We’d like to say massive thanks to all of you who joined PSY’s first community call on 23rd June 2023. We appreciate all your support. This is a recap of the entire session, in case you missed it!

Listen to the recording of the PSY’s first community call session here.

Gatsby:

Hello, I’m Gatsby from PSY, I mainly work on the business development.

Today, in this video, I am going to give a presentation about our protocol PSY, including our mission, how PSY works, the unique feature over competitors, roadmap, and lastly tokenomics. After the presentation, there is a QA section by our founder, Hoffman.

So, let’s start with PSY’s mission. We are developing PSY to deliver decentralised and scalable stablecoin in the DeFi Space.

Looking at the current landscape of the stablecoin, as this graph shows, the majority of stable coin share is still dominated by a centralised one like USDT.

Meanwhile, we had seen the emergence of liquid staking derivative space. Up to now, the market for LSDs has indeed grown significantly, becoming the leading category in the DeFi Space.

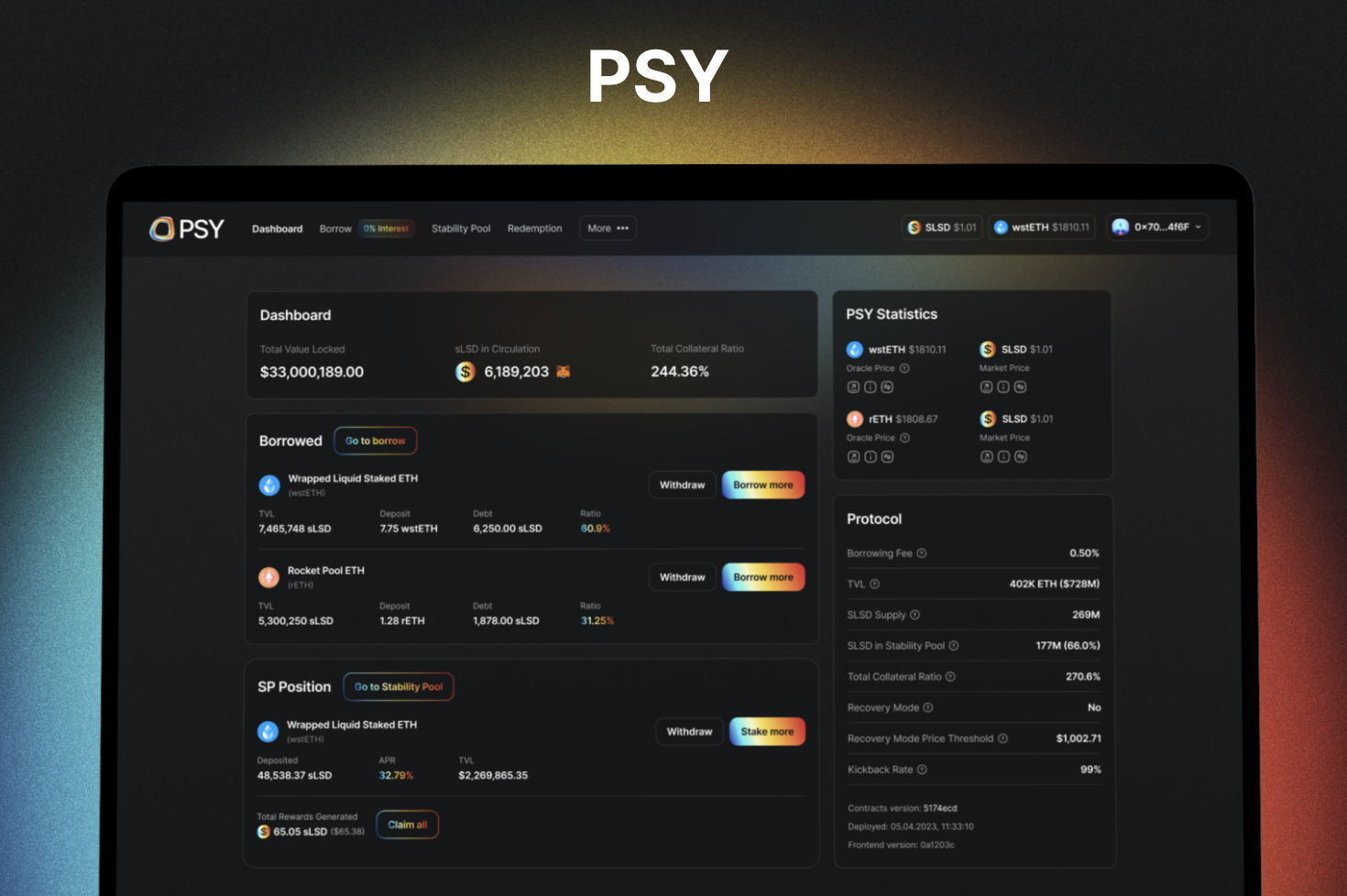

And that’s why we are building PSY, which is a decentralised lending protocol, where you can mint a stablecoin, called SLSD, by collateralising scalable Liquid Staking Tokens such as wstETH, rETH and frxETH without paying interest.

And, at the launch, we are going to accept frxETH by Frax as the first collateral.

PSY will be launched on Arbitrum, which is different from other LSD backed stable coin mostly deployed on mainnet.

Additionally, PSY provides some unique features.

