Raft is an immutable, decentralized lending protocol that allows people to take out stablecoin loans against one of the most sustainably productive collateral assets, Lido Staked Ether (stETH).

What is R?

R is the first USD stablecoin backed solely by stETH. R provides the most capital-efficient way to borrow using your stETH while keeping your stETH rewards flowing in.

R aims to be the stablecoin of choice within the decentralized ecosystem, with deep liquidity across many trading pairs and a stable peg.

Why Raft?

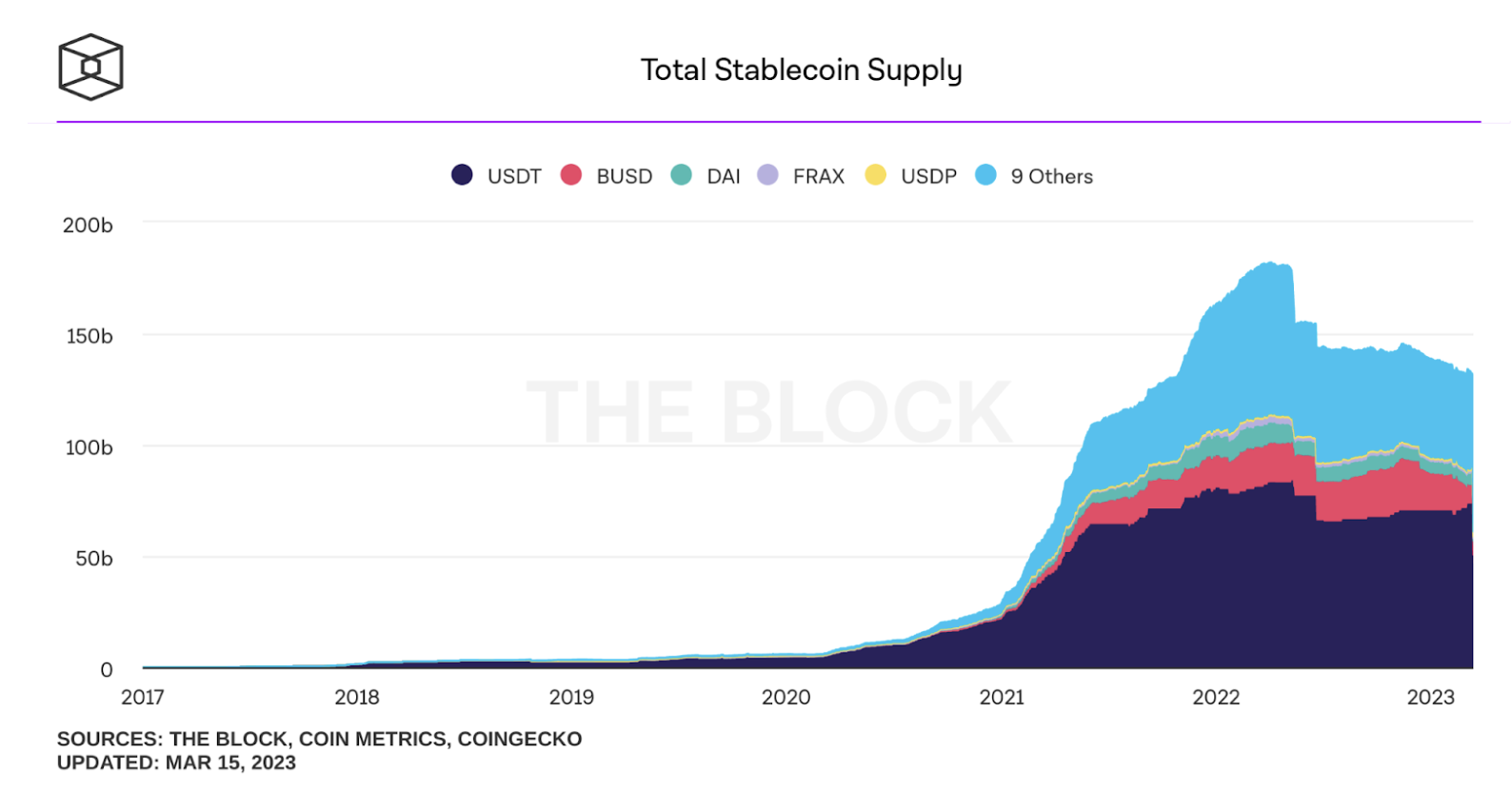

We need a safe, decentralized stablecoin that can't be stopped, enabling billions to store value pegged to USD.

Recent events like the FTX collapse and the USDC depeg have shown the world the benefits of self-custody and censorship resistance.

The USDC depeg was caused by its dependence on collateral held by banks. DAI, a supposedly decentralized stablecoin, has suffered the same fate because more than half of its collateral is made of USDC.

R belongs to the second-generation stablecoins which break the link between peg stability and fiat collateral. Unlike fiat-backed stablecoins, R is always fully backed by uncensorable and decentralized crypto assets, and instantly redeemable without the intermediation of any third party.

In a time of illiquidity crises and recent bank failures such as SVB, Signature Bank and Credit Suisse, a trustless decentralized financial system is emerging.

A decentralized stablecoin like R is a key part of this system, enabling billions of people to store value pegged to the US dollar instead of hyperinflationary currencies. Raft is immutable so it can’t be upgraded, and it doesn’t rely on banks.

Why now?

Today, there is a total of 17.8 million ETH (~$32 bn) deposited with Ethereum’s POS validator set. Almost two thirds of staked ETH cannot be withdrawn from the current validator balances.

