MON Protocol Turns Treasury Into Yield With XSY’s UTY Vaults

TL;DR MON Protocol has moved a strategic portion of its treasury into UTY, the synthetic dollar issued via XSY’s Yield Lab. The partnership converts volatile holdings into a stable-value asset that has earned 11% APY on-chain and ready for scale.

Treasury Management:

Managing a corporate treasury today means stitching together multiple venues, wallets, and risk models, all just to eke out a few extra basis points. XSY collapses that complexity into one vertically integrated stack:

Origination – We design the strategies in-house, seeding them with our own capital.

Curation – Risk desks and real-time telemetry minimize hidden exposures.

Distribution – Treasuries mint and hold a single token and collect yield, full stop.

The result is above-market, risk-adjusted yield without the operational overhead that usually comes with on-chain opportunities. MON Protocol & Avalanche Foundation are among the first public treasuries to harness this end-to-end model.

Why MON Protocol Chose UTY

MON Protocol’s treasury isn’t just a war-chest; it’s months of team salaries, server costs, and community prize pools. During the regular crypto market whiplash, treasury leaders see their balance sheet swing -30% in one week, forcing last-minute hedges that cost time, yield and distract from their core business.

The mandates that follow are blunt: “Match, or beat, T-bill returns, keep everything on-chain and never expose us to another 3 a.m. liquidity scramble.”

After mapping the universe of CeFi lenders, DeFi pools, and cross-chain bridges, one clear gap emerged: no single venue combined principal protection, superior yield and operational simplicity.

XSY’s vertically integrated stack checked all three boxes enabling MON Protocol to trade in fragmentation for one simple solution.

“Our priority is building gameplay, not juggling treasury risk. UTY gives us a principle protected yield structure so we can spend more time and resources developing our product, all the while deepening our belief and participation in the Avalanche ecosystem.”

— Giulio Xiloyannis, CEO, MON Protocol

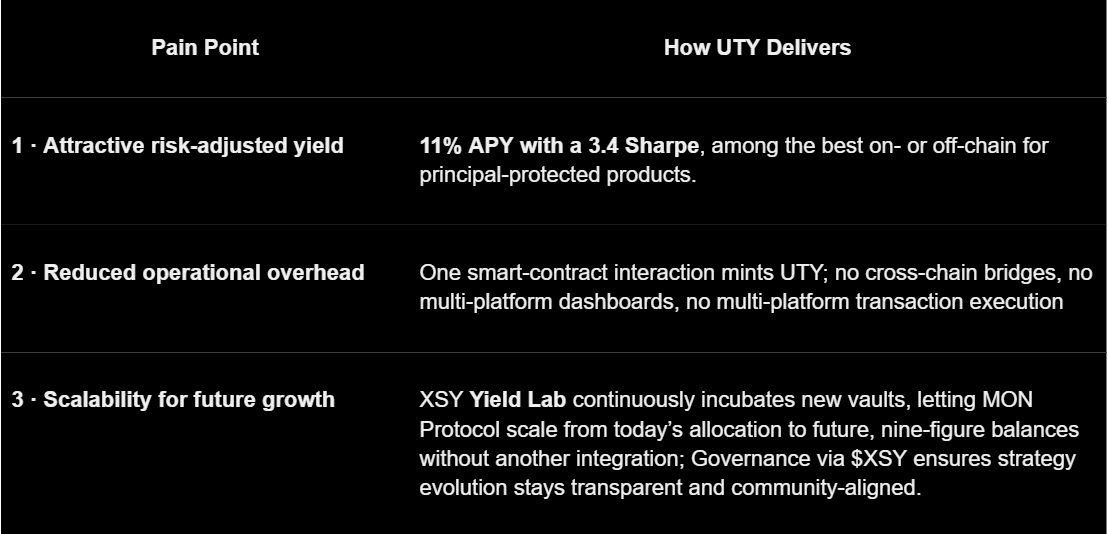

MON Protocol’s finance team mapped its pain points into three buckets: yield quality, operational drag, and future scalability. UTY checked every box:

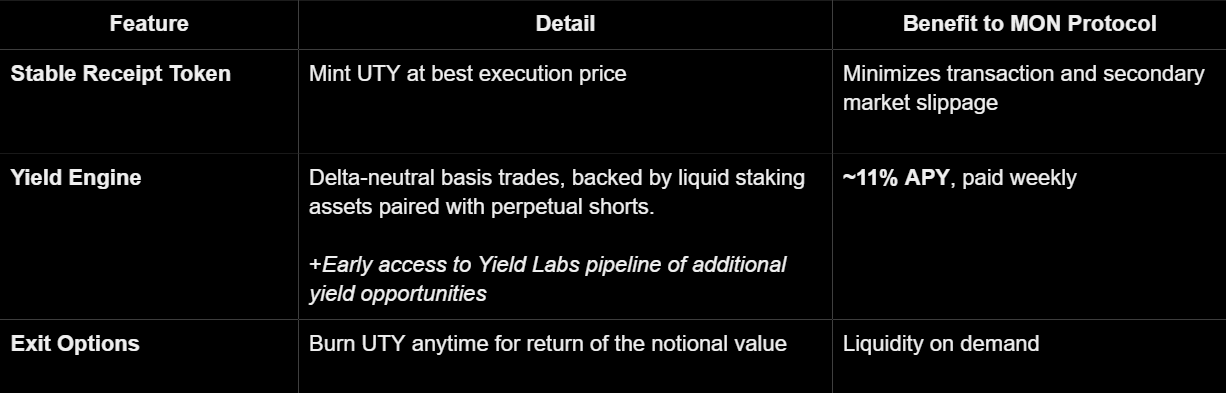

How UTY Works & What MON Protocol Gets

“MON Protocol’s choice validates our originate–curate–distribute model. Their community can now play harder, knowing the treasury is being put to work efficiently.”

— David Markley, COO, XSY

Next Steps

Treasury leads — Book a 30-min call to learn more about XSY’s unified platform; info@xsy.fi