Hello friends, as many users of the Waves ecosystem know, just recently the first futures trading platform was born in it, one which many experienced traders on the Waves Exchange has been missing so much.

Today, we will talk about what this platform is, how to use it correctly, and what pitfalls you should pay attention for so that not to lose your deposit at the first use. So, Tsunami Exchange - easier than is looks, let's go! 🚀

What are futures and how to make money on them?

Before we get into the workings of the exchange itself, we should dive into such a concept as futures, and why they can bring good profits in the hands of understanding traders.

A futures, or future contract, is a derivative security or derivative.

Tsunami uses perpetual futures, the distinctive feature of which is the absence of an expiration date. We can easily hold a position for as long as we want.

Perpetual futures are a popular way of earning for many traders around the world, and there are many reasons for that fact:

-

we have no need to buy and sell a real asset;

-

we can increase the size of collateral for a position by using leverage;

-

we can hedge risk if the price of the asset we bought on the spot trade moves down.

It sounds pretty complicated, but I'm sure it will make a lot more sense to you as you read!

Tsunami Exchange - what is the beast?

When we first get acquainted with the exchange, we find ourselves on a pleasant website with a fresh design, pointing out the main points with which it would be nice to get acquainted before the first approach to trade. Now in order. What is the Tsunami Exchange?

According to the official documentation,

"Tsunami Exchange is a gamified derivatives market based on virtual AMM, which allows trading any assets - cryptocurrencies, NFT, commodities (oil, gas, etc.)."

And now let's understand what all these complex terms mean, in language we can understand.

Gamified

Gamification - the adding of game mechanics into the project, helping the project to become more exciting and understandable for users. In Tsunami’s case the gameplay will be built on trading competitions between users and adding interactive NFT-avatars, which, in turn, will act as artifacts that somehow increase your income.

Warning - Spoiler below😱

Derivatives

Simply put, derivatives are instruments whose value is linked to an asset on the market. But how do derivatives participate in the market? The thing is that Tsunami does not use real assets for trading - be it Waves, EGG, Pluto, etc. We don't need to buy Waves to start trading, it is enough to have USDN in your account, which in turn is already used by the exchange when we open new positions.

Virtual AMM

If you, like me, follow the news in the DeFi world, you probably noticed that AMM is a rather frequently used word lately, but can we confidently say that we know what it is? AMM (automated market maker) is an exchange that allows instant transactions in which the exchange price depends only on the number of tokens stored on the smart contract at the moment.

The word "virtual" means that a smart contract does not hold real assets, but instead holds a USDN pledge in a separate vault that allows us to buy virtual assets from AMM pools. Thus, the AMM in Tsunami acts as a conductor of prices at which we open our positions.

I congratulate you, we have figured out the definition. Let's move on!

Interface: simplicity is the key to success

The first time you open a Tsunami trading application, it seems as if you can't keep your eyes open. But is it really that complicated? Let's evaluate the situation.

