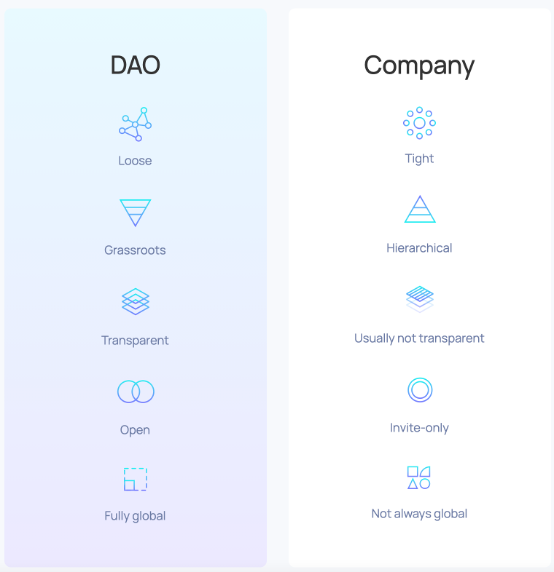

Decentralized Autonomous Organizations (DAOs) are communities of tokenholders dedicated to the long-term success of a protocol through a shared mission based upon codified rules on the blockchain. Unlike traditional companies, DAOs are transparent, permissionless, and global, reflecting broader qualities of blockchain technology itself.

