The DeFi landscape is witnessing a surge in yield-bearing stablecoins. Ethena's USDe has become the third-largest stablecoin by market capitalization, and other issuers like Spark, Aave, and Circle are also exploring the market. Since the Converge network aims to be the storage and settlement layer for stablecoins, it will likely be home to a lot of yield-bearing stablecoin activity.

The emergence of this new asset class introduces unique challenges that current automated market makers (AMMs) are not equipped to address. As this article will cover, Terminal Finance intends to bridge this gap.

Yield-Derived Impermanent Loss

Impermanent loss is a phenomenon that affects liquidity providers (LPs) in most AMMs, and occurs when the price of one asset changes relative to the other in a liquidity pool. Upon such a price shift, arbitrageurs are incentivized by profit to trade with these pools, by buying the asset that has relatively appreciated. As a result of rebalancing, liquidity providers will find themselves holding less of the appreciated asset, and more of the depreciated asset. This results in a loss of value compared to simply holding the assets outside the pool.

Loosely speaking, impermanent loss can be thought of as the fee liquidity providers pay to arbitrageurs for keeping the pool's price in line with the market's. It follows that the larger the shift in relative price between two assets in a pool, the more impermanent loss liquidity providers will incur.

Pools that hold yield-bearing stablecoins face the unique problem of yield-derived impermanent loss. This is a form of impermanent loss that arises from a held token's accrual of yield. We will illustrate this with an example.

Example: Simple sUSDe/USDT Pool

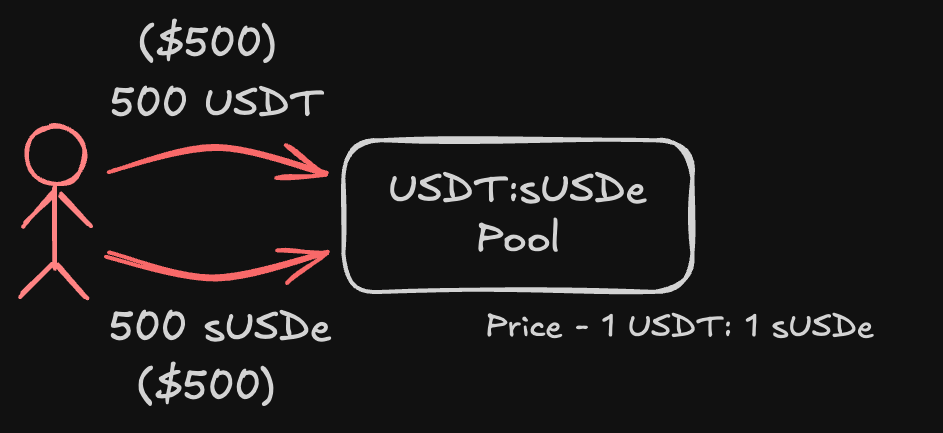

As a simple example, consider a pool holding sUSDe and USDT. Note that sUSDe is yield-bearing, while USDT is not. For simplicity, let us assume that the initial prices of sUSDe and USDT are both $1.

Alice, a liquidity provider, wishes to deposit $1000 worth of liquidity into the pool. For the liquidity to be able to facilitate trading on both sides, it must be composed of equal values of sUSDe and USDT. So, Alice has to supply 500 sUSDe and 500 USDT to the pool.

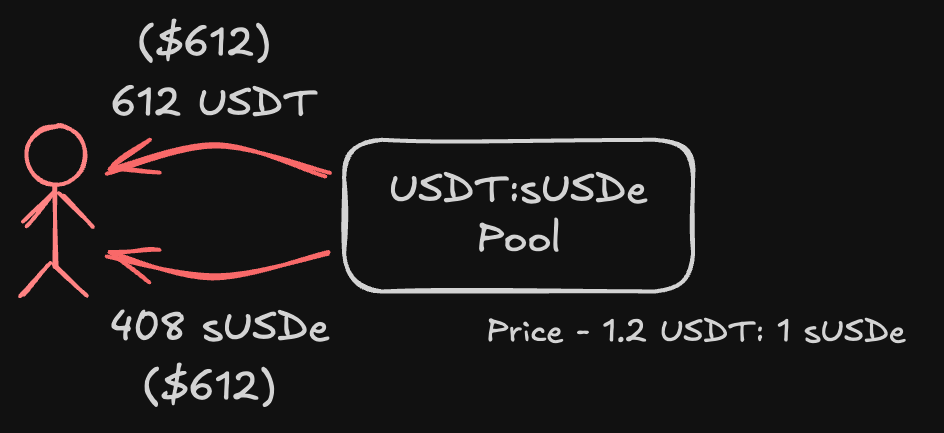

Over time, because of its native yield, sUSDe will gradually increase in price relative to USDT. When this happens, arbitrageurs step in to buy sUSDe by selling USDT to the pool. Say the price of sUSDe climbs to $1.5. Alice’s position would have been rebalanced to hold less sUSDe (~408 sUSDe) and more USDT (~612 USDT). Notice that once rebalanced, Alice's position is holding equal values of sUSDe and USDT again. We omit the mathematical details of the rebalancing here, but what is important to note is that Alice's position is now approximately worth $1224.

