Hi everyone,

TraderJoe has announced its new product which had been planned for a year ago- Liquidity Book. And in today’s article, we will have an insight into Liquidity Book and does LB can compare to Uniswap.

Problems with AMMs

Before we go into the protocol, it’s important to understand how AMM works. When trading on an AMM, customers join a liquidity pool. When a user requests a cryptocurrency conversion, a mathematical formula called x*y=k is utilized to calculate the values of tokens that the user may receive on a regular basis in terms of quantity and price (X and Y are the numbers of Tokens in the pool; K is a constant that remains constant).

Then what is the disadvantage of this formula?

- Impermanent loss: AMM would not exist in terms of arbitrage control without a normal order book. Traders must keep the asset’s price on a single AMM, resulting in Impermanent losses on many exchanges. To summarize, these traders must earn by setting an equilibrium price, but this profit is provided by the liquidity providers. Providers may lose money even if they get a transaction charge if the price swings too much. This is a “temporary” loss because the price will always revert, which does not always occur.

- Slippage: When a consumer purchases a significant number of tokens X, slippage may occur. Slippage can be expensive, especially when trade volumes are large. Assume there are 10,000 tokens in a pool and you want to swap 9,000 tokens.

What Is Liquidity Book?

Imagine in the liquidity book, each pool is separated into several pricing ranges. Each bin has its own set price and operates as a constant sum market, which means it does not reliant on token x and y reserves to compute the price.

Users decide which pools they want to deposit assets into when they deposit assets into the Liquidity Book. This implies they can set their own rates for providing liquidity. This is in contrast to x*y=k pools, which always give liquidity from 0 to infinity.

Each pool in Liquidity Book additionally tracks volatility using the innovative Volatility Accumulator. This enables the pool to adjust fees in order to compensate liquidity providers for the Impermanent Loss they incur under unpredictable situations.

As a result, Liquidity Book’s pools may offer trades with zero or low slippage, while still ensuring that customers are adequately paid for the risks they take.

Features on liquidity book

The protocol has two features: Concentrated liquidity and Liquidity bins. These two characteristics enable traders in receiving the best pricing regardless of the size of their transaction.

Concentrated Liquidity

A concentrated liquidity position is generated when liquidity is allotted to a pricing interval. LPs are free to open as many positions in the pool as they choose, resulting in personalized price curves tailored to their unique market outlook using range orders. In short, concentrated liquidity refers to the capacity of liquidity providers (LPs) to deliver liquidity in a narrow location along the price curve.

Does it useful to liquidity providers?

Yes, since there are tokens that have nothing on swaps. When dealing with concentrated liquidity, traders can obtain significantly better pricing with little or no price effect, even in pairings with low TVL. As long as their liquidity remains in the active pricing range, LPs will profit greatly, collecting much higher fees with