[Note: this is a companion article to our Lagrange Thesis video. Watch it here:]

“It may be the largest exploit in DeFi history.“

At least that was how Coindesk introed their breaking news report on the Ronin Network suffering a $625M hack in March 2022.

While Ronin wasn’t the first high-profile bridge exploit (Wormhole got hacked just a month earlier) nor the last (BNB bridge followed soon), it underpinned several innate flaws with k of n security assumptions. Not only do validator-based bridges carry centralization risks and fester inefficiency, each cross-chain protocol only works with a capped set of validators, prone to attack by compromising the plurality of its nodes:

“Security across isolated k of n protocols is either constant or sublinear with respect to staked collateral”, wrote Ismael, the founder of Lagrange, in one of his primers: “as the amount of available collateral increases, security increases at a diminishing rate as the validator set begins to cap out in size.”

The Ronin news also broke at a time when “multi-chain” was finally maturing into a headmost narrative. Celestia’s Mamaki testnet was just about to drop, monolithic blockchains were suddenly cringe and Ethereum killers all rebranded to Ethereum alternatives.

As the space was speedrunning towards a world of many winners, it desperately needed a more secure alternative to both isolated k of n bridges and randomized light client sync committees.

Call me Ismael

Around Devcon 2022, we met a young team working on state proofs - a new cryptographic primitive that would enable trustless, non-interactive verification of cross-chain states. It promised to kill trusted intermediaries and instead replace them with attestations and ZK proofs of the finality of blocks:

The backdrop for our initial conversations with Ismael Hishon-Rezaizadeh, the founder of Lagrange, couldn’t have been more pointed. If you believed a multichain reality was inevitable, integrating state proofs meant enabling a whole basket of new use cases -- or at the least supercharging the ones we already had.

From bridging assets more securely to unifying liquidity across DEXs, Lagrange was building a unified view of blockchain states free of multisigs and 100x more interesting. As Ismael told us:

“When we started Lagrange we thought that there was an issue with how dApps could access cross-chain and historical state. We felt that being able to compute meaningful analysis over cross chain was something dApps did not have access to -- and that meant that a lot of DeFi and GameFi builders were constrained in what they could build and what they could do on chain.”

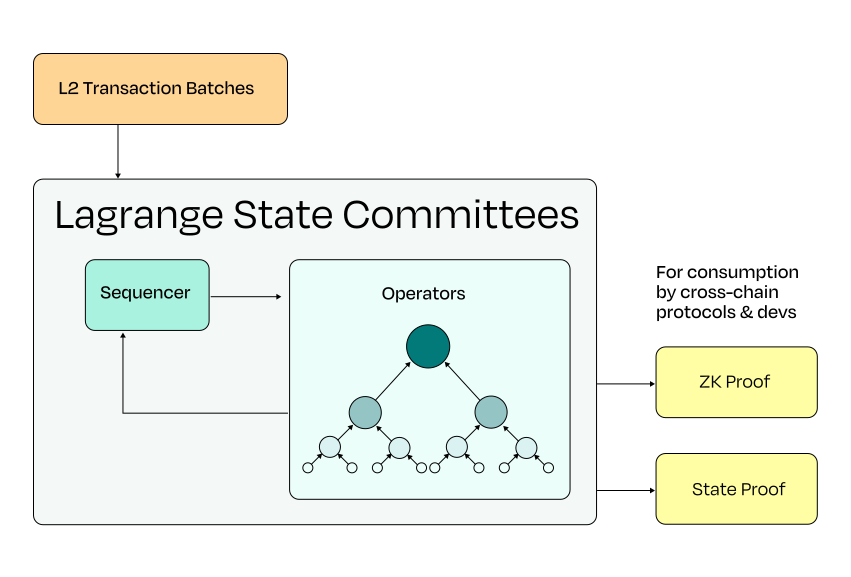

That was mid 2022. Soon after, Lagrange came out with State Committees, an efficient ZK light client (and an EigenLayer AVS) for optimistic rollups that settle on Ethereum. State Committees offer a ‘fast mode’ for bridging from Optimisms and Arbitrums of the world, with security derived from an ever-growing, dynamically sized set of nodes. More on them later.

