Abstract

This article presents an in-depth, data-driven analysis of the February 2022 Wormhole bridge exploit, one of the largest in DeFi history. Using original Dune dashboards, we investigate the immediate and mid-term impacts on Solana's token flows, user behavior, and cross-chain infrastructure, offering key insights into the ecosystem's resilience and evolution.

The Wormhole Incident: How a $320M Bridge Exploit Impacted Solana's Ecosystem

On February 2, 2022, the Solana ecosystem experienced one of the largest hacks in DeFi history when attackers exploited the Wormhole cross-chain bridge, stealing approximately 120,000 wETH valued at around $320 million. Using data analytics from Dune, I've analyzed metrics before, during, and after this critical incident to understand its profound impact on Solana's ecosystem.

Understanding the Wormhole Bridge

Before we dive into the data, let’s quickly explain what Wormhole is and why it matters. Wormhole is a cross-chain protocol that lets different blockchains, especially Solana, communicate with each other. It allows tokens to move between Ethereum, Solana, and other chains, helping create a more connected blockchain ecosystem.

Before the attack, Wormhole had become essential infrastructure for Solana. It enabled a large amount of cross-chain liquidity and played a major role in strengthening Solana's position in the DeFi space.

The Attack: What Happened?

On February 2, 2022, attackers found a serious bug in Wormhole’s signature verification process. This flaw allowed them to fake valid signatures and mint 120,000 wETH (Wrapped Ethereum) on Solana without actually depositing ETH on Ethereum.

The exploit happened quickly, mostly within a few hours. Once it was discovered, Wormhole paused bridge operations, but by then, the damage was done.

Source:- Wormhole Acknowledgement Tweet

In the early hours of February 3, Wormhole confirmed the exploit on Twitter and promised to keep wETH backed 1:1. Their quick response showed transparency and commitment during a crisis.

Later that day, Jump Crypto announced that they would replace the stolen 120,000 ETH. This act of support showed a strong institutional belief in the future of cross-chain technology and Wormhole’s role in it.

Methodology and Data Analysis

To measure the full effect of this hack, I created a detailed Dune dashboard tracking key metrics across three timeframes:

-

Pre-Attack Period: January 17 – February 1, 2022 (15 days before)

-

Attack Period: February 2-3, 2022

-

Post-Attack Period: February 4-18, 2022 (15 days after)

This method helps highlight normal trends, immediate reactions, and longer-term recovery.

Immediate Market Impact

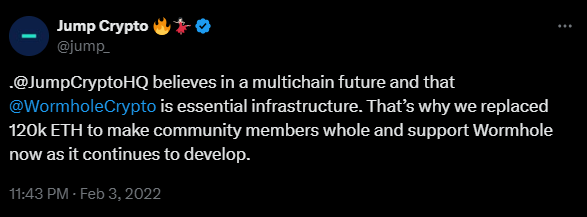

1. SOL Token Price Reaction

Right after the hack news broke, SOL’s price fell by about 10%, dropping from around $100 to $90. Panic selling played a big part in this. But within two days, the price bounced back, and by February 7, it had fully recovered. Jump Crypto's announcement to cover the stolen funds played a key role in restoring confidence.