If Alice is to withdraw her position now, we say she would have realized an impermanent loss of $26. This is because if she were to not provide liquidity in the first place, and instead, hold onto her 500 USDT and 500 sUSDe, she would have had $1250 now.

Example: Concentrated sUSDe/USDT Pool

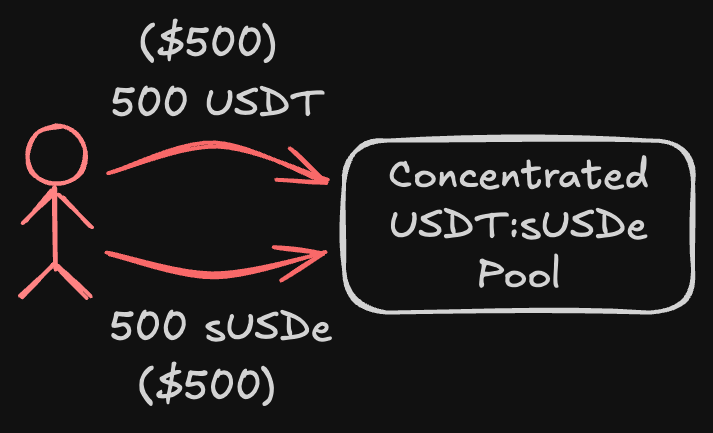

The yield-derived loss illustrated above might seem marginal, but it can be made significant in concentrated liquidity pools. Introduced by Uniswap V3, concentrated liquidity is a mechanism that allows liquidity providers to concentrate their liquidity within a specific price range. This allows significantly less trading slippage in pools, but it also amplifies the effects of impermanent loss.

This is due to the fact that upon price movements in the pool, concentrated liquidity positions rebalance in a more extreme manner. Consider Alice's position of 500 USDT and 500 sUSDe again, but this time, let us assume that Alice has concentrated her liquidity to the price range of $0.91 to $1.1.

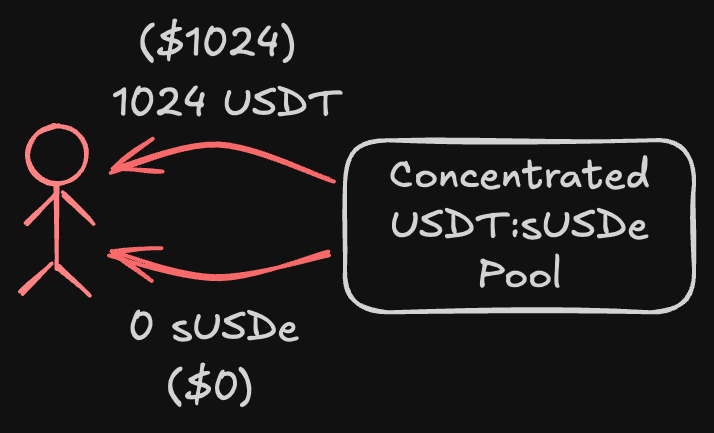

When the price of sUSDe climbs to $1.5, well outside of Alice's concentrated range, arbitrageurs will fully buy out sUSDe in Alice's position, leaving her with only USDT. In this case, Alice's position would have been rebalanced to hold 0 sUSDe, and 1024 USDT. This is worth $1024, which is $226 less than if she had simply held her assets outside the pool.

Note that even if the price of sUSDe were to only increase to $1.05, Alice's position would still have rebalanced more compared to a non-concentrated position. Generally, the narrower the concentrated range, the more extreme the effects of impermanent loss. Liquidity providers can protect themselves from this by widening their concentrated ranges, but this also means they will earn less from trading fees as their liquidity will be less utilized.

Another naive solution could be to have pools only hold stablecoins that do not accrue yield (e.g., USDe instead of sUSDe). However, this is obviously not ideal since it would mean the foregoing of profits.

Redeemable Tokens

Terminal Finance aims to provide a more holistic solution by designing pools that capture yield without exposing liquidity providers to yield-derived impermanent loss. To do this, we adopt the use of redeemable tokens — tokens that wrap around yield-bearing stablecoins but peg their value to the non-yield-bearing counterpart. Redeemable tokens gradually inflate to supply in line with the appreciation in price of the underlying principal to represent yield.

