Introduction

Investors nowadays seek new ways to leverage their assets with a fluctuating market of buying, selling, and trading NFTs. However, it is met by the difficulty of accessing liquidity for blue-chip NFT holders, problems with maintaining community growth, and limitations to yield generation on NFT assets owned by Metaverses landowners and developers. Then enter fractionalized ownership, staking, and NFT's hottest new sector: lending.

This research article will mainly focus on exploring the Lending sector in NFT Market.

NFT lending solves the liquidity problem of NFTs by providing immediate crypto payment in exchange for one's NFT. It also provides investors with a means to generate non-taxable income. In most cases, NFT lending is executed autonomously by smart contracts on the blockchain. There are four main models, each with its pros and cons.

NFT Lending Models

Peer-to-Peer

Peer-to-peer (p2p) lending markets offer the most flexible structure and allow for the broadest range of accepted collateral. The platforms such as NFTfi runs a system to allow anyone to make loans and set terms without a centralized or third-party intermediary. Once a deal is struck, NFT is moved into the protocol's smart contracts and held in escrow until the expiration of the loan. The loan duration is fixed for the entirety of the loan. Lenders may take the NFT collateral into their possession if a borrower defaults on a loan or negotiate a different repayment schedule.

Peer-to-peer lending is among the best options for lenders and borrowers due to its convenience and security, especially for several significant aspects:

-

Oracle is not required.

-

The system is scalable across different classes and categories of NFT.

-

Token loans (ETH and DAI) are issued in widely accepted tokens.

-

Risk-free for the protocol if NFT is sold to marginal buyer upfront.

However, it is not the fastest method since a lender must be willing to work with a borrower on a mutually agreed-upon schedule. And without market makers (professional lenders), it is hard to scale liquidity.

Peer-to-Pool

In peer-to-pool lending markets, users trade with a pool of assets sourced from a distributed and often permissionless set of lenders. Borrowers deposit their NFT collateral into a smart contract and draw a loan at a variable interest rate. The loan duration is inconsistent, with LTV and liquidation ratio configured by governance.

Peer-to-pool lending platforms like Pine offer speed but lose flexibility. They also assign value based on floor prices, limiting the number of capital owners can access. NFTs are illiquid and can be manipulated more efficiently than other tokens, so teams run their own centralized oracles. On other platforms like Drops, lenders can select the type of NFT collateral they want lending exposure to and the protocol to isolate and contain the idiosyncratic risk of any particular collection.

For the peer-to-pool model, there are several advantages worth mentioning: white-listed NFT collateral has strong liquidity; with the capability to scale through pooled liquidity; in the case of loans issued in widely circulated tokens, and isolation of risks across different NFT classes/categories. However, it is less capital-efficient than peer-to-peer models due to the borrower/lender mismatch and the exogenous oracle required.

Peer-to-Protocol

Peer-to-protocol NFT lending works similarly to Defi lending, where protocol coins are lent directly to lenders. Peer-to-protocol NFT platforms require coin deposits into the pools from liquidity providers. The borrowers can then automatically access their liquidity after locking their NFTs in a digital vault that works on a smart contract.

Borrowers usually lock their NFTs in a CDP(collateralized debt position) and receive pUSD in return for repaying the loan. To ensure the solvency of lending protocols, liquidation ratios prevent loans from exceeding the values of underlying collateral by guaranteeing the value of a loan does not exceed that of the collateral underlying the loan.

This model has the following advantages: when NFT collateral is whitelisted, it provides instant liquidity, and the marginal cost of loans is zero. However, some drawbacks are also listed:

-

Borrowing is only possible with native stablecoins.

-

For stablecoins to be helpful to borrowers, they need to gain adoption/acceptance outside the protocol's internal ecosystem.

-

NFT collateral is bundled as part of the protocol.

-

Scalability across classes and categories of NFT is more complicated.

-

It is necessary to consult an exogenous Oracle.

Rentals & Leasing

NFT renting differs from the other three structures in that the holder of an NFT leases out the NFT in exchange for upfront capital. By renting NFT utilities, such as members-only content, events, and tickets, you can access some premium NFT features more affordably than purchasing them outright. Many NFTs are unused by their owners for most days or weeks, thus wasting their utility. Thus, NFT renting has opened up a secondary economy in the NFT industry.