A lot can happen in crypto in 2 weeks - eons happen in 2 years. Over time, Lagrange’s initial cross-chain focus became much more holistic, which recently actualized via their second product line. In a recent blog post titled ‘The Next Chapter’, Lagrange vowed “to unlock new types of data-intensive and cross-chain applications by enabling verifiable computation over blockchain data at a ‘big data’ scale. The way we achieve this is through our hyper-parallel ZK Coprocessor.”

Below, we take a closer look at the current state of Lagrange and its 2 main product lines (State Committees and ZK Coprocessor), its journey from another ZK upstart to a go-to interoperability play, and read the tea leaves on what comes next.

Lagrange At a Glance

Lagrange Labs was founded to address interoperability challenges between blockchain protocols using cryptography and zero-knowledge (ZK) proofs.

The team initially developed State Committees, which are groups of restaked nodes that attest to the finality of blocks for optimistic rollups. State Committees generate State Proofs - treated as sources of truth for cross-chain applications - and have been integrated with popular interoperability protocols like LayerZero, Axelar, and Polymer Labs.

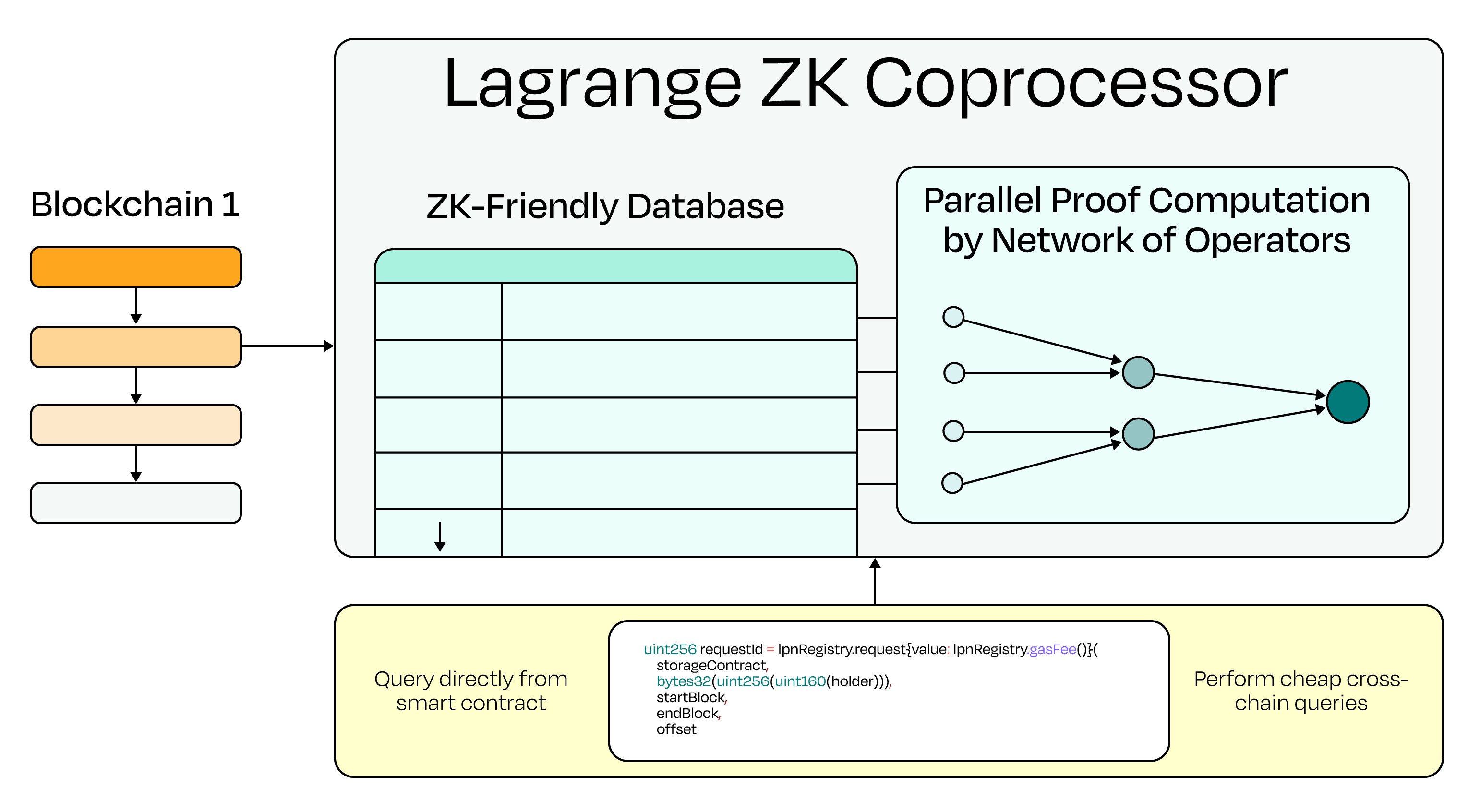

Originally focused on cross-chain interoperability, Lagrange has expanded its vision to enable verifiable computation over any blockchain data at a Big Data scale. Their second product, the hyper-parallel ZK Coprocessor, processes blockchain data into a SNARK-optimized structure, leveraging a decentralized network of provers. These provers can efficiently handle large-scale SQL queries, allowing developers to perform complex computations more cheaply and at scale. The ZK Coprocessor's ability to horizontally scale ensures fast and reliable proof generation.

All of this led Lagrange to recently secure $13.2 million in seed funding to expand ZK Coprocessor’s capabilities, and support its ecosystem of partner projects.To understand how Lagrange is doing, we take a closer peak at its on-chain data below.

