1. Project Overview📝

Introduction

Terra is a public blockchain protocol that deploys a set of algorithmic decentralized stablecoins to support a thriving ecosystem bringing DeFi to the masses.

Terra Protocol, established in January 2018, is an algorithm-based stablecoin protocol dedicated to providing a stablecoin system with stable prices and wide adoption.

"Terra" refers to the stable coins in the system. Unlike MakerDAO, Liquidity, and other currency protocols, which mainly focus on minting stable coins pegged to the US dollar, Terra aims to provide a richer set of currency combinations from the very beginning. Meet the needs of stablecoins in different regions and scenarios. The Terra protocol currently offers several stable coins pegged to the U.S. dollar, South Korean won, Mongolian tugrik, Thai baht, and the International Monetary Fund’s Special Drawing Rights (SDR). However, in terms of issuance, UST is still the most important stable currency of Terra Protocol.

In addition to the rich variety of currencies, the bigger difference between Terra and Maker is that it is not limited to a coinage or lending protocol, but tries to build and introduce a larger financial service system around its underlying currency system. Therefore, the Terra protocol is essentially developing Towards a public chain ecosystem focusing on DeFi.

Terra is a stable coin blockchain protocol. The main function of its native token, Luna, is to maintain the stablecoin anchoring algorithmically through the pledge and destruction mechanism. It can be regarded as an elastic stablecoin system. The characteristic is that the stablecoin in the Terra system can be benchmarked against various real assets such as USD, KRW, and EUR. The native token, Luna, has pledge, dividends, and voting rights.

Terra initially focused on the Asian e-commerce payment space and launched its mobile payment app CHAI in South Korea with an annual transaction volume of nearly $1 billion. In 2018, it received joint investment from Binance, Huobi, OKEX, Upbit, etc. Its founder Daniel Shin is the founder of the Korean e-commerce platform TMON, which is currently the second-largest e-commerce platform in Korea. Other team members have excellent technical and business skills. Sustained attention.

Current market cap

- LUNA:41B

- UST:17B

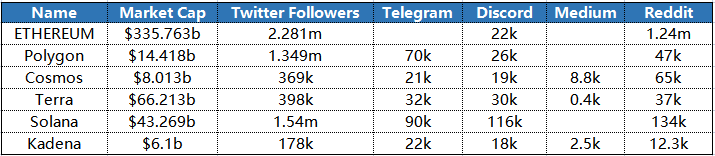

2. Communities📱

3. Team💻

The main body of Terra's core team is Terraform Labs, which we can understand as the existence of Block.one relative to EOS. This team is the creator and core driving force of the Terra project.

Founders

There are two main founders of Terra: Daniel Hyunsung Shin and Do Kwon.

Daniel Shin is the co-founder of Terra, and in Terra's early coverage he was featured frequently in the news as the company's founder. Daniel himself is a well-known entrepreneur in the Korean e-commerce field. He graduated from the Wharton School of the United States and is also the founder and chairman of the Korean e-commerce platform TMON. Founded in 2010, the platform focuses on group buying and has about 9 million users as of 2020. According to news reports, it is the second largest e-commerce platform in South Korea.

But starting in 2020, Daniel Shin gradually faded out of Terra’s external publicity, and the team’s external spokesperson became another co-founder, Do Kwon.

Terra's CEO and co-founder Do Kwon graduated from Stanford University with a major in computer science and was selected as "Forbes 30 Under 30" in 2019. He founded the messaging app Anyfi in January 2016, but quit in October 2017. Beginning in 2020, Do Kwon has stepped up to the front of the stage as the company's main spokesperson, often appearing in media and community AMAs to communicate with everyone.

Terraform Labs, the company behind Terra Protocol, is based in Seoul, South Korea and has a company size of about 50 people. This is not a small team for an encryption company.

In terms of personnel distribution, most of Terra's employees work in South Korea, but there are also many employees in the United States. The highest proportion of jobs are developers, followed by BD, finance and marketing. The staff's majors are also concentrated in the fields of computer, mathematics, finance and so on.

Terra's team does not come from the encryption field like other DeFi and public chain teams, but mostly from the Internet business background. At present, the team has also made full use of this advantage, using its own industrial resources to continuously embed the Terra ecosystem into large-scale Internet products through payment applications.

Investment capital

Figment Networks、Arrington XRP Capital、Binance Labs、OKEx、Huobi Capital、Polychain Capital、FBG Capital、Hashed、Kenetic Capital、TransLink Capital。

4. Tokenomics

Token

As the core token of Terra, Luna has three main functions for token holders:

Governance tokens: used to initiate proposals, and vote on proposals for important parameters and rule adjustments of the protocol, financial sponsorship, etc.;

Staking to get rewards: By staking Luna to the validator, you can get the gas fee of the Terra network, the stable currency tax and the minting of Luna;

Minting assets: If users want to mint new Terra stable coins, they must do it through Luna. This action is a bit similar to converting Luna into stable coins. This process is called minting coins. The Luna currently consumed by minting coins will be unified into the community pool. According to the official According to the plan, the Luna in the community pool will be destroyed after Terra Protocol's Columbus-5 mainnet goes online.

In addition, when Terra Station, Terra's official wallet client, converts Terra into Luna through the built-in Terra Swap function, the transaction fee will also be used to repurchase Luna and distributed to nodes as income.

Distribution

The planned total of Luna tokens is 1 billion, the actual total is about 995.41 million, and the current actual supply is about 415 million. The distribution of the tokens is as follows:

Terraform Labs (10%): Used to facilitate research and development of the Terra project.

Staff and Contributor Pool (20%): Used to compensate staff and contributors to the project.

