Executive Summary

Token sniping bots are automated tools designed to take advantage of newly launched tokens by purchasing them the moment they become available, often before regular users even have a chance to react. These bots actively monitor the Solana blockchain for token listings, using high-speed strategies and priority execution to front-run manual traders. Once they acquire the tokens early, they typically sell them soon after for a quick profit. This process can cause token prices to spike unnaturally, leaving everyday users either paying inflated prices or holding tokens that quickly lose value.

Several factors make Solana especially attractive to sniping bots. Its fast transaction speeds and minimal fees lower the cost of repeated bot operations. Additionally, unlike some other chains like Ethereum, Solana lacks built-in protections against such tactics. The transparency of Solana’s data, while good for openness, also allows bots to detect and exploit token launches in real time.

These activities create an uneven playing field, reduce confidence among retail traders, and can seriously damage the early momentum of promising projects. However, with proper understanding and targeted mitigation strategies, the ecosystem can take meaningful steps to reduce the influence of sniping bots and promote a fairer trading environment.

Key Findings

-

Dominant Sniping Platform: pump.fun has emerged as the most commonly used platform for snipers to monitor and attack new token launches on Solana. Its popularity stems from how quickly it surfaces newly created tokens.

-

Use of Priority Execution Services: Snipers leverage specialized services to gain transaction speed advantages. These include:

-

Jito (Tip Account)

-

NextBlock (tip feature)

-

Temporal.xyz

-

Bloxroute

-

0slot

-

These tools help bots secure faster transaction execution, giving them a clear edge over regular users.

-

Early Buyers Are Often Bots: Our analysis found that the initial set of buyers in many token launches is rarely manual users. In most cases, they are sniper bots acting within seconds of the token going live.

-

Coordinated Wallet Usage to Obfuscate Activity: Many sniper operations involve coordinated actions across multiple wallets. Bots typically purchase tokens from various addresses and then consolidate and dump the tokens from a different wallet. This tactic makes it difficult to trace back the full sniping pattern.

Recommendations

-

Blacklist Known Sniper Wallets: DEXs and token projects should maintain and actively update blacklists of wallets identified as snipers, reducing their ability to repeatedly exploit new launches.

-

Enforce Holding Periods on New Tokens: Introducing a minimum holding time, such as 5 to 10 minutes, before tokens can be sold may limit the ability of bots to profit from instant flips and protect early liquidity.

-

Enhance Bot Detection Mechanisms: RPC providers in the Solana ecosystem should work on identifying bot-like patterns (e.g., bursty, high-frequency transactions) and implement throttling or rate-limiting to reduce bot efficiency.

Introduction

Token sniping has become a growing concern within the Solana ecosystem, particularly during new token launches. In many cases, individual users, despite being prepared and ready to trade, find themselves priced out within seconds of a token going live. This sudden shift is rarely due to organic demand or market dynamics. Instead, it's often caused by automated sniper bots that are specifically designed to exploit the speed advantages of the Solana blockchain.

These bots continuously monitor the network for new token listings and execute purchase orders almost instantly, well before manual traders can act. By becoming the first buyers, snipers can manipulate the initial price movement and quickly offload their holdings for profit. This leaves regular users with inflated prices or tokens that rapidly lose value due to immediate dumping.

The use of sniper bots undermines fair market participation and erodes user trust, especially for newer users and developers launching early-stage projects. It introduces an imbalance that favors automation over human participation, distorting price discovery and damaging credibility across the ecosystem.

This report takes a closer look at the token sniping landscape on Solana. We examine the platforms most commonly targeted, the technical methods and tools used by snipers, and the network patterns that reveal how these operations are structured. Additionally, we explore the broader implications for users, developers, and the overall health of Solana’s on-chain environment.

What Are Token Sniping Bots?

Token sniping bots are automated programs built to take advantage of the brief window of opportunity when a new token is launched. On Solana, these bots monitor the blockchain for newly created tokens in real time. As soon as a token goes live, they execute buy orders instantly, well before any human trader can respond. Their speed is often achieved through techniques like prioritized transaction submission and custom RPC routing.

After acquiring the tokens, these bots usually sell them off within seconds, capitalizing on the immediate price spike they help trigger. This buy-sell loop creates artificial price inflation and leaves manual traders at a clear disadvantage. Many are forced to buy at a higher price, or worse, end up holding tokens that quickly lose their value after the dump.

To identify sniper bots in action, we examined on-chain data to spot patterns of behavior that suggested automation.

-

Immediate Purchases: We tracked wallets that bought new tokens within the same block they were created

-

Quick Dumps: These same wallets typically sell their tokens within 5 minutes of buying

Repeat Offenders: We focused on wallets that did this over 10 times after 31st March 2025, proving it wasn't accidental (Flipside Query).