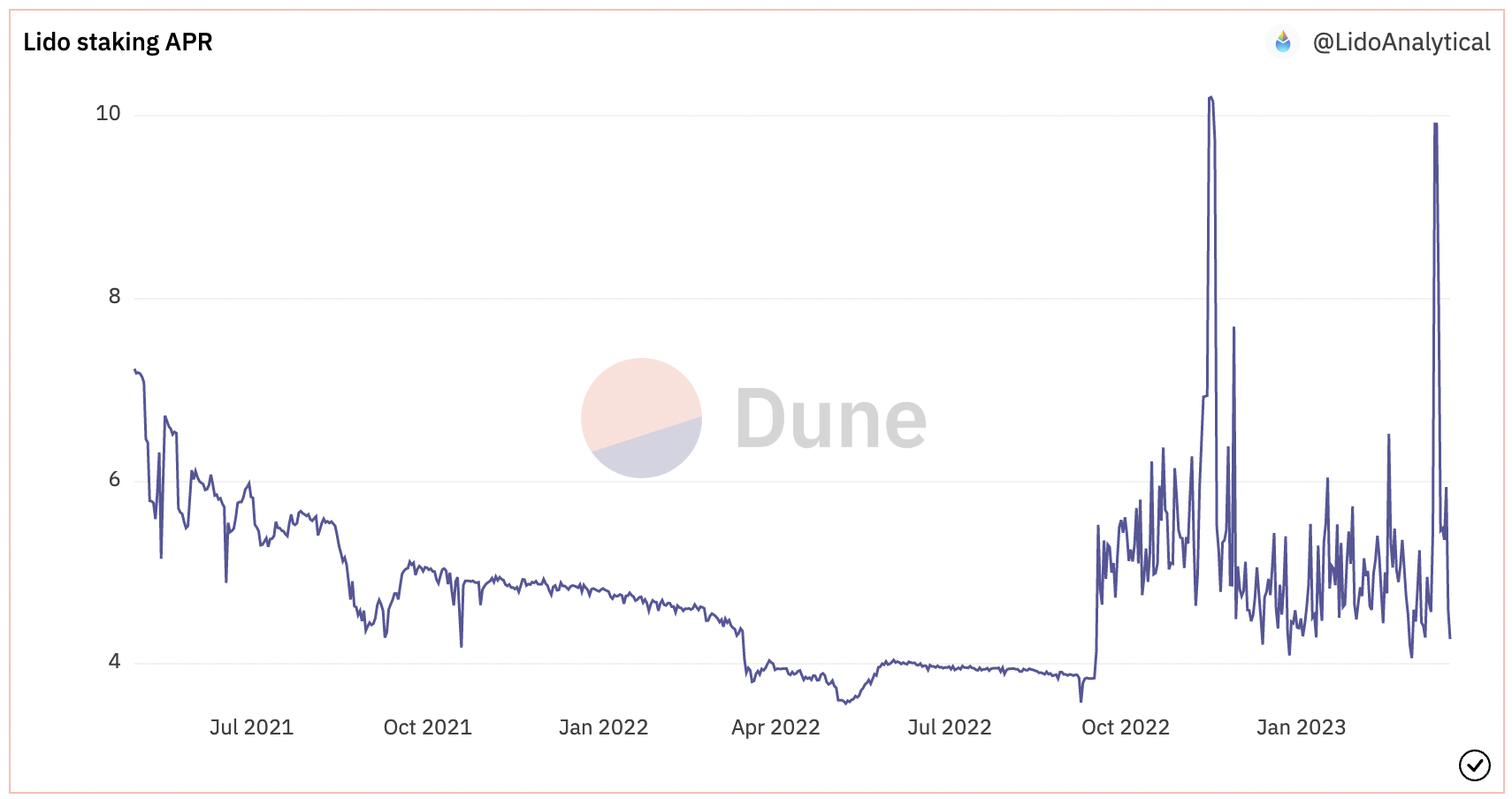

However, the all-important Shanghai/Capella upgrade will enable staked ETH withdrawals and uplift any liquidity constraints that may have existed. As a result, the stETH market cap, currently at ~$10 bn, is poised to increase over time.

We expect that most existing ETH stakers will want to keep their ETH staked, earning a healthy yield of 4-6% on average.

We also believe that enabling withdrawals will attract more ETH holders to stake their ETH, increasing the total market cap of stETH way beyond the current market value of nearly $10 billion. This is a huge opportunity for Raft to grow.

How does Raft work?

Raft is built on Ethereum, and enables ETH stakers to earn yield while borrowing R, making it the most capital-efficient stablecoin. We build on the foundations of the Liquity protocol, adding key improvements to it.

Users can deposit stETH into a Raft position, borrow R with an over-collateralization ratio of at least 110%, and pay zero fees.

While users hold and use R, they keep earning their stETH rewards.

Become a Frontend Operator

The Raft protocol is completely permissionless and will allow anybody to become a Frontend Operator.

Frontend Operators facilitate user deposits and withdrawals for the Raft protocol.

Growing a large network of Frontend Operators will stimulate worldwide R adoption and remove any single point of failure, ensuring a robust, decentralized financial experience for all.

Built by Tempus

Raft is built by the Tempus team, a venture DAO backed by Lemniscap, Jump, Tomahawk.VC, GSR, Wintermute and others.

Wrap up

Raft is an immutable, decentralized lending protocol that allows people to take out stablecoin loans against stETH.

With the upcoming Shanghai upgrade and traditional banks failing, there has never been a better time to launch a protocol like Raft.

If you want to learn more details about Raft protocol, check out our documentation.

Jump on board the Raft Discord and get involved in the R-evolution of decentralized finance.

Useful Links

Website: https://www.raft.fi/

Twitter: https://twitter.com/raft_fi

Telegram Channel: https://t.me/raft_fi

Telegram Group: https://t.me/raft_chat