The Field is Pinto’s credit facility. It allows users to lend Pinto to the protocol in exchange for future repayment of the principal plus a fixed interest amount. Modern currencies, like the US Dollar, rely on credit to stabilize the currency by bringing future value to the present. Pinto embraces credit through the Field, which loosely mirrors the way the Fed utilizes bonds. Increasing interest rates on bonds increases the value of the US Dollar, similar to how algorithmically raising the Temperature in the Field indirectly increases the value of Pinto.

The protocol aims to balance Pinto's supply and demand to maintain an approximate price of $1. When users Sow Pinto in the Field, the protocol burns these tokens, thereby reducing supply and indirectly creating upward price pressure.

Key terms

-

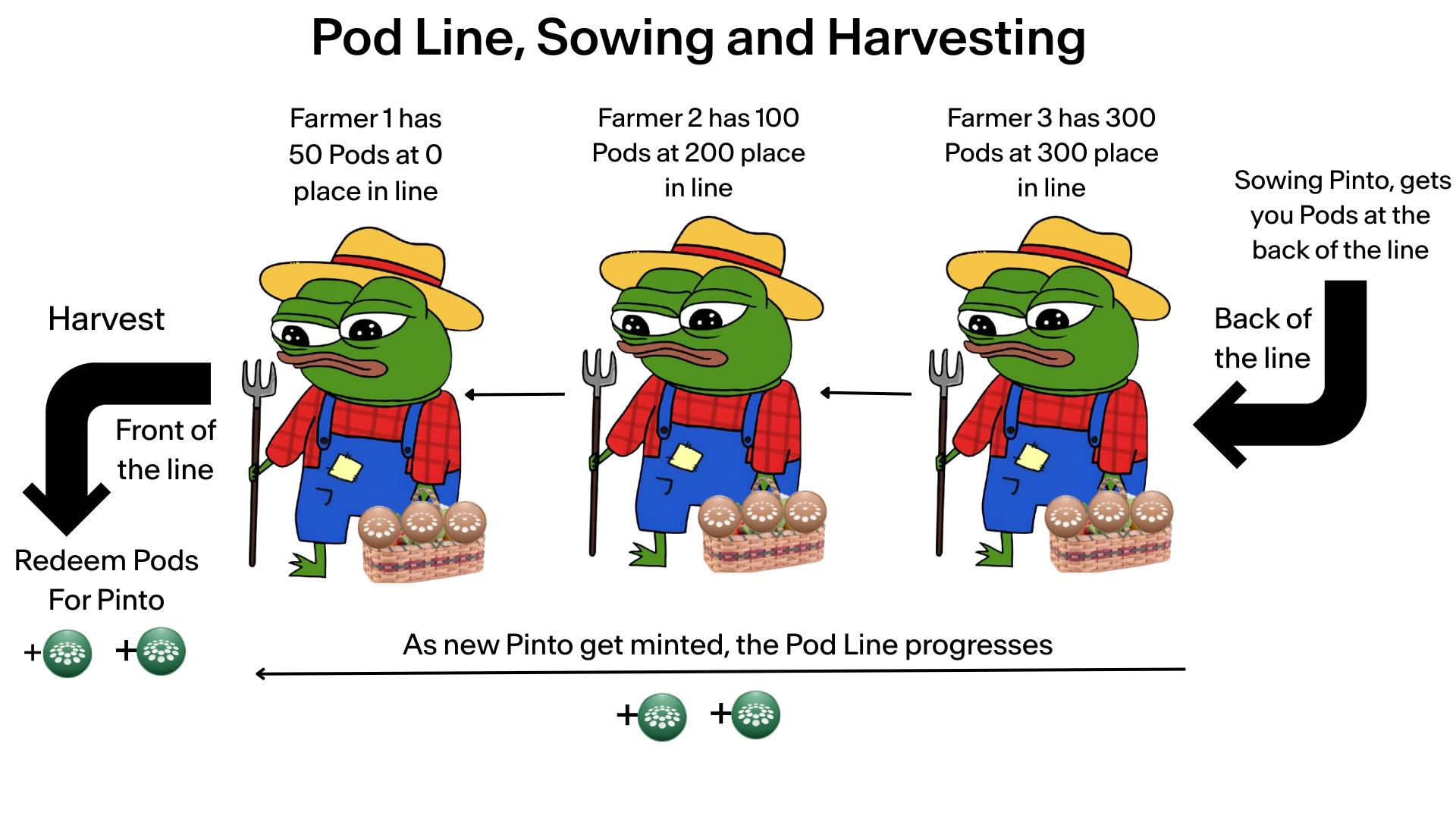

Pod: Represents debt the protocol owes to users. Each Pod is repayable 1:1 in Pinto. A Pod is represented by its place in the Pod Line.