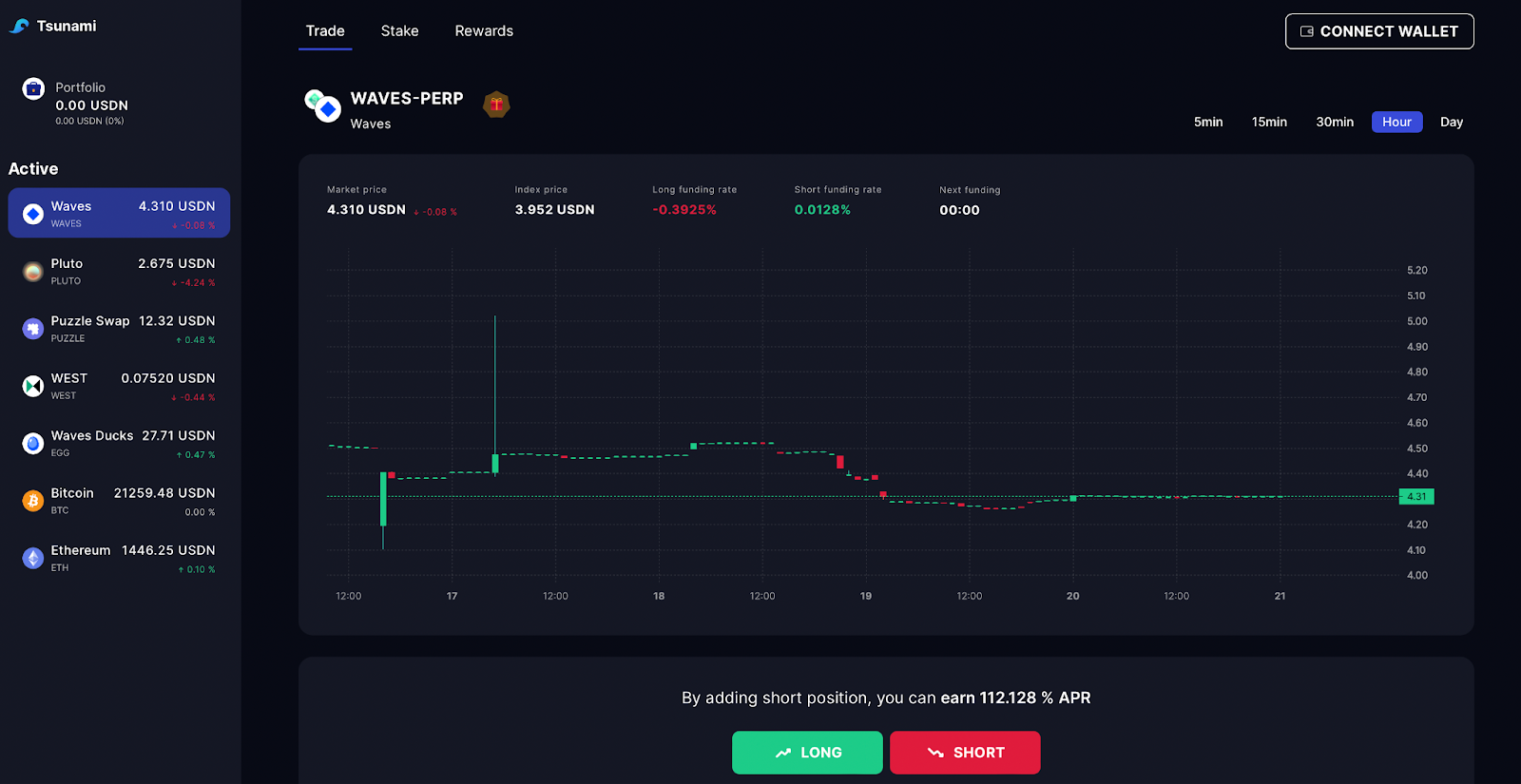

In the block on the left we see the pairs which are already added to Tsunami and are successfully traded in real time. Above it - a small but extremely useful block Portfolio, which reflects the status of all our positions, profit or loss.

In the main field of the site is a visual display of the chart of the open trading pair, where we can change the time intervals of the display for our convenience.

Let's look up into the space above the chart and move on to the most useful part - the prices. Here we see 2 prices: Market Price and Index Price. Why 2 and why they are different is a fair question, I’ll tell you.

Index Price is updated due to special oracles - services which collect information on the price of an asset from various exchanges, and reflect the real value of the asset for which we can buy it on the spot trade.

Market price, in turn, is formed by the open positions of traders who, informally speaking, place bets on the direction in which the Index Price will move in the future.

It is due to the difference between these two prices the magic happens and we can make a profit!

Tsunami trading - is it real to make money?

So, friends, if you have reached this point, you are ready to conquer the waves, and no obstacles will not stop you. It's time to experience the tsunami of emotions of a real trader - start trading!

