Launched on Mainnet in November 2022 and recently on Optimism, our protocol has quickly gained popularity among the DeFi community by offering users a transparent and predictable lending and borrowing experience. We designed it to be trustless, meaning that users can interact with it without the need for intermediaries, aiming to make DeFi accessible to everyone, regardless of their technical expertise.

To further enhance its transparency, Exactly Protocol will share publicly through its official blog all changes made on the protocol’s parameters to provide users with visibility into the protocol’s decision-making process, even though it does not yet have an official DAO (Decentralized Autonomous Organization).

How Does Exactly Protocol Address Liquidity Challenges

In the DeFi ecosystem, a common issue arises when a protocol’s liquidity pool reaches 100% of its utilization, resulting in no available liquidity for users to withdraw their assets from the pool.

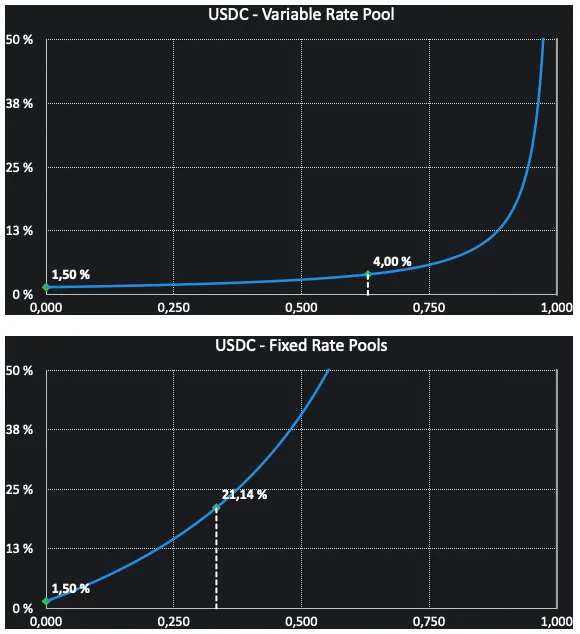

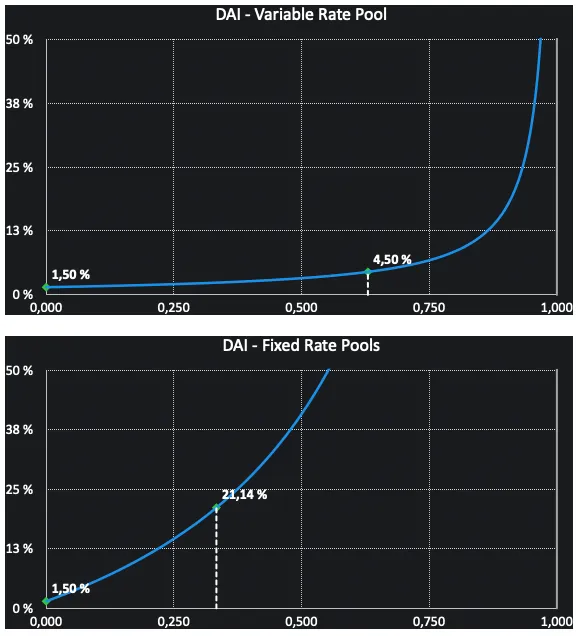

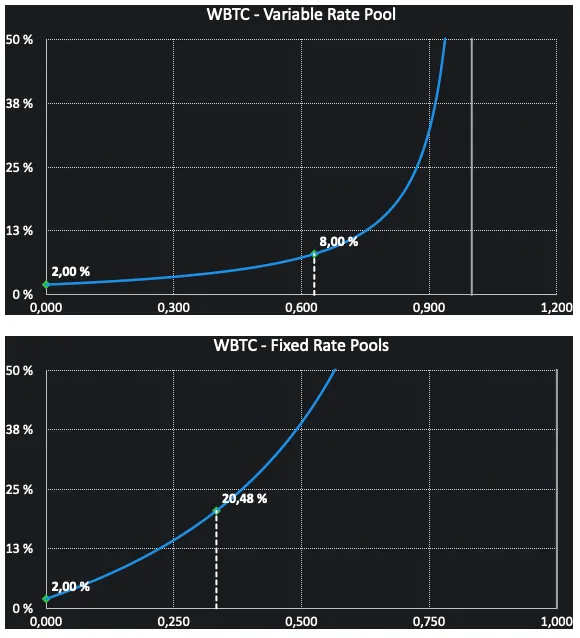

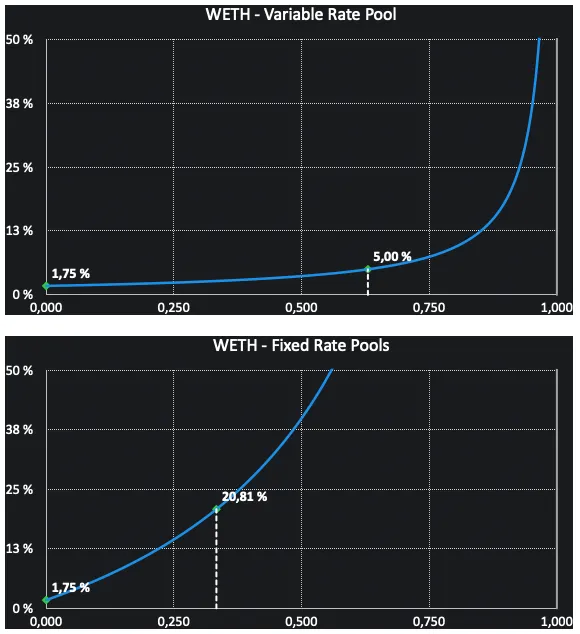

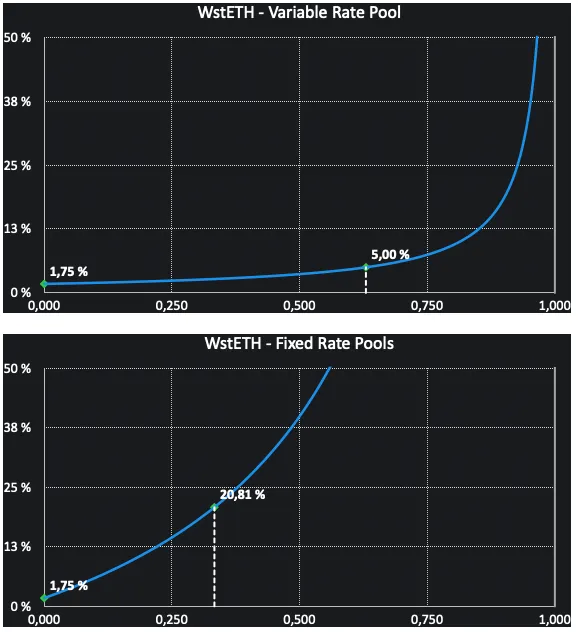

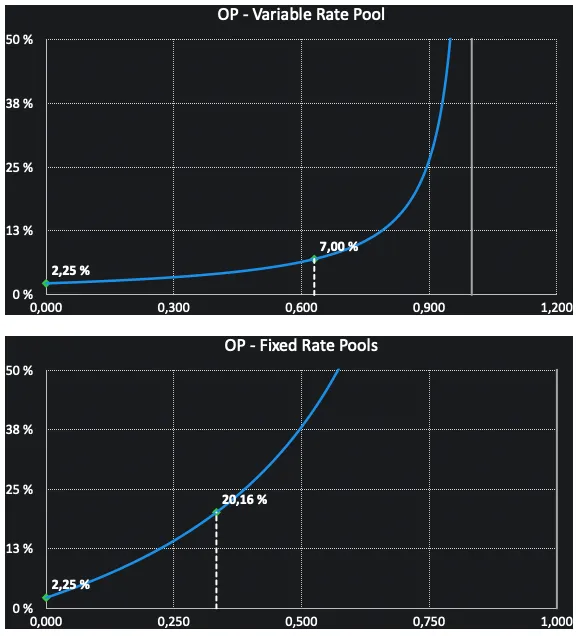

Exactly offers innovative solutions to address this challenge. Firstly, through the Interest Rate Model (IRM), interest rates can be dynamically adjusted. This means that as users approach full utilization of the available reserves, funding rates increase rapidly. In the case of Exactly and given the convexity of its IRM model, this mechanism works more efficiently than linear alternatives prevailing in other protocols.

Secondly, the protocol introduces a novel concept in DeFi that comes from the Traditional Financial system by maintaining a Reserve Factor. This is the fraction of the total Variable Rate Pool supply selected as Liquidity Reserve, currently set at 10%. Liquidity Reserves cannot be borrowed and remain constantly available, ensuring users can access their funds in the Variable Rate Pool.