Major Sniping Platforms on Solana

Not all decentralized exchanges (DEXs) on Solana are equally targeted by sniping bots. Bots tend to focus on platforms that offer the best conditions for rapid, automated trading. These conditions include fast token listing times, low barriers for token creation, immediate liquidity, and minimal protections against market manipulation.

To understand where sniping bots are most active, we analyzed trading data from the dex_solana.trades table on Dune Analytics, specifically focusing on trades after March 31, 2025. We filtered this dataset to track tokens exhibiting typical sniping behavior, such as rapid buy and sell cycles shortly after token launches.

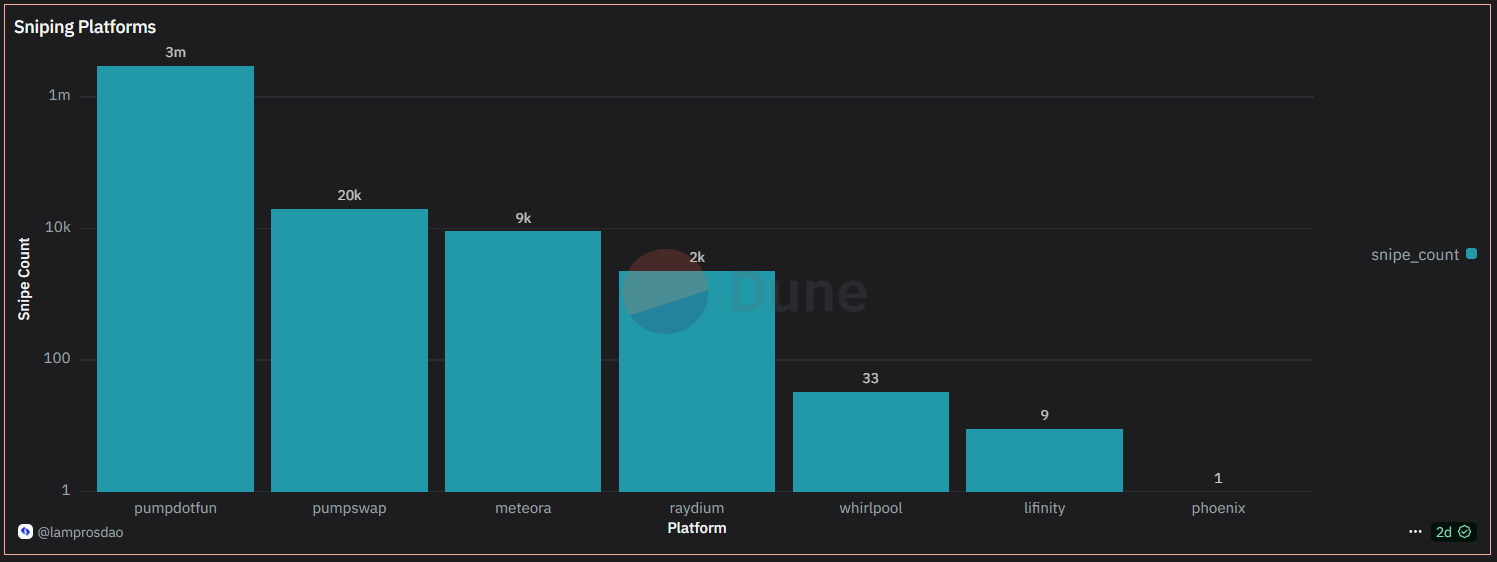

Source:- Sniping Platforms

Our findings were clear: Pump.fun stood out as the primary platform for sniping activity, with over 3 million sniping-related events during the analysis period. While Pumpswap and Meteora also saw significant bot activity, their volumes were notably smaller in comparison. In contrast, well-established exchanges like Raydium, Whirlpool, Lifinity, and Phoenix recorded little to no bot activity.

The dominance of Pump.fun is largely due to its platform design, which allows anyone to launch tokens and provide liquidity without permission and at lightning speed. This combination of accessibility and speed makes it an attractive target for both retail traders and bot operators. Bots can exploit these features to gain quick entry, accumulate tokens, and exit almost immediately after a launch, securing a profit within seconds.

This analysis underscores an important point: platforms that make it easiest to create and trade tokens are often the most vulnerable to sniper bot exploitation.

Notable Wallets and Entities Involved

To better understand the ecosystem of token sniping on Solana, we conducted a focused analysis of high-frequency sniper wallets—those that consistently engage in sniping activities across multiple token launches. Using Arkham Intelligence, we examined the full transaction histories of these wallets, looking for patterns in their behavior and identifying the broader network of entities and services that support their operations. This included interactions not only with primary sniping platforms like Pump.fun, but also with other infrastructure components such as liquidity provisioning tools, developer wallets, funding sources, decentralized exchanges, and private RPC services.