A platform such as ReNFT works similarly to peer-to-peer marketplaces, enabling renters and tenants to transact without needing permission. NFT rentals are facilitated by smart contracts and involve transferring an NFT to another person's wallet for a specified period. There are no repayment terms, interest, or worry of liquidation, and lenders generally give lenders access and credibility.

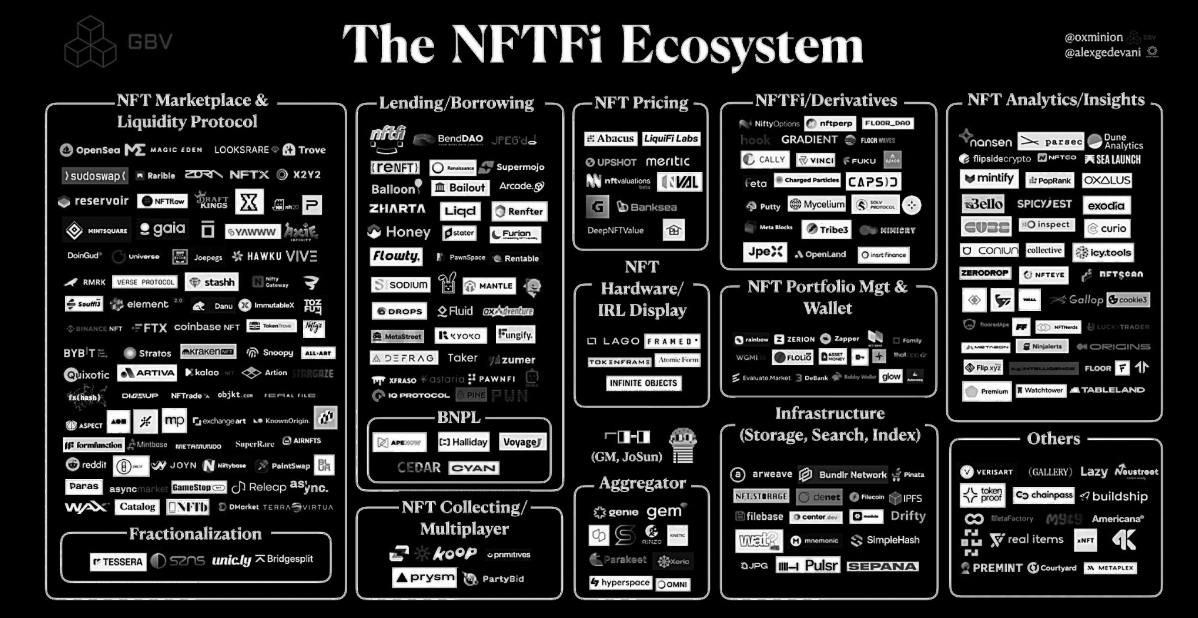

Ecosystem Mapping

P2Peer Leading Firms

NFTfi.com

Stephen Young founded NFTfi, a platform for getting cryptocurrencies loans on NFTs and offering loans against NFTs. The loan gets paid back with interest to the lender, while the NFT returns to the borrower's wallet. Currently, 20% of loans on the platform get defaulted on, but most are lower-value loans. NFTs are acquired by funding loans that users hope will default on. Young claims NFTfi is helping borrowers by including features that allow term negotiations and extensions. The platform has transacted over 1,500 loans and earned over $500,000 in interest. NFTfi.com was founded at the beginning of the COVID-19 pandemic with seed funding of $890,000. The British Virgin Islands is now the company's jurisdiction. NFTfi plans to use the money to fund its decentralization efforts, grow its team, launch new product features, expand its platform across other blockchains, and invest in its community. (Discord Twitter)

Arcade

Arcade. xyz, the leading decentralized lending marketplace for NFT collateral, launches Arcade V2, which features upgrades to the underlying protocol and an app redesign. With an escrow system, users can access fixed-rate loans collateralized by Ethereum-based NFTs on the platform. According to CoinDesk, Arcade has $15 million locked up in blue chip NFTs and $6 million in loan volume, with loans averaging $350,000. (Bored Ape Yacht Club, CryptoPunks, and Doodles, among others, are regarded as blue-chip NFTs.) Arcade raised $15 million in a Series A funding round led by Pantera Capital in December. (Discord Twitter)

