Re-thinking the DeFi Credit Market: A Call to Action for Real-World Solutions

During a recent AMA with Mike Dudas, Gabriel Gruber, founder of Exactly Protocol, noted the DeFi market's current state. According to Gabriel, "The use cases for DeFi at present might be perceived as limited, with some similarities to a decentralized casino. The focus appears to be more on obtaining tokens through various projects, rather than finding ways to utilize the technology to benefit consumers effectively."

This perspective raises the question of how we can better utilize this technology to solve real-world problems and create value for people. While it's important to acknowledge the limitations and challenges of the DeFi market, it's also essential to keep pushing forward and finding new solutions. The DeFi market has tremendous potential to impact positively, and it's up to all of us to work towards making that a reality.

The role of Fixed Rates in the DeFi Credit Market

The Time Value of Money is a crucial concept in traditional finance that illustrates how the value of money changes over time. It states that a certain amount of money is worth more in the present than it will be in the future due to its potential to generate income over time.

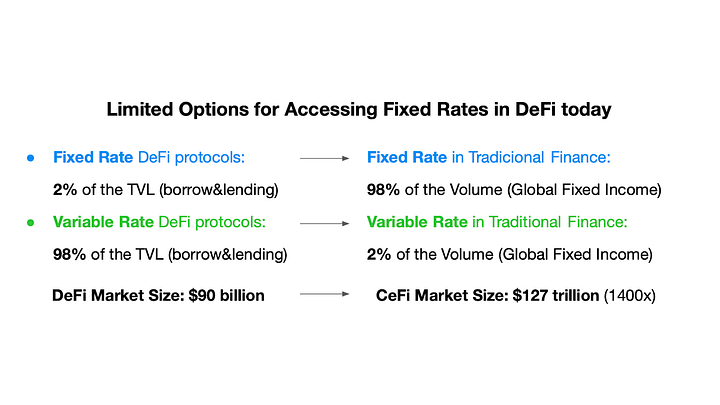

The Time Value of Money principle is not widely used in the DeFi ecosystem; as a result, this leads to the prevalence of variable rates in the DeFi credit market.

In comparison, traditional finance predominantly utilizes fixed rates, with 98% of the volume in fixed-rate products. The average consumer typically has a fixed income and prefers the stability of fixed-rate borrowing to predict their monthly payments better. In the DeFi borrow and lending market, fixed rates only make up a small portion, 2%, of the Total Value Locked (TVL).