The State of Lagrange

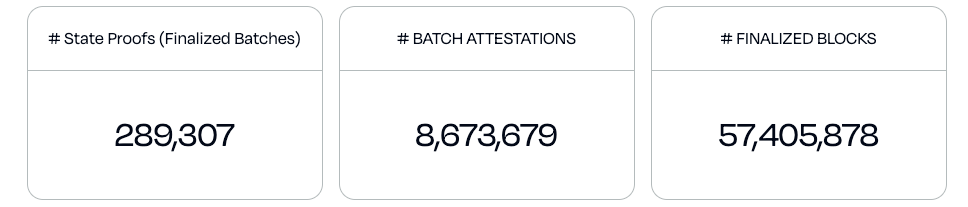

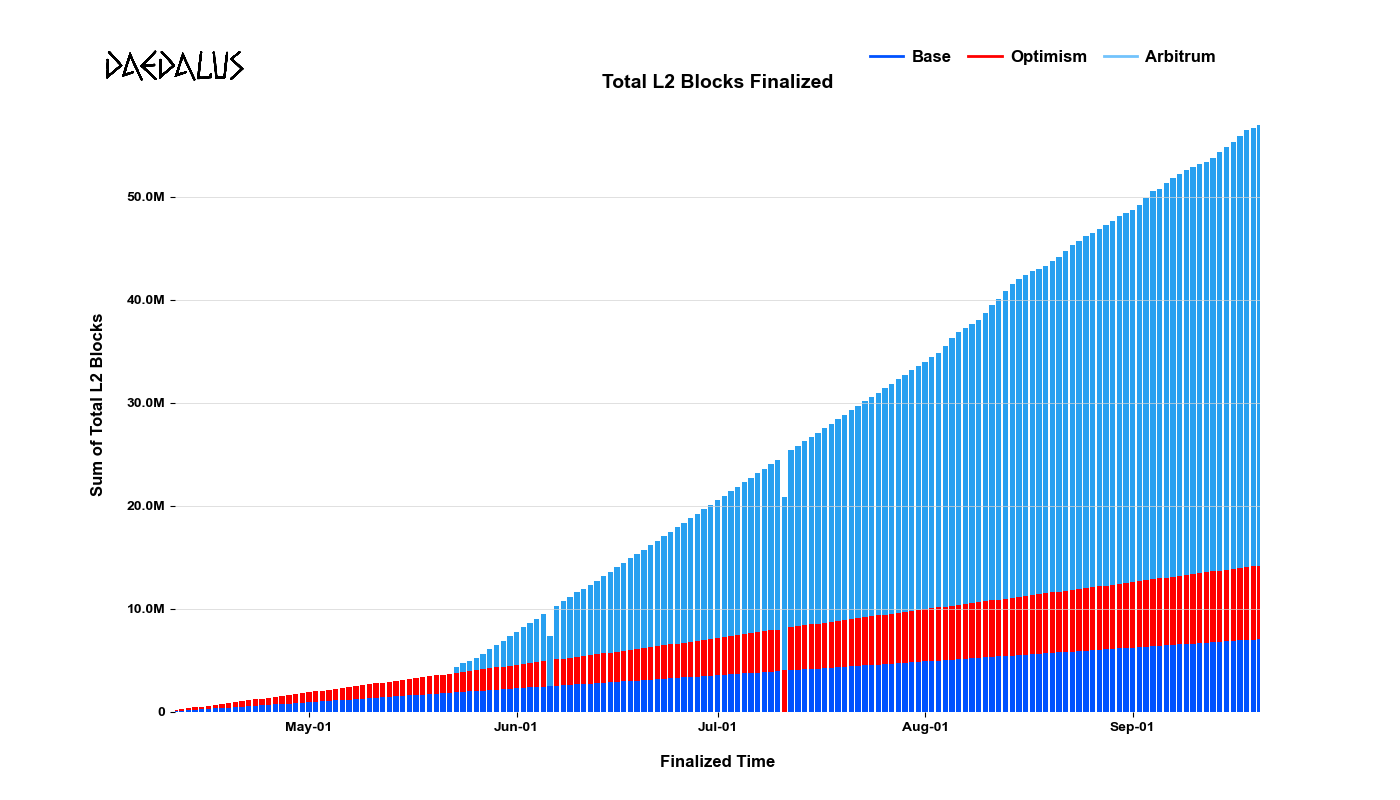

Looking at Lagrange’s State Committees at the time of writing, there have been over 57.4 million finalized blocks and over 289 thousand state proofs generated. More than 42 million of these are Arbitrum blocks, highlighting the significant impact of Lagrange’s recent partnership with the L2.

In fact, as the below chart illustrates, although there are more operators overall on Optimism and Base, significantly more blocks are actually being finalized on Arbitrum (8x more blocks per day than Base and Optimism).