-

Pod Line: The queue of all Pinto the protocol owes to users, maintained in FIFO (First In First Out) order.

-

Soil: The amount of Pinto the protocol is willing to be lent in a given Season.

-

Temperature: The interest rate offered by the protocol for new loans. Fixed at time of Sow.

-

Sow: Lending Pinto to the protocol in exchange for Pods.

-

Plot: A group of consecutive Pods created by a single Sow action. Plots can be partially harvested or transferred.

-

Harvest: Collecting repayment once Pods reach the front of the Pod Line.

Incentivizing Lenders

Each Season, the protocol adjusts its parameters to incentivize burning the optimal number of Pinto while minimizing debt issuance. This forms a perpetual game of open-market discovery of price and lending appetite.

Below the Price Target

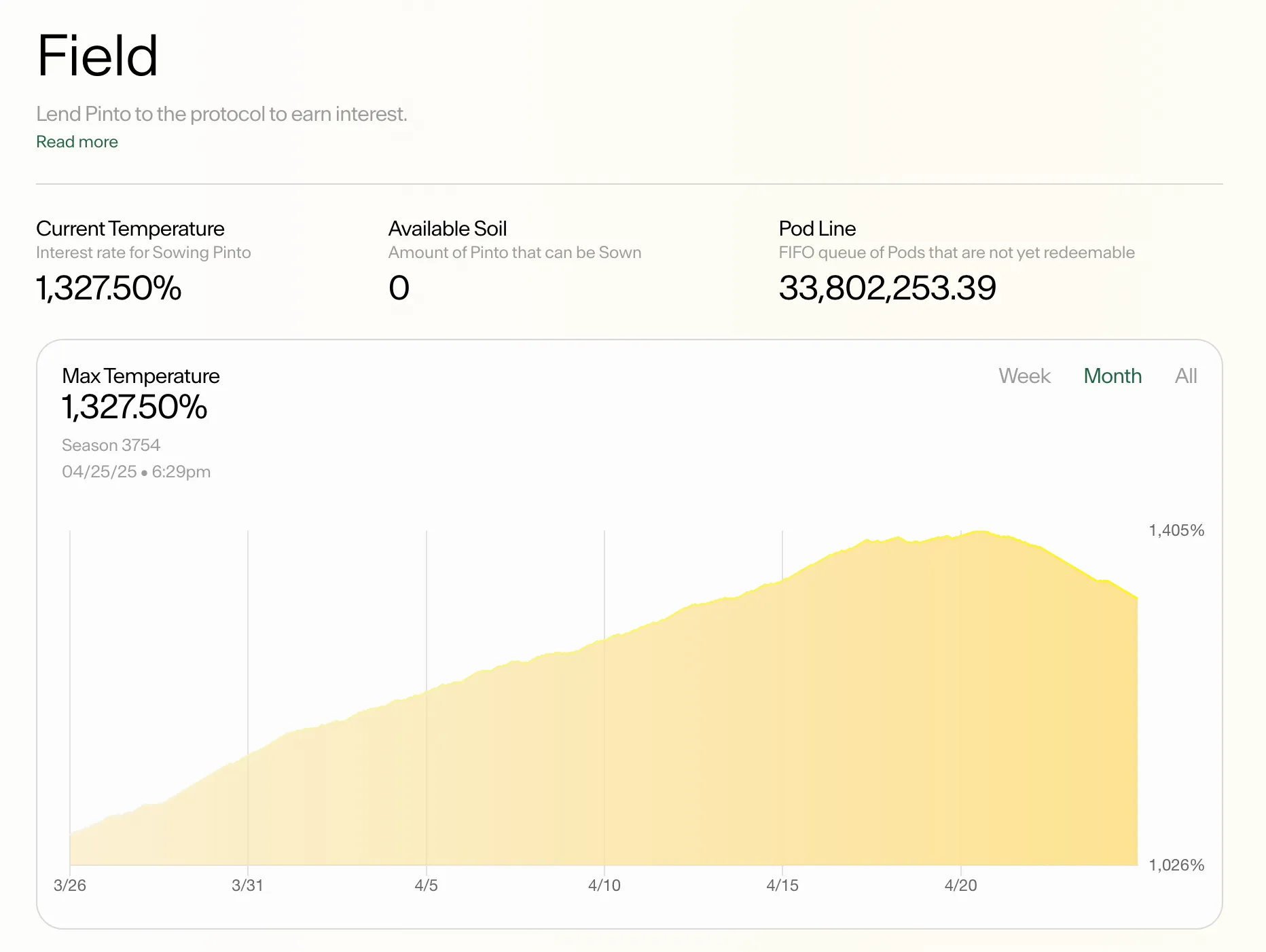

When Pinto falls below the $1 target, the protocol increases debt issuance to stimulate upward price pressure. If Soil demand remains low, the protocol gradually raises Temperature until market participants start Sowing. This allows for organic discovery of the market’s minimum acceptable Temperature. When consistent demand emerges, Soil supply increases incrementally, allowing for discovery of demand size.

Above the Price Target

When Pinto is above the $1 price target, the protocol continues accepting loans with a minimal amount of soil. The Temperature decreases each Season until Soil demand decreases, effectively discovering a soft equilibrium at the lowest possible Temperature.

Basic Game Theory in the Field

The Field is a continuous competition between the protocol and market participants. The protocol seeks minimal debt issuance (low Temperature) while participants compete for optimal entry conditions (high Temperature).

Below the price target, Soil issuance scales to match demand and the Temperature generally rises until sufficient demand is found. Above the target, less Soil is available and Temperature generally decreases. Users looking to Sow are naturally in a race condition with the rebound of the Pinto price. Furthermore, it is always advantageous to be earlier in the Pod Line and Sow with a higher Temperature, but these forces are often at odds with each other. Waiting for Temperature to increase gives competitors the opportunity to Sow first and extend the Pod Line.

