In this research article, we’ll explore the impact that the upcoming Ethereum Shanghai upgrade will have on the DeFi ecosystem, specifically the Liquid Staking Derivatives and the decentralized stablecoin market.

The highly anticipated upgrade is set to occur on April 12, 2023, and is expected to be the most significant network update since the Merge.

So, what is the Shanghai upgrade, and why does it matter to investors, Ethereum validators, and the entire crypto community, including Raft and its R stablecoin?

Let’s jump right in!

Unlocking Staked ETH and Staking Rewards

The Shanghai upgrade, also known as the Shanghai/Cappela or Shappella upgrade, will enable the withdrawal of staked ETH (stETH) from the staking contract and claiming of staking rewards. The effective withdrawal of stETH into stakers’ wallet will be enabled by the Lido staking contract upgrade, which will happen after the Shanghai upgrade.

This update removes a major barrier to staking ETH since users can stake and unstake without worrying about withdrawal limitations.

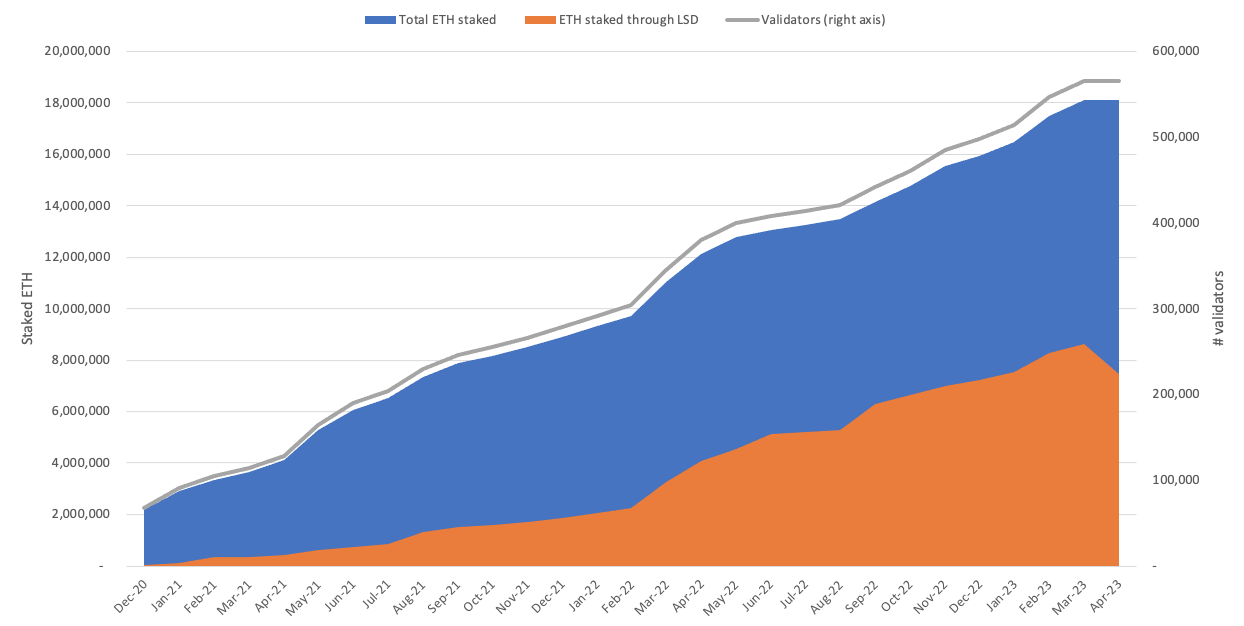

Since the Merge integrated the Beacon chain with the Ethereum network, around 18 million ETH (15% of the circulating supply) has been staked by over 500,000 validators, with payouts to stakers totaling over 1 million ETH.

However, these staked assets and rewards remain inaccessible until the Shanghai upgrade.

A notable 43% of the staked ETH has been deposited through liquid staking derivatives (LSD) like Lido and Coinbase. Many retail users prefer LSDs because they allow earning yield on top of staked ETH without lock-up concerns.

Moreover, staking on LSDs requires as little as 0.1 ETH compared to the 32 ETH minimum for running a node.

Key Features of the Shanghai Upgrade

The three key features that will be delivered with the Shanghai/Capella upgrade include:

-

The ability to update the withdrawal credentials of an Ethereum validator from the older 0x00-type (derived from a BLS key), to the newer 0x01-type (derived from an Ethereum address).

-

Partial withdrawals, or the periodic and automatic “skimming” of earned, consensus layer rewards from an active validator’s balance (over 32 ETH).

-

Full withdrawals, or the reclaiming of an “exited” validator’s entire balance.

Validators with the 0x00 type credentials need to update them as only validators with the new 0x01 type withdrawal credentials will be eligible to make partial or full withdrawals from the Ethereum network.

In terms of withdrawals, every 12 seconds (each slot) all Ethereum validators are scanned to identify the first 16 validators that are eligible for full or partial withdrawal. The ranking of the validators depends on the time the node was set up. A total of 16 withdrawals can take place in each slot.

This means there will be a maximum sell pressure of 54,000 ETH (~$97 million @ $1,800/ETH )

How Will Staked ETH Withdrawals Work?

There will be two types of withdrawals: Full and Partial.

Full Withdrawal:

A validator can leave the Beacon chain by unstaking all of the ETH they have contributed to it, including with their staking incentives, using the complete withdrawal mechanism.

The validator no longer participates in the staking program after the entire withdrawal is finished. Before they can completely withdraw their funds, the validator must start a Beacon chain exit.

