I feel many DeFis seem magical because actually someone takes on the burdens. SNX has been performing exceptionally well recently, and we can imagine that there must be someone who is bearing the burden for SNX too. But who are they?

We all know that slippage exists in traditional trading platforms.

Let us assume you buy 1 BTC for $20,000 USD.

But if you want to buy 10,000 BTC, your average cost will always be higher than 20K, because your trade will pump up the price of BTC.

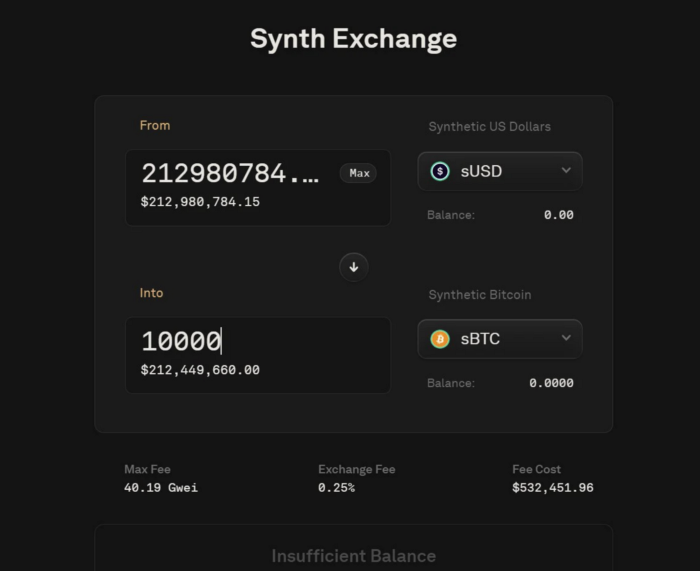

Now you can make transactions on SNX without any slippage. What does it mean? It means that even if you want to purchase 21 million bitcoins, as long as you have enough sUSD, BTC will be traded at the market price for you. Well, nothing is for free. So who is carrying the burden?

Let’s start with the mechanism of SNX.

One basic mechanism: stake to mint stablecoin.

Two special mechanisms: “Zero Slippage Trading” and “Global Debt”.

The basic mechanism is that you can mint $sUSD by staking $SNX, and these sUSD can be spent as $1 (this also depends on the liquidity of the Curve/Uniswap sUSD pool), but it is also your debt. So far, Synthetix works almost the same as how users can mint $DAI on MakerDAO.

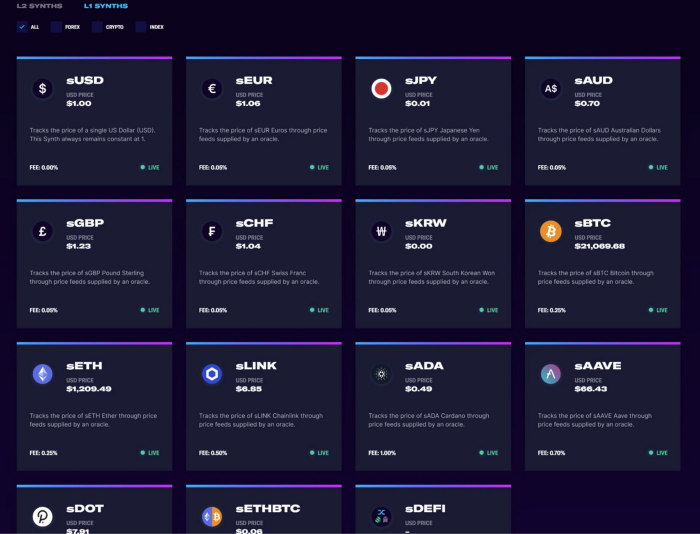

But the difference is, there are also sBTC, sETH, and many other synths asset(there even used to be stocks and oil). All these assets are minted at the moment when people traded with zero slippage. Of course, this 0 slippage trading exchange can only use sUSD as the entry ticket.

Assuming the current price of BTC is $20,000 USD, you can use sUSD to buy as many as sBTC you want instantly without any slippage, and all traded at $20,000 USD, aka, “Zero Slippage Trading.

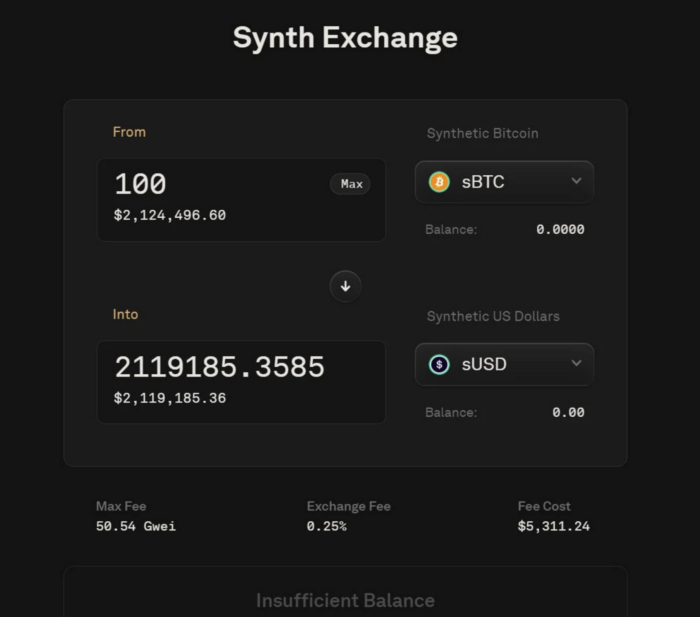

However, in fact, there is no BTC collateral behind sBTC. Then how does it peg the price with BTC? The answer is that the sBTC you hold can also be sold at the market price anytime without slippage.