Let's assume that we already have experience in trading and we know why we open long and short positions so we don’t have to focus on these details.

Funding

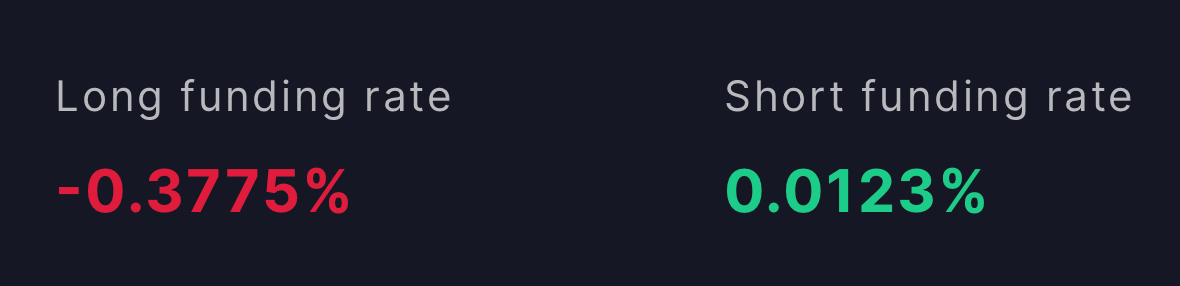

To understand how trading at Tsunami happens, we need to break down a new term: funding. Funding is payments made by traders every hour, depending on market conditions. If Market Price is higher than Index Price, longs pay shorts, and conversely, if Market Price is lower than the Index Price, shorts pay longs. The size of the payment depends on the price difference as well as the size of our position.

If you have had any experience with futures exchanges, you already know about fundings, as they are the most popular mechanism for bringing our two prices closer together. Let's look at an example.

In the image above, we see that funding is paid by traders who have opened long positions, while "shorts" in turn earn 0.40% profit per hour. The funding mechanism helps to encourage traders to close unprofitable positions and open new ones, even if they are directed in the opposite direction to the market.

Sometimes it happens so that a trader has opened a position in the "correct" direction, i.e. has foreseen the Index Price movement, but such movement has turned out to be quite obvious for other traders who have also opened positions in that direction. An imbalance was formed on the market. Because most traders have opened positions in one direction, there is no support for the fundings, and traders wait for either opening positions in the opposite direction, or for the price change.

To avoid such situations in the future, a dynamic curve will be introduced. It is a tool that moves Market Price closer to Index Price automatically, without traders opening new consciously "losing" positions.

