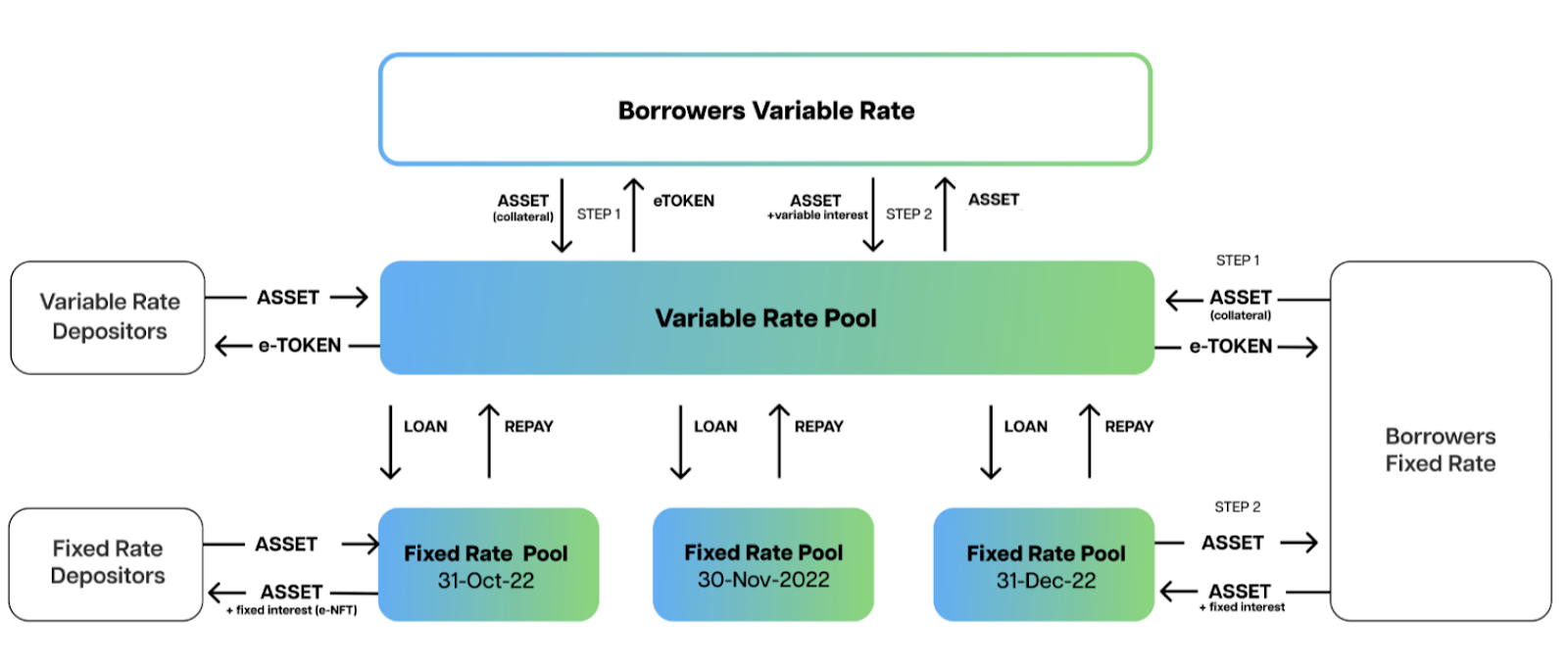

Exactly is a decentralized, autonomous, non-custodial and open-source protocol that will bring the missing link to the DeFi credit market, enabling users to frictionlessly exchange the time value of their assets at a fixed or variable interest rate.

The Protocol allows users to borrow and deposit funds at a fixed interest rate with various maturity dates by interacting with Fixed Rate Pools representing different terms. The fixed interest rates are determined based on the specific utilization rate at the time of the transaction.

The funding of each Fixed Rate Pool will be provided by the fixed rate depositors in each Fixed Rate Pool and by the variable rate depositors in the Variable Rate Pool.

How the Exactly Protocol Works

The Exactly Protocol has two types of pools for each asset:

-

Variable Rate Pool: Depositors receive a variable interest rate, much like in a money market. The Fixed Rate Pools can borrow money from the Variable Rate Pool if they need more liquidity.

-

Fixed Rate Pools: These pools have a specific maturity date and one interest rate unique to each transaction, which is determined by the relationship between supply and demand of credit (Utilization Rate) at the specific time the borrowing started and is fixed until maturity. The Fixed Rate Pool receives liquidity from users making fixed-rate deposits and the available liquidity in the Variable Rate Pool.

Exactly Protocol is completing the DeFi credit market

Exactly users can choose among four different options:

-

Deposit an asset in the Variable Rate Pool and receive a variable interest rate. They will receive an Exactly Token (eToken) as a deposit voucher.

-

Deposit an asset in a specific Fixed Rate Pool and receive a fixed interest rate at maturity. They will also be able to withdraw the deposit before the expiration date.

-

Borrow an asset from a specific Fixed Rate Pool and pay a fixed interest rate if an asset was deposited in the Variable Rate Pool as collateral before that. They will also be able to repay the loan before the expiration date.

-

Borrow an asset in the Variable Rate Pool and pay a variable interest rate without a maturity date.