For example, if a participant expects Pinto to stay below the price target for another week and the Temperature to increase during that time, they may decide to wait a week before Sowing. However, during that week different users may come to the system and Sow with some size, which would mean that when the original participant returns to Sow, there may not be enough Soil left to enter. Even if there is enough Soil, their Pods will be placed significantly further back in the Pod Line, effectively increasing the time until their loan is paid back.

Snowballing

Each Season below the price target the protocol issues only a fraction of the Soil that theoretically needs to be Sown to return Pinto to the price target. The protocol is not in a rush to return to the price target, instead preferring to optimize for minimal debt issued on its way back to the price target. As a result, it does not require a significant amount of value to sell out all Soil in a single Season. Generally (with a few technical caveats), when the Soil in a Season sells out, the protocol interprets the demand for Soil to be sufficient, and reacts by decreasing the Temperature and increasing the amount of Soil issued in the next Season. Each Season that has sufficient demand will see further decreases in Temperature and increases in Soil issued until demand falls off. This allows for a snowball effect to take place: the Soil starts to sell out in consecutive Seasons as participants enter with moderate size; entry opportunity in Field begins to diminish as a result of Temperature dropping and the distance to the price target decreasing; therefore creating bidding competition to Sow before Temperature drops further; which amplifies the amount of Sowing and in turn creates consistent price pressure on Pinto.

Pod Market

Pods are transferrable, enabling liquidity and giving users opportunities to exit their debt position before maturity. It also provides opportunities to enter into the Pod Line closer to the front. The Pinto UI offers a built in, peer-to-peer marketplace for buying and selling Pods. You can interact with the Pod Market here: https://pinto.money/market/pods

