Dirac Finance is revolutionizing DeFi yield generation by blending traditional finance sophistication with the accessibility of DeFi. This signifies the rise of a new era of innovative DOV protocols.

Their provide investors with the opportunity to capitalize on cryptocurrency volatility, offering organic, high, and sustainable yields.

In this article we will focus on what it is and why you should be interested, feel free to read. 📜

1. What is Dirac Finance 💮

Ecosystem & Partnership

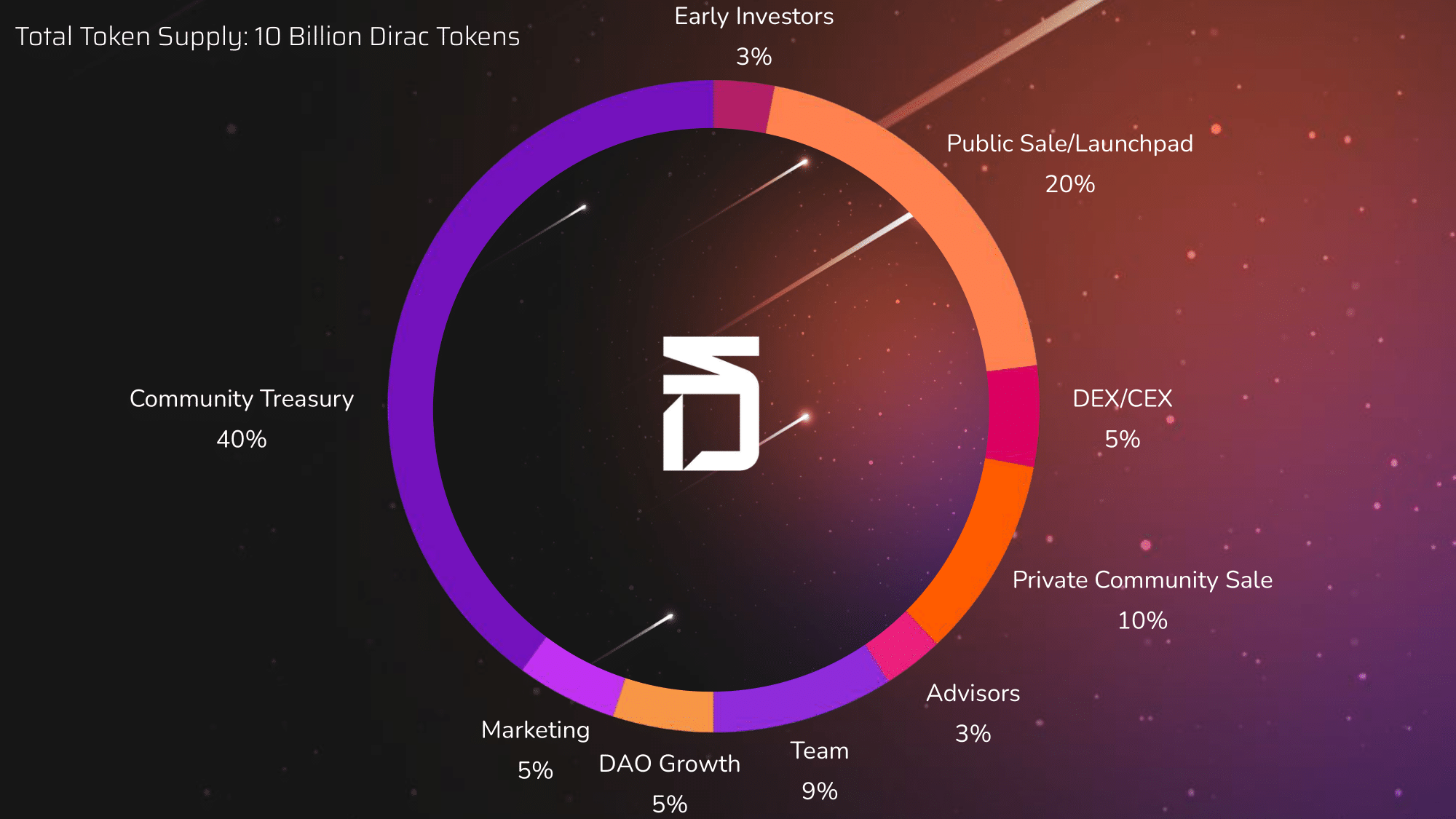

Tokenomics

Unique of Dirac Finance

Problem Solving

2. Private Beta Test Alert

3. Source 📜

1. What is Dirac Finance 💮

Dirac Finance, a DeFi DOV protocol, is dedicated to delivering high and sustainable organic yields to investors. Our mission is to seamlessly integrate proven TradFi strategies into the crypto space.

Key to Dirac Finance's innovation is the implementation of risk mitigation techniques, advanced decision-making algorithms, and pool hedging solutions. These measures are designed to protect investor principal while enhancing yields across all vaults.

Committed to providing a secure avenue for high-yield generation, Dirac Finance aims to be the preferred platform for investors seeking capital preservation and substantial returns.

Dirac Finance's vaults include uncomplicated option strategies, structured products and coupon bonds with capital protection.

Ensuring the safety of investors is our top priority, which we achieve through various forms of capital protection, intelligent decision-making algorithms, risk mitigation practices and advanced hedging techniques.

Their steadfast commitment to capital protection and high sustainable returns positions Dirac Finance as the best choice for cryptocurrency investors.

Ecosystem & Partnership

- Tokenomics

Unique of Dirac Finance

At Dirac Finance, they prioritize security above all else, firmly believing that the most profitable strategy should not compromise security. Their guiding principle is the paramount importance of security and they make every effort to honor this commitment.

They believe that DeFi investors deserve the highest level of security. Their philosophy is that the best strategy starts with a foundation of security, providing solid capital protection and generating returns for investors.

To make this vision a reality, Dirac Finance devotes significant resources to developing and testing our protocols. Their meticulous approach ensures that every line of code passes a rigorous audit, meeting the highest standards set by the DeFi community.

This unwavering commitment to security is at the core of their mission to instill investor confidence in the Dirac Finance ecosystem.

Decentralized Option Vaults (DOVs) have emerged in the market, promising increased yield opportunities for investors. The simplicity of DOVs lies in their role as infrastructure providers with varying levels of abstraction for users.

Despite this, many of these solutions employ high-risk vault strategies, like selling naked options, leading to unfulfilled high Annual Percentage Yields (APYs) and putting investor principal at risk. Consequently, the market has seen limited growth, marked by low Total Value Locked (TVL).

-

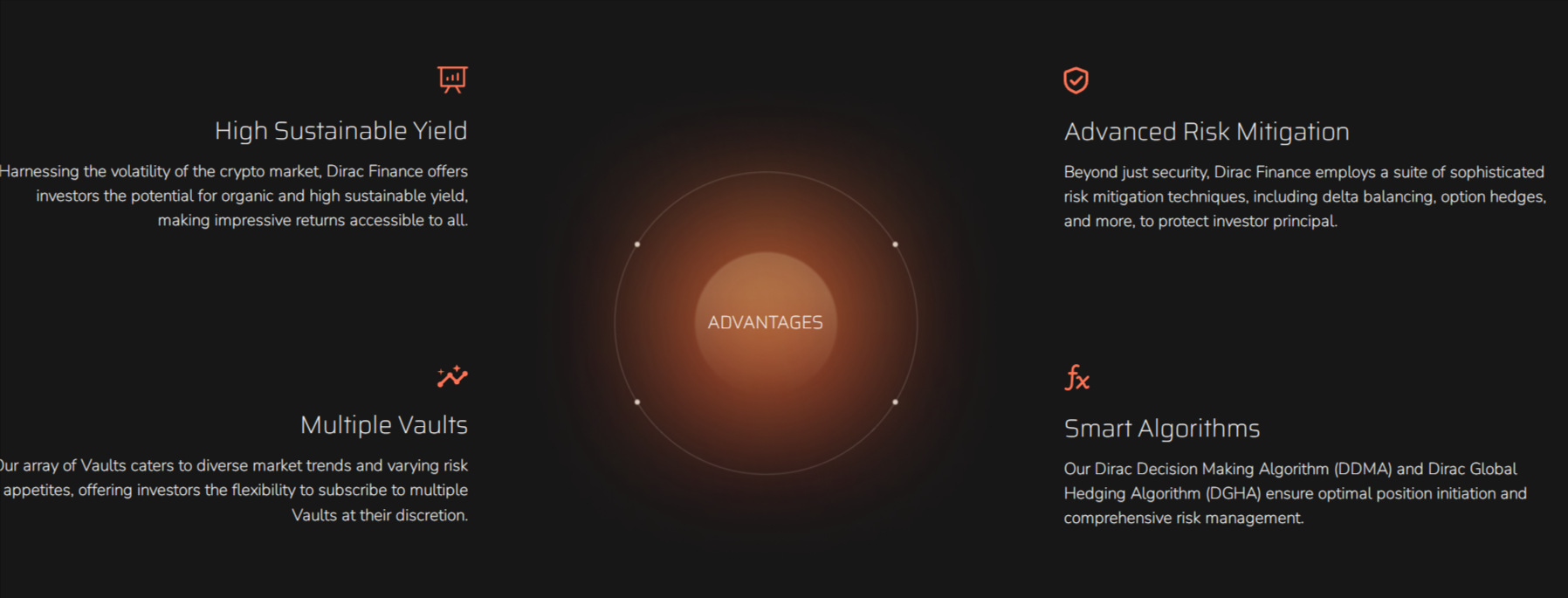

High Sustainable Yield

Dirac Finance provides investors with the opportunity to achieve high and sustainable yields by capitalizing on the volatility of the crypto market, making significant returns accessible to all.

-

Multiple Vaults

With a diverse range of treasuries, they cater to different market trends and risk appetites, allowing investors the flexibility to subscribe to multiple treasuries according to their preferences.

- Advanced Risk Mitigation

Going beyond basic security measures, Dirac Finance employs sophisticated risk mitigation techniques such as delta balancing, option hedges, and more to safeguard investor principal.

- Smart Algorithms

Their intelligent algorithms, the Dirac Decision Making Algorithm (DDMA) and Dirac Global Hedging Algorithm (DGHA), ensure optimal position initiation and comprehensive risk management.

Problem Solving

Dirac Finance is a pioneering DOV company whose mission is to seamlessly integrate established profit generation solutions into the DeFi landscape. Their strategy revolves around leveraging the inherent high volatility of the cryptocurrency market to make impressive returns accessible to all.

Aiming to offer meticulously crafted high yield vaults, they cover the spectrum from simple option strategies to structured products and coupon bonds with capital protection. To reduce risk, increase returns and protect capital.

Dirac Finance uses intelligent decision-making algorithms and precisely targeted hedging techniques.

The design focus in user-friendliness ensures that complexity remains elegantly hidden behind a streamlined trading interface. Investors can effortlessly deposit their assets in selected vaults, and these assets are strategically placed in sophisticated option strategies.

Their goal is to provide investors with a secure path to lucrative returns in the ever-evolving cryptocurrency landscape.

2. Private Beta Test Alert

For more information, please visit their social media and their Discord.