P2Pool Leading Firms

Pine Protocol

Pine Protocol was founded by Alex Ho. By utilizing NFTs, users can borrow cryptocurrencies in real-time using their assets as collateral. Currently, the platform supports OpenSea and LooksRare. Pine has facilitated over $2 million in loans since it launched its alpha version in February and its official product launch at the end of April. Tech in Asia reports the company has raised US$1.5 million in a seed round led by Sino Global Capital, Amber Group, and Spartan Group. Among the investors were Alameda Research, Gate Ventures, Impossible Finance, and Shima Capital. (Discord Twitter)

BendDAO

BendDAO is the first decentralized peer-to-pool liquidity protocol for non-fungible tokens. NFT owners can deposit their assets on BendDAO as collateral and borrow loans in ETH. However, A misalignment between borrowers and lenders has led BendDAO to stop accepting ETH deposits and require borrowers to pay 100% interest on any ETH borrowed. Following the liquidation crisis, pseudonymous BendDAO co-founder CodeInCoffee wrote in a governance proposal. The proposal passed quorum with 97.13% votes in favor of changes at the time of publication and will see the liquidation threshold for the collateral drop from 85% to 70%, the auction period shortened from 48 hours to 4 hours, and the interest base rate adjusted from 100% to 20%. (Discord Twitter)

Drops DAO

Drops DAO is a community-driven, trustless loan platform for NFTs. In early 2021, Darius Kozlovskis initiated Drops DAO. It is a financial primitive for NFTs that uses cryptocurrencies as collateral for loans. The project has raised $1 million in seed capital funding from top investors in the crypto space, including Enjin CEO Maxim Blagov. Drops DAO provides decentralized loans for NFT, metaverse, and Defi assets by leveraging its lending pools. Users can use up to a 60% collateral ratio and a highly scalable network to borrow or supply tokens as collateral. (DiscordTwitter)

P2Protocol Leading Firms

JPEG’d

JPEG'd designed the protocol, which enables NFT holders to use their NFT as collateral. Users can deposit their whitelisted NFT into JPEG's smart contract as collateral and use it to take advantage of the lending mechanism. Once this NFDP opens, JPEG mints a synthetic stablecoin $PUSd matching the loan amount and sends the $PUSd to the user. Users can then deploy their stablecoin loan elsewhere while their NFT remains locked to the JPEG platform. This effectively transforms the NFT from a static work of art into a revenue product, and once the user has used up their loan, they will repay the principal and accrued interest, and they will get their NFT back from the JPEG vault. And to improve liquidity, JPEG DAOs initially acted as the primary liquidity provider. The agreement uses various mechanisms to incentivize the wider community to provide additional mobility. This is especially important for maintaining $PSUd at parity with the dollar and enabling users to easily convert $PUSd to other stablecoins with as little slippage as possible. (Discord Twitter)

UnUniFi Protocol

UnUniFi Protocol offers a decentralized cross-chain NFT marketplace and platform with auto Defi yield. They automatically operate the issued stablecoins and can receive rewards. They allow small amounts to be borrowed against NFTs for short loan periods. The UnUniFi Protocol uses GUU ($GUU) for governance or commission. GUU is a cryptocurrency that rewards users who mint JPU and plays a vital role in the UnUniFi Protocol's governance. Users can vote to change specific software parameters by owning and staking GUU. UnUniFi Protocol allows cryptocurrency owners to borrow against their assets and receive other collateral, which can be used to purchase goods and services. (Discord Twitter)

Rentals Leading Firms

IQ Protocol

IQ Protocol for NFTs provides a platform for token holders to rent out their NFTs to other users, creating a more sustainable economic model. IQ Protocol's model for NFT lending and borrowing is built to be risk-free. Instead of giving the original asset to the borrower, a wrapped version of the NFT is given to the borrower, who returns the original NFT to the owner after the rental period. It is called the contract deployed to create eligibility for chosen NFTs a Warper because it "warps" the original asset and makes a wrapped expirable version for the person renting. It has reached a $12m fundraising round led by Crypto.com Capital and partnered with 30+ blockchain and GameFi in 2022 alone (with no signs of slowing down!) (Discord Twitter)