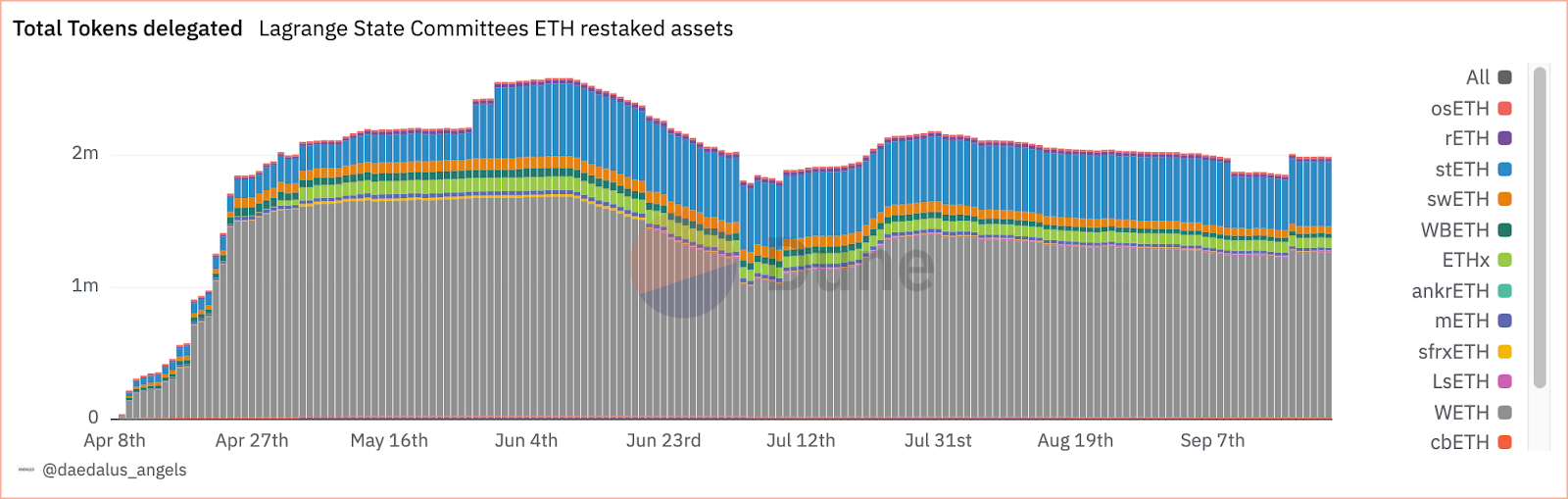

Lagrange State Committees were the first ZK AVS launched on EigenLayer mainnet, and found product-market fit at an impressive pace. Within a few weeks after the mainnet launch, the value of restaked ETH surpassed $6bn (peaking at ~$9bn in early June), and still currently sits close to $5.5bn or 2 million restaked ETH:

To abstracts away the USD/ETH pair volatility, the below chart shows the restaked amount in ETH instead. Overall, the total hasn't changed much since week 3 of State Committees’ launch, hardlocking the amount restaked at around 2M ETH.

Lagrange's consolidation is also visible when comparing the sum of all restaked Eigen from their operators versus other AVSs (chart below).

