Introduction

Ethena respectfully requests the community and validator set consider it for the USDH ticker, proposing a Hyperliquid-first stablecoin leveraging the collective battle-tested expertise and resources of Ethena and its partners with an emphasis on security, community, and compliance.

Ethena is committed to allocating significant capital and human resources to position USDH as a flagship, best-in-class stablecoin for Hyperliquid users and builders.

We believe the ideal partner for USDH should only be considered by the community if they are able to deliver the following:

-

Immaculate track record of handling stablecoin issuance at multi-billion dollar scale. Subscale issuers without sufficient track record present material risk to the entire system considering the importance of a native stablecoin for the core operations of the exchange.

-

Ability and desire to return the vast majority of the value created via USDH to the Hyperliquid community and users.

-

Credible option to diversify the tail-risk of a USDC-related unrecoverable hack via security infrastructure that is governed by a guardian network of elected Hyperliquid validators, rather than under the sole oversight of a single stablecoin issuer.

-

Legitimate pathway to create multi-billion dollar value for the Hyperliquid ecosystem beyond USDH to support the Hyperliquid mission to House All of Finance and fulfill the sacred prophecy of $800/point.

Summary Terms

-

USDH to be initially backed 100% by USDtb, the soon-to-be first GENIUS compliant payment stablecoin issued in partnership with Anchorage Digital Bank (“ADB”, the only OCC chartered crypto bank in the US) once live on October 1st and, indirectly, Blackrock BUIDL (the largest asset manager on earth with $14 trillion of AUM). USDtb is the only stablecoin Blackrock has agreed to allow for full collateralisation in BUIDL and USDtb benefits from the lowest fee tier on the product of any issuer holding it as a reserve. USDtb supply is currently larger than the total cumulative supply of every other pure treasury-backed stablecoin issuer that has submitted an application thus far. Including USDe, Ethena products are ~10x larger than those of all other such issuers combined, excluding Sky. To date, Ethena has minted and redeemed >$23 billion of tokenized dollar assets with zero security issues or downtime.

-

Ethena commits to deploy at least 95% of the net revenue generated via USDH reserves for the benefit of the Hyperliquid community either in the form of HYPE purchases and contributions to the Assistance Fund, HYPE purchases and distributions to all validators (see section Economics section below for details), and other means that may be considered preferred by the community. We propose a KPI based milestone approach where validators may elect to adjust these economics in the future.

-

Ethena will cover all transaction costs for migration of USDC to USDH should the Hyperliquid community and validator set want to redenominate the current quote pairs on the core exchange into USDH from USDC.

-

Ethena Labs Research would submit a proposal to the Ethena Risk Committee to add USDH as an approved backing asset for USDe. If the proposal is approved, which we expect would be likely given their comfort with USDtb, Ethena would offer a special fee tier for swaps of USDH for instant liquidity on >$5b USDC and USDT also held in USDe’s backing to a number of market makers and liquidity providers approved by the Hyperliquid validator set and onboarded by Ethena via its normal compliance process in order to support rapid liquidity. In our view this would serve to boost both liquidity for USDH and health of market microstructure of perpetual pairs on exchanges as market makers need near zero cost to arbitrage USDH denominated pairs with USDT pairs on CEXs. Without this feature the microstructure of all USDH denominated pairs on Hyperliquid would suffer from permanently impaired liquidity.

-

We proposed USDH security and ongoing management would be constructed with an elected group of Hyperliquid validators - including, if elected, trusted teams like LayerZero, which has already committed to serving in this capacity - to ensure that the ongoing security and oversight of USDH is not left to a single issuer with a unilateral ability to cause harm or fail to respond to a critical security incident immediately. As ZachXBT has outlined on several occasions publicly, we are concerned with the speed at which existing issuers on Hyperliquid would be able to adequately respond to a security incident on the exchange or chain. Ultimately, there are two major right-tail risks which could materially impact the solvency and viability of the exchange: a) a hack of the multisig and bridge, or b) mismanagement of the dominant stablecoin integrated into every perpetual pair as the quote asset. The ability to contain and respond to these scenarios via USDH security is critical to mitigate one of the few existentially important risks. Under this proposal, Ethena would provide the back end infrastructure for USDH, but an elected guardian network would retain the ability to freeze, reissue or resolve any security incident that occurs with USDH without reliance on Ethena as a sole actor. We believe this will help to address one of the largest current risk factors for Hyperliquid.

