras were born in it, molded by it. We didn't see the NFTs until we were already men, by then they were nothing to us but GUD JPEGS!

Berachain will be a brand new playground for normies and degenerates alike. If NFTFi on Ethereum is checkers, NFTFi on Berachain will be 5D backgammon on Pluto. Prepare accordingly.

NFTFi Partnooors

As a special bonus, we’d like to shout out our partnooors building the next generation of NFTFi on Berachain:

AbacusDAO: NFT lending platform

BabyBera Finance: NFT/Yield farming/Memecoin

Caviar: NFT AMM

GumBall: NFTFi platform and NFT marketplace

Goldilocks: DeFi DAO - AMM/NFT-Fi/Yield farming

Protecc: Protecc Labs is an NFT market maker and ecosystem partner, dedicated to bolstering liquidity for NFTs across a variety of financialization verticals.

Spice Finance: NFT lending aggregator

TeddyBera: NFT-based support for Bera projects