A Phased Rollout for Long-Term Alignment

Catex is entering the market with a carefully structured, multi-phase launch—built to maximize sustainability, vote participation, and capital efficiency from day one. Each stage in this timeline is engineered to activate a key part of our ecosystem, culminating in a fully functional ve(3,3)-powered DEX on Unichain.

Let’s walk through each key phase of the Catex rollout.

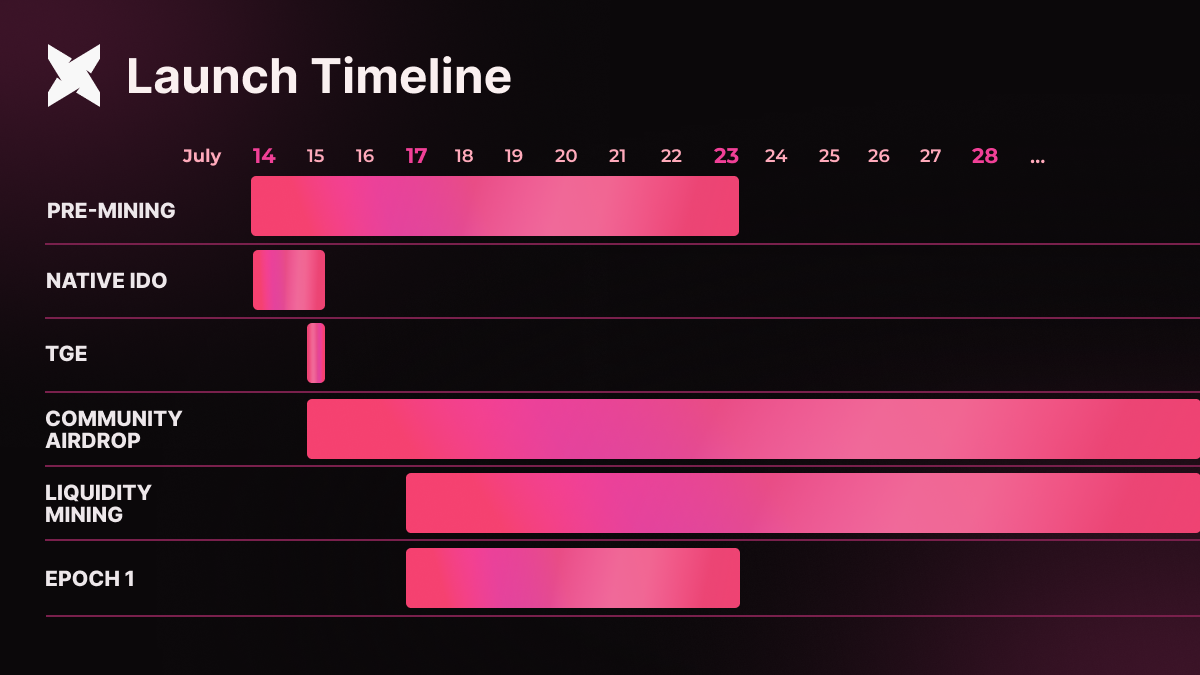

Native IDO (July 14–15)

The Catex IDO is split into two distinct phases:

-

Phase 1: Whitelisted Access — Eligible holders of CATEX-O NFTs will enjoy a 24-hour window to contribute, with boosted veCATX incentives for maximum lock-ups.

-

Phase 2: Public FCFS — Following the whitelist period, the sale will open to the public on a first-come, first-served basis.

This structure ensures loyal supporters are rewarded, while still leaving space for new community members to join.

TGE – Token Generation Event (July 15 @ 23:00 UTC)

At 23:00 UTC on July 15th, Catex officially launches.

The TGE marks the start of:

-

Token claims for both IDO participants and community airdrop recipients

-

veCATX locking for voting power

-

Gauge voting and emissions preparation

This also means very litte waiting period between TGE and the first epoch. Users can lock their CATX before the epoch flips and immediately participate in epoch 1.

Community Airdrop (July 15th onwards)

Shortly after the TGE, airdrop claim portals will open.

Eligible participants—including veTOKEN holders from Lynex, Ocelex, Thena, SwapX, and top $UNI holders on Unichain—will be able to claim their CATX.

All airdropped tokens will be distributed as max-locked veCATX, ensuring every recipient starts aligned with governance and emissions from day one.

Get ready to vote, earn, and shape the direction of Catex.

Epoch 1 Begins (July 17–23)

The first full governance cycle of Catex officially begins.

This is where the ve(3,3) engine comes to life:

-

veCATX holders vote on gauge allocations

-

Trading fees and incentives start accruing

-

Emissions begin flowing based on votes

Epoch 1 marks the launch of Catex’s incentive flywheel—where liquidity drives volume, volume generates fees, and fees reward those who are aligned and locked.

This is the start of an economy powered by governance, strategy, and aligned incentives.

Liquidity Mining (July 17 onward)

With the start of Epoch 1, Catex kicks off its Liquidity Mining phase.

New pools go live, emissions begin flowing, and incentives are activated to drive deep, early liquidity. We’ve secured core LP partners and configured initial gauges to support trading activity from day one.

Catex will be showcasing its full Uniswap v4 infrastructure — including dynamic fees, hooks, and flash accounting — unlocking new levels of capital efficiency.

Here’s what to expect:

-

Native LP rewards

-

ALM / Partner-aligned liquidity pools

-

More hook-powered pools rolling out in the following weeks

This marks the beginning of a capital-efficient, incentive-aligned era on Unichain.

Pre-Mining (Until July 23)

There will be a strategic overlap between the pre-mining and liquidity mining phases, designed to give users time to smoothly migrate into the new pools. This transition is expected to happen quickly, as the yields in the new pools will significantly outperform those from pre-mining. The pre-mining phase will officially conclude at the start of Epoch 2.

The Road Ahead

With the launch of CATEX and the rollout of our first epochs, we’re setting the foundation for a capital-efficient, hook-driven, and community-governed DEX on Unichain. From strategic emissions to active veCATX participation, every step is designed to drive sustainable growth, deep liquidity, and real yield.

Whether you’re a liquidity provider, voter, builder, or explorer — this is just the beginning.

Let’s make DeFi smarter, fairer, and more aligned.

Welcome to Catex.