-

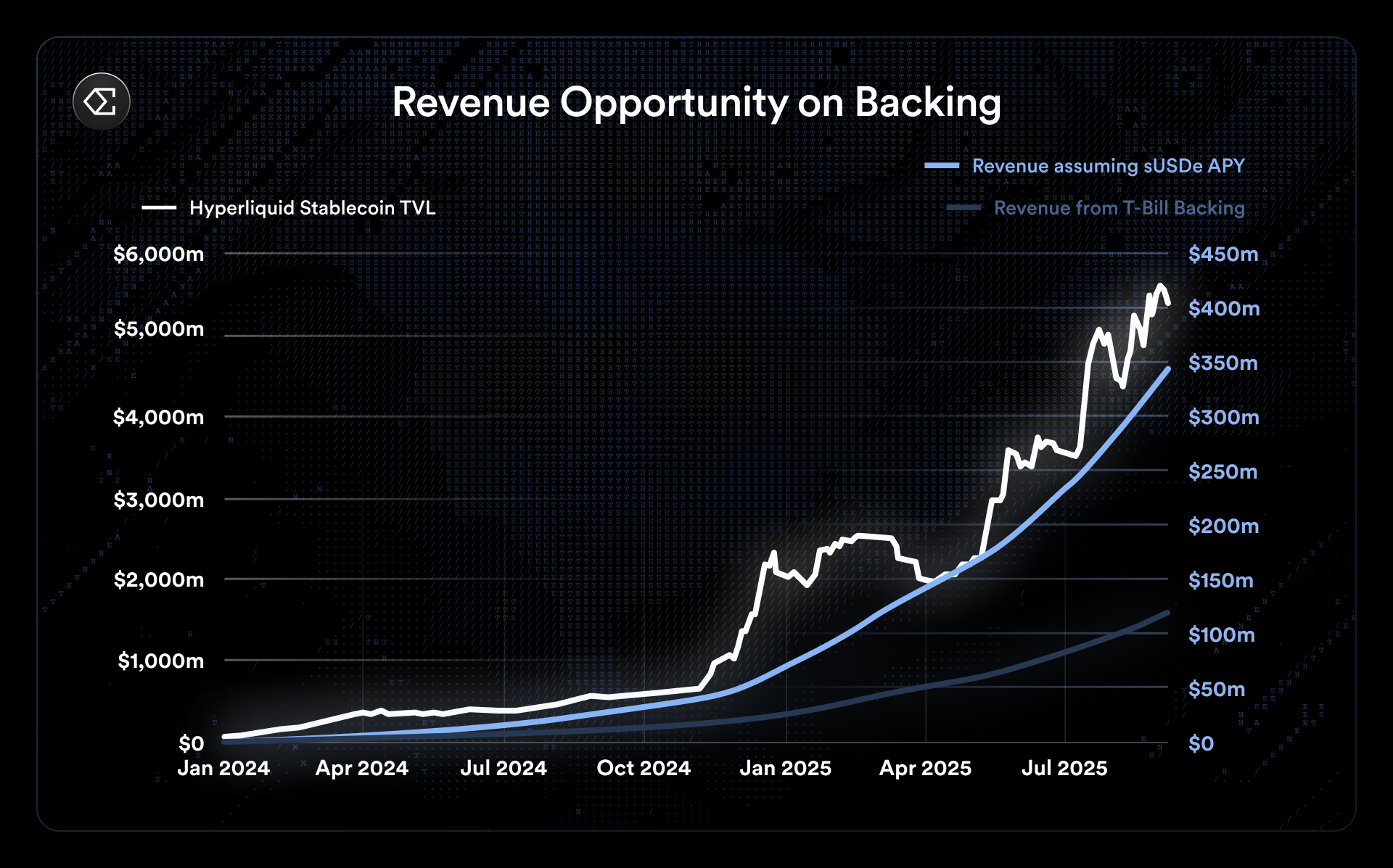

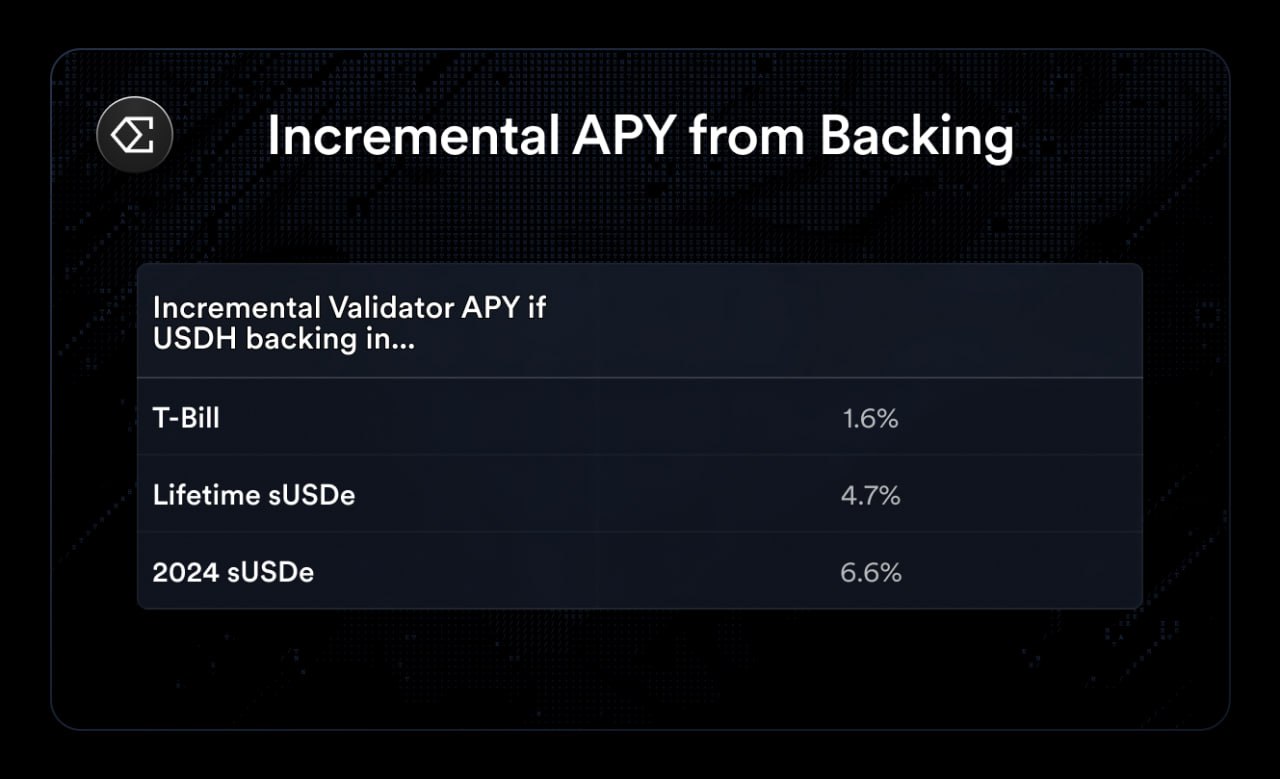

Given the nature of Ethena’s diverse offerings across dollar products, USDH would retain the optionality to adjust the backing to include both USDe or hUSDe if the Hyperliquid community and validators determine it prudent at a later date. Should the community and validators want to later diversify into assets with a different return profile to generate more revenue for buy-backs, USDH will have the flexibility to do so - differentiating this proposal from other issuers who cannot service this option. For absolute clarity, USDH will remain 100% backed by USDtb to start, and this proposal is positioned only for approval of USDtb. Another vote will be required if the backing is to ever change to anything other than USDtb, and the decision will be left to the community rather than to a single issuer. For reference, if USDH backing at $5.5b supply was in sUSDe on the average APY since inception the benefit to the Hyperliquid community under this construct would be $698M (~13% APR) in annual cash flow, 54% of current annualised cash flow for Hyperliquid overall. If sUSDe’s 2024 APY of 18% is applied, $990M of cash flows would be delivered to Hyperliquid, reflecting ~76% of Hyperliquid’s current annualised cash flow.

-

House All of Finance: while being able to capture ~$200m+ of annual cash flow (or $700m-1b via USDe) from native stablecoin issuance is indeed valuable to Hyperliquid, we encourage the community to dream bigger and imagine what else is possible from a partner beyond a narrow and commoditised product offering of fiat-backed stablecoin infrastructure that other issuers are offering. This is not enough to fulfill the $800/point prophecy. We have been working on some other initiatives for the last 6 months we will share with you in the sections below.

