Exactly's Mission

Exactly's mission is to bridge the gap between traditional finance and crypto by introducing the "Time Value of Money" concept. To fill this gap Exactly provides a decentralized, non-custodial, open-source protocol that offers an autonomous fixed and variable interest rate market.

The protocol aims to provide users with a seamless and efficient way to manage their crypto assets by offering the opportunity to make deposits or loans at a fixed interest rate for a specific period, just like in traditional fixed-income investments. This feature helps users to effectively hedge against interest rate volatility, providing a much-needed solution in the DeFi ecosystem.

Solving the Fixed Income Problem in the DeFi ecosystem

At Exactly, we strive to eliminate obstacles that impede the flow of liquidity in the DeFi ecosystem. Our approach is to tackle the issue of fixed income head-on, using a first-principle methodology that considers the challenges and limitations of integrating traditional finance with DeFi on blockchain technology.

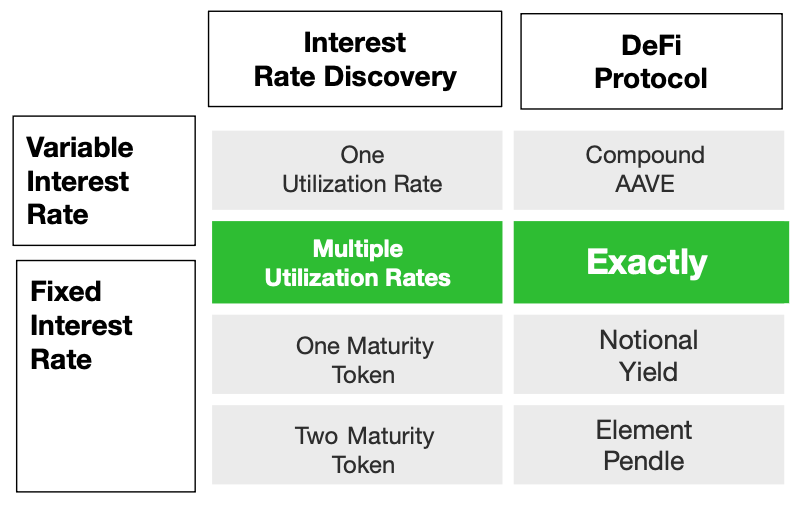

This is why the Exactly Protocol is designed to determine the fixed interest rate directly from the credit supply and demand in each of our Fixed Rate Pools for a given asset and maturity term. The interest rate is calculated based on each token's credit utilization rate for each Fixed Rate Pool, ensuring that the rate reflects the current market conditions for each respective maturity date.

Why does Exactly matter?

As DeFi continues to gain momentum, the demand for decentralized and transparent financial solutions continues to rise. With a focus on fixed-rate financial products, Exactly Protocol is positioning itself at the forefront of this movement by offering an innovative approach to the time value of money.

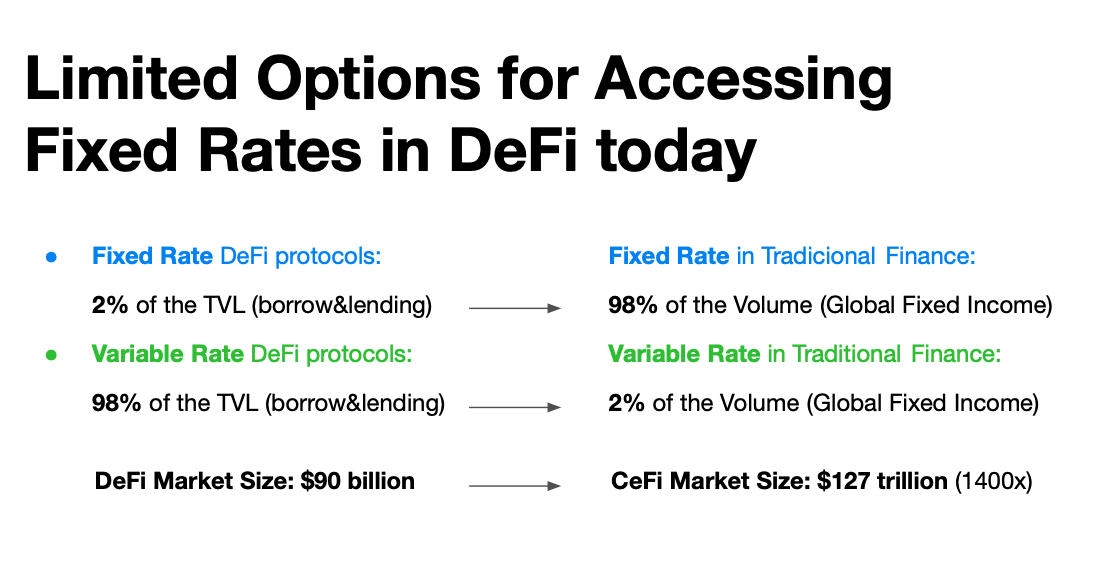

The traditional financial world primarily operates using fixed-rate products, with 98% of the volume in fixed-rate offerings. This is because the average consumer typically has a fixed income and prefers the stability of fixed-rate borrowing, allowing them to predict their monthly payments better. However, in the DeFi borrowing and lending market, fixed rates make up only a small portion, 2%, of the Total Value Locked (TVL).

To address this imbalance and bring the DeFi credit market to a broader audience, Exactly Protocol provides a decentralized, non-custodial, and open-source protocol that offers an autonomous fixed and variable interest rate market. This enables users to exchange the time value of their assets in a frictionless and efficient manner.

The Power of Interoperability, Security, and Innovation

Exactly is unique in its implementation of the ERC-4626 standard, which increases the protocol’s interoperability, decreases development time, and enhances user security. Additionally, the protocol’s innovative interest rate model, featuring a continuous and differentiable (non-linear) function, paves the way for a new era of fixed-income derivatives and offers exciting investment opportunities.

The Exactly value proposition:

-

Simplicity: Traders can arbitrage between fixed and variable rates for various periods and hedge the interest rate risk for their long or short positions, with or without leverage.

-

Frictionless: Investors and DAOs can receive fixed and variable deposit rates. End-users can take fixed-interest rate loans for more extended periods with certainty.

-

Efficiency: Fixed and variable interest rates live in the same protocol with a new approach towards multiple interest rate discovery through the Utilization Rate of each Fixed Rate Pool.

Exactly Use Cases with Fixed and Variable Rates in DeFi

Exactly brings a unique solution to the DeFi market, offering a range of use cases for traders, investors, and end-users. Here are just a few examples of how the Exactly Protocol can be utilized:

-

Arbitrage between Fixed and Variable Rates: Traders can take advantage of fluctuations in interest rates by arbitraging between fixed and variable rates for different maturity dates.

-

Arbitrage between Fixed Rates: Traders can also arbitrage between fixed rates for different maturity dates, taking advantage of discrepancies in interest rates.

-

Hedge Interest Rate Volatility Risk: Investors and traders can hedge the interest rate volatility risk for long or short leverage positions, ensuring stability in their investments.

-

Deposits with Flexibility: Investors and DAOs can receive fixed or variable deposit rates, with the option for early withdrawal if needed.

-

Borrow with Certainty: End-users can take out loans at either fixed or variable interest rates for longer periods, with the option for early repayment if desired.

Keep yourself in the loop on Exactly Protocol’s developments and our goal to disrupt the DeFi ecosystem by following us on Twitter and Mirror and joining our lively communities on Discord and Telegram.