Source:- SOL Price Query

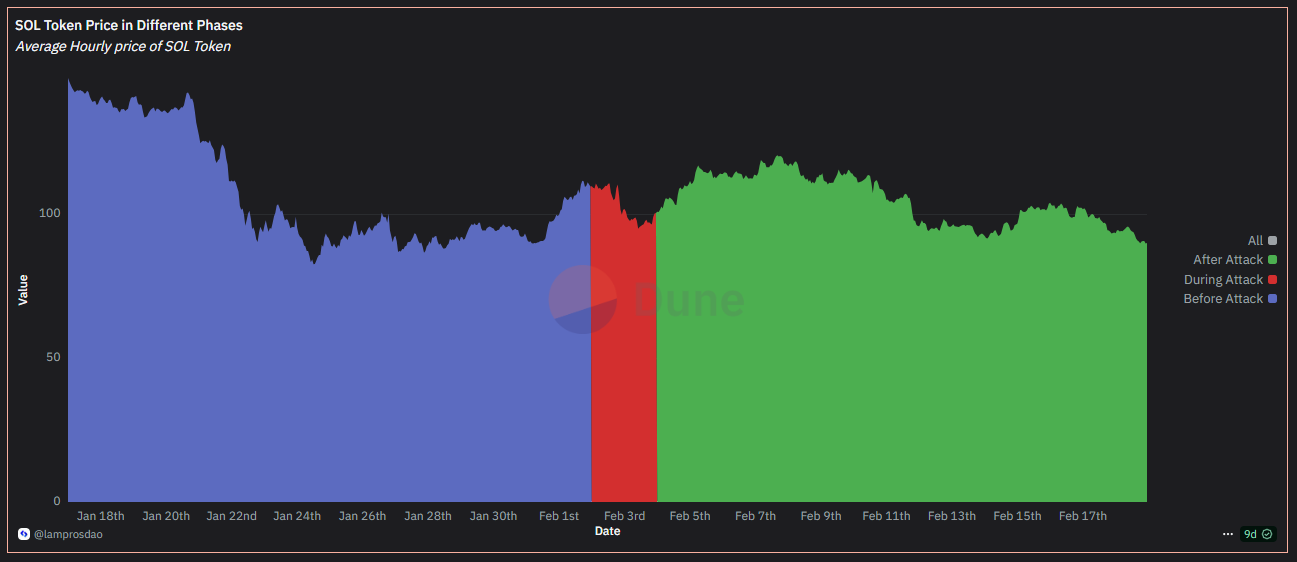

2. SOL Trading Volume Spike

In the days following the exploit, SOL trading activity surged. Volume reached nearly $50 million per hour, about 5x the usual rate. Some were panic-selling, while others took advantage of price swings. After a few days, activity slowed and returned to normal levels.

Source:- SOL Trading Volume Query

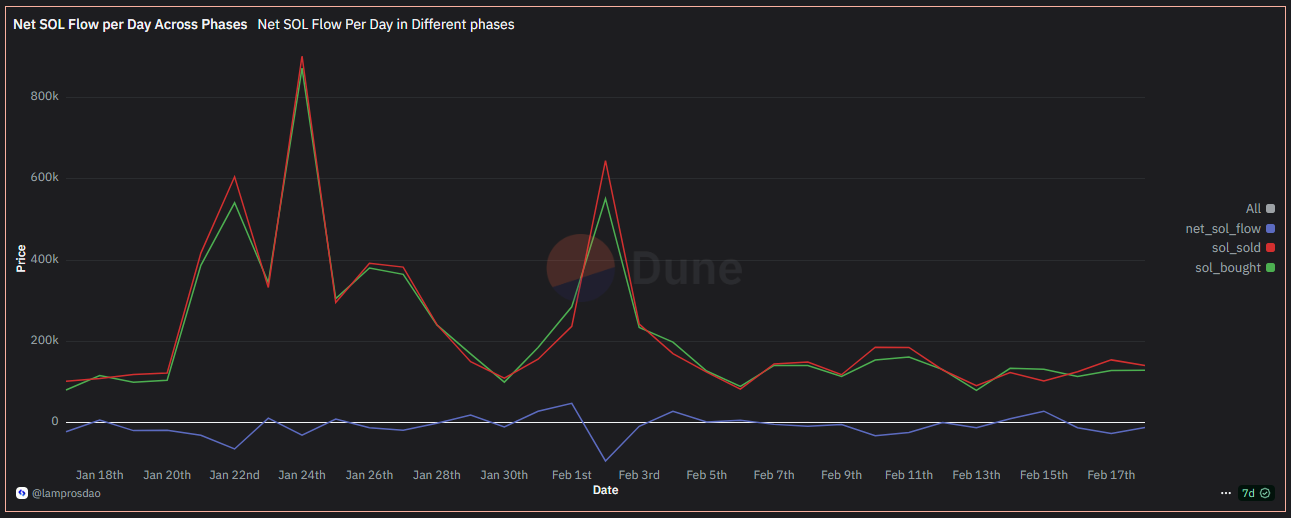

3. Net SOL Flow Analysis

Between February 2 and 3, about 65,000 SOL were withdrawn from exchanges. This suggests that users were moving their tokens to self-custody, likely out of caution. Even after Jump Crypto’s announcement, withdrawals continued for a few more days, showing that some users remained skeptical.