Leverage

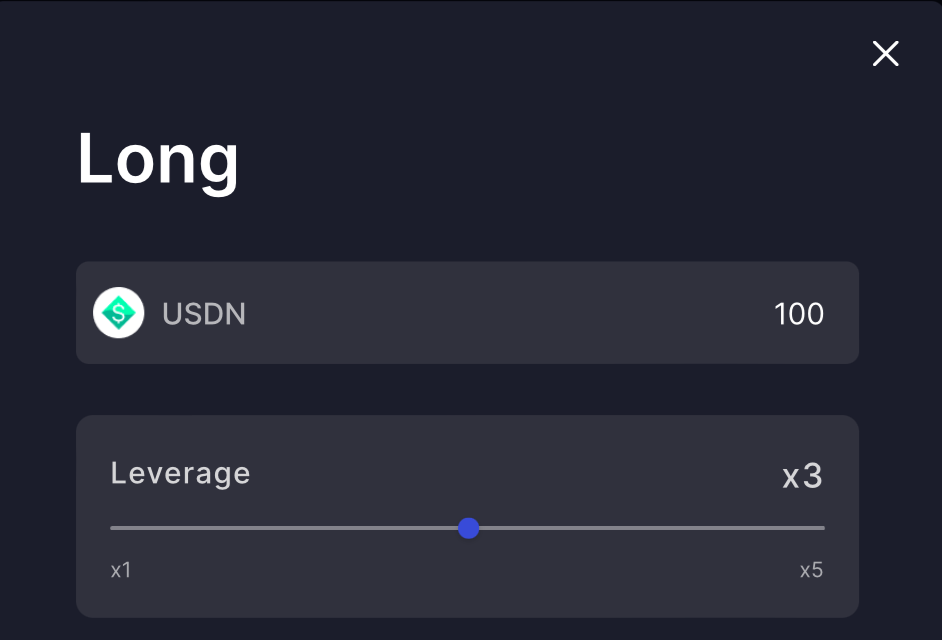

So, let's assume that we are risky guys, and we decided to understand the Tsunami work empirically , or "by trial and error”. When we open a position in one direction or another, we see a suggestion on the interface to add Leverage to the position.

Financial Leverage is the ratio of a trader's money to the total amount of money he or she trades. But where does the extra money come from to provide the increase of our position?

The thing is that we don't need additional "real" assets to increase our position. All that vAMM works with is the USDN security that the user provides when he opens a position. It is as if we are saying: I have 100 USDN, but let's open a position for as many units of an asset as if I were giving 200 USDN. And vAMM answers: ok, but then I will have to move the price of your position closer to the current open price, ok?

Thanks to the example above we understand how vAMM works and why it is more efficient than using a regular AMM.

Fees

Every time we open a new position, we pay 1% fees, half of which goes to the $TSN staking rewards and the other half to an insurance fund that helps stabilize the protocol and close unprofitable positions.

Liquidation

When trading on futures exchanges, there are often sharp changes in price that can lead to the liquidation of our open positions.

In order to allow users to trade on Tsunami without fear of losing the security of their entire position, Tsunami Exchange has introduced a mechanism of partial liquidation.

Partial liquidation is the process in which if the Margin Ratio falls below 8%, the users' position will not be liquidated completely, but only that part of it, which will be enough to restore the Margin Ratio to a level above 8%.

At one time can be liquidated at least 15% of the current volume of the open position. If the Margin Ratio of our position falls to 1% or lower, the position will be liquidated in full.

With the introduction of the partial liquidation of our funds remain safe for as long as possible, which helps to make trading on the Tsunami Exchange more comfortable and reduces the risk of losses for users.

Well, now you're almost experts in the world of Tsunami, so let's break down the most interesting things, the things that were left to the sweet - the additional plusses that will help us to increase our income.