Morning Auction

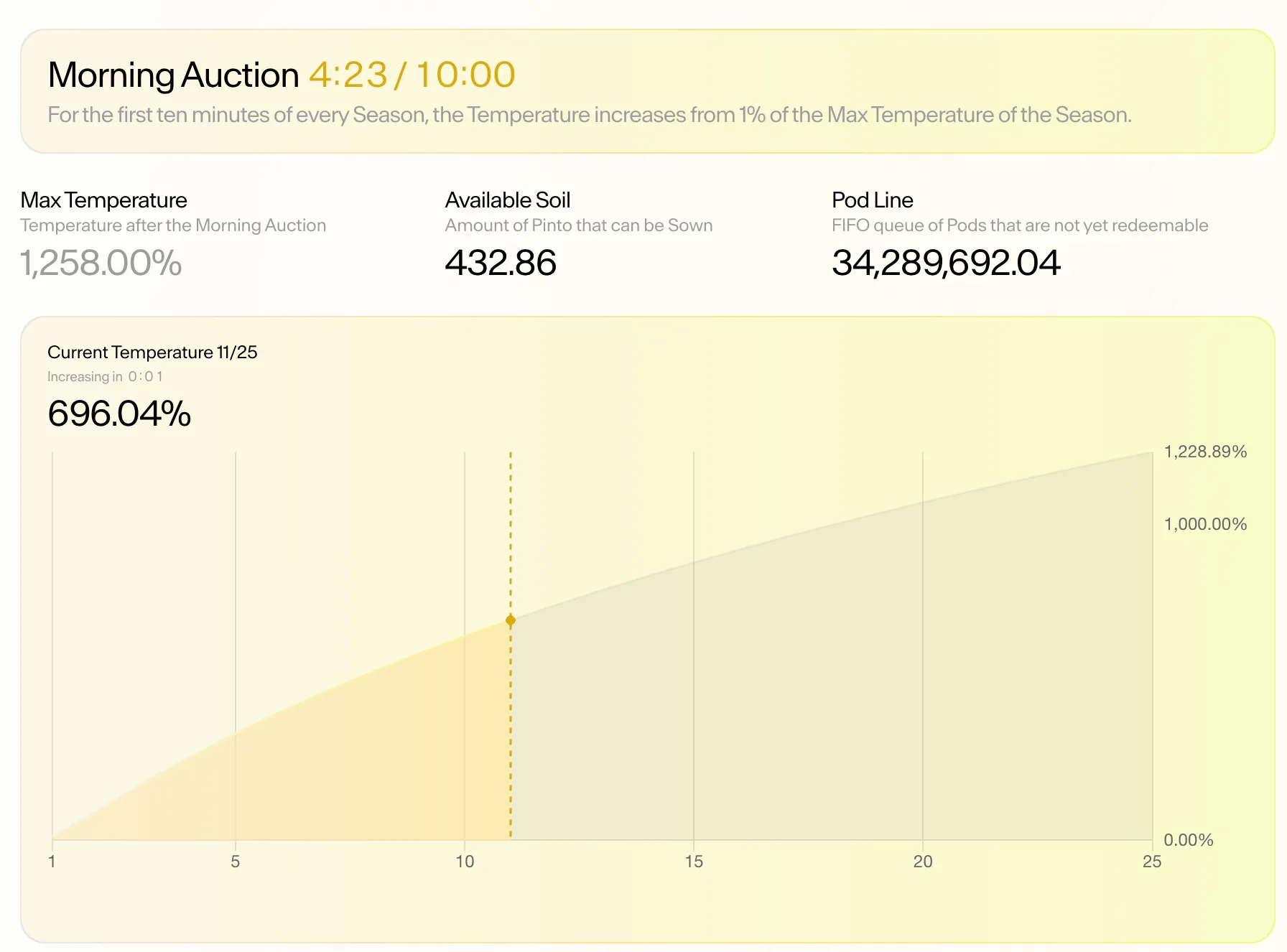

For the first 10 minutes of each Season, the Field is in a special state called the Morning Auction. During this period the Temperature offered by the protocol gradually increases from 1% to the Maximum Temperature of the current Season. This window of reduced interest offering acts as a Dutch Auction and allows Sowers to bid against each other for the limited Soil by accepting lower Temperatures.

An example of the morning auction is shown in the screenshot below. Notice that the Maximum Temperature for the Season is 1,258% but the Temperature a Sower would receive at 4 minutes and 23 seconds after the hour is only 696.04%. Sowing at this time would be advantageous if a user would like to enter the Field but expects Soil to sell out before the end of the Morning Auction.

Tractor

Tractor is a generalized tool within the Pinto protocol. It allows users to authorize third parties to execute certain protocol actions on their behalf. Its initial application is advanced Sow strategies offered through the Pinto UI. Specifically, it allows users to specify which Silo asset they want to Sow from (Pinto or LP deposits), how much they want to Sow, what Temperatures they are willing to Sow at, and the minimum amount that can be Sowed on their behalf. This effectively allows dollar-cost-averaging into the Field and results in more efficient price discovery for Soil. Tractor support for Sowing is essential to facilitating the snowball effect because it gives users the tools necessary to compete efficiently across many seasons without needing to manually submit each transaction. You can read more about using Tractor in the Field here.

Creditworthiness

Pinto and the Field are still young — the protocol has had limited opportunity to prove its ability to pay back debt. However, as more Pods are paid back, the creditworthiness of the protocol will increase and competition will drive down interest rates accordingly. In other words, Pinto will become more efficient as it scales. The experiment is just getting started and the impact of the Field within the economic model is still being discovered.

Explore the Field and join the Pinto farm now.

*Relevant Links:*Pinto App: https://pinto.money/overview