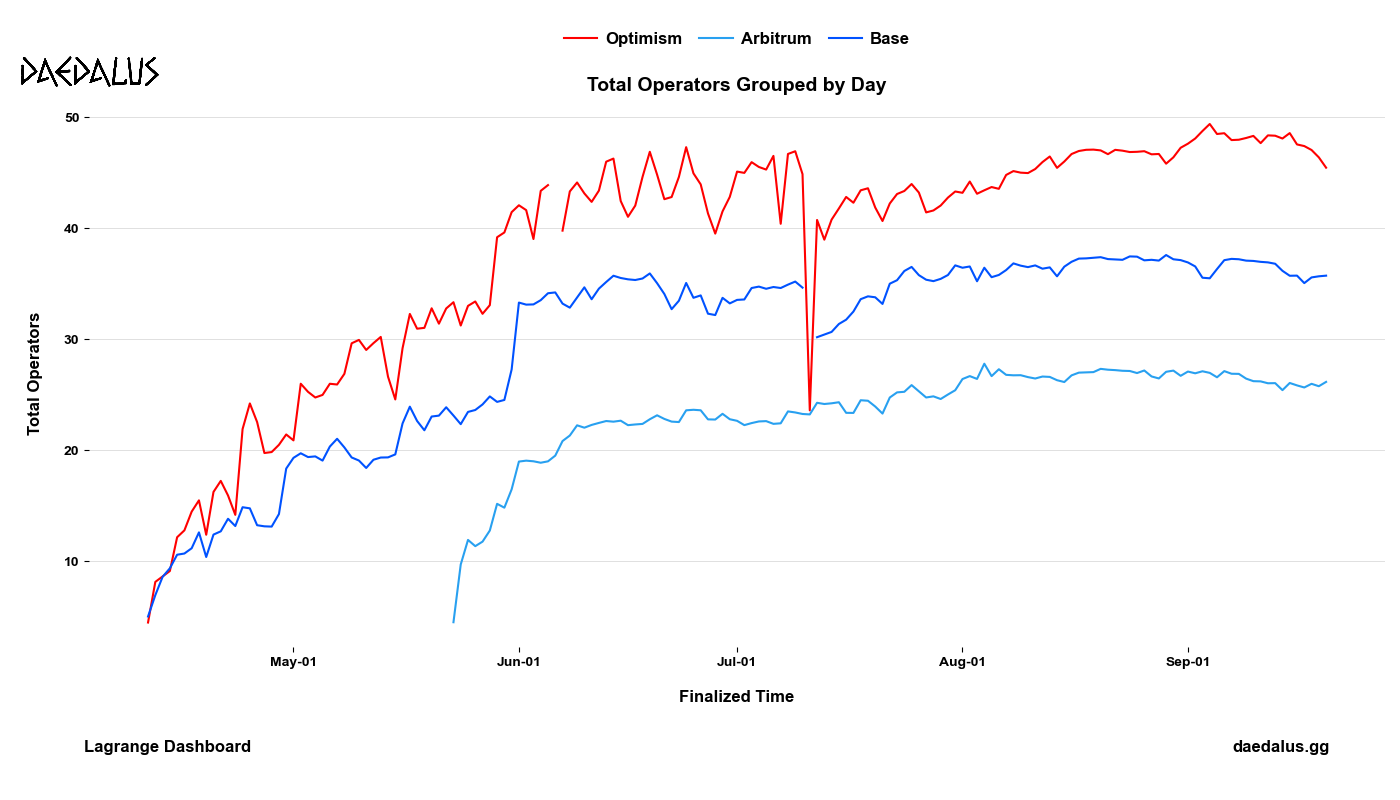

Not only are over 70 operators deploying Lagrange State Committees (with the biggest number of stakers outside of EigenDA), there are also more than 60 operators on the ZK Prover Network, currently the #7 AVS by number of stakers. Both of these AVSs are from Lagrange; at the moment, their combined operator restaked Eigen trails only behind EigenDA:

The number of operators in Lagrange’s State Committees and their dynamic over time is illustrated on the chart below:

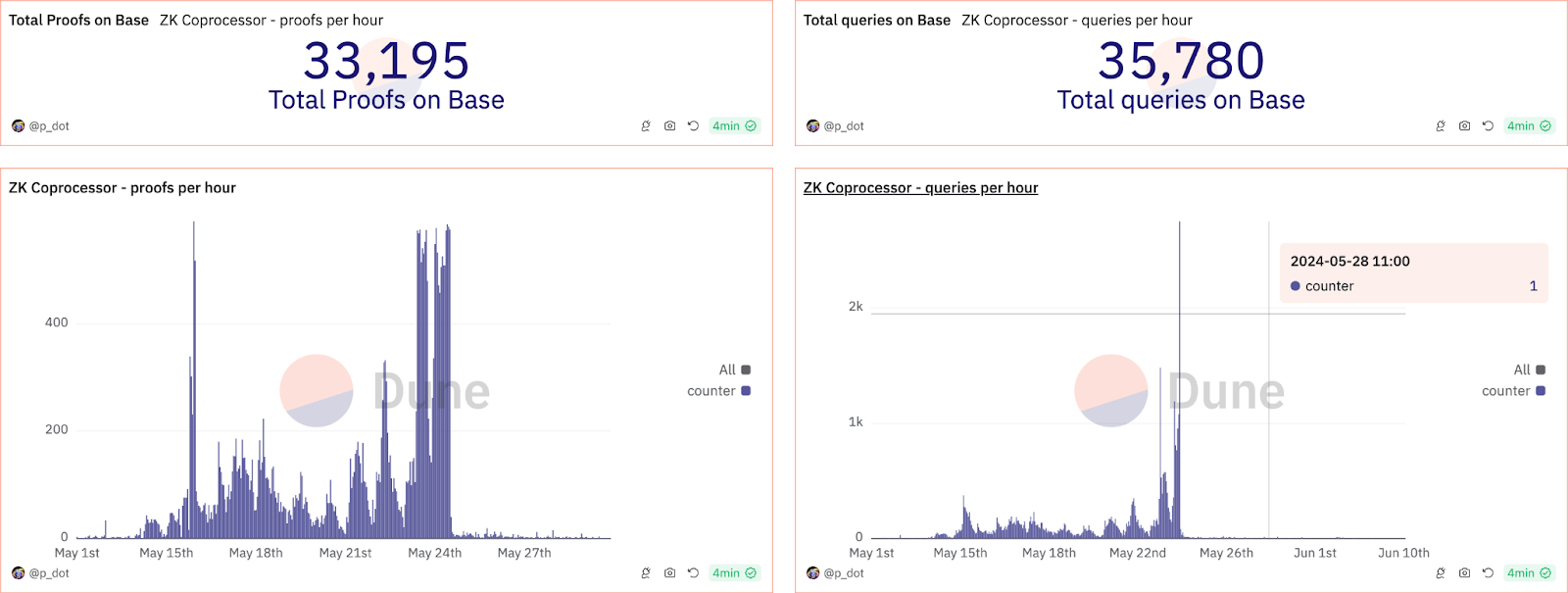

A major recent milestone for Lagrange was the launch of the Euclid Testnet, which introduced Ethereum's first verifiable database and ZK Coprocessor. Aggregated on-chain activity shows significant participation in the first phase of testnet that ran until May 24th, with over 33,000 proofs generated on Base:

