Layer 2 was created to solve the problems of L1 congestion and high gas fees. Now L2 networks with various technical architectures have emerged, but which application ecology is better? Which projects have a better user experience?

This article is about the performance analysis of each L2 chain written by Vitalik at the beginning of last year.

In general, my own view is that in the short term, optimistic rollups are likely to win out for general-purpose EVM computation and ZK rollups are likely to win out for simple payments, exchange and other application-specific use cases, but in the medium to long term ZK rollups will win out in all use cases as ZK-SNARK technology improves.

Top-ranked chains ( ranked by TVL ):

1. Arbitrum

Arbitrum is an Optimistic Rollup. It’s model likes Ethereum interaction, but with much lower gas fees than that in L1.

Since Arbitrum has not issued it’s native token, the only way to "invest" in Arbitrum is to participate in its rapidly developing ecosystem.

Because Optimistic Rollups assumes that transaction data is correct, rather than directly proving its correctness, Optimistic Rollups have a "challenge period" during which suspected fraudulent transaction data can be discovered and the transaction restored . This is why bridging funds from Ethereum (L1) to Arbitrum (L2) only takes about 10 minutes, while bridging funds from Arbitrum (L2) back to Ethereum (L1) can take about 1 week.

Arbitrum is an Optimistic Rollup L2 scalability solution for Ethereum. If you're new to cryptocurrencies, this might just be a bunch of puzzling words for you. We will try to avoid getting too technical and try to make this article easier to understand.

Basically, you can think of an L2 scalability solution as a blockchain network built on top of another blockchain. In the case of Arbitrum, Arbitrum is a blockchain network built on top of Ethereum. By building on Ethereum, Arbitrum enables cheaper and faster transactions while benefiting from the security of Ethereum.

Many of the Ethereum dApps and protocols that are the favorite of users are already deployed on Arbitrum. For example, Uniswap, Balancer, Ren, Multichain and Synapse have all been successfully deployed. If you're concerned about the slowdown in these deployments, DeFi yield aggregator Yearn Finance has also deployed on Arbitrum. Over time, more and more dApps and protocols will continue to launch on Arbitrum.

Many exciting new protocols and dApps are launching natively on Arbitrum. The three most successful projects so far are Dopex, GMX and TreasureDAO.

- Dopex

- GMX

- TreasureDAO

Reference: Arbitrum 上线 6 个月之后:有哪些值得关注的生态项目

2. dYdX

Aims to build a robust and professional crypto asset trading exchange where users can truly own their trades and ultimately the exchange itself.

On April 6, 2021, the Layer 2 version of dYdX was officially launched on Ethereum.

The dYdX open protocol is based on 0x, Ethereum and powered by smart contracts. In the DeFi derivatives trading protocol, dYdX is different from other common AMM models. dYdX adopts a relatively traditional order book model to provide users with top-level order types.

On August 30, 2021, the trading volume of dYdX in the past 24 hours exceeded US$1.04 billion, surpassing PancakeSwap V2 and Uniswap V3, and ranking first in the DEX trading volume rankings.

The advantages and disadvantages of dYdX are obvious.

Advantage:

Order Book Mode and Decentralized Contract Mode. In the field of decentralized derivatives, there are not many exchanges that can provide perpetual contracts, and dYdX has obvious advantages. Compared with centralized exchanges, dYdX does not have to worry about the platform doing evil, misappropriating user assets privately, running away, etc., and can avoid many potential moral risks. In addition, dYdX transactions do not require KYC, only an Ethereum wallet is required, and the transaction can be started by connecting, eliminating the cumbersome authentication steps.

Advantages over DEX:

From the business model point of view, dYdX cannot be simply defined as a DEX, and the data of its lending services is very eye-catching - the pool has issued a total of 17.4 billion US dollars in loans in 2020. Just comparing the trading business, the dYdX of the order book model not only has richer service types than the AMM-type DEXs on the market, but also has the user experience closest to the traditional CEX, such as spot trading, margin trading, and contract trading all support market prices , limit price, stop loss and other settings. On the question of why the order book was chosen, the development team of dYdX believes that the order book has a lot of successful experience in the history of cryptocurrency trading, and traditional market makers are more accustomed to using this model. In addition, compared with CEX, dYdX's "off-chain matching + on-chain settlement" design solves the former's security and transparency issues, and also ensures higher performance and response speed, sufficient to support larger user traffic.