Source:- Net SOL Flow

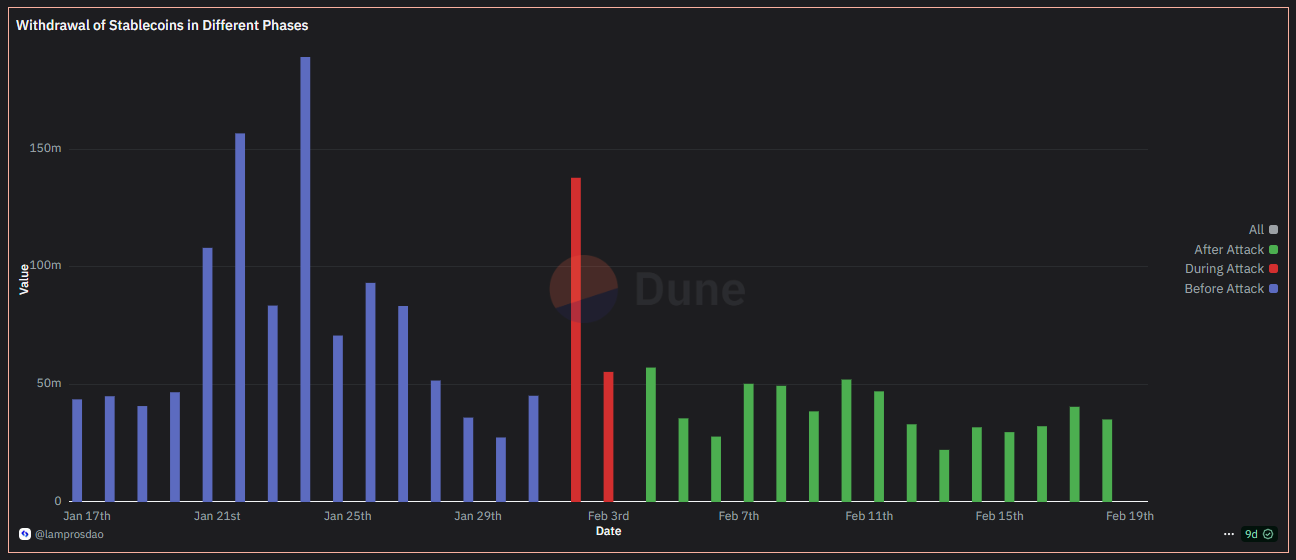

4. Withdrawal of Stablecoins

Users also pulled out $137.9 million in USDC on the day of the hack, almost 3x the normal amount. The next day, another $55.3 million was withdrawn. While the pace slowed afterward, stablecoin inflows never returned to normal. Daily amounts stayed 25–30% lower, impacting liquidity in Solana DeFi protocols.

Source: Withdrawal of Stablecoins

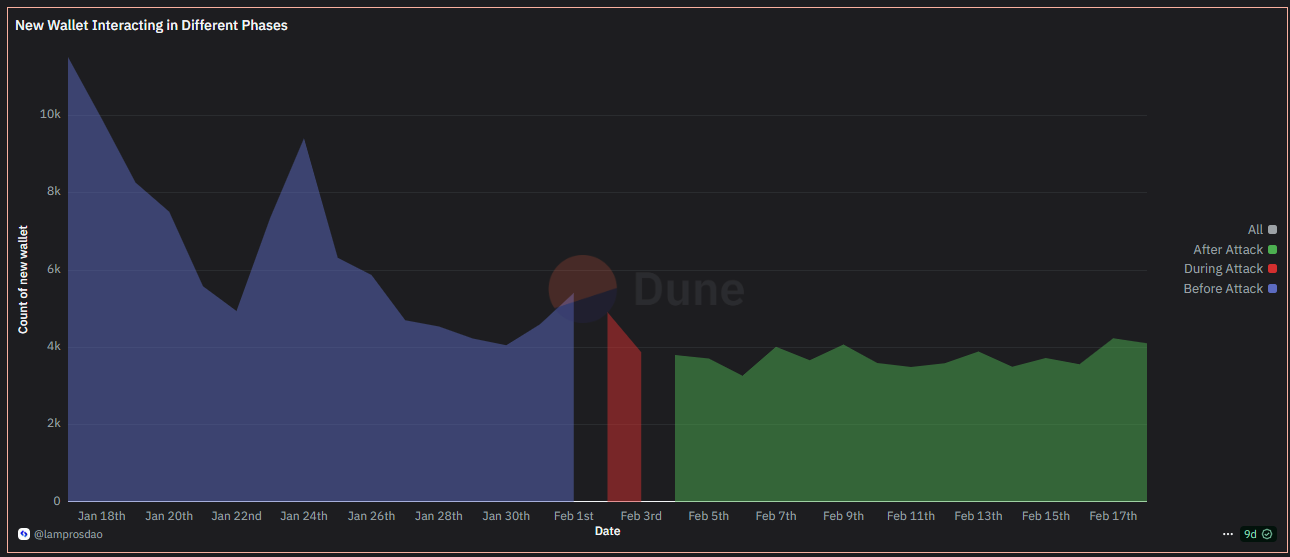

5. New User Adoption Impact

Before the hack, around 5,000 to 11,000 new wallets were created daily. Afterward, that number dropped to 3,800–4,000, a 25% decrease. Even after SOL’s price recovered, new user growth stayed low. This indicates that while existing users stuck around, newcomers were more hesitant.

Source: User Adoption Impact

Mid-Term Ecosystem Consequences

-

Persistent Reduction in New User Growth

Even after the immediate shock wore off, new wallet creation remained 25% lower than before the exploit. This shows a lingering trust issue for potential new users.

-

Stablecoin Liquidity Reset

Stablecoin volumes never fully bounced back. The daily average stayed 25–30% below pre-attack levels, which impacted DeFi apps that rely on stablecoin liquidity for lending, borrowing, and trading.

-

Cross-Chain Activity Redistribution

Though Wormhole resumed service, user behavior shifted. Other bridges gained traction as users spread their cross-chain risk. This change reflects a more cautious approach to bridge usage going forward.

Overall Impact on Solana

The Wormhole exploit caused real damage but didn’t cripple Solana. The most lasting effects were:

-

A 25% drop in new user growth

-

A 25–30% decline in stablecoin liquidity

Most importantly, it shifted the mindset of the ecosystem from fast growth to security-focused innovation. Bridge infrastructure is now approached with greater caution and stronger verification requirements.

Conclusion

The $320 million Wormhole exploit is a major lesson in blockchain resilience. Although the market bounced back fast thanks to Jump Crypto’s swift action, deeper effects were felt in user behavior, liquidity, and development. It pushed Solana and the broader DeFi space to rethink and improve security practices, especially around cross-chain activity.

This event serves as a reminder: in Web3, recovery is not just about price, it's about trust, infrastructure, and long-term ecosystem health.