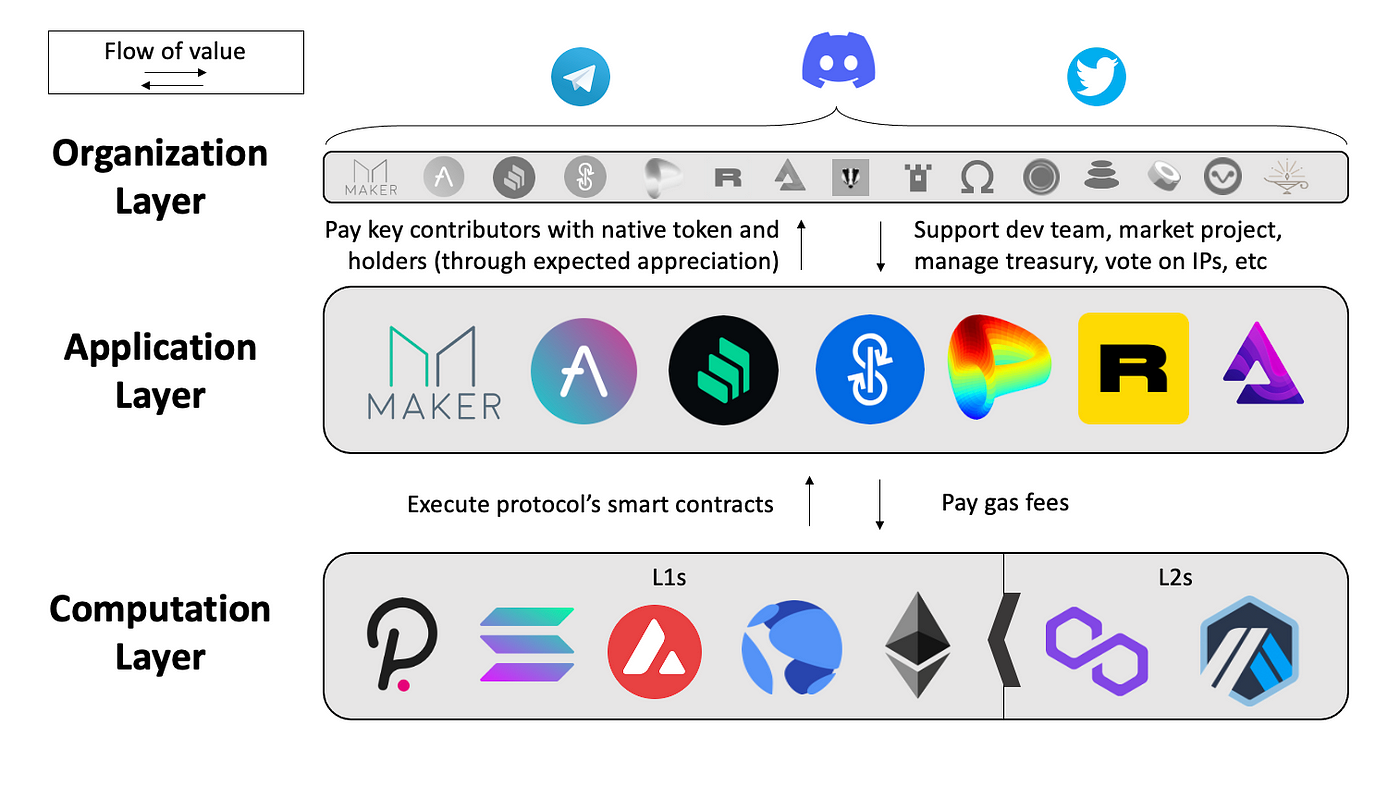

Many ignore the more human organization layer when examining the crypto ecosystem, and instead focus heavily on the technology (granted I make some broad generalizations breaking it into two buckets). The purpose of this essay is to show the importance of that organization layer and its implication for the entire ecosystem.

The blockchain ecosystem can be divided into a computation, application, and organization layer. The computation layer consists of nodes and validators of the decentralized computing network; it also importantly houses the VMs for smart contracts to be executed, and consists of miners and validators. The application layer consists of various dApps with specific smart contracts for the computation layer, typically involving the software engineers and development teams. Finally, the organization layer consists of the key contributors who support the application (usually incentive by token ownership) through marketing, business development, outreach, treasury management, etc — this layer involves the DAOs tied to each application. 2021 saw massive development and maturation of this layer.

2021 in context of crypto market cycles

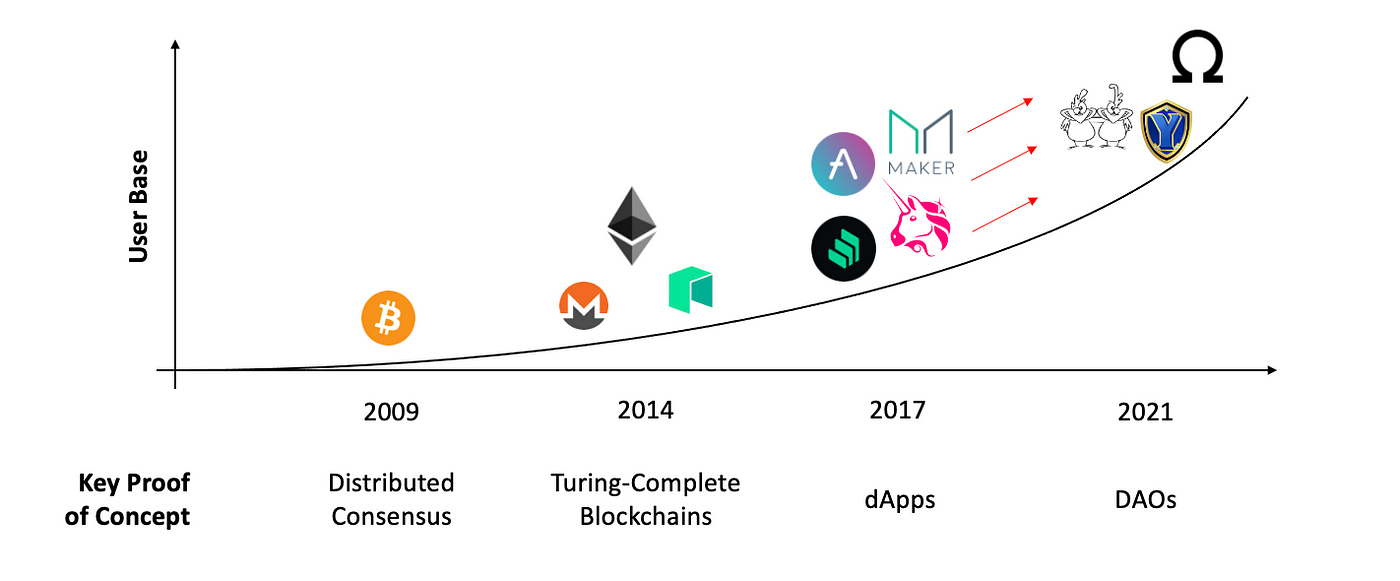

In 2009, the Bitcoin whitepaper was released, creating the world’s first cryptocurrency. Bitcoin proved the feasibility of distributed ledger technology (DLT) over the next few years as enough miners operated the network to maintain the ledger’s liveness.