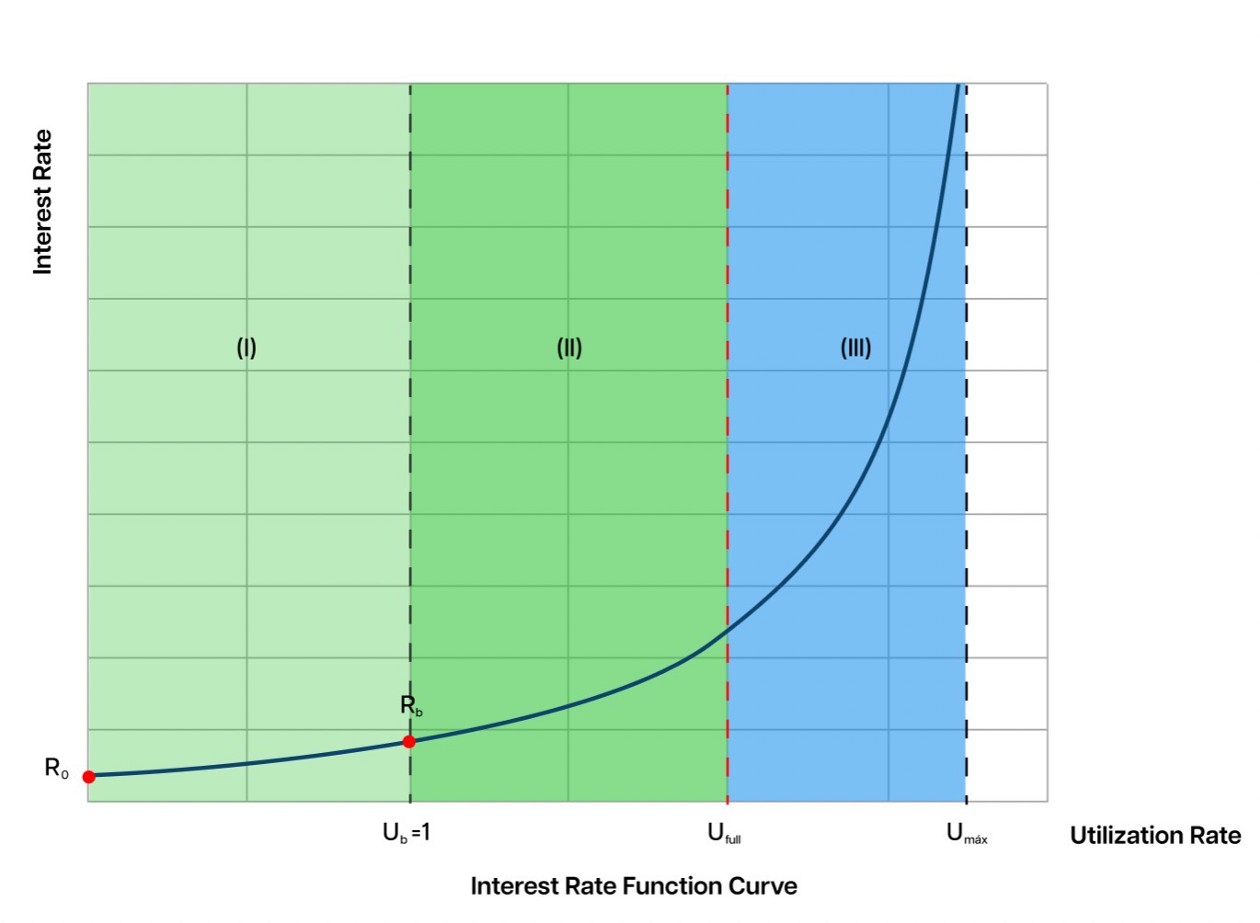

The Exactly Interest Rate Model

The borrow interest model is a continuous and differentiable function that diverges asymptotically from the maximum Utilization Rate. It acts as a natural barrier to credit demand as the level of utilization depletes protocol liquidity capabilities to prove new loans.

The Fixed Rate Pool lending fixed rate depends on its Utilization Rate, which can be increased with liquidity from the Variable Rate Pool as needed resulting in a higher interest rate (light pink area in the chart).

The Exactly Value Proposition

-

A complete market for credit supply and demand in DeFi: Traders can arbitrage between fixed and variable rates for various periods and hedge the interest rate risk for their long/short positions with/without leverage. Investors can receive fixed and variable rates on their deposits. Consumers can take a fixed-interest rate loan for more extended periods with certainty.

-

Liquidity efficiency: Fixed and variable rates live in the same Protocol with a new approach towards fixed interest rate discovery via the Utilization Rate of each Fixed Rate Pool.

-

A new type of interest rate model with a continuous and differentiable (not linear) function that will set the basis for the development of a fixed-income derivative market (forwards/swaps).

The Secret Exactly Master Plan

We want to democratize access to financial services in a decentralized and efficient way in 3 (not) easy steps:

-

Low Volume and High Transaction Value: Decentralizing the time value of money. Build the Exactly Protocol to complete the DeFi credit market on Ethereum and to get product market fit from the “whales.”

-

Mid Volume and Mid Transaction Value: Decentralizing the protocol governance. Build the Exactly tokenomics, mint utility tokens to the community, and move to a DAO governance.

-

High Volume and Low Transaction Value: Build Exactly protocol with other white-listed pools to connect DeFi with CeFi, and receive more liquidity in these new types of pools with credit scores to reduce crypto over-collateralization for the end user.

Our endgame is to democratize access to financial services in a decentralized, non-custodial and autonomous way.