In the thrilling world of decentralized finance, solvency and stability are the dynamic duo that guarantee user trust and adoption.

Enter Raft, a decentralized lending protocol that allows people to take out stablecoin loans against capital-efficient collateral.

Raft’s first stablecoin is called R and is backed exclusively by stETH (Lido Staked Ether). With its eyes set on becoming the number one stablecoin within the decentralized ecosystem, R relies on the powerful tag team of liquidations and redistributions to safeguard its value and maintain solvency.

Let's embark on a journey to understand how these processes work with R.

Liquidations

Liquidations play a vital role in making sure each 1 R is always backed by at least 1 USD worth of wstETH.

An account becomes eligible for liquidation when a Position's Collateral is between the Minimum Collateralization Ratio and 100% collateralization (i.e., 100% < Position's Collateral < 110%).

The liquidation process is initiated when the Liquidator calls the smart contract to perform the liquidation.

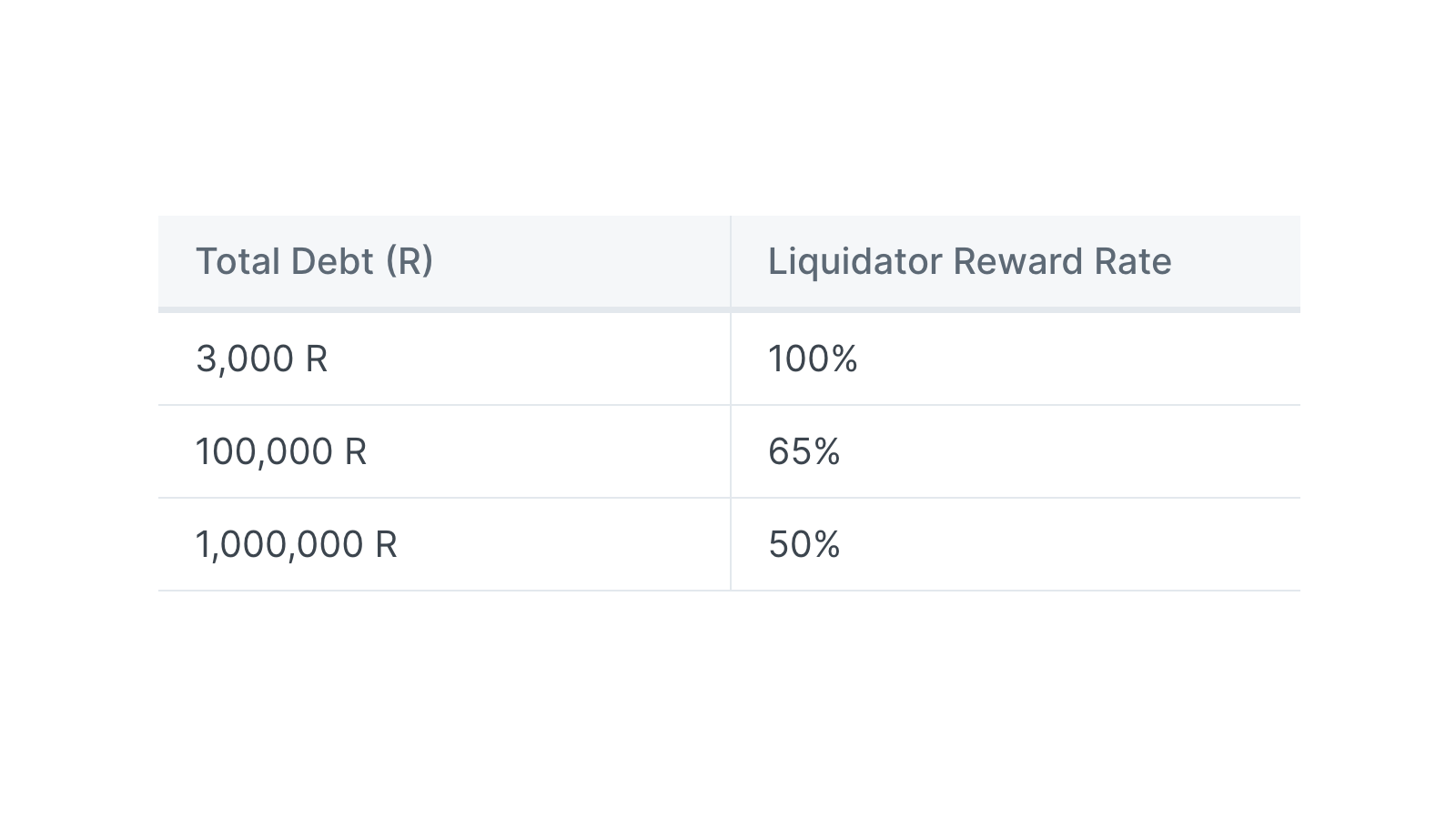

The Liquidator pays off the Borrower's Total Debt, and in return, receives the equivalent amount of Matching Collateral and the additional Liquidator Reward, which is based on a pre-defined formula.

Positions below the Minimum Collateral Ratio can be liquidated through the following methods, earning the Liquidator collateral and liquidation rewards:

-

[Optional Flash Loan]: Borrow Borrower's Total Debt from a Liquidity Pool (such as Balancer).

-

[Optional Flash Mint]: Flash mint Borrower's Total Debt directly from RAFT.

-

Call the Liquidation contract, submit Borrower's Total Debt.

-

Receive wstETH equivalent to Borrower's Total Debt + Liquidation Reward Rate of Excess Collateral.

-

Swap wstETH back into R.

-

[Optional Flash Loan]: Repay Borrower's Total Debt of flash loan.

-

[Optional Flash Mint]: Repay Borrower's Total Debt * (1+FlashMintFee%) of flash mint.

Redistributions

Redistributions serve as a last line of defense in the highly unlikely event that liquidators fail to liquidate all under-collateralized, risky Positions. They are designed to ensure that losses incurred by an under-collateralized position are fairly distributed among all Positions, reducing the risk of systemic failure. This mechanism maintains user trust and confidence in the protocol, making it a vital part of DeFi lending.

If a borrower's collateralization ratio falls to 100% or below, a Redistributor may initiate a Redistribution process, earning a Redistributor Reward.

The remaining collateral and debt of the affected Position are proportionally split among other Positions based on their collateral amounts, with higher collateral amounts receiving a larger share. After the redistribution, the under-collateralized Position is closed.

The Redistributor's role is to invoke the contract for initiating the redistribution process. Due to the potential for high gas fees, an incentive is provided to the Redistributor.

The Redistributor Reward Rate is a dynamic percentage of the Total Collateral, set according to a pre-defined table.

Wrap Up

The mechanisms of liquidations and redistributions are crucial for ensuring solvency and stability in decentralized finance protocols like Raft.

The R stablecoin, designed to always retain a value of 1 USD, relies on these mechanisms to maintain stability and reliability.

By understanding how liquidations and redistributions work with R, users can confidently trade R with minimal slippage or price impact. To learn more about Raft and its features, please visit the official documentation.

Find out more about Raft’s One-Step Leverage.

Jump on board the Raft Discord and get involved in the R-evolution of decentralized finance.

Useful Links

Website: https://www.raft.fi/

Twitter: https://twitter.com/raft_fi

Telegram Channel: https://t.me/raft_fi

Telegram Group: https://t.me/raft