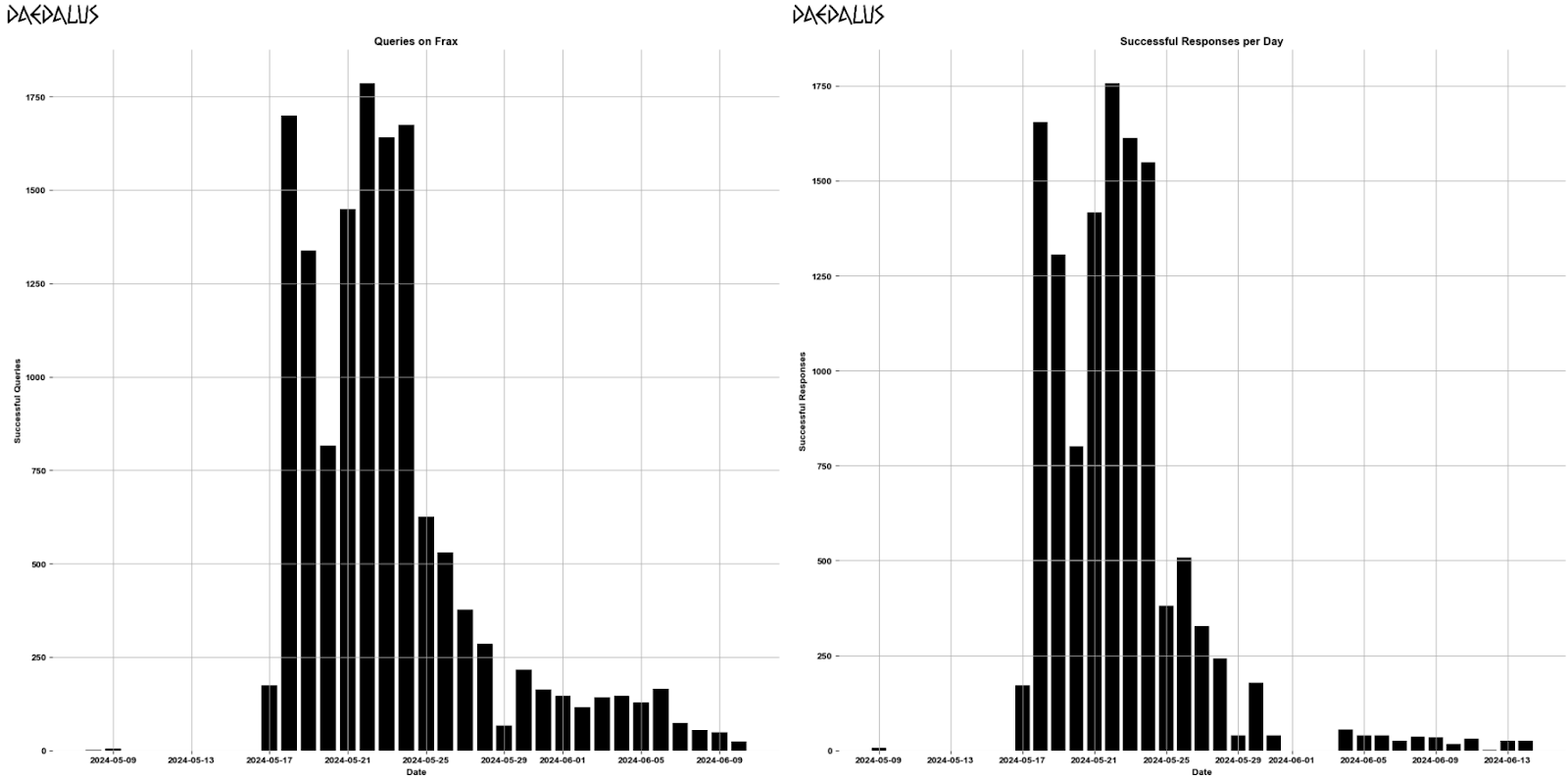

Similar activity was seen on Frax, which accounted for almost 14,000 queries and over 12,000 proofs:

Lagrange ZK Coprocessor 1.0

Lagrange’s ZK Coprocessor 1.0 went live in early September, enabling the proving of custom SQL queries over on-chain data directly from smart contracts, and letting developers build more data-rich applications.

The diverse utility of Lagrange's ZK Coprocessor is well illustrated through its on-launch integration with Gearbox. Gearbox is a DeFi protocol that uses credit account abstraction to bring together lenders and borrowers. It uses RewardPool contracts that reward users that deposit liquidity.

Gearbox’s current RewardPool contracts are integrated with liquidity mining contracts, called Farming Pools, based on 1Inch’s implementations. Users receive yield based on the output of Farming Pools and the duration of time that they’ve provided liquidity.

The Farming Pool contracts have several key limitations such as only being able to pay out one reward asset, only having one payout mechanic (based on share size) and incorrectly displaying user balances in Etherscan. With Lagrange’s ZK Coprocessor, Gearbox will be able to distribute rewards entirely based on proofs, rather than Farming Pool contracts.

For example, if new rewards such as GHO or ARB are needed, users can simply claim rewards directly using proofs submitted to the RewardPool, rather than based on the Farming Pool contract logic. As a result, the above limitations are effectively removed from Gearbox’s deposit incentive programs.