-

Ethena will commit to supporting the broader growth of Hyperliquid through a variety of other initiatives with Hyperliquid native teams and builders. Ethena is uniquely positioned to do so given its size and influence on broader derivative markets as the single largest entity to face any centralised exchange measured by AUM on exchange accounts. The ~$13b of supply in USDe represents ~2x the total short sided OI across every pair on Hyperliquid perpetuals, and this balance sheet can, subject to risk committee approval, be deployed to help support liquidity on both the existing exchange and emergent HIP-3 markets. There is no larger and more impactful partner to exchanges in the space.

-

Deployment of hUSDe: Ethena has begun development and will be supporting the launch of hUSDe by Liminal native to Hyperliquid once HIP-3 is live. For reference, the hUSDe ticker was purchased weeks ago by the Ethena deployer address. hUSDe is designed as a fork of USDe which isolates exposure solely to Hyperliquid markets with long spot positions acquired via Unit spot assets, and short derivative positions executed via Hyperliquid Core market or other HIP-3 enabled markets (eg USDT0 or USDH margined HIP-3 markets). hUSDe will be issued in partnership with Liminal and will drive significant spot and hedging flow activity through Hyperliquid. hUSDe will sit alongside USDH as an alternative for users who want to capture a different risk and return profile to fiat stablecoins. hUSDe is planned to be exported from Hyperliquid into HyperEVM and broader EVM integrations where Ethena and Liminal can act as external business development arms for Hyperliquid to proliferate the growth of hUSDe in the same way we have demonstrated we can with USDe and sUSDe. This includes proposals to integrate hUSDe into existing Ethena partner applications such as Aave, Sky, and Pendle amongst others. hUSDe not only has the benefit of providing a unique alternative dollar asset to Hyperliquid users, but creates a powerful fly wheel of adding short sided derivative open interest to Hyperliquid markets which further stabilizes funding rates and deepens liquidity.

-

HIP-3 Markets: Ethena has strategically invested in the leading third-party Hyperliquid front-end with the largest volume of builder code fees: Based. We have been working alongside this team for months in stealth as they prepare to ship HIP-3 front-ends built on Ethena products: USDe, hUSDe, and USDH (should this application be successful). We view the three largest fee generating opportunities for HIP-3 markets to be: a) reward-bearing collateral, b) modular prime brokerage to enable portfolio margin, and c) perpetual swaps for equities. Ethena is uniquely positioned to support each of these items where other issuers cannot. As some of you have picked up already, there is a HIP-3 project already publicly building on Ethena’s product set.

-

HIP-3 Reward-Incentivized Collateral: Ethena’s USDe has grown to double the size of USDC on Bybit with 12% penetration of all dollar assets on the exchange. When given a choice, users have shown a stated preference to trade with USDe over USDC to margin their derivatives with reward-bearing exchange-incentivized collateral on the second largest crypto derivative exchange in the world. HIP-3 markets which give users this choice would provide front-ends built on Hyperliquid a compelling alternative to compete on this emerging trend within CeFi markets. Ultimately it is not our job to tell users whether they should be using USDH, USDe, or hUSDe, but it is our job to provide them the option to make their own decision like an adult. Ethena is the only entity capable of offering this capability to Hyperliquid at multi-billion dollar scale.

-

HIP-3 Modular Prime Brokerage: Ethena has been in discussions with a currently in-stealth project which is bringing a prime brokerage layer to Hyperliquid. Performing basis trades on Hyperliquid is currently inefficient versus competing platforms in CeFi due to a lack of portfolio margin where users would be able to deposit BTC, HYPE, or even USDe to margin the USDC quoted perpetuals. Ethena is the single largest lender into Aave via USDe backing, and has the second largest lending balance sheet in the space behind only Tether. The prime broking layer will require deep lending balance sheets to unlock trading with BTC or HYPE collateral and Ethena is well positioned to support this, subject to Ethena governance.