The first feature is multi-collateralisation, meaning we accept multiple LSDs as collateral. The point is that we also accept their LP token on DEXes like the LP token for frxeth and WETH pair. That is to say, you can earn your LST rewards + farming and trading-fee reward from DEXes, while collateralizing them to mint SLSD.

The second feature is the leverage module, which allows users to leverage their LST rewards and DEX rewards. As our minimal collateral ratio is 110%, theoretically, you can leverage your position up to 11x.

And the last unique feature is our ve(3,3) tokenomics. The critical point for stablecoin is its utility across the DeFi space, and we need to attract liquidity to DEX pools for $SLSD pairs. With ve(3,3,) tokenomics, we will incentivize community partners to incorporate $SLSD as their stablecoin as well as DeFi users to provide liquidity into the $SLSD paired pools by distributing $PSY reward emission through voting.Also, we are aiming for community-driven protocol. If you lock PSY and become vePSY holders, you will be rewarded by fees, bribes and token rebase. By implementing ve(3,3) tokenomics, we’d like to reward PSY stakers with those incentives for actively participating in our governance.

Token allocation is as follows.

It’s yet tentative, but we are planning to issue 400M tokens for the initial supply. We allocate 40% to IDO, 12.5% to the team with vesting, and about 50% to the treasury which is for protocol development and growth including POL, airdrop, grants, and marketing.

As the emission rate decays epoch by epoch, our total supply converges to around 1.6 billion tokens. The allocation to emission will reach to more than 70%, while share for IDO, team, and Treasury will decrease gradually.

To wrap up, PSY’s architecture is as shown. Minters collateralize LSD tokens and borrow SLSD from trove. Stability pool is set to liquidate in case trove(s) are below the minimum collateral ration and anyone can be liquiditator and get rewarded with PSY and collateral tokens by depositing SLSD. And as I explained in tokenomics slides, liquidity pools are rewarded by ve(3,3) tokenomics and governance.

Our next step is the product launch and IDO in Q3. We will soon implement the multi-collateral module for user’s benefit. In Q4 this year, we will deploy leverage module, and try expanding SLSD utility through protocol collaboration. Next year, We will explore LSD strategy, and expand our ecosystem further through to deliver universal LSD collateralised stable coin.

That’s it for the presentation about PSY. Thank you for watching the presentation, and please feel free to drop a comment here or our discord if you have any questions or feedback! So that’s it about the basic introduction of PSY, and let’s moving on to the QA section.

Hoffman please, introduce yourself and start the session!

Hoffman:

Hi I’m Hoffman, I do engineering of PSY, stablecoin protocol, I will be answering questions on discord from now on.

Who are the team members behind PSY ?

Our team consists of total four members. Two engineers, and two bizdevs. Back in the last year, we all got excited about the LSDs and upcoming Shanghai upgrade, then we teamed up.

What is the current development status of PSY and what are PSY main goals in 2023/24?

We have already launched our testnet for the stablecoin part. Also the audit for that part is already finished and you can check it.

We will launch stablecoin part around the first half of July, and later, launch token parts around the second half of July.

After that, we are going to expand our utility with leveraging and multi collateral parts.

Who are PSY strategic partners and investors? What benefits do we and PSY get from those relationships/ partners?

We didn’t get any investment before, we wanna be a community owned protocol. For partnerships we will make partnerships with collatral partners, and liquidity partners. Collateral partner means LSD and Decentraliesd exchanges. Liquidity partner means decentralized exchanges who provide liqudiity for us.

With these partnerships, users will have multiple options to manage their assets.

What are the specific LSTs that PSY supports, and how were they chosen?

We will support multiple LSDs. sfrxETH, rETH, wstETH, and their LP tokens are our collaterals

How secure is the wrapped ETH (WrapETH) used by PSY, and are there any potential risks to users?

WETH is not our collateral, so I assume this question is about the security of our collateral. The risk of stablecoin collateral is mostly about price vilatility. As LSD tokens are all based on ETH, thus volatility is relatively stable, compared to other small assets. Also the security of LSD tokens are battletested.

How does the 0% interest rate for lending in PSY work, and how is it sustainable for the platform in the long-term?

We are not charging interest but one time borrowing fee and redemption fee. Redemption fee and borrwing fee are better in terms of predictability. As we are not free to use, there is revenue and we don;t see any concern on sustainability in the future

Can you further explain the ve(3,3) token model introduced by PSY, and how it benefits users?

ve(3,3) is initially adopted by DEX, and They incentivize liqudiity provision on their platform. Just like decentralized exchanges, we incentivize other protocols to adopt our stablecoin. With PSY emissions, users of partner protocols will get extra rewards, in addition to yield from partner protocols.

With PSY running on Arbitrum, what are the advantages and potential challenges of using this layer 2 solution?

We choosed arbitrum b/c its home for defi and, gas is cheap. One drawback of Arbitrum is that liquidity is less than mainnet, but we see the liquidity volume will flip that of mainnet in the next bull run.

Gatsby:

All right, Thank you very much Hoffmann, and Thank you everyone for joining our community call today. As I mentioned the presentation, we are going to launch our product and tokens next months. we will keep you updated through our SNS. So please follow our Twitter and join discord if you haven’t yet. And please stay tuned. Again lastly please feel free to drop questions if you have any questions and feedback.

About PSY

PSY is a community-driven, decentralized lending protocol designed to enable interest-free loans in a stablecoin - SLSD - by collateralizing multiple LSDs (Liquid Staking Tokens and their LP tokens). The protocol is set to be launched on Arbitrum.