With Lagrange’s solution, Gearbox can ensure that core computations within its yield-bearing vaults are handled autonomously and in a gas-efficient manner. This not just streamlines user experience but also significantly enhances the feature set and yield-bearing potential for users, while still maintaining the trustworthiness and secure designs that Gearbox is known for.

A look forward

With its State Committees and now ZK Coprocessor, Lagrange sits at the forefront of crypto’s wholescale efforts to revamp the user experience and unlock practical new use cases via zero-knowledge proofs.

When it comes to what these future use cases will be - and Lagrange’s role in their comeuppance - Ismael remains agnostic:

“Lagrange is a business that does ZK proofing at its fundamental. We generate proof for our zk coprocessor, we generate proof for state committees, and we may generate proof for other demanded sources as well.

Right now, the first and foremost priority of our team are our two biggest demand sources (state proofs and zk coprocessor). But broadly, from a founder or a company standpoint, what we generally believe is that if you build tech, you should be looking to apply it to the best use cases.

We continue to believe that if you build something, it is the imperative of the business to apply that to the place that has the most impact; and if we see that there are other places that the compute of data or zk designs are able to create strong impact in crypto in a new vertical that is yet to be named, we will continue to apply that, as such.”

To stay up to date with the team’s progress and future plans, follow Ismael and Lagrange on X.