Terra Alliance (20%): The Terra Alliance is critical to driving early adoption and usage of Terra. We will use this part of the prize pool to set up incentives, mainly market discount programs (such as user coupons) and batch incentives for affiliate partners.

Stable Reserve (20%): Bootstrapping stablecoins is not an easy task. The Stability Reserve will be used to manage the early stability of the network near its origin.

Supporters (26%)

Genesis Liquidity (4%)

Up to 70% of the total token volume has an unknown unlock time. In addition, Terra's browser function is extremely limited, and currently there is no function to query the Luna address ranking, holding ratio, etc., which further reduces the transparency of the project's tokens. This is worth the vigilance of investors. After all, clear and transparent rules and data disclosure are more reliable than relying on the moral self-discipline of projects.

5. Ecosystem🔄

1) Anchor

Anchor launched on Terra in March 2021. The selling point of this product is that it can provide a stable savings rate of about 20% per annum. Perhaps the 20% yield is not very attractive to crypto users who have experienced the DeFi mining boom, but it is very attractive to traditional world users in a low interest rate or even negative interest rate environment.

Anchor’s rate of return for savings users is relatively fixed, and the target rate can be adjusted by its community governance, currently 19.46%. Compared with the floating deposit interest rates of most DeFi products, Anchor's fixed interest rates are more in line with the financial management habits of traditional financial users. This high and stable "financial management product" is a crude and effective means of attracting new funds.

In the cryptocurrency bull market, due to the bubble in the valuation of various projects, the price of project tokens has also risen, coupled with the active speculation and arbitrage demand, the demand for stablecoin borrowing has greatly increased. This allows all kinds of mining income to remain in double-digit or even triple-digit for a long time. But when the crypto market entered a bear market, the value of the rewarded tokens fell, investment and arbitrage demand shrank, and savings income naturally fell sharply.

So how does Anchor keep its deposit rate around 20% for a long time?

There are two main reasons:

It only accepts assets with native staking income as loan collateral, such as Terra's core token Luna, and the recently supported stETH (through cooperation with staking service provider Lido). Therefore, Anchor can obtain additional staking income from collateral tokens to subsidize depositors.

Anchor launched a 4-year lending and mining mechanism after its launch. When the actual rate of return of the system (borrowing rate + staking income of mortgaged tokens) is lower than the target savings rate, the system will increase the intensity of borrowing and mining to stimulate borrowing behavior (essentially reducing borrowing rates through token subsidies) ), thereby improving the utilization rate of deposit funds, and finally raising the borrowing rate to the target savings range (such as the current 19.46%) to meet the income needs of depositors.

In addition to Anchor, Terra is also preparing Anchor-like products for different countries, including Tiiik, a savings app that also targets a 20% savings rate (which is preferentially open to users in Australia), and Saturn, a fixed-interest product targeting consumer apps. Money (supports GBP and EUR deposits), which also reveals Terra's ambition to expand to more regional users.

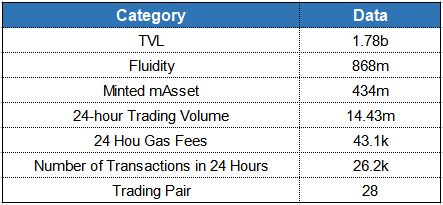

2) Mirror

Mirror Protocol is a decentralized synthetic asset protocol. It is incubated by Terra and uses Terra stablecoins as the main collateral to freely mint and trade various synthetic assets with a 150% mortgage rate. Synthetic assets are also called in the Mirror platform. are mirror assets (mAssets). The goal of mAssets is to simulate and track the price of any asset, from stocks to cryptocurrencies, giving investors a wealth of asset classes to choose from.

All mAssets on Mirror are paired with UST and can only be traded through UST, which provides a direct transaction usage scenario for UST.

In theory, the price of a synthetic asset is a "mathematical function" based on changes in the parameters of the underlying underlying. There is no actual value support, and there is no need to host the underlying assets (for example, the underlying assets of Tesla stock synthetic assets should be Tesla stocks), and are directly synthesized on the blockchain.

Therefore, synthetic asset smart contracts can be all-encompassing and add leverage, allowing for greater flexibility than traditional assets. The subjects it can cover include stock indices, individual stocks, interest rates, foreign exchange, commodities and commodity indices, and even alternative derivatives based on credit, housing, inflation, weather, etc., and there is great room for exploration.

This allows Mirror to theoretically meet the full range of investment needs of investors in the Terra ecosystem.

However, it should be noted that, unlike Synthetix's synthetic assets that use oracle machine quotations for direct transactions, Mirror's synthetic assets are traded through the AMM mechanism. On the one hand, it brings huge liquidity demand to UST, and on the other hand, it also causes problems such as high slippage caused by a large single transaction amount, which affects the user experience of the product.

In addition, Mirror currently enables liquidity mining, which brings additional income to this market, which was originally a zero-sum game, and is of great help to Mirror's initial rapid growth, but the value capture of MIR tokens and this The sustainability of the model remains to be seen.

At present, among the top five applications of Terra, the TVL of Mirror and Anchor accounts for nearly 98%. Unlike Anchor, which created Terra's stablecoin demand through high-interest fixed-income deposits, Mirror created a huge stablecoin demand for Terra through the liquidity mining of mAsset assets.

In addition to Mirror, Terra is also incubating other investment products to provide users with richer investment options. For example, at the end of March this year, Do Kwon, co-founder of Terraform Labs, said that he was developing an algorithmic ETF product Nebulas based on Terra ecology, as well as derivatives trading platform Vega and so on.