Our goal was to uncover the hidden framework that enables sniping activity, extending beyond just the visible platforms.

Example:

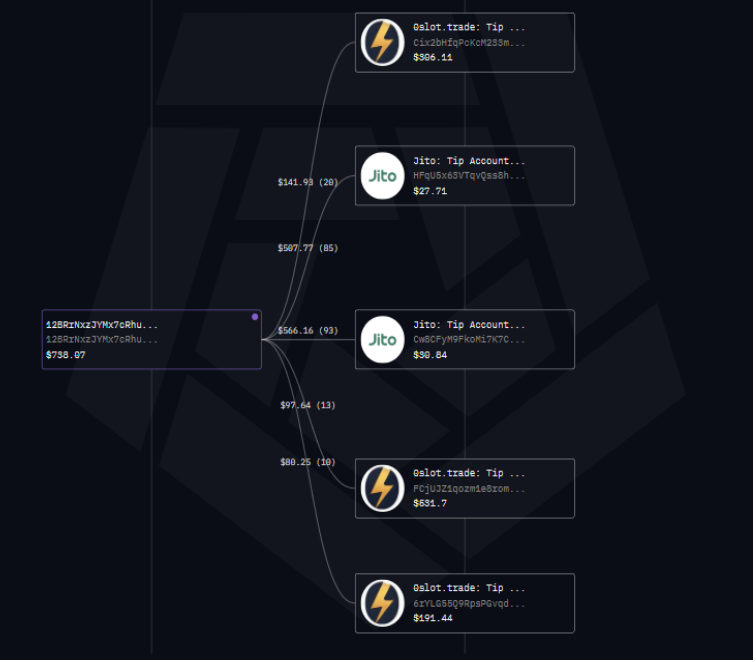

In the course of our investigation, we discovered that many sniper wallets have ongoing connections with specialized infrastructure providers that facilitate ultra-fast transaction execution. These services—such as private RPC endpoints, priority relays, and custom bot integrations—play a critical role in giving snipers the technical advantage needed to consistently outpace other traders. Below are some examples of the services supporting these snipers:

-

Jito: Tip Account: Jito is a modified Solana validator client that allows users to send "tips" to validators. This incentivizes validators to prioritize specific transactions or bundles, ensuring faster transaction inclusion, which is essential for sniping bots aiming to secure early token purchases. (Source)

-

NextBlock: Tip: NextBlock provides an API that helps validate transactions and ensures their rapid inclusion in blocks. By allowing users to pay higher fees, it increases the priority of transactions, making it an important tool for bots that need swift execution. (Source)

-

Temporal-xyz: Temporal offers advanced Solana RPC services optimized for low-latency transaction submission. Their infrastructure routes transactions through multiple channels, reducing confirmation times and boosting performance. (Source)

-

Bloxroute: Bloxroute’s Trader API enhances transaction propagation on the Solana network. With features like swQoS and FastBestEffort modes, Bloxroute improves transaction inclusion rates and reduces latency, which is crucial for bots that need fast execution. (Source)

-

0slot: The 0slot protocol enables snipers to send transactions at maximum speed, ensuring they execute trades quickly and efficiently. (Source)

This analysis highlights an important point: successful token sniping is not solely dependent on the bot's strategy. It also relies heavily on the supporting infrastructure, which includes custom RPC endpoints designed for speed, funded tip accounts that prioritize transactions, latency-reducing services, and sometimes access to private order flow. These combined elements create a highly coordinated system that allows snipers to dominate token launches, leaving regular users at a disadvantage. (Arkham Tracer Link)

Methodologies Observed in Snipers

To uncover the tactics used by token sniping bots on Solana, we conducted a targeted behavioral analysis of wallet activity using a custom-built Dune Analytics query. Focusing on transactions after March 31, 2025, we filtered for addresses that consistently generated high profits from sniping newly launched tokens. This investigation revealed sophisticated patterns that go beyond simple front-running, showcasing coordinated strategies designed to exploit token momentum while avoiding detection.

Key Observations:

-

The "Buy-Spread, Dump-Centralized" Strategy

-

Pattern Summary: A network of wallets simulates organic interest in a token before consolidating profits through a single dumping wallet.

-

How It Works:

-

Distributed Buys: 15–20 wallets buy small amounts of the same token shortly after launch. These wallets often share signature clusters, suggesting control by the same entity.

-

Artificial Hype: Multiple buyers create the illusion of growing demand, attracting unsuspecting retail investors.

-

Centralized Dumping: All purchased tokens are funneled to one wallet, which executes a large sell to capitalize on the inflated price.