2014 saw a major innovation: Turing-complete blockchains. Blockchains could now execute far more advanced code than Bitcoin Script, which was intended solely for payments, prioritizing decentralization and security over scalability and customization. The most prominent project to emerge from this wave is obviously Ethereum. Solidity, the network’s Turing-complete language, could execute smart contracts using the Ethereum Virtual Machine (EVM), making previously unimaginable applications suddenly programmable. It should be noted that the first iteration of the DAO model emerged in this period but saw little traction after The DAO (the world’s first investment DAO founded in 2016) had $50m stolen, actually leading to a fork in Ethereum to fix the bug.

In 2017, the first major dApps — notably in DeFi — exploded. The ICO — using tokens to quickly raise capital for a new project — was discovered as a new financing mechanism, leading to a wave of innovation at the application layer. While many point to this cycle as the emergence of DAOs, I argue that most projects were only at the beginning of a gradual process of progressive decentralization. For example, Uniswap launched without a governance token and didn’t release one until a fork in 2020 created its more decentralized, egalitarian competitor, Sushiswap, and quickly converted some of its users. Early DAOs were also relatively weak and lacked the assets, tooling, and sophistication of their current form; they could be better characterized as online clubs or chat groups.

Now we arrive at 2021, where the DAO model is increasingly seen as the final evolution of every major project in the space. Many of the first-movers in DeFi — notably MakerDAO, Compound, Aave, Uniswap, and others — have matured and reached much greater levels of decentralization with larger and more engaged user communities. The post-2017 bear market revealed how robust some of these communities could be. Additionally, projects not planning to fully decentralize are commonly looked down upon by the community; not aiming to become a DAO has almost become a buffer for user acquisition. It must be noted that the pandemic was a major catalyst, proving that virtual work can be just as — if not more — efficient than in-person work; the year also provides suites of best practices and professional tooling for running a virtual company.

A few characteristics define this modern iteration of the DAO. First, while maintaining a non-hierarchical horizontal structure, DAOs show quite advanced division of labor into various “working groups,” “guilds,” etc, each with a defined mission and set of responsibilities; this characteristic enables specialization on the part of existing members, while allowing newcomers to work on projects best suited for their skillset or interests. Second, defined rules and norms are becoming a standard for highly efficient DAOs; with hundreds of members spread across the world, these clear definitions allow for a consistent culture to create a better sense of community. Third, formalized, systematic record keeping ensures proper information turnover given the relatively loose, project-based work involved with DAOs; the increased use of Google Drive, Notion, forums, etc helps members look at past governance proposals, meeting notes, projects, and other resources to prevent overlap and learn from past mistakes. When combined, these characteristics define a new generation of DAOs that can be significantly more efficient and better support network value capture.