“By design, the protocol sets aside a percentage of the Variable Rate Pool deposits as Liquidity Reserves. Liquidity Reserves cannot be borrowed and are only made available to meet withdrawal requests in the Variable Rate Pool” — Exactly Protocol’s Math Paper.

Updates on the Interest Rate Model Parameters

The Interest Rate Model is a crucial component of any lending and borrowing platform in the DeFi space. It determines the interest rates that borrowers and lenders must pay or earn, respectively, for participating in the protocol. As such, any changes made to the IRM can have a significant impact on the protocol’s incentives to users and overall functionality.

The Risk Management team behind the Exactly Protocol has decided to adjust the curve in their different IRMs to reduce the unlikely probability of liquidity shortages. This change aims to ensure that users can access their funds when they need them and provide a more reliable borrowing and lending experience.

Update on the OP token Risk-Adjust Factor

Another change that users can expect from Exactly Protocol is an increase in the Risk-Adjust Factor of the OP token.

Initially set at 0.35 during the launch of Exactly Protocol on Optimism, the Risk-Adjust Factor of the OP token has now been adjusted to 0.58, which aligns with the current risk model.

“Each asset supported on our protocol has its own Risk-Adjust Factor, which represents the proportion of the asset value to be used as collateral. For example, if a user supplies 100 ETH as collateral, and the Risk-Adjust Factor for ETH is 50%, then that user can borrow a maximum of 50 ETH worth of any other asset in any Variable Rate Pool.” — Exactly Protocol’s White Paper.

These adjustments to the IRM curves and in the Risk-Adjust Factor will provide users with an even better lending and borrowing experience, well-positioning the protocol on its growth as a leading DeFi protocol in the years to come.

For further transparency, all Exactly Protocol parameters can be checked at https://docs.exact.ly/guides/parameters