-

-

Example:

-

Token: Doge’s Older Brother (Gen), launched April 26, 2025

-

Participants: 16 buyer wallets (connected across 4 signature clusters: 1st Signature, 2nd Signature, 3rd Signature, 4th Signature)

-

Total Buy Volume: 23.3 SOL

-

Final Sell: 31.8 SOL via one wallet (Profit: 8.5 SOL - Signature)

-

Execution Window: All activity completed within 3 minutes post-launch.

-

-

-

The "Bulk Buy, Chunk Dump" Method

-

Pattern Summary: The sniper buys early during retail-driven price increases and exits in multiple waves to avoid large, noticeable dumps.

-

How It Works:

-

Initial Bulk Buy: The sniper wallet buys a significant amount of a trending token, often after initial buys have started.

-

Gradual Exit: Instead of dumping all at once, the sniper sells in smaller, timed transactions.

-

Avoid Detection: This gradual sell-off helps prevent rapid price drops or detection by anti-sniping tools.

-

-

Example:

-

-

The "First Buyer Advantage" Tactic

-

Pattern Summary: The sniper positions itself as the first external buyer of a token, aiming to capture maximum upside from launch momentum.

-

How It Works:

-

Immediate Buy: The bot monitors new token deployments and executes an immediate buy within seconds of launch, before most users can react.

-

Affiliation: This wallet is often part of a broader sniping group.

-

Early Sell: The token is sold minutes later for a significant profit.

-

-

Example:

-

Wallet: beatXn94NgBqA9wn4Jq1rqLFpwCN5qUh2jgUpYRLzZn

-

Token: Lordship The Straight Frog (Lordship)

-

Initial Buy: $198.27 SOL

-

Final Sell: $8,857.97

-

-

Timeframe: Sold within 2.5 minutes of token launch.

Mitigation Strategies: How Solana Can Defend Against Sniping

To level the playing field for regular users and discourage malicious bot behavior, the following protective measures can be implemented during token launches:

-

Mandatory Holding Periods

-

Action: Introduce enforced holding windows of 5 to 15 minutes post-launch during which tokens cannot be sold.

-

Purpose: This lock-in mechanism prevents sniper bots from executing immediate buy-then-dump strategies, reducing short-term volatility and encouraging more organic price discovery.

-

-

Dynamic Sell Taxes

-

Action: Apply a time-based taxation model that imposes a high sell fee (e.g., 20%) for early sellers within the first 10 minutes of launch, gradually decreasing to 0% over time.

-

Purpose: This discourages rapid profit-taking and incentivizes holders to stay invested, helping stabilize token performance.

-

-

Bot-Tagged Transaction Filtering

-

Action: Enable RPC nodes and validators to detect bot-like behaviors, such as sending over 100 transactions within a second.

-

Purpose: Flagged transactions can then be deprioritized, rate-limited, or rejected by validators, reducing the disruptive influence of bots during critical moments.

-

-

Private RPC Usage During Launches

-

Action: Encourage projects to use private RPC endpoints during launch periods to shield transaction data from public visibility.

-

Purpose: This reduces the chances of bots sniffing pending trades and executing front-running strategies based on that data.

-

-

Pre-Confirmation Transaction Protections

-

Action: Although Solana lacks a conventional mempool, developers can explore features akin to Ethereum’s protection tools, such as relay encryption, randomized transaction submission timing, and hidden transaction queues.

-

Purpose: These mechanisms limit bot visibility before confirmation, reducing the chances of frontrunning by snipers.

-

-

Sniper Wallet Blacklisting

-

Action: Maintain a shared, community-driven blacklist of wallets known to repeatedly engage in sniping activity.

-

Purpose: Projects can use this list to preemptively block these addresses at launch, reducing their ability to exploit new token releases.

-

Conclusion

Sniping bots have become a systemic threat to fair token launches on Solana. By leveraging the network’s speed, low fees, and lack of built-in bot protections, these bots consistently exploit new token releases, securing early buys, driving up prices artificially, and exiting for profit before real users even have a chance. This undermines user trust, damages project reputations, and disincentivizes participation in the broader ecosystem.

Our investigation shows that this is not a random or isolated phenomenon, but a coordinated, high-frequency operation powered by a sophisticated performance stack, including custom RPCs, tip-based prioritization systems, and latency-optimized infrastructure. Platforms like Pump.fun have emerged as preferred hunting grounds due to their rapid launch dynamics, further amplifying the reach and impact of sniping bots.

To protect Solana’s token economy, the ecosystem should adopt measures like holding periods, dynamic sell taxes, sniper wallet blacklisting, and private RPCs. Additionally, Solana-specific protections, such as transaction hiding, encrypted relays, or randomized timing, can help counter bot advantages.

Ultimately, fighting back against sniping bots is not just about protecting traders; it’s about ensuring that innovation on Solana can thrive in a fair, trustworthy, and permissionless environment.