Full withdrawals are expected to take a minimum of 28 hours. This includes the time required to exit as a validator which is 5 epochs or 32 minutes (1 epoch is 32 slots; (32*12*5)/60) and the minimum time required to become fully withdrawable which is 256 epochs or 27.3 hours ((256*12*5)/60). Full withdrawals are expected to be longer than this.

Partial Withdrawal:

The partial withdrawal feature enables validators to withdraw any balances that exceed the 32 ETH requirement for running a node.

Validators can choose to withdraw all excess ETH (net of penalties and rewards) and stake them on the network to earn rewards which is otherwise not possible.

The processing time for partial withdrawals will be shorter than for full withdrawal processes.

Based on data from ParaSpace, it is anticipated that 10% of validators will remove their staked ETH after more than one month and that all staked ETH can be withdrawn after more than one year. The purpose of this delay is to emphasize the security of the Ethereum network.

Dominance of Lido, Coinbase, and Rocket Pool

While only 15% of the total circulating supply is staked on the Ethereum network, we believe this number is set to exponentially increase once the Shanghai upgrade has taken place as unstaking will become an easier process.

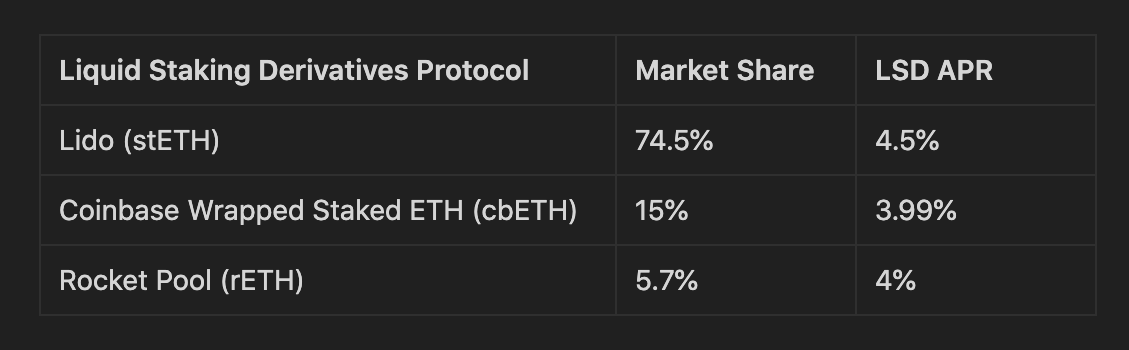

Today, close to 95% of the staked ETH on LSDs is dominated by 3 players namely Lido, Coinbase, and Rocket Pool.

Some of the reasons that have led to the dominance of Lido among other LSDs include:

-

User-friendly platform: Lido offers a simple and intuitive interface that makes staking accessible to users with varying levels of technical expertise.

-

Liquidity for staked tokens: stETH has the deepest liquidity in the Curve, Balancer, and Uniswap pools. This helps stakers easily exit their position.

-

Strong community and governance: Lido has a robust community that actively participates in the platform's governance. The decentralized nature of Lido's decision-making process allows the platform to be more adaptable and responsive to market needs.

-

Security and transparency: Lido utilizes a decentralized network of node operators to secure the assets being staked. This distributes risk and improves the overall security of the platform. Additionally, Lido's smart contracts are open-source, which promotes transparency and allows users to verify the platform's security measures.

Shanghai Upgrade’s Impact on DeFi

The Shanghai upgrade could potentially reduce the number of validators and the total value locked (TVL) on the Beacon chain as staking rewards are claimed and assets are unstaked.

However, some argue that allowing ETH unstaking will increase the amount staked as more individuals and institutions participate.

Due to a lack of deep liquidity, a large majority of the LSDs so far have not been utilized effectively because of the risk of depeg in the price of the token when compared to ETH.

For example, taking stETH, the most liquid token, it has not been trading at 1:1 on many occasions when there were liquidity issues in the market. This led to a lot of discussions around liquidations due to leveraged stETH positions on mainnet.

The rising popularity of liquid staking derivatives is one reason for this belief. As more stETH holders want to use their tokens to seize opportunities in the decentralized economy, the total addressable market for Raft's R stablecoin expands.

R stablecoin offers an innovative and capital-efficient solution for users to transform stETH into a more productive asset without giving up their yields.

Increased competition among validators may also lead to higher yields for stakers, with Lido likely remaining at the forefront of innovation. Raft's R stablecoin holders will be in a unique position to benefit from the Shanghai upgrade, providing them with a flexible and capital-efficient solution for borrowing stablecoins while earning yield on their stETH.

Conclusion

The Shanghai upgrade is a big event for Ethereum, affecting many areas like staking, the amount of ETH available, competition in staking, and new ideas in the Ethereum staking world.

The upgrade's effect on Ethereum's price in the short term is hard to guess, as it depends on what most validators decide to do with their rewards and unstaked assets. The market is always changing and can be surprising.

However, to make sure the upgrade doesn't cause too much trouble for Ethereum's price, there's a limit on how much can be withdrawn each day.

In short, the Shanghai upgrade brings lots of changes and opportunities for the Ethereum network and its users. Raft is ready to capitalize on this, bringing a more capital-efficient way for ETH stakers to borrow seamlessly and safely.

Find here more info about what are we building on Raft and our innovative features, like One-Step Leverage.

Jump on board the Raft Discord and get involved in the R-evolution of decentralized finance.

Useful Links

-

Website: https://www.raft.fi/

-

Twitter: https://twitter.com/raft_fi

-

Telegram Channel: https://t.me/raft_fi

-

Telegram Group: https://t.me/raft_chat