A perpetual futures contract, also known as a perpetual swap, is an agreement to non-optionally buy or sell an asset at an unspecified point in the future. Perpetual futures are cash-settled, and differ from regular futures in that they lack a pre-specified delivery date, and can thus be held indefinitely without the need to roll over contracts as they approach expiration. Payments are periodically exchanged between holders of the two sides of the contracts, long and short, with the direction and magnitude of the settlement based on the difference between the contract price and that of the underlying asset

Trades on Tsunami settle in USDN, so all collateral used on the exchange is in USDN. This allows the protocol to leverage staking contracts of USDN to provide additional yield to TSN stakers.

The price of perpetual contracts will often diverge from the broader market (aka index price). These deviations signal sentiment on the exchange - if a majority of traders expect the underlying asset to increase in value over time, the price of the perpetual contract will likely exceed the index price. Likewise, if most traders expect the price to fall, the price of the perpetual will be below the index price.

There are two mechanisms that moderate this process, and function to keep the perpetual contract price close to the index price.

Funding payments

Every hour, traders with open long or short positions will pay each other a funding payment, depending on market conditions. If the contract price is above the index price, longs will pay shorts. If the contract price is below the index price, shorts will pay longs. The size of the funding payment is a function of the difference between the contract price and the index price, as well as your position size. This incentivizes traders to take the unpopular side of the market.

Periodic funding payments are the most common mechanism used by exchanges to do perpetual swaps. Funding payments act to converge the mark price (the price on Tsunami) and the index price (the average price from major exchanges).

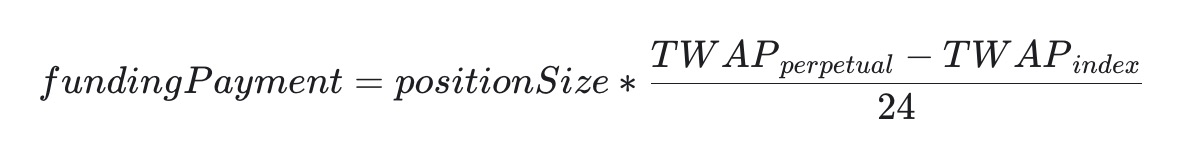

An amount of funding payment is calculated using the formula:

As a rule of thumb - the higher the difference between mark price and index price, the more funding you will pay when you open a divergent position, and the more you collect opening a converging position.

Arbitrage

If the contract price diverges significantly from the index price in other exchanges, arbitrageurs can benefit in two ways.

-

If they hold a position elsewhere, they can use Tsunami to take the inverse position and earn funding payments.

-

They buy or sell an asset elsewhere, and long or short that asset using Tsunami, in the expectation that the price will tend to move back toward the index price.

Conclusion

This way, Tsunami creates economic incentives for converging market and index price. Any imbalance creates a nice opportunity to arbitrage or take funding payment, that incentivize traders to open positions in convergent direction.