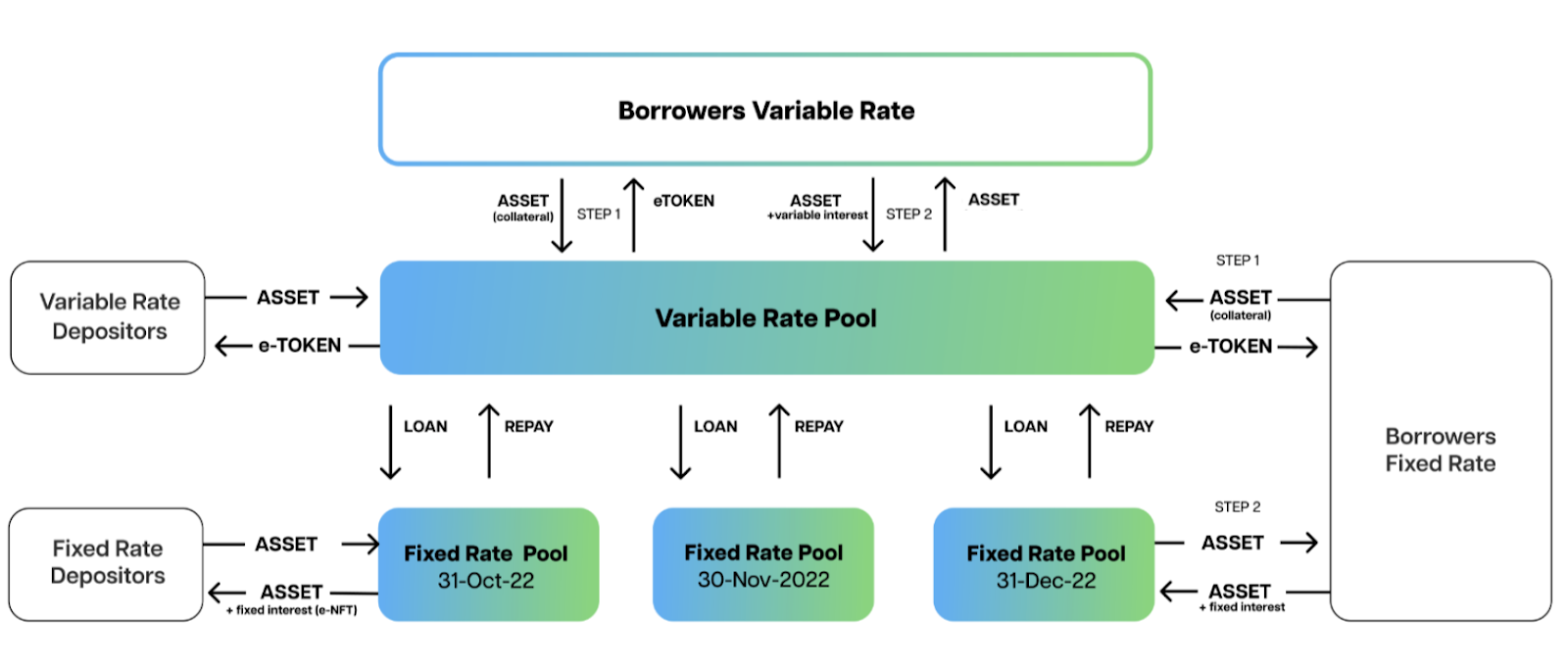

Exactly Protocol has introduced an innovative solution to tackle the challenges raised in the DeFi market: a protocol that provides an autonomous fixed and variable interest rate market. This protocol enables users to effortlessly exchange their assets' Time Value of Money, filling the gap in the DeFi credit market and making it more accessible to a broader audience.

Exactly allows users to make deposits or loans at a fixed rate for a predetermined period, similar to traditional finance’s “fixed income” concept. This feature offers stability and predictability to users looking for a more secure and reliable way to participate in the DeFi market.

What makes Exactly different?

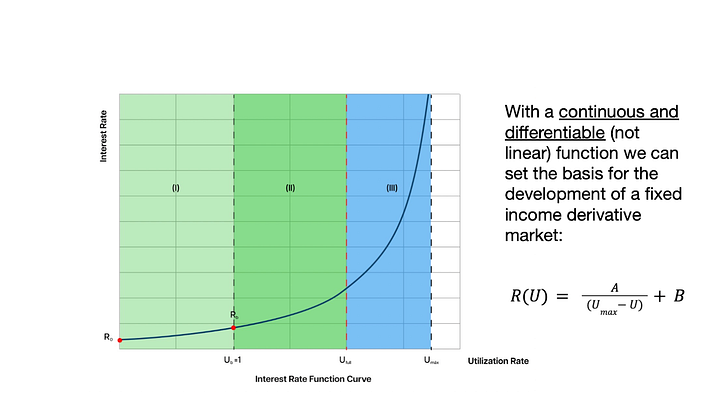

- A New Interest Rate Model: Continuous and differentiable (non-linear) function that will set the groundwork for developing a fixed-income derivatives market.

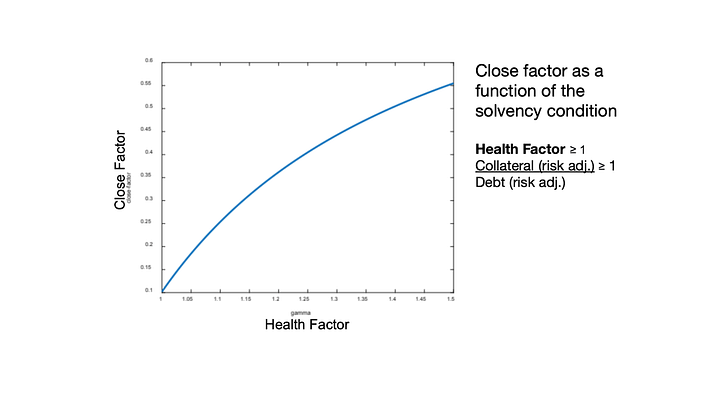

2. Dynamic Close Factor: New liquidation process that returns the user to a solvency situation more efficiently and equitably.

3. Risk Model: Improves capital efficiency by increasing the lending power with risk-adjusted collateral and debt for the health factor calculation.

4. Dynamic Utilization Rate: Optimal allocation of assets between Variable and Fixed Rates Pools according to the supply and demand of credit.

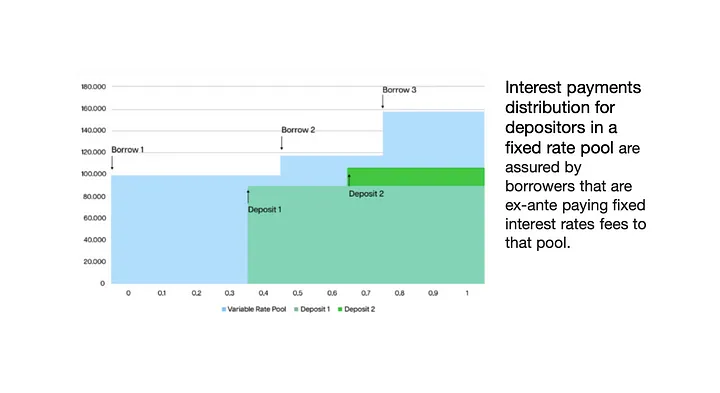

5. Solvency condition: Fixed interest rates for depositors are assured by previous borrowers that are ex-ante paying fixed interest rates.