-

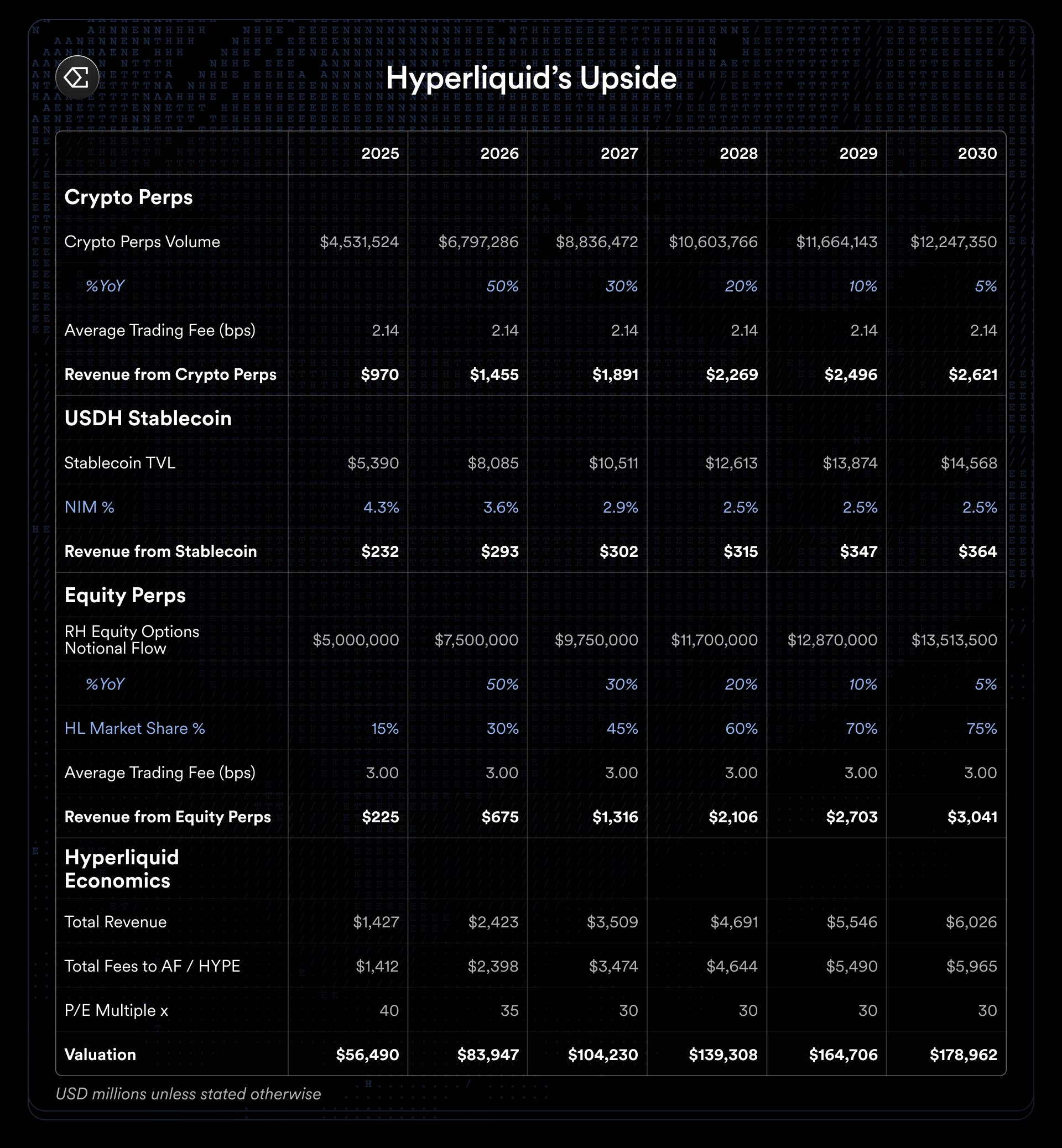

HIP-3 Perpetual Swaps on Equities: this represents the single largest cash flow opportunity for Hyperliquid and any front-end providing this product via HIP-3. Equally, the growth of perpetual swaps on equity markets represents one of the largest opportunities for Ethena to expand the TAM of potential basis trade backing assets within USDe by >30x. A core problem for these markets is that there is no natural liquidity provider for this product in crypto to take the other side of the natural long skewed demand. Put differently, who would like to short the chart below?

Ethena is the only natural counterparty to this trade with a $13b (and growing) balance sheet. Should equity assets be approved as eligible backing for USDe via Ethena governance, Ethena can provide a unique role in bootstrapping and supporting deep liquidity on these markets for Hyperliquid. We believe this represents an opportunity size larger than the current market capitalization of Robinhood which could be added to the current Hyperliquid valuation, and Ethena is one of the few entities on earth set up to scale this product from zero with a partner (e.g., Unit) on HIP-3.

-

Ethena has set aside a minimum of $75m in a mix of cash and token incentives to grow HIP-3 front-ends deploying with Ethena related products including USDe, hUSDe and USDH should this proposal pass which will have 50% of their fee generation captured by Hyperliquid via HIP-3. This $75m figure will be increased closer to $150m if these HIP-3 markets grow to sufficient scale.

-

Launch of Securitize platform on HyperEVM: Securitize, the world’s leader in tokenizing real-world assets as well as the chosen tokenization partner of BlackRock, will deploy its platform to HyperEVM and bring institutional grade tokenized funds, stocks, and other financial products to the Hyperliquid ecosystem for no deployment cost should Ethena & USDtb win the USDH proposal.

-

Launch of Native USDtb on HyperEVM: Anchorage Digital Bank, the only federally chartered crypto bank and Ethena’s issuance partner for USDtb, will deploy USDtb as a native asset on HyperEVM, making it the only GENIUS-compliant stablecoin in the ecosystem. With native Hyperliquid USDtb broadly available on Hyperliquid while serving as the backing for USDH, the create/redeem flows for USDH will be seamless and extremely cost effective, supporting a robust peg and user experience.

For the avoidance of doubt, the commitments made by Ethena to support the growth of Hyperliquid and its ecosystem are *NOT* conditional on winning USDH. We plan to support and build on Hyperliquid even if we are not chosen for the simple reason that we believe Hyperliquid is one of the most impressive and important stories to emerge in the last 20 years not only within crypto, but all of tech and finance. We want to play a role in supporting this story regardless of whether the community grants us the privilege and responsibility of delivering USDH.