Landworks

LandWorks is a metaverse land renting marketplace based on Ethereum. It enables landowners to earn passive income on their assets, and renters easily leverage metaverses. EnterDAO and the $ENTR token govern the protocol. Any lender can charge rent using ETH or USDC. The protocol can be changed with a passing governance proposal. LandWorks protocol is a two-sided market in which lenders and renters trade tokens. A yield farming program is developed to provide liquidity. The LandWorks NFT token is issued to the land depositor once a given land is listed in the protocol. (Discord Twitter)

Others

Pool Delegate Mechanism - MetaStreet

One exciting model in NFT lending to emerging that strikes a compromise by leveraging both the benefits of peer2peer marketplaces and peer2pool marketplaces, no oracle requirement, and pool capital, respectively, is the pool delegate model pioneered by Metastreet. Metastreet uses a pool delegate system to allow lenders to aggregate capital, which allows for scale. Maple uses a similar approach for loans uncollateralized on-chain but secured through legal agreements that give lenders off-chain guarantees.

In February 2022, MetaStreet secured $3 million in seed financing and $11 million in initial protocol liquidity to jumpstart the expansion of the quickly developing collateralized NFT lending market. Regarding collateralized NFT volume, MetaStreet is the largest capital provider on NFTfi.com. This funding round was led by Dragonfly Capital, with participation from several strategic investors, including Ethereal Ventures, Sfermion, Nascent Capital, etc. (Discord Twitter)

Reference

(n.d.). Retrieved November 9, 2022, from https://www.techinasia.com/exclusive-nftbacked-crypto-loan-protocol-raises-15m-seed

Ape, P. (2022, February 28). What is JPEG'D? Retrieved November 9, 2022, from https://www.apewell.com/post/what-is-jpeg-d

Cherry crypto - NFT lending models. (n.d.). Retrieved November 9, 2022, from https://www.cherry.xyz/writing/nft-lending-models

Genç, E. (2022, May 11). What is NFT lending? Retrieved November 9, 2022, from https://www.coindesk.com/learn/what-is-nft-lending/

IQ protocol: NFT renting - medium. (n.d.). Retrieved November 9, 2022, from https://blog.iq.space/iq-protocol-nft-renting-ac59cb215592

Labs, M. (2022, February 08). MetaStreet raises $14 million in SEED & initial liquidity capital to help NFT debt scale. Retrieved November 9, 2022, from https://www.prnewswire.com/news-releases/metastreet-raises-14-million-in-seed--initial-liquidity-capital-to-help-nft-debt-scale-301478074.html

Liu, B. (2022, August 23). Benddao proposes emergency changes during liquidity crisis. Retrieved November 9, 2022, from https://blockworks.co/dao-liquidity-crisis/

Looking for liquidity? here's everything to know about NFT lending. (2022, August 18). Retrieved November 9, 2022, from https://nftnow.com/guides/looking-for-liquidity-heres-everything-to-know-about-nft-lending/

NewsBTC. (2022, May 06). Drops Dao launches mainnet to allow borrowing of NFT-collateralized loans. Retrieved November 9, 2022, from https://www.newsbtc.com/news/company/drops-dao-launches-mainnet-to-allow-borrowing-of-nft-collateralized-loans/

Protocol, U. (2022, June 10). What is ununifi protocol? Retrieved November 9, 2022, from https://medium.com/@ununifi/what-is-ununifi-protocol-8a5b502ffe41

Tan, E. (2022, January 31). Arcade launches NFT lending platform as blue chips hold strong. Retrieved November 9, 2022, from https://www.coindesk.com/business/2022/01/31/arcade-launches-nft-lending-platform-as-blue-chips-hold-strong/

Todorov, Z. (2022, January 21). A decentralized protocol for renting virtual land in the Web3 metaverse. Retrieved November 9, 2022, from https://medium.com/enterdao/a-decentralized-protocol-for-renting-virtual-land-in-the-web3-metaverse-ca61bf32a443