At Exactly Protocol, we aim to make Decentralized Finance (DeFi) and its numerous benefits accessible to a broader audience. That’s why we have created a new approach to minimize the impact of bad debt, using a Bad Debt Clearing system that allows us to offer our users a resilient lending protocol.

Understanding Bad Debt & Its Implications in the DeFi Credit Market

In simple terms, bad debt refers to unpaid loans, i.e., loans that have not been repaid due to the borrowers.

In the DeFi ecosystem, due to the volatility of the crypto market, decentralized loans must be over-collateralized by a safe spread**,** providing a margin for the creditor to liquidate bad loans before dealing with bad debt.

Traditional lending protocols are vulnerable to accumulating bad debt due to how their liquidation mechanisms are designed. Therefore, a certain Loan-to-Value (LTV) ratio must be maintained in decentralized lending platforms, i.e., the ratio between the collateral a user puts up and the amount they borrow.

Usually, when an account breaches a certain LTV ratio, they are liquidated by a third party (e.g., a liquidation bot) for an incentive, paying off the debt so that the protocol and liquidity providers do not bear the losses.

However, problems arise when a position is not liquidated on time due to a sharp price fall, absence of DEX liquidity, blockchain congestion/downtime, etc. In such cases, the liquidated collateral is ultimately unable to cover a position’s debt, leaving the protocol a bad debt.

The Importance of a Bad Debt Mitigation Strategy

The significance of a bad debt mitigation strategy in DeFi protocols cannot be overstated. Without a comprehensive plan to handle bad debt, the protocol leaves this debt with the lenders, leading to severe implications.

In a scenario where all users begin to withdraw their assets, those left behind are burdened entirety of the outstanding debt. This snowball effect eventually hits a point where the remaining users find themselves unable to withdraw their assets due to a liquidity crisis.

Hence, an effective bad debt mitigation strategy is vital not only for maintaining the financial health of the protocol but also for ensuring user trust and protocol stability.

Exactly’s Solution Step by Step

We have implemented an innovative solution at Exactly Protocol by introducing an improved liquidate function. This function first checks with the Auditor contract how many assets the liquidator can repay, considering the borrower’s collateral and the Dynamic Close Factor calculation.

The Close Factor weighs the borrower’s shortfall and the positive target health of the position post-liquidation to prevent cascading liquidations and not harm the borrower as much.

Then, the liquidation function proceeds to iterate over all fixed loans where the borrower borrowed, prioritizing the oldest ones. If extra repayment is needed, it continues with the variable debt. After the liquidator seizes what corresponds, a call to Auditor’s handleBadDebt function is made.

The handleBadDebt function checks if the borrower has exhausted all collateral, and if so, triggers the clearBadDebt function in each market. This one finally deletes the debt and spreads the losses by subtracting them from a general accumulated earnings pool.

Permissionless Liquidations

The handleBadDebt function is external and permissionless and can be called not only during liquidation but at any time by anyone. While there is no direct incentive for a user to do so, it aids in maintaining the protocol’s solvency.

Our team has also developed an open-source team-driven liquidation bot. As compensation for the earnings subtracted from the accumulator when the clearing happens, in every liquidation, the liquidator also transfers into the protocol an incentive for them in every liquidation.

We strongly advise and invite anyone interested in becoming an active participant in Exactly Protocol’s liquidations to fork our open-source bot and build on top.

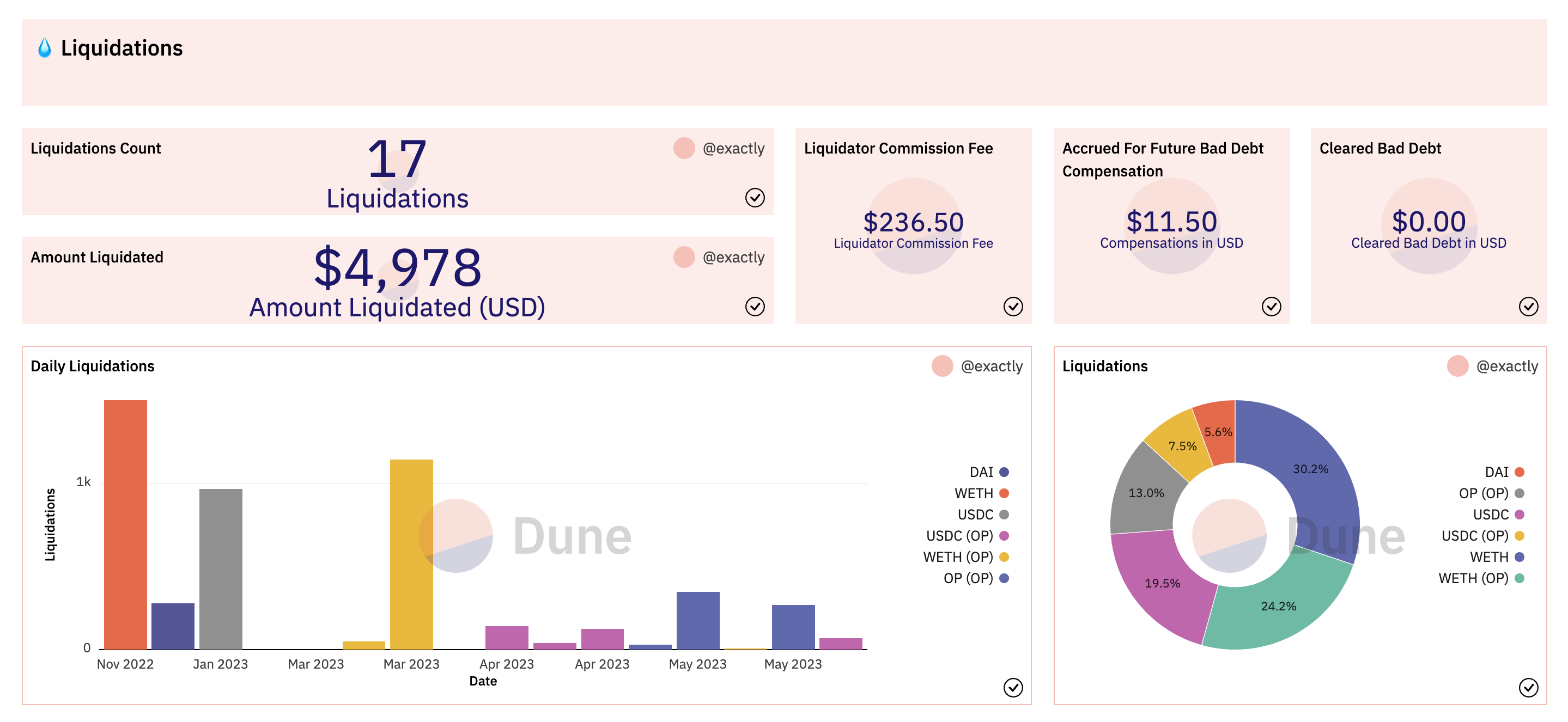

Liquidations Stats

We have created a special section in our official Dune Analytics Dashboardto monitor the state of liquidations on the protocol. In this section, you can find liquidation’s key metrics, such as Daily Liquidations, Liquidations Count, Total Amount Liquidated, Liquidator Commission Fees, Accrued for Future Bad Debt Compensation, and Cleared Bad Debt.

Are you interested in learning more about Exactly Protocol? Follow us on Twitter, and join our Discord and Telegram to stay in the loop.