In the world of DeFi, capital efficiency is the lighthouse that guides every investor's journey.

Capital efficiency is about maximizing the returns on invested capital and minimizing risk at every stage. Raft has introduced an innovative approach to capital efficiency through its unique stablecoin, R.

The Pursuit of Capital Efficiency in DeFi

Capital efficiency is the touchstone of DeFi. It revolves around the optimal use of funds, where every asset is put to work to generate the best possible returns.

Raft's launch of R represents a significant leap forward in the realm of capital efficiency. Backed solely by stETH (Lido Staked Ether), R provides a capital-efficient way to borrow against your stETH, offering deep liquidity and maintaining a stable peg to the USD.

The Economics of Borrowing R

Borrowing R is straightforward and cost-efficient. After depositing either stETH or wstETH (wrapped stETH) as collateral, users can borrow R with a collateralization ratio of at least 110% for each R borrowed.

The best part: R can be borrowed for free!

R vs Others

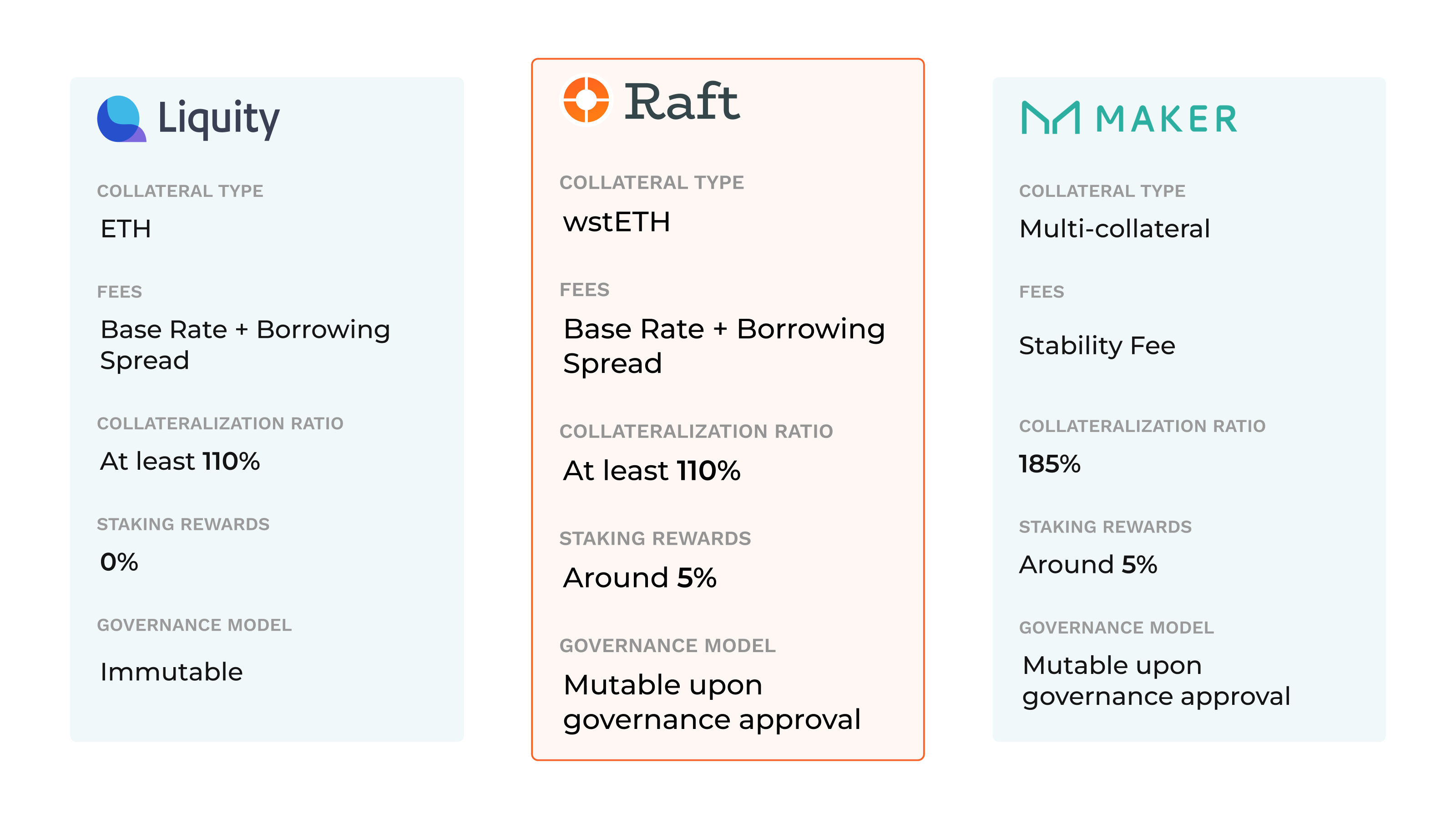

Although R draws inspiration from other stablecoins like DAI and LUSD, it distinguishes itself by adding improvements in several key areas:

-

R is solely backed by staked ETH, offering a more capital-efficient approach to borrowing and lending.

-

R features a more efficient liquidation mechanism compared to DAI and LUSD.

DAI, for example, is a decentralized stablecoin that is over-collateralized with various types of cryptocurrency assets. R improves upon this by using a censorship-resistant asset as collateral that eliminates the risks associated with backing a stablecoin with centralized assets. R also introduces flexible fees, which makes it more attractive for users seeking to borrow against their collateral.

On the other hand, LUSD, a stablecoin issued by Liquity, also offers loans against ETH collateral, which does not accrue any yield to borrowers. R allows users to deposit wstETH as collateral and earn staking rewards without compromising on the intrinsic features that make ETH a perfect collateral asset.

In terms of collateralization ratio, R can be borrowed by posting at least 110% of the borrowed dollar amount as collateral. This ratio makes R as efficient as LUSD and more efficient that DAI.

Like DAI and LUSD, R does not make compromises when it comes to security. All Raft smart contracts have been fully audited by Trail of Bits and Hats Finance.

Wrap Up

Raft's introduction of R is an important milestone in the pursuit of capital efficiency in DeFi. As we continue to navigate the currents of this dynamic financial landscape, it's clear that protocols like Raft are pivotal in steering us toward a more efficient, decentralized future.

DAI and LUSD are stablecoins that paved the way for many DeFi applications, and R improves on them by adding several unique features. Users interested in borrowing against their cryptocurrency collateral should consider their individual requirements and preferences when choosing between these options.

Now it's your turn to set sail. Join us at Raft and experience the benefits of capital efficiency with R.

Jump on board the Raft Discord and get involved in the R-evolution of decentralized finance.

Useful Links

-

Website: https://www.raft.fi/

-

Twitter: https://twitter.com/raft_fi

-

Telegram Channel: https://t.me/raft_fi

-

Telegram Group: https://t.me/raft