Frankly speaking, even if I sell 100 BTC simultaneously through Binance and Coinbase, I can easily make a big dip. Not to mention selling through DeFi.

Frens with some foundational understanding may ask: How about someone buys a large amount of BTC at 20K, and then sells them all at 69K, who will pay for the money earned? Excellent question. This leads to the other mechanism called global debt.

If there are only two people in this system, you and me. We both deposited SNX and lent 100,000 sUSD each.

You borrowed sUSD, and hold.

I bought a lot of Bitcoin(sBTC) after borrowing sUSD and sold it at the top. I made a profit of 400,000 sUSD later.

At this time, you will be surprised to find that the money you owe the system has increased to 300,000 sUSD, not just the 100,000 you borrowed at that time.

The simple reason is that you are in debt for my profits.

This is how Global Debt works. Every $SNX staker is on the move together. All users have to propotionally pay off the debt the system owes.

In other words, you borrowed sUSD, and if someone in the system made money from the transaction, your debt would increase. Of course, if someone in the system loses a lot of money, you will owe less as a result.

So if your sUSD is borrowed from the system, you need to trade a lot and try to outperform everyone else in the system. It’s like a trading competition, where the top players make money from the bottom players. It means that even if bottom players gained positive profits, as long as the profits are not more than those of others, bottom players themselves will become “prizes”.

Therefore, back to Zero Slippage Transaction, it became clear that the people who are bearing the burden are those who stake SNX to borrow sUSD. However, if that’s all I want to say, then this article is completely unnecessary.

It is not enough to just know about something. We should know how and why.

So why would anyone want to bear the burdent? The answer is very simple. By staking SNX and borrowing sUSD, you can earn protocol’s fees along with SNX’s inflation rewards. Recently it has risen to 300%+ annualized return, which is still high now.

Then, where did this 300% APR come from?

Looking around, someone has to carry the burden for this 300%, right? I think it came from aggresive competition.

Then the point is, how did it happen?

After its latest update, SNX has been joined into 1inch’s route. A large transaction, such as an ETH sell order of 1 millions USD, should have swapped on Uni V3 with an slippage in the past. But now, it goes to synthetic, since there is zero slippage.

Therefore, as long as a certain moment like below exists:

SNX medium rate (0.3%+Curve)+0 slippage > Uni V3 low rate (0.05%)+with slippage

Then, the 1inch routers will go through SNX+Curve.

The user’s ETH will be first exchanged for sETH through Curve, then sETH will be exchanged for sUSD through Zero Slippage Transaction, and finally sUSD will be swapped for USDC through Curve.

The whole process completely skipped Uniswap!

Originally, Uniswap V3 LPs wanted to earn these fees. Now, because of the lower rate on SNX and aggregators like 1inch, the fees of large transactions are directly earned by SNX instead of Uniswap.

Synthetix is actually a good example of a project moving away from the lightly Ponzi model to a real & sustainable business. It used an almost suicidal method (subsidizing Zero Slippage Transactions with LPs’ funds) but successfully took others’ business over, and then earned money back through fees.

In this case, the people who are bearing the burden become the LPs of ETH-USDC or WBTC-USDC on Uni V3. In fact, the IL of V3’s LPs is terrifying, and they all depend on those transaction fees. Now part of the fee earnings has taken away by SNX. It becomes more difficult for Uni LPs.

Of course, Uniswap was actually the winner of the prior competition. Uni’s 0.05% volatility pool and 0.01% stability pool won over V2 DEXs, Curve, and the vast majority of CEXs.

CEXs really have to be aware of the rise of DeFi. If I remember correctly, many CEXs may still have a transaction rate of 0.2%. Under the current GAS fee rate, the DeFi trading experience may easily outperform that of CEXs with a slightly larger transaction size. Therefore, we have another exchange’s boss, in addition to Uni V3 LPs, who are also bearing the burden.

Some friends may say that the owners of CEXs only make more or less money. How can they lose money? So who are the ultimate burden bearers? I’ll stop here. Another sad story 😂

The transaction fee market is limited, and it is even gradually shrinking as the crypto secondary market cools down. Free money does not come from nowhere. No moat can last forever. As DeFi continues to evolve, its user experience will become better and better. If CEXs are satisfied with their current model and become too chill to innovate, their situation will become dangerous.

Although DeFi has lots of immaturity and is full of magic, I am always optimistic about the future of DeFi. I still believe that under the soil of such fanatical innovation, forbidden fruit that cannot be grown in traditional markets will be born here. Most of them are poisonous, but you never know when they will become the new Holy Grail.