Proposal Stakeholders and Supporters

About Ethena

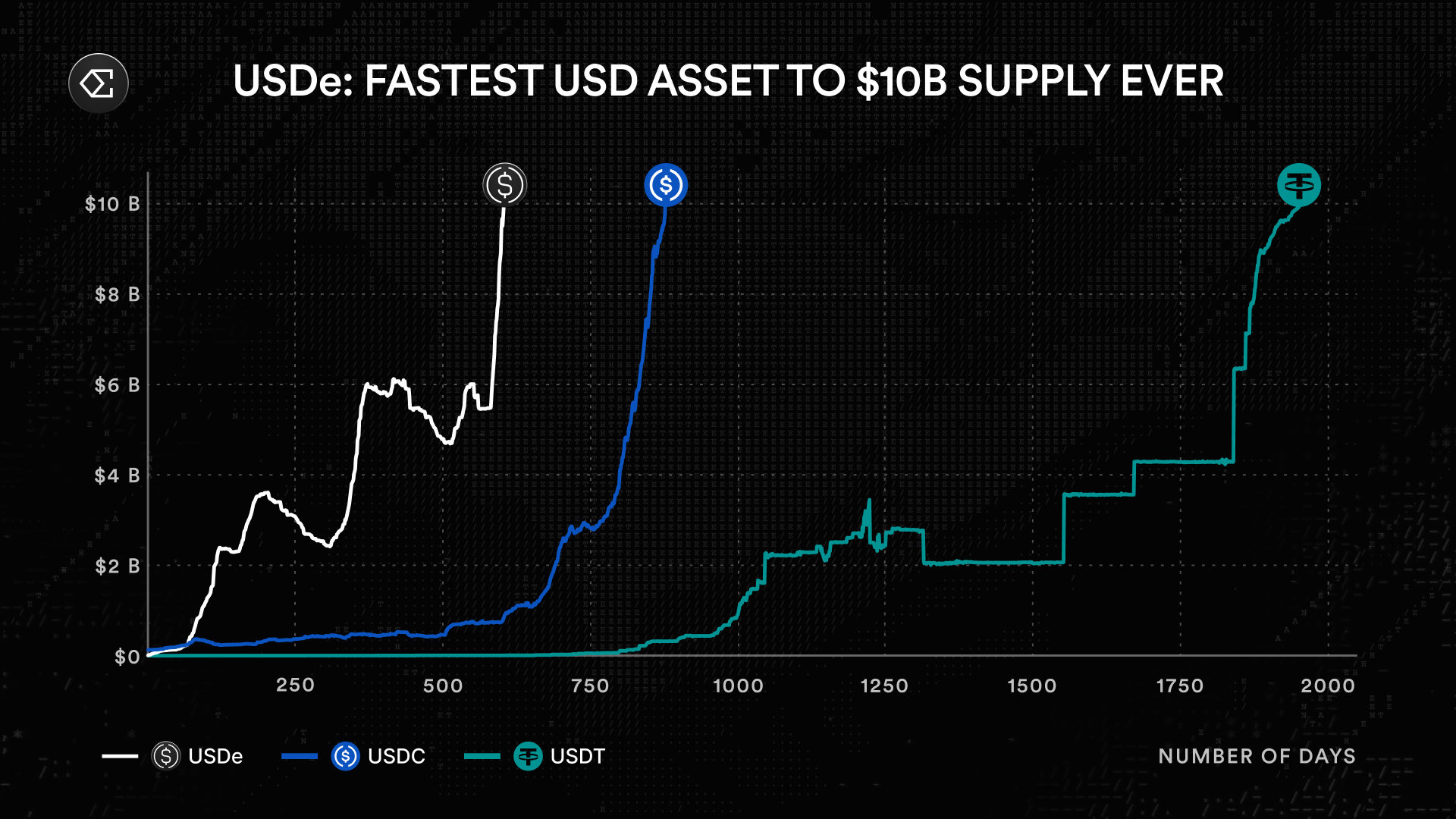

Ethena is the protocol behind USDe, the third-largest and fastest growing USD-denominated crypto asset in history with $13 billion in supply. Ethena is also a contributor to USDtb, the eight-largest stablecoin with $1.6b in supply, which has its reserves primarily in Blackrock BUIDL. Ethena has over $14.5 billion in TVL today across both products. Ethena Labs is a team of 27, with deep experience across finance, quantitative execution and trading, and scaling digital asset products with a deep focus on security and risk management.

About Securitize

Securitize, the leader in tokenizing real-world assets, is bringing the world on-chain through tokenized funds and public stocks in partnership with top-tier asset managers, such as Apollo, BlackRock, Hamilton Lane, KKR and others. Securitize, through its subsidiaries, is a SEC-registered broker-dealer, digital transfer agent, fund administrator, and operator of a SEC-regulated Alternative Trading System (ATS). Securitize has also been recognized as a 2025 Forbes Top 50 Fintech company.

About USDtb Reserves

USDtb is up to 100% backed by BlackRock's BUIDL.

BlackRock, with $12 trillion in assets under management, is the world’s largest asset management firm, having earned the trust of clients around the world over multiple decades. Being one of the largest global asset managers of cash, with $970 billion in cash management assets under management as of 30 June 2025, we believe the BlackRock Global Cash Management Group’s investment team is able to provide scale-related benefits, which include: more efficient trade execution, increased liquidity, tighter bid/offer spreads and greater buying power.

BlackRock has invested heavily into the digital assets space, building capabilities that have allowed it to become the largest crypto asset management firm and largest tokenized fund manager in the world.

On this USDH proposal, Robert Mitchnick, Head of Digital Assets at Blackrock, said the following:

“We are excited to enable Ethena’s USDtb, which is 100% backed by BUIDL and uniquely positioned to offer institutional grade cash management as well as on-chain liquidity to Hyperliquid users.”

About Anchorage

Anchorage Digital is a global crypto platform that enables institutions to participate in digital assets through trading, staking, custody, governance, settlement, stablecoin issuance, and the industry’s leading security infrastructure. Home to Anchorage Digital Bank N.A., the only federally chartered crypto bank in the U.S., Anchorage Digital also serves institutions through Anchorage Digital Singapore, which is licensed by the Monetary Authority of Singapore; Anchorage Digital NY, which holds a BitLicense from the New York Department of Financial Services; and self-custody wallet Porto by Anchorage Digital. Recently, through the enactment of GENIUS, Anchorage Digital Bank became the only U.S., federally regulated and GENIUS-compliant stablecoin issuer bank.

Anchorage is the first OCC regulated crypto bank with products under federal prudential oversight - meaning there is no licensing approval risk, as it already holds an OCC charter. Anchorage has uncapped issuance capabilities (no $10 billion cap, unlike certain chartered banks) without requiring additional approvals.

Nathan McCauley, CEO of Anchorage, said the following regarding this USDH proposal:

“At Anchorage we have worked significantly to allow for institutional access to Hyperliquid. Great to see Ethena's USDtb, soon to be issued by Anchorage as the first GENIUS-compliant issuer at the federal level, working with the Hyperliquid community to provide a sovereign stablecoin that helps the ecosystem grow.”

About Unit

Unit is the asset tokenization layer on Hyperliquid, enabling seamless deposits and withdrawals for a wide range of assets. Unit’s first integration allows major crypto assets to flow between Hyperliquid and their native blockchains. Built from first principles, Unit's architecture is designed exclusively for Hyperliquid. Unit today is the main tokenization layer for Hyperliquid, with a native integration into the Hyperliquid front end for assets like BTC, ETH, and SOL.

About Based

Based is a payments and trading infrastructure startup built natively on Hyperliquid, focusing on crypto spending via debit cards and performant trading terminals and apps to rival CEX performance. The team spent over 3 years in the crypto payments space, building up robust relationships and products in the segment. Based has since rolled out a Hyperliquid builder codes platform, which has processed billions in trading volume, and also recently attained an ATH of 7% 24h Hyperliquid perps volume dominance.

About Liminal

Liminal is a Hyperliquid-native protocol that enables users to earn through delta-neutral strategies. Built on Hyperliquid, Liminal removes market direction exposure while capturing native yield from perpetual markets. Liminal delivers a seamless delta-neutral product, offering both simplified and advanced features that cater to various user groups. Liminal underwent a phased deployment with invite-access only and gradually increasing caps, only recently opening access for all depositors. Liminal has grown to around $87 million in TVL.

_____

If USDH grows a similar scale to what USDC represents on Hyperliquid currently, even a small incident could have disastrous repercussions across the whole Hyperliquid ecosystem. The decision on who operates USDH is an extremely important decision that will have a permanent effect on Hyperliquid’s direction.

Ethena’s Track Record

Today there is well in excess of 5 billion USDC on Hyperliquid. Considering the current momentum of Hyperliquid, it is highly likely that Hyperliquid stablecoin supply will easily touch and pass $10 billion in the coming 6-12 months.

There are only three digital dollars with at least $10 billion in supply today: Tether’s USDT, Circle’s USDC, and Ethena’s USDe. Ethena has a proven track record of simultaneous technical and go-to-market execution with both USDe and USDtb: we have scaled two digital dollars from zero to multi-billion supply faster than any other developer, while maintaining continuous uptime, transparent proof-of-reserves, and rigorous security controls. Ethena also has one of the widest user bases in DeFi, with global geographic distribution and a mix of retail, power users, and institutions interfacing with Ethena products.