Security First

The protocol has completed +6 code audits with a strong emphasis on user safety and received a top score of 95% from DeFiSafety. Exactly is at the top of the borrowing and lending DeFi protocols ranking with this score.

The DeFiSafety team has said, "Exactly Protocol does exactly the right steps in every aspect, getting a score of 95%, putting it in the top ten protocols we have reviewed! This is a serious, mature protocol that I would feel confident investing mine or others' money into."

Throughout the process, the team has partnered with top audit firms such as Coin Spect, Chain Safe, and ABDK Consulting to ensure the security and stability of the protocol. Also, the protocol launched a Bug Bounty Program in partnership with Immunefi, a leading bug bounty program platform for web3 projects.

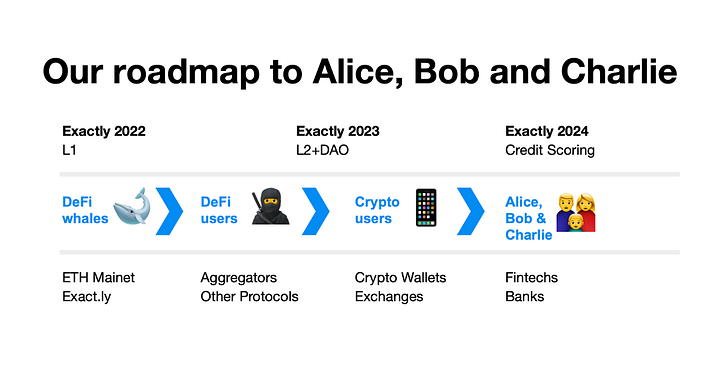

Long-term Vision: connecting DeFi with the End-user

The first step in this long way is to prioritize "Low Volume and High Transaction Value". This involves establishing a product-market fit with key players in the crypto world, commonly referred to as "whales".

The next step is decentralizing the protocol governance by developing the Exactly tokenomics, distributing utility tokens to the community, and transitioning to a DAO (Decentralized Autonomous Organization) governance structure.

The final step is focused on bridging the gap between DeFi and CeFi (Centralized Finance) by integrating Exactly Protocol with other reputable, white-listed pools. This integration will increase liquidity in these new pool types and provide credit scores to mitigate the risk of over-collateralization for the end user.

Decentralizing the Time Value of Money in Practice

By decentralizing the Time Value of Money, Exactly Protocol enables users to unlock the potential of their finances through decentralized borrowing and lending markets with fixed and variable interest rates for various assets. At Exactly, users can take advantage of this concept by earning interest on their deposited funds while also using borrowed funds to generate additional returns.

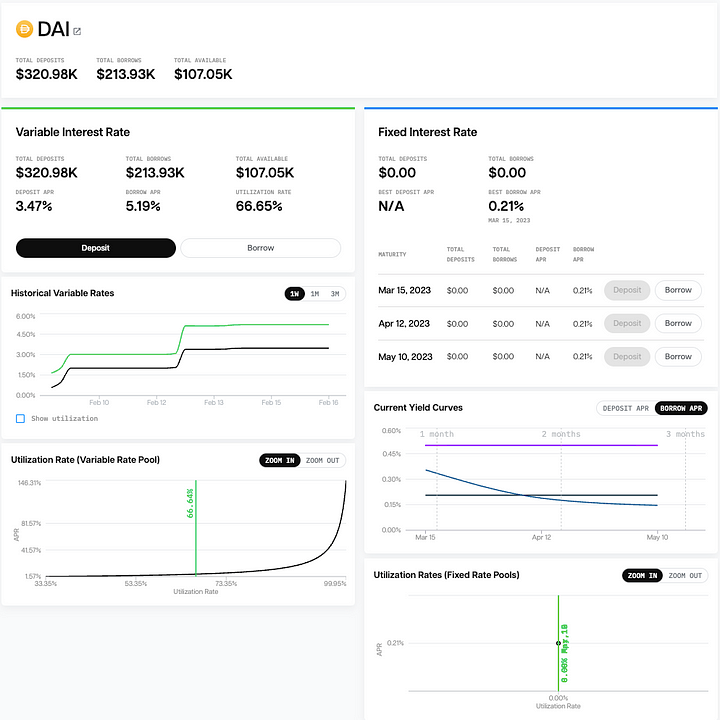

For example, the protocol allows users to deposit and borrow DAI at both fixed and variable rates. This empowers users to manage their finances in a decentralized, flexible, and efficient way without relying on traditional financial intermediaries.

Keep yourself in the loop on Exactly Protocol’s developments and our goal to disrupt the DeFi ecosystem by following us on Twitter and Mirror and joining our lively communities on Discord and Telegram.

- DAI is a decentralized stablecoin launched by MakerDAO in 2017.