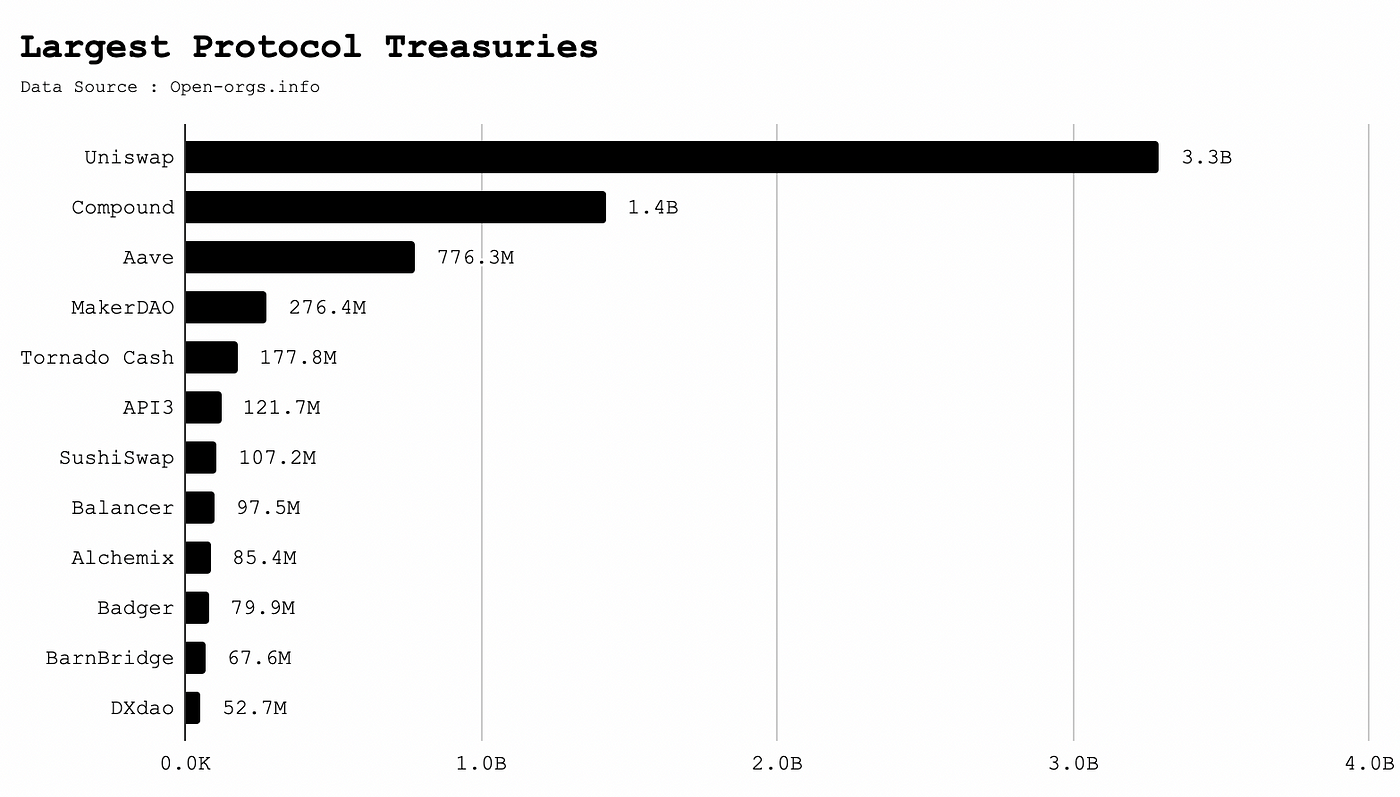

2021 also equipped DAOs with massive treasuries to be used for paying contributors, investments, token buybacks, and growth capital. In total, major networks now control approximately $21b; putting this number in perspective, these Discord communities manage about twice the balance sheet of Twitter.

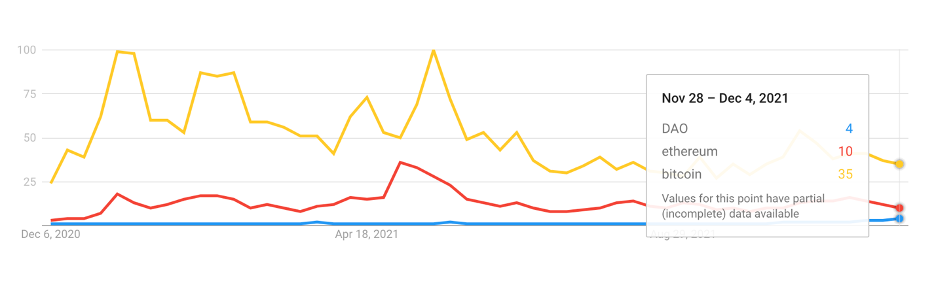

However, despite public interest in crypto exploding in 2021, DAOs seemed to be left out of the hype cycle. Search data remains relatively flat, especially when compared to major cryptocurrencies like Bitcoin and Ethereum. Most are still even unfamiliar with the term.

Over the next decade, I expect DAOs to move into the mainstream by becoming lucrative full-time work and — arguably more importantly — cementing a place in the gig economy for part-time contributors. Every cycle in the crypto market can ultimately be framed as excitement around one innovation, and I firmly believe the emergence of a new generation of DAOs will define the 2021 market.