Delta neutral, Shorts, funding rates, Perps, Staking.

Harmonix Finance is transforming sophisticated hedge fund strategies into accessible and easy-to-use automated vaults. Like its native Hype dela neutral vault.

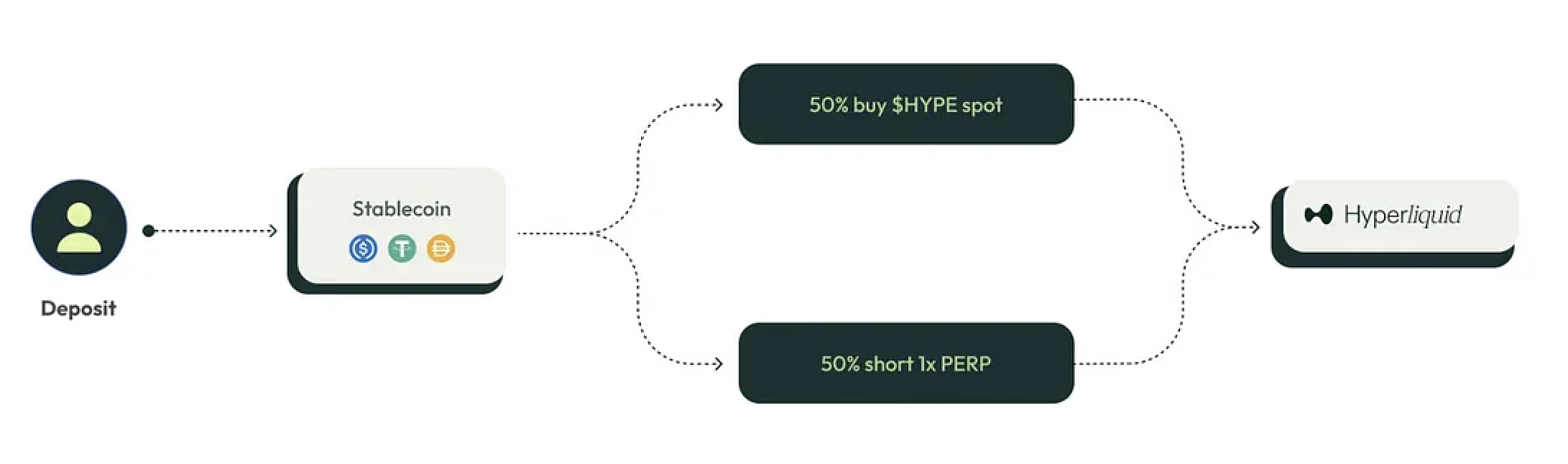

Delta Neutral Strategy

-

A delta-neutral position is created by opening two positions on Hyperliquid: one holding the spot asset (Hype) and the other shorting the same asset. This approach removes exposure to price movements, allowing the depositor to earn yield from the funding rate without being affected by market fluctuations.

-

And adding an additional layer of yield by staking the spot asset to secure the network.

What is a Short?

•A short is a strategy where an investor bets on an asset’s price decline by borrowing and selling it immediately. If the price drops, they can buy it back at a lower price, returning the borrowed amount and keeping the profit. However, if the price rises, they must repurchase it at a higher price, incurring a loss.

•In a delta-neutral strategy, losses are offset by holding a 1:1 position. For example, if you’re short 100, you’d also hold a long spot position of 100 to balance market movements. This way, a 3% loss on the short is offset by a 3% gain in the spot asset.

What are funding rates?

•Funding rates are an hourly payments between long and short traders in perpetual futures to keep contract prices close to the spot price — they are positive when longs dominate (bullish) and negative when shorts dominate (bearish).

•Historically, Hype funding rates have remained positive and are currently at 11%. This means that opening a delta-neutral position with 10,000 USDC would yield a total of 11,100 USDC after one year.

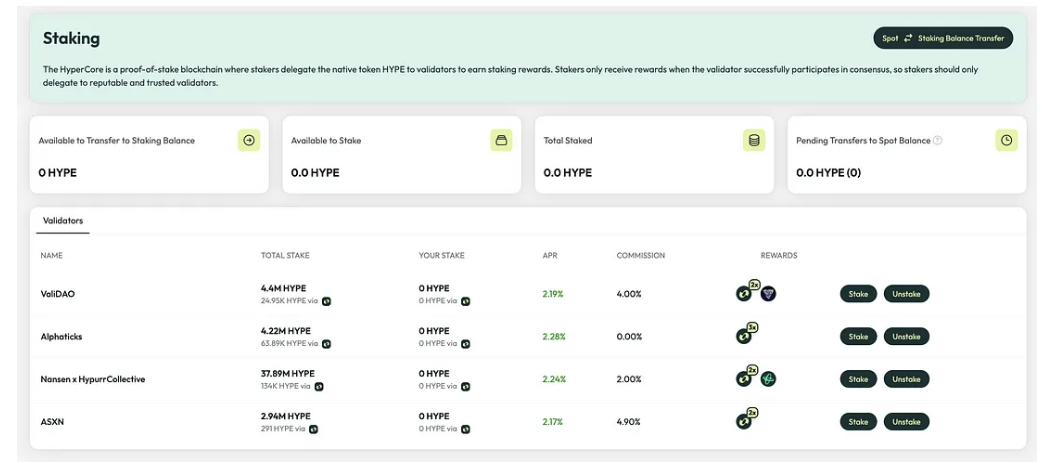

What is Staking a spot asset?