Tsunami Bounty

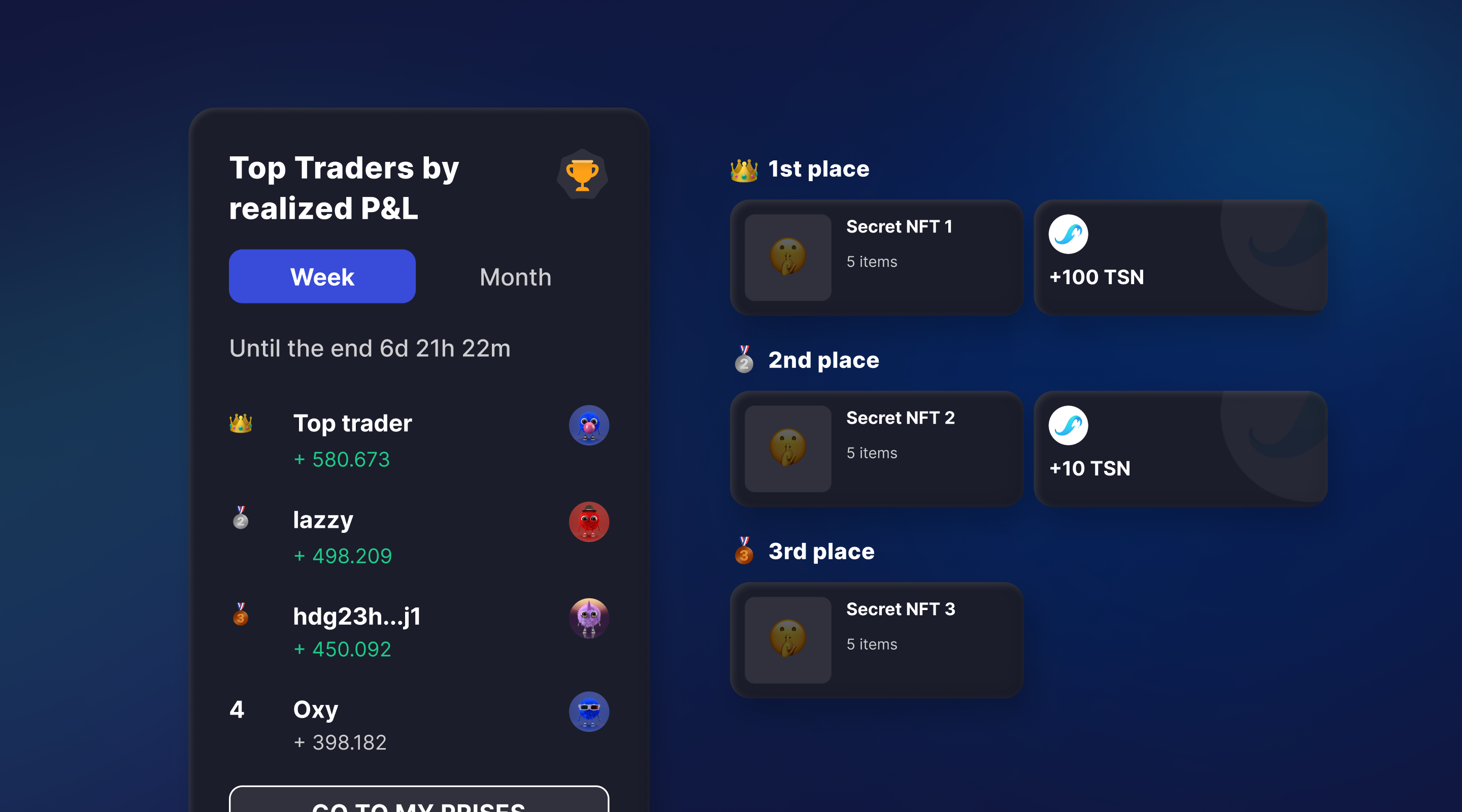

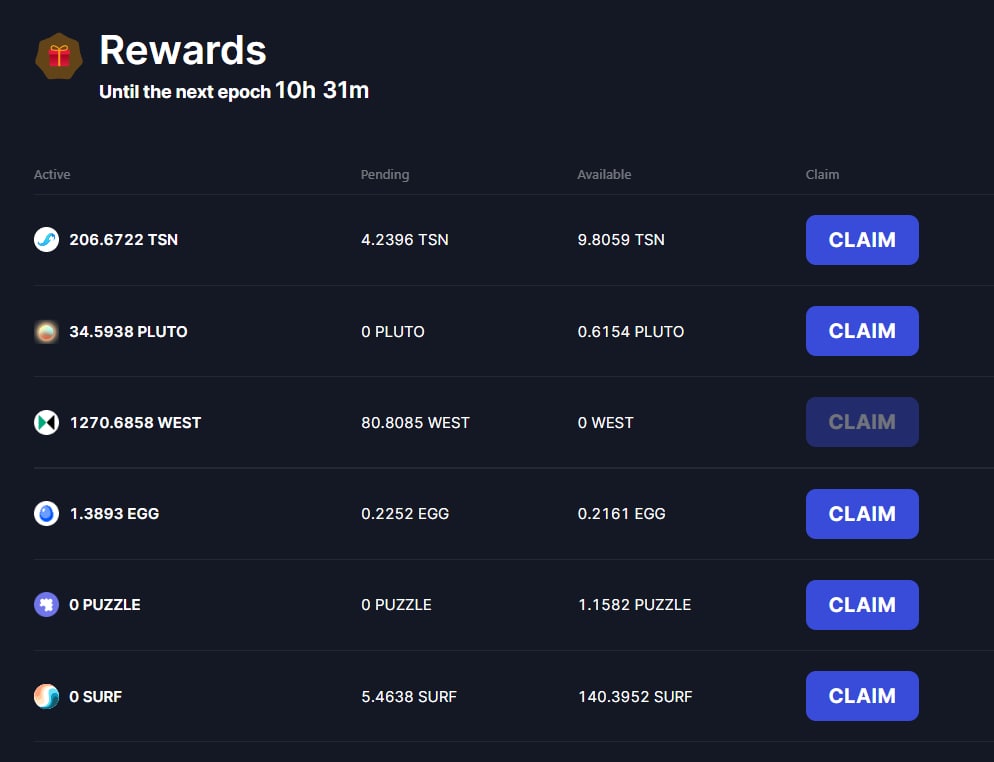

Quite often when launching new products to attract new users and maintain their interest, teams launch rewards programs for early users, so we got to one of the nicest parts of learning the Tsunami world with you - the bounty or user rewards.

By increasing your trading volume on Tsunami, you help the exchange grow and expand, so the team has introduced additional rewards for trading and liquidity replenishment. The amount you can earn depends on the amount of commissions you have paid for a special period of 1 week. The time until the end of the current period is displayed in the "Rewards" tab.

How to receive the reward?

Every time you open a new position, we pay a fee of 1%. According to the tokenomics of the project, the team puts aside up to 1000 $TSN per week for the users' rewards, so we can easily earn up to 200% from fees in $TSN token, and for some pairs there are additional conditions, where we can earn 200% in tokens of this pair on top! The more open positions in a week, the better.

Another factor for earning rewards is the average size of open positions. For example - 3 days a week there was an open position for 1000 USDN, and 4 days - 0 (no open positions). Then the average position size will be calculated as 3/7*1000 + 4/7*0. If you have not opened any new positions for the period, fees will not be taken into account.

So, in order to get the maximum number of rewards plus our profits, you need to actively trade during the week and keep the position open as long as possible. That's it!