Disadvantage:

The biggest limitation at present is that there are too few trading pairs supported. Whether it is spot, lending or derivatives business, except for stable currency trading pairs, dYdX only provides spot and leveraged trading services for ETH, BTC, and LINK. To meet the diverse investment needs of users, it is difficult to compete with other platforms. The development of specific businesses is also relatively backward, the spot business cannot compete with Uniswap, and the lending business is far behind the leading lending platforms such as Compound. Therefore, if the platform can continue to make efforts in the derivatives business, there may be certain opportunities in the future.

Secondly, the order book mode requires sufficient user volume and transaction depth. The reason why Uniswap adopts the AMM mode can solve the liquidity problem of small currencies and complete the cold start, while the order mode is difficult to attract small and medium projects, which is also the reason for the slow development of dYdX one. Finally, there is the issue of handling fees. dYdX adopts the off-chain transaction and on-chain settlement model. Although dYdX puts transaction matching out of the chain, most operations still need to be completed on the chain. When ETH breaks through a new high, the gas fee is high. Today, users need to call smart contracts for deposits and withdrawals. The handling fee is as high as tens of dollars, which is much higher than that of centralized exchanges. This is not friendly to small and scattered users, which limits the further development of dYdX to a certain extent. developing.

Recently, dYdX has mentioned many times that more new assets will be launched quickly. dYdX is also working with Layer 2 scaling project StarkWare to integrate its Layer 2 technology into dYdX contract products to further improve performance and address high gas fees.

3. Metis

Metis is an Optimistic Rollup chain equivalent to EVM, originally forked from Optimism. It powers multiple interconnected aggregates, with a primary focus on enabling easy creation of DACs (Decentralized Autonomous Companies).

Start time: 2021-05-13.

After launching at $5, METIS quickly rose to $8 through the first public distribution in the PAID Network’s IDO and Gate.io’s IEO. It then consolidated around $5 for three months before reaching as high as $300.

At 23:00 on November 19th, the Metis mainnet launched, and users could participate in mining about a week after the launch.

The emergence of Metis has become a new milestone in the history of Layer 2. Metis is a fork of Optimism that aims to make more improvements over its currently more popular competitor. Metis seeks to provide the standard benefits of Optimistic Rollups, such as low fees (<$1), high speed (less than a second), and Ethereum-level economic security. But beyond that, it plans to differentiate its platform by offering a more decentralized design, native data storage, faster withdrawals to the layer 1 Ethereum main chain, and improved usability for DApp providers.

While Metis uses a fork of Optimism's OVM, it adds some features aimed at improving the original design. These features include:

- Highly decentralized—different from centralized Optimism, Metis has designed multiple virtual machines (multi-chain) support, Peer Nodes, Sequcer Pool and other mechanisms, and opened verification nodes to the community. These decentralized measures will further improve Rollup security and avoid downtime like Arbitrum.

- EVM equivalent — the original smart contract does not require any changes.

- IPFS Integration — Cheaper data storage option than using ancillary solutions, faster validation when posting state changes to Ethereum thanks to Rangers.

- Polis Middleware - Provides templates and support for an improved development environment for novice developers new to cryptography.

- Multiple Execution Layers — Metis will allow DACs to spin up new MVM execution environments to scale capacity as block space requirements increase.

- Licensing Environment - DACs can customize access controls to their MVM instances.

In addition, Metis is unique in that:

- Everyone can publish on-chain DAOs or DACs, run and manage their own communities, applications and enterprises, and Metis is the tool to achieve all this.

- The Metis service is not limited to the DAO level, but also develops a standard module to measure everyone in the DAO, which includes wallets, RP, various attributes, and the basic Optimistic Governance (OG) mechanism.