•Staking a spot asset means locking up your spot asset to help support a network, like validating transactions. In return, you earn a share of the fees incurred by users, paid in the same asset you staked.

•Staking a Hype token currently give you a 3% APY, that means compound interests. For securing the networks transactions.

•A delta neutral gives exposure to funding rates and interests from the staked spot asset.

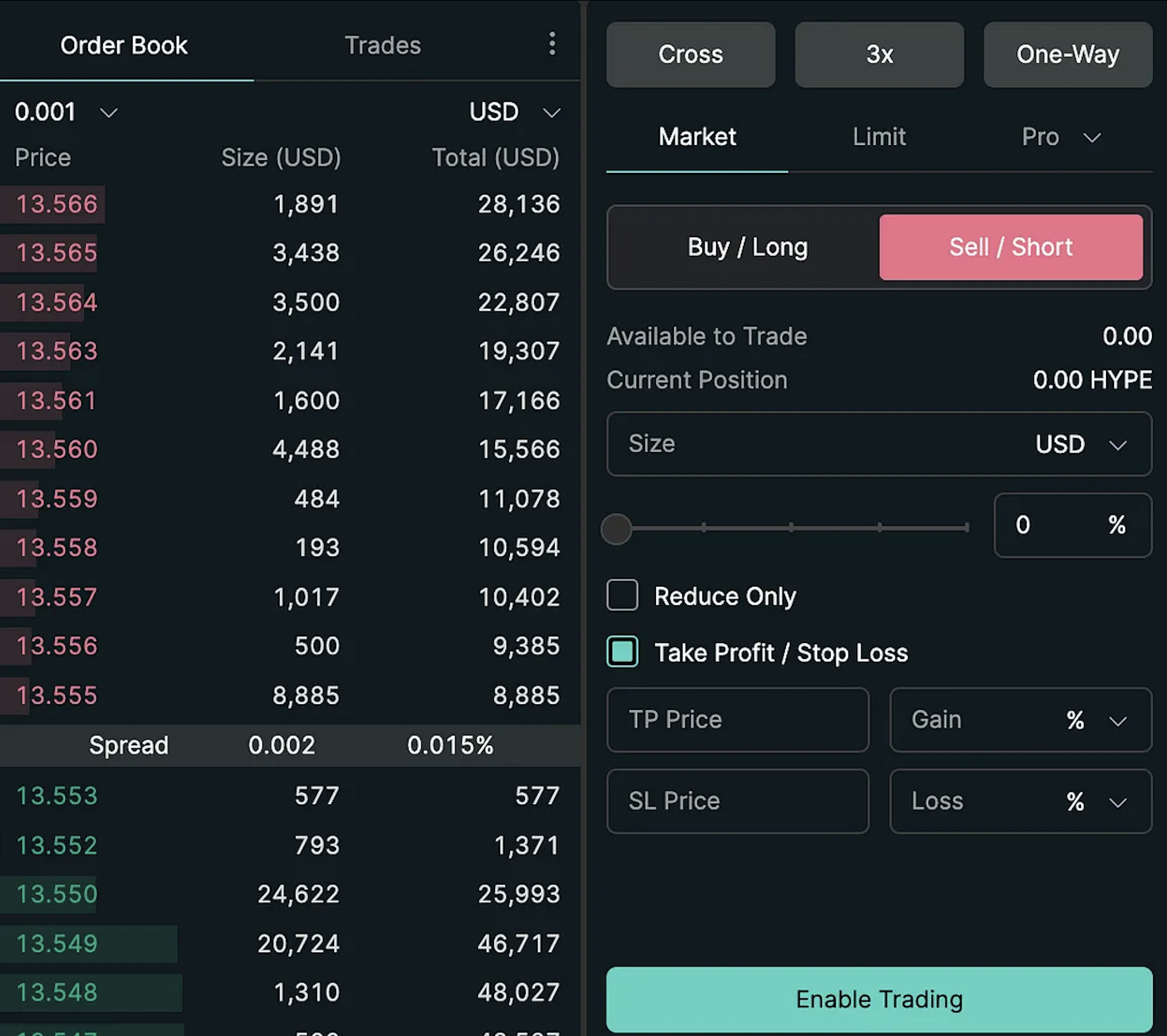

What are perpetual futures Order book Exchanges?

•A perpetual order book is protocol, in this case Hyperliquid that where users can trade long, short and spot assets.

•Futures contracts are agreements to buy or sell an asset at a predetermined price and on a specific future date. (Futures represent an “obligation,” whereas options give you a “right.”)

•Perpetual swaps are futures contracts with no expiration date. These gained popularity with Bitcoin and other cryptocurrencies, offering high liquidity and leverage. They are designed to track spot prices through funding rates. As one of the most liquid products in crypto, perpetual swaps provide access to cheap leverage and mimic spot prices via funding rates.

Risks

By opening a delta-neutral position on Hype, you’re betting on positive funding rates (more traders longing than shorting) and the increase in the spot asset price. Sense by staking the asset your also generates yield.

-

Negative Funding Rates: Bearish market sentiment could reduce returns or cause losses.

-

Smart Contract Risk: Vulnerabilities or hacks could lead to loss of funds.

-

Short Position Liquidation: Price increases may lead to liquidation of the short position if not managed correctly.

-

Vault Mechanism Defaults: Failures in automated vault mechanisms could cause unexpected losses.

Long Live DeFi

HL

C