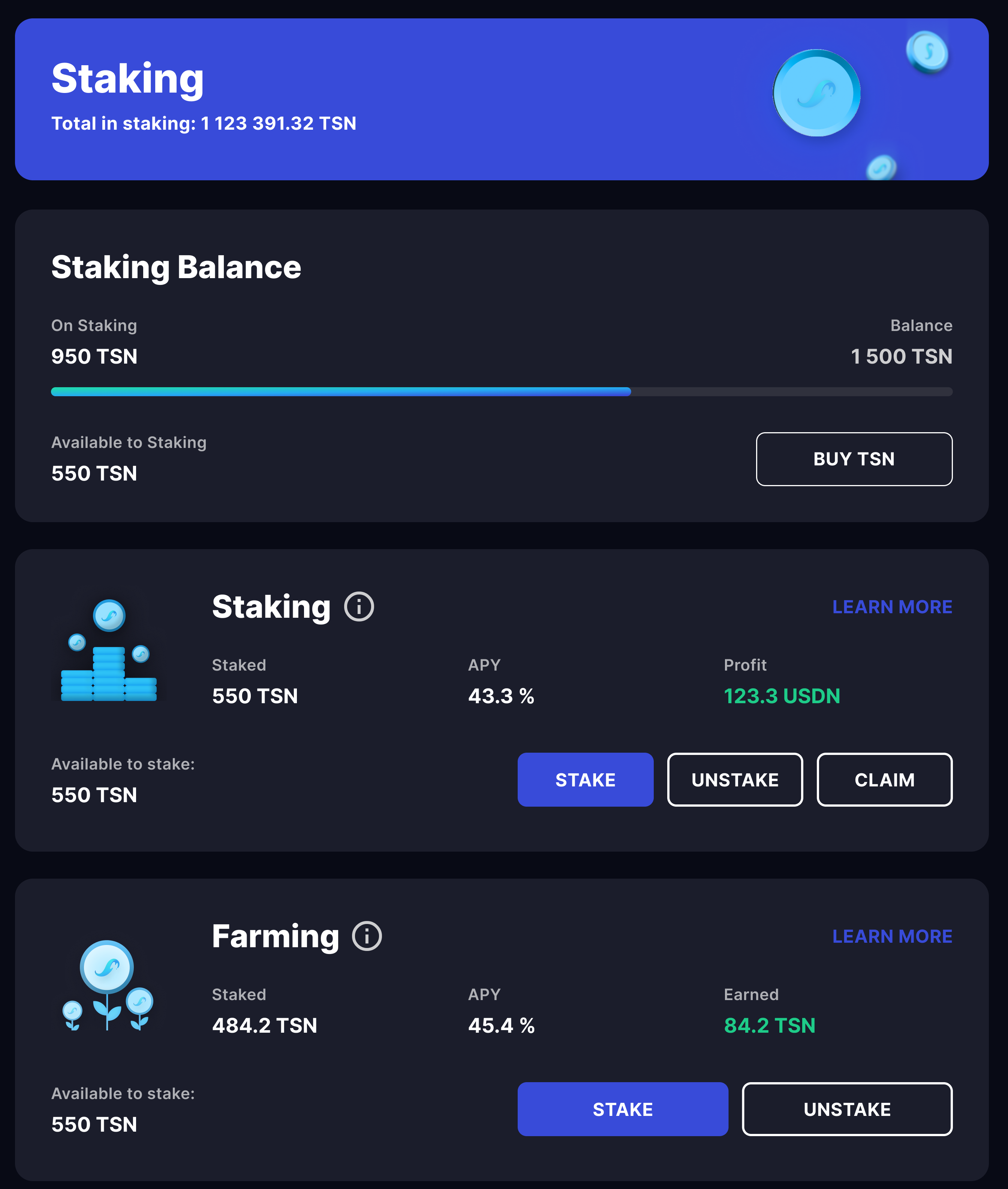

Staking/ Farming of $TSN

The $TSN token is positioned as a management token with which you can make decisions about the future of the exchange together with the team. In the near future, the token will be added to well-known services for cryptocurrency monitoring - CMC, Coin Gecko, DeFi Lama, etc.

Let's imagine that you took your rewards from the trade and go to pour them into the glass. Take your time, with a $TSN token you can earn more. Stakers get 0.5% of the volume of all trades that take place on the Tsunami Exchange. Imagine a volume of several million USDN per day. Can you imagine that?

In addition, according to roadmap the Tsunami Exchange team recently implemented a Farming feature that reinvests your $TSN tokens, automatically redeeming them with a contract and depositing them into your wallet without additional transactions!

While you plan to dump your earned $TSN in the market, farming APY plans to go to the moon (or Pluto, who knows).

Conclusion

Today we got acquainted with Tsunami Exchange, learned how to trade and earn profit, became masters in investing tokens and figured out how to get rewards for it all.

Trading on Tsunami was not as hard as it seems at first glance! You can always practice by opening a position for 5-10 USDN and follow the price changes.

Below you will find all the relevant links to the Tsunami Exchange. Thank you for being with us!

Links

Website - https://tsunami.exchange

Chat - https://t.me/tsunami_exchange_chat

News channel - https://t.me/tsunami_exchange

Twitter - https://twitter.com/ExchangeTsunami

Documentation - Tsunami Documentation | docusaurus | Tsunami

Thank you for reading! Your Tsunami team 🌊