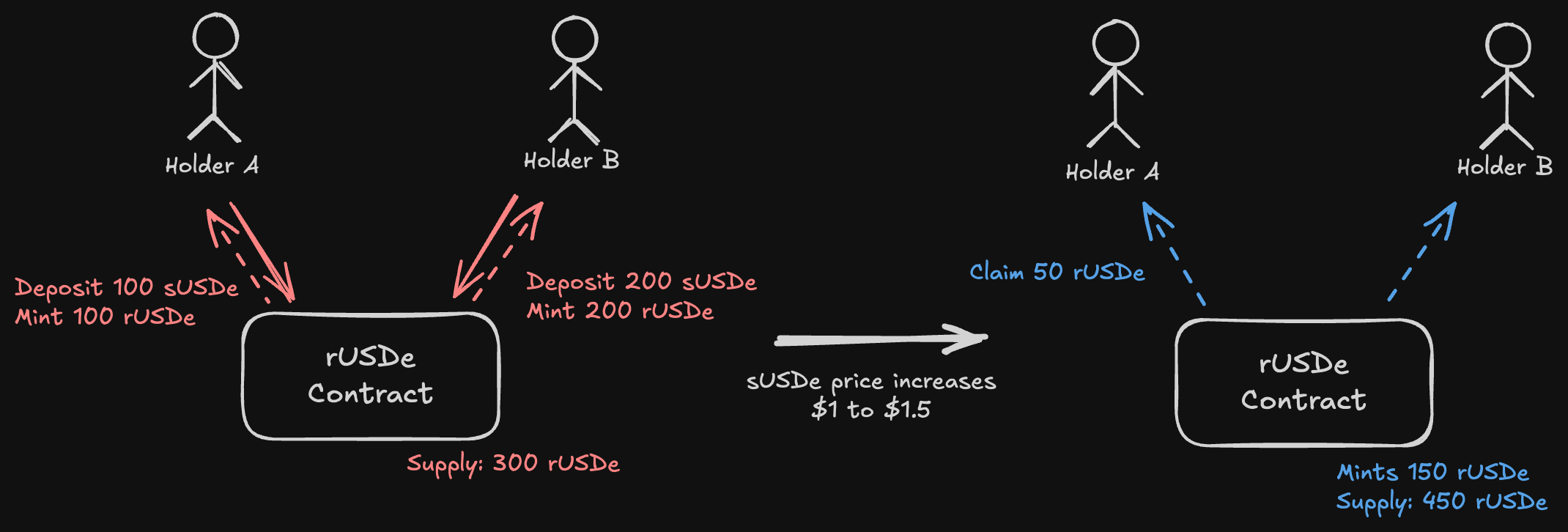

This mechanism is easier illustrated with a concrete example. Take sUSDe, that is yield-bearing relative to USDe. A redeemable token called rUSDe can be created. rUSDe tracks the market price of sUSDe:USDe via a price oracle. Then, users can:

-

Mint rUSDe by depositing sUSDe, at the current sUSDe:USDe price.

-

Burn rUSDe for sUSDe, at the current sUSDe:USDe price.

These mechanisms effectively peg the value of rUSDe to USDe. In other words, 1 rUSDe is always the price of 1 USDe. Since USDe is a non-yield-bearing stablecoin, this means that rUSDe is also a non-yield-bearing stablecoin.

Next, there must be a way for rUSDe holders to capture yield. To achieve this, when the sUSDe:USDe price increases, the rUSDe contract can mint new rUSDe tokens to represent yield. This new supply is then made claimable by all rUSDe holders in proportion to their holdings.

For instance, if the price of sUSDe increases from $1 to $1.5, and the rUSDe contract has 1000 rUSDe in circulation, it can mint 500 new rUSDe tokens to represent the yield accrued by the underlying sUSDe. For every 1 rUSDe any holder has, they can claim 0.5 new rUSDe tokens.

Separating Yield from Liquidity

Instead of directly holding yield-bearing tokens, Terminal pools hold their redeemable wrappers as a proxy. Since redeemable tokens are pegged to the non-yield-bearing counterpart, pools are no longer exposed to yield-derived impermanent loss. Consider a Terminal pool holding rUSDe and USDT.

Traders can swap USDT for sUSDe by swapping USDT for rUSDe, and then redeeming rUSDe for sUSDe. Swapping sUSDe for USDT works similarly, but in reverse: traders redeem rUSDe for sUSDe, and then swap sUSDe for USDT.

Consider the scenario where the price of sUSDe increases from $1 to $1.5 again. Since the price of rUSDe is not affected, no rebalancing occurs in the pool. It follows that liquidity providers will not incur any impermanent loss. On the other hand, pools can still capture yield by claiming the minted yield from the rUSDe contract. This yield can then be redirected to liquidity providers, proportionate to the liquidity they provide.

Without the fear of yield-derived impermanent loss, liquidity providers can concentrate their liquidity to a narrower price ranges as well, maximizing their trading fees and minimizing slippage for traders.

Conclusion

Terminal Finance offers Converge a new subclass of concentrated liquidity AMMs – one that is specifically designed to handle yield-bearing stablecoins. By separating yield from liquidity, Terminal pools can capture yield without exposing liquidity providers to yield-derived impermanent loss. This allows liquidity providers to mint narrower concentrated positions, optimizing fee capture while reducing trading slippage.

Our above examples have only covered the case of a single yield-bearing stablecoin in a stable pool. However, Terminal Finance's pools are generalized to handle many more cases, including pools with double yield-bearing stablecoins, and volatile yield-bearing tokens like wstETH. As Converge's ecosystem of yield-bearing stablecoins starts to grow, Terminal Finance wishes to equip the network with the necessary tools to trade this new asset class.