When two people want to collaborate, Metis helps them build connection and trust and perform detailed tasks.

In addition to the functional advantages, the security aspect is also great: Metis is very secure, all business activities are carried out on the sidechain, and the privacy is very high and only visible to the collaborators involved. When the Layer-2 transaction is packaged and uploaded to Layer-1, the additional permission layer of game theory and Metis can ensure the security of the process.

Reference: 详解二层扩容方案 Metis 特性与竞争优劣势_MyToken

4. Optimism

Optimism is an EVM compatible Optimistic Rollup chain. Its goal is to be fast, simple and secure. With the November 2021 upgrade to "EVM Equivalent", OVM 2.0's old fraud prevention system has been disabled, while a new fraud prevention system is being built.

Optimism does not have a native token and has no plans to issue a native token in the short term, but it will happen sooner or later.

Optimism has 4 main benefits: EVM equivalence, data security, speed, and cost.

Optimism is one of the most EVM compatible chains, its focus is to go one step further and be EVM equivalent. Optimism is able to support any Ethereum application using its Optimistic Virtual Machine (OVM), which is an EVM-compatible virtual machine. Developers are able to deploy any Ethereum-based dApp onto Optimism with little to no architectural changes. This allows decentralized applications (dApps) built on Ethereum to seamlessly integrate on Optimism.

Optimism’s transactions are also cheap, at a fraction of the cost of Ethereum transactions. Currently, Optimism’s base transfer fee is $1.66, while Ethereum’s base transfer fee is $8.77 (see live fees here). The Optimism team estimates that they have collectively saved more than $335 million in gas fees from transactions processed on the network.

Optimism has 3 major drawbacks: long and costly withdrawals, potential incentive misalignment among network participants, and underlying L1 censorship transactions.

Large Ethereum-based dApps such as Uniswap and Synthetix are already deployed on-chain and fully operational. Optimism has a growing native ecosystem that includes DeFi projects like Rubicon Finance, and an already up and running NFT marketplace: Quixotic. Several NFT collections have appeared on Optimism, with the top three being OptiPunk (a derivative of CryptoPunks), Optimistic Bunnies, and OldEnglish. The most popular dApps right now are DeFi dApps; 50% of the top 10 are DeFi apps by log occurrence. The log occurrence rate refers to the number of times an entity's smart contracts are successfully executed.

Reference: Optimism:为以太坊的「乐观」未来铺路

5. zkSync

zkSync is a user-centric zk rollup platform from Matter Labs. It is a scaling solution for Ethereum and already exists on the Ethereum mainnet. It supports payments, token swaps, and NFT minting.

Version 1.0 will be launched in early 2021, with only deposit, transfer, and nft functions; the zkSync 2.0 test online will be launched on June 1, and the official website has not yet been launched.

zkSync 2.0 is an EVM-compatible ZK Rollup built by Matter Labs and powered by zkEVM developed by Matter Labs.

And zkSync 1.0 has been online payment for nearly 1.5 years, zkSync 1.0

- Reduce the mainnet transfer cost by about 50 times;

- Completed nearly 4 million transactions;

- 98% of transactions in the last 4 rounds of Gitcoin donations use zkSync.

If 2022 is indeed the year of Tier 2, it will be a huge opportunity.

One of the most promising L2 solutions is zkRollups. Some industry leaders have called them the Holy Grail of Ethereum scaling.

Why?

They have an interesting design feature that the more transactions they process, the cheaper they are. It turns the blockchain trilemma upside down.

One of the leaders of zkRollups is zkSync. They are in the early stages, but it is very likely that it will reach full production on mainnet soon.

zkSync is building an open protocol for "decentralization" and "elastic optimization". We aspire to be fungible: even if Matter Labs disappears or is compromised, the web should thrive. Our primary target audience is 1) people using blockchain to achieve financial sovereignty, and 2) decentralized protocols built for these people.

What are the main differences between zkSync 2.0 and optimistic rollups (e.g. Arbitrum, Optimism)?

Significantly higher security

ZK rollup removes the reliance on watchers and replaces the economic security of game theory with cryptographic security - you trust pure mathematics rather than incentivizing participants.

Higher capital efficiency

In OR, native withdrawals of any asset take a long time (best case: 1 week). This is a security parameter that cannot be reduced without an exponential drop in security.

For homogenized tokens, this problem can be mitigated by having a lot of idle liquidity on the other side of the bridge. To compensate for the opportunity cost of funding, users are required to pay for bypassing the waiting period.

For smaller funds this may be acceptable, but for professional traders this already constitutes a huge cost and will be reflected in their profit margins. This solution is not efficient for institutions that need to transfer large amounts of liquidity (billions) between L1 and L2 on a regular basis, as liquidity providers are unlikely to let so much money sit idle.

User experience of NFT

Native withdrawals of NFTs cannot be accelerated - liquidity provider solutions do not apply because NFTs are unique. So, to withdraw NFTs, users have to really wait 1 week or more.

In zkSync, any withdrawal will be completed between 15 minutes and 3 hours, when there is more activity, the withdrawal time will be faster.

Transaction costs

For most popular cryptographic use cases, ZK Rollups are cheaper because it requires the least amount of data to be published on-chain (no signatures and transaction parameters).

However, for some common use cases, the cost savings are orders of magnitude larger. Specifically, ZK Rollups only need to publish final changes to the state, and since many transactions go into the same storage slot, the cost can be amortized. For example, all transactions in the same block and oracle update transactions have zero data availability cost.

Finally, zkSync 2.0 will have an extension called zkPorter, which offers flat transaction fees of 1-3 cents by putting data off-chain. Optimistic rollups fundamentally cannot have such off-chain data availability scaling, because without public data, observers cannot verify the validity of each transaction. Therefore, it is impossible for them to offer such a hybrid system to users who prefer ultra-low fees to security.

Reference:

Differences between zkSync and StarkWare:

Reference: 专访 Matter Labs 团队:zkSync 2.0 如何在 L2 赛道脱颖而出?_MyToken

How does Optimism compare to Arbitrum?

Optimism and Arbitrum are both Optimistic Rollups

Optimism was the first solution to invent the EVM-compatible Optimistic Rollup protocol, but Arbitrum released it earlier.

Their main difference is their fraud prevention logic:

Optimism opts for non-interactive fraud proofs, which re-execute the entire transaction and perform the required computations on L1 to find out the truth.

Arbitrum opts for interactive fraud proofs, which only perform specific steps that are disputed on L1. Disputes were dissected and broken down until the exact steps that led to the disagreement surfaced. The parsing is performed by the Sequencer and the validator, and only the specific steps that narrow the dispute to are computed on L1 to determine the correct final state.

The benefits of non-interactive fraud proofs are simpler designs and do not require the parties involved to coordinate with each other, which in turn makes fraud proofs instant. Interactive fraud proofs require two or more parties to work together to dissect the challenge and take longer to resolve. The downside is that computing the entire transaction on L1 is much more expensive than a single step. There is also a limit to the size of blocks and transactions (based on L1) that can be effectively verified in the non-interactive approach, which the interactive approach does not face since only a single step needs to be verified. Optimism is currently working on moving to an interactive fraud prevention model equivalent to EVM.

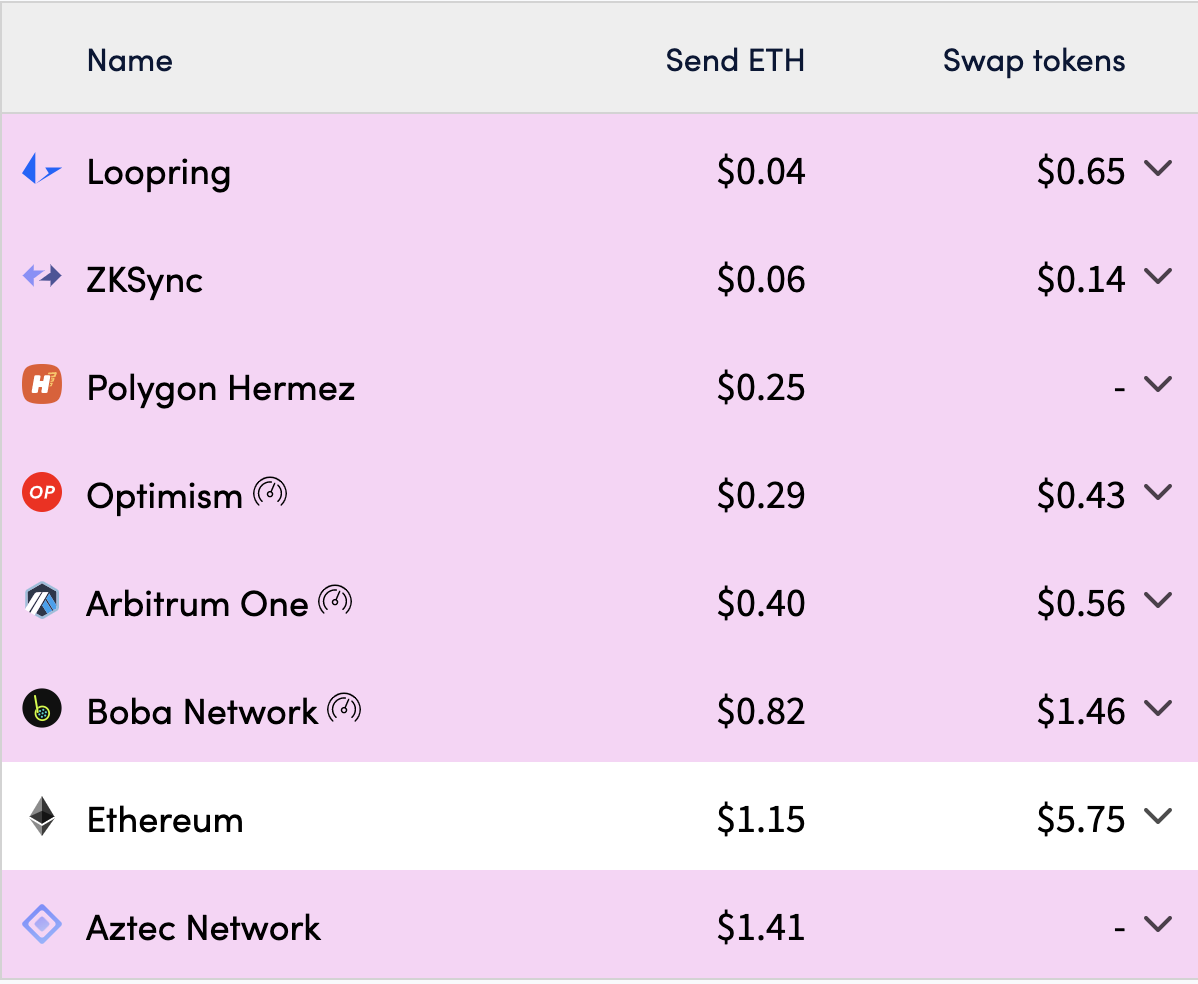

How much does it cost to use Layer-2?

Conclusion

Among the above five projects, zksync, Optimism, and arbitum have not issued native tokens so far. Participating in their ecology projects may have more opportunities to get rewards.

The five projects all use the rollup solution, but they are different. There are OR and ZKR. Each has different advantages and disadvantages. The L2 that uses OR was launched last year, and ZKS will wait until this year.

Each project has worked hard on its own shortcomings, and I believe it will be well resolved.

Finally, quote the judgment of Vitalik again:

In general, my own view is that in the short term, optimistic rollups are likely to win out for general-purpose EVM computation and ZK rollups are likely to win out for simple payments, exchange and other application-specific use cases, but in the medium to long term ZK rollups will win out in all use cases as ZK-SNARK technology improves.

However, compared with technical solutions, the pros and cons of the application are also related to the user experience.