Should Ethena win the USDH ticker, USDH will inherit the same operating standards that we apply to USDe and USDtb, driving billion dollar outcomes for both.

Security

Security is core to Ethena’s DNA.

Security of Ethena’s products is maintained through a system of comprehensive audits, which help identify potential vulnerabilities, logical errors, or inefficiencies across our smart contract systems, user interfaces, and internal operations. To date, Ethena has had zero smart contract incidents that have resulted in the loss of funds for either USDe and USDtb.

Through our secure mint and redeem infrastructure, Ethena has processed over $23 billion of mint and redeems for USDe and USDtb between their eligible mint and redeem assets, with zero downtime through a 24/7/365 on-demand effectively atomic facility.

In addition, thoughtful construction of back-end infrastructure reinforces technical focus on security by accounting for many types of risks, including counterparty and market risks. There is no better example of this in action than the Bybit hack in February 2025; following speculation that USDe reserves might be compromised, Ethena acted decisively and transparently to show the market that the spot reserves were NOT exposed to the hack due to USDe’s infrastructure and to mitigate any potential loss due to unrealized profit on the exchange. Ethena has experienced multiple black-swan events in its less than two years of existence and, due to the robustness of the solution, has not skipped a beat.

We intend to replicate that standard of go-to-market execution and protocol security with USDH from day one.

Team

Behind Ethena Labs is a globally distributed team, providing robust resources to support USDH and 24/7 coverage. The team includes:

Guy Young, Founder & CEO

6 years experience across investment banking, hedge fund, private equity investment roles. Prior to founding Ethena, spent 5 years at Cerberus Capital Management and its affiliates ($65bn AUM) investing in special situations for financial services businesses across the capital structure.

Alex Nimmo, CTO

15 years’ experience in financial services technology, building scalable, low-latency, trading, risk, and exchange systems in both investment banking and crypto. Prior to joining Ethena, was an early employee and became Head of Engineering at BitMEX, the creator of the perpetual swap and the largest derivative exchange in the space between 2018-2020.

Christoffer Hjortlund, CIO

Before joining Ethena’s founding team, built and ran own automated trading operation following 10 years of experience, primarily within technology, trading and quant roles at Flow Traders.

Ivaylo Kirilov, Head of Smart Contract Development

9 years of software engineering expertise, combined with 5+ years focused on on-chain asset management and DeFi infrastructure. His tenure as a Lead DeFi engineer at Wintermute saw him spearheading the creation of a proprietary trading desk, managing proprietary on-chain assets across multiple chains, and ensuring on-chain security at the most successful crypto-native market making entity in the space.

Elliot Parker, COO

6 years experience across trading, marketing, and product roles. Prior to joining Ethena spent 2.5 years as a product lead at Paradigm where he lead the implementation of the futures spread product and 1 year at Deribit within operations.

Zach Rosenberg, General Counsel

10+ years experience in transactional and structuring work with large private equity, publicly traded companies, and early-stage startups, including the last 4+ years focusing solely on the crypto and blockchain industry. Prior to joining Ethena and following an 8 year career at PwC, operated a law firm for 3 years advising dozens of companies (including Ethena from inception) and investors as outside counsel.

USDtb Solution Overview

USDtb is a fully-collateralized stablecoin backed by Blackrock BUIDL and liquid stablecoins like USDC and USDT, launched in December 2024 as a collaboration between Ethena and Securitize.

Since launch, USDtb has grown to become the 8th largest stablecoin. It is eligible as rewarding derivatives margin collateral on Bybit, as well as having integrations as collateral or trading pairs on DeFi venues including Curve, Aave, Morpho, Euler, and more.

USDtb is secure and credible. It is over 90% backed by BlackRock’s BUIDL, BlackRock’s tokenized money market fund issued in collaboration with Securitize. BUIDL is managed by BlackRock Financial Management with assets custodied at Bank of New York Mellon. Following the migration to Anchorage as issuer, it is expected to be virtually 100% backed by BUIDL.

USDtb provides significant market benefits to other T-bill backed stablecoins, such as:

-

Compliance focus: Created in collaboration with Securitize & BlackRock to ensure the comfort of all stakeholders. USDtb is the only stablecoin to have the capability to hold up to 100% of its backing in BUIDL (not limited at <20% like other issuers) due to its framework and architecture. Following its migration to ADB as issuer (expected October 1, 2025), USDtb will be the only GENIUS compliant stablecoin in the market at large scale, with other issuers waiting for uncertain charter applications or future OCC rules that may permit nonbank issuers under certain circumstances.

-

Liquidity Profile: USDtb enjoys market-leading secondary market liquidity across CeFi, DeFi, and OTC Desks as well as direct redeem capabilities against $5b of existing stablecoins within USDe backing.

-

Security focus: USDtb smart contracts have passed 3 full private audits from leading auditors Pashov Audit Group, Quantstamp, and Cyfrin with no high or medium level findings in October 2024. An additional Code4rena contest was completed in early November 2024.

USDtb: A Compliance Overview

USDtb is the first stablecoin with a clear path to compliance with the recently passed GENIUS Act via Ethena’s partnership with ADB. As a federally chartered crypto bank, ADB is a qualified payment stablecoin issuer under the Act - in contrast to other large stablecoin issuers without federal or state charters (typically only holding Money Transmission Licenses, which do not make the issuer GENIUS compliant), ADB does not need to apply for or obtain a charter or other classification in order to begin issuing GENIUS compliant stablecoins immediately.

Furthermore, regardless of the outcome of this proposal, ADB will be able to facilitate native Hyperliquid USDtb deployment, enabling seamless integration with USDH and the broader Hyperliquid ecosystem. Whether Ethena is granted USDH or not, USDH will have a GENIUS-compliant option to leverage in its architecture.

Some issuers have presented varying interpretations of regulatory pathways for GENIUS compliance. Currently, the only clearly established path to full GENIUS compliant issuance is through national or federal banks with charters from the OCC. Nonbank entities, including those with Money Transmission Licenses or BitLicenses, do not yet have a defined route to compliant payment stablecoin issuance under GENIUS. The OCC and state regulators may take up to a year to release further guidance, and issuers operating under a New York BitLicense would need to petition the New York regulator to approve Hyperliquid as a chain for issuance, which can take over a year. We encourage the Hyperliquid community and validator set to thoughtfully evaluate related claims made by issuers and consult independent legal experts as needed.

For the avoidance of doubt, construction of the reserves using an amalgamation of tokenized money market funds is not sufficient for GENIUS-compliant issuance. It is an absolute requirement that the issuer hold an OCC charter for compliant issuance at this time as there is no current framework for nonbank entities to become compliant GENIUS issuers. In our view, no proposal put forward to date provides for a clear avenue to achieving this for USDH itself within the next several months to over a year.

Economics

Edited:

Ethena commits to deploy at least 95% of the net revenue generated via USDH reserves for the benefit of the Hyperliquid community either in the form of:

-

HYPE purchases and direct contributions to the Assistance Fund,

-

HYPE purchases and distributions to users with staked HYPE delegated to validators

For purposes of this initial proposal, the community and validator set can assume that only option 1 will be enacted on day one of launch. Should Ethena’s initial proposal be accepted a second vote can be held whereby the community and validators decide whether option 2 is in the community’s best interest. That proposal would include the allocation between the Assistance Fund and validators.

We believe option 2 may create additional benefits via generating a higher nominal yield on staked HYPE, which will have a disproportionate impact on the ability of Sonnet BioTherapeutics, Inc.,the Hyperliquid Digital Asset Treasury Company, to generate greater inflows from allocators within traditional finance.

Hyperliquid is unique compared to proof-of-stake blockchains where the nominal yield from staking is primarily composed of an inflationary supply of the native token. The cash flow generation of Hyperliquid across both the exchange and, once live, USDH sets it apart from any other comparable blockchain. Providing exposure to this value stream via staked HYPE will be extremely compelling to these investors.

Below is a worked example on the proforma impact of providing USDH cash flow to staked HYPE validators.

Performance KPIs

We believe that the proposals offering 100% revenue passthrough to Hyperliquid are not building for sustainable outcomes for themselves or Hyperliquid more broadly. The Hyperliquid community should support a team that is incentivized and aligned with an outcome of USDH scaling to multi billion dollars of supply. Support for USDH should extend beyond initial deployment into growing a meaningful ecosystem of integrations around it.

We propose to share 95% of the revenue generated by USDH’s backing with the Hyperliquid community via incentives, investment, and other programs. This split is not intended to be a revenue source for Ethena; rather, it is designed to ensure operating cost coverage and sustainability.In our view, the issuer of USDH should be incentivized over the long term to foster growth and drive outcomes. That component should be subject to the issuer meeting the expectations of the Hyperliquid community. In that light, we propose Ethena as issuer of USDH would be subject to the following KPI milestones and thresholds:

-

Reaching 5 billion in USDH supply

-

At least 99.5% of time in between 20 bps of 1.00 for the USDH/USDC spot pair on Hyperliquid markets, measured from one week after USDH launch

Another validator vote would be held to reduce the allocation of revenue to the Hyperliquid community from 95% to 90%. The 5% reduction would be directed to an Ethena-native ecosystem entity (e.g., the Ethena Foundation or a similar entity to be determined at the time of the proposal) that would purchase HYPE with the proceeds and hold it on its balance sheet for productive use within the Hyperliquid ecosystem (e.g. staking).

These KPIs incentivize Ethena to create the best outcomes for USDH while driving growth to HYPE and ensuring continuing alignment with Hyperliquid overall.

Additional Security Details

Guardian Network

We propose USDH security and ongoing management would be constructed with an elected group of Hyperliquid validators - including, if elected, trusted teams like LayerZero, which has already committed to serving in this capacity - to ensure that the ongoing security and oversight of USDH is not left to a single issuer with a unilateral ability to cause harm or fail to respond to a critical security incident immediately.

As ZachXBT has outlined on several occasions publicly, we are concerned with the speed at which certain existing issuers on Hyperliquid would be able to adequately respond to a security incident on the exchange or chain.

Ultimately, there are two major right-tail risks which could materially impact the solvency and viability of the exchange: a) a hack of the multisig and bridge, or b) mismanagement of the dominant stablecoin integrated into every perpetual pair as the quote asset. The ability to contain and respond to these scenarios via USDH security is critical to mitigate one of the few existentially important risks.

Under this proposal, Ethena would provide the back end infrastructure for USDH, but an elected guardian network would retain the ability to freeze, reissue or resolve any security incident that occurs with USDH without full reliance on Ethena as a sole actor. We believe this will help to address one of the largest current risk factors for Hyperliquid.

Further details about the guardian network would be released and elections for guardian network participants would take place at a later date should Ethena win this proposal.

Custody

Ethena would propose custodying the backing assets of USDH with one or more custodians, on HyperEVM, in public & segregated wallets. Custodians are specialized service provider experts with extremely strong governance & risk controls.

Anchorage, considering its alignment with Ethena for USDtb already, will likely be the best candidate for USDH on-chain collateral backing at this point in time. Anchorage has also already announced its support for custody on Hyperliquid.

All Anchorage Digital Bank customers are able to mint/redeem native Hyperliquid USDtb day 1 with no fees. This gives broad access to Hyperliquid native USDtb from a primary market perspective, and greatly supports institutional usage of the asset.

Further, Anchorage has a Stablecoin Rewards program for institutional clients to hold balances and earn rewards. Hyperliquid native USDtb will be included in this program.

Ethena x Hyperliquid

Ethena has actively supported Hyperliquid since Q4 2024. We deployed the first HyperCore USD spot asset that enables daily rewards to users via partner programs, with an average APY close to 10% since launch. Ethena was also among the first non-native protocols on HyperEVM with USDe and sUSDe, providing additional incentives to users via Ethena points.

We have made an effort to spend time working closely with the best teams in the ecosystem to find ways we can plug in Ethena assets and products to support growth of HyperCore and HyperEVM.

Earlier in Q3, Ethena invested in and formed a strategic partnership with Based, the leading builder codes exchange on Hyperliquid. We have been working closely over recent months to explore how we can expand Hyperliquid’s dominance on-chain through the integration of Ethena products (e.g., with USDe-margined HIP-3 perpetuals), including Ethena assets as spendable using Based’s debit card.

We are also collaborating with the Liminal team in an effort to combine our ability scaling delta-neutral products with their Hyperliquid-native execution track record. We have begun work on hUSDe, a joint product with Liminal described earlier in this proposal.

We are also aligned with Unit, which recently hinted at their plans to launch ENA/uENA as one of the next spot assets on Hyperliquid.

Working with Unit, Based, Liminal, and other leading Hyperliquid-native builders reinforces our conviction. We are encouraged by the strong native ecosystem of builders and are excited to support them.

Hyperliquid is one of the most notable stories in all of finance and tech in recent decades. At Ethena, we will continue to support its growth whether or not the community grants us the privilege of bringing USDH to market.

The most successful outcomes in DeFi have been achieved through synergistic partnerships between major protocols. We think Hyperliquid and its community can benefit from continued investment from Ethena, and vice-versa.

New Hyperliquid initiatives for Ethena include:

-

hUSDe: hUSDe is a Hyperliquid-native synthetic dollar that is fully collateralized by Hypercore-native collateral, including delta-hedged Unit spot. hUSDe inherits the technical properties, risk frameworks, and transparency standards of USDe, combining that with Hyperliquid-native execution from the Liminal team. hUSDe will be structurally similar to USDe in that its backing sits entirely in fully-collateralized (in most market conditions) delta-hedged crypto collateral and stablecoins. Like USDe, its backing is (in most market conditions) fully collateralized, delta-hedged crypto collateral and stablecoins; unlike USDe, all collateral and execution reside exclusively on HyperCore and HyperEVM. Liminal will manage collateral and execution, leveraging its proven delta-neutral product. hUSDe will be a major holder of Unit spot assets (e.g., uBTC, uETH), with delta exposure hedged on HyperCore via equivalent short derivatives. hUSDe will provide benefits across the board for the Hyperliquid ecosystem, including: 1) improving funding rate stability & ask-side liquidity, and 2) a composable, reward-bearing asset that enables more financially efficient protocols and products.

-

Rewarding asset-margined perps via HIP-3: In 2024, we introduced the concept of reward-bearing dollar margin on Bybit via an integration of USDe within portfolio margin on the platform coupled with rewards programs paid by Bybit. Users can margin futures positions in USDe and earn Bybit’s USDe promotional rate (~13% APY since launch) from Bybit as they trade, which reduces the user’s transaction cost, improves retention of positions, and effectively reduces the net funding rate that a user pays. This has since grown to be a billion-dollar integration for Ethena on Bybit as well as other CEXes like Deribit. It is a model that we think can be brought to Hyperliquid and find a strong user appetite, and actually entice net growth of the exchange by bringing functionality that users want directly to Hyperliquid natively.

-

Bringing USDe balance sheet to hedge on Hyperliquid subject to Ethena governance: Ethena has evaluated integrating HyperCore as an eligible venue for a portion of its hedging flow ever since it was raised in our governance forums by shoku. While the absence of portfolio margin and certain legal uncertainties have posed hurdles, we remain committed to resolving them in due course and integrating HyperCore into USDe’s infrastructure.

-

Supporting prime brokerage / portfolio margin functionality on Hyperliquid: Ethena operates unlevered on centralized exchanges. We aim to replicate this on Hyperliquid by partnering with external prime-brokerage builders or the core team if it becomes part of the HyperCore roadmap.

-

Supporting equity perpetuals on Hyperliquid subject to Ethena governance: We view equity perps to be a $100 billion+ opportunity, catering to traders whose current alternatives are equity options or offshore CFDs. Ethena can be a powerful accelerant for equity perps. As mentioned above, in absence of delta-neutral participants, equity perps will likely have high positive funding due to both end user preference (who tend to skew long) and equities tendency to exhibit positive drift. As Ethena plugs into Hyperliquid for hedging flows (either via USDe and/or hUSDe), Ethena will seek to expand collateral backing to equity perps (subject to Ethena governance approval for USDe). Ethena’s flows would help provide lower funding rates for end-users while also contributing to open-interest and liquidity.

-

Continue to support HyperEVM with our partner applications: Ethena has supported HyperEVM from day one. We worked with LayerZero to make USDe one of the first dollar assets launched on HyperEVM. We’ve also partnered with Hyperliquid-native projects, such as Hyperlend, Felix, and Hyperbeat, to provide Hyperliquid users with more earn opportunities across HyperEVM. USDe pairs are consistently one of the highest-volume on Curve. Most recently, we worked with Pendle to support its fixed-rate, dollar-denominated yield products on HyperEVM, while also providing the HyperEVM Pendle sUSDe market with the highest incentive allocation across all Pendle sUSDe markets via Ethena points.

Across all our initiatives on Hyperliquid, we aim to continue to grow DeFi by bringing institutions on chain. We think Ethena remains well positioned to expand institutional interest in DeFi - including on Hyperliquid.

Hyperliquid’s upside is undoubtedly significant, and through the initiatives above, we believe we can play a key role in compounding its growth alongside the community.

Deployer Address: 0x47581b206ffb2752c165b987141bad0dc22bd605

And lastly, but most importantly:

Hyperliquid

Appendix I: Hyperliquid’s Upside

Appendix II: Timelines and Product Roadmap

As noted above, Ethena has experience growing multiple dollar products to billion dollar scale in less than two years of existence. We expect a general rollout, scaling, and product development sequence as follows:

Stage 1: Deployment

During this first phase, USDH would be natively deployed on HyperEVM and connected to USDH on HyperCore. This phase would come in short order, pending the outcome of any required audits and security workstreams, as well as design and deployment of the guardian network infrastructure.

Stage 2: Spot

Once USDH is live on HyperCore spot, the focus will shift to building liquidity. Ethena aims to focus initially on liquidity for the following pairs: HYPE/USDH and USDC/USDH, with BTC/USDH, ETH/USDH, and SOL/USDH following shortly after. We consider USDC/USDH liquidity to be especially important, as tight spreads for the pair should result in improved liquidity for all other pairs due to improved arbitrage conditions for other traders. Ethena is currently partnered with two market makers on HyperCore for USDe spot liquidity and has strong relationships with multiple market makers for USDe and USDtb across centralized exchanges. To the extent additional liquidity incentives are needed, Ethena, affiliates, and general ecosystem participants may provide USDH loans to market makers to improve its overall liquidity profile.

Bootstrapping a stablecoin requires upfront investment - Ethena commits to using Ethena points to incentivize USDH usage and trading across Hyperliquid ecosystem, which should further improve liquidity.

Stage 3: Perps

If HyperCore native perps are unavailable for USDH margin, Ethena commits to supporting the launch of USDH-margined HIP-3 perps, with the same roadmap described above for spot of prioritizing liquidity and volume across majors (HYPE, BTC, ETH, SOL), and subsequently broadening to other pairs. If HLP will not support USDH-margined perps, Ethena aims to support the build out of an alternate “HLPH” vault with participation from third-party market makers to bootstrap and support liquidity.

Appendix III: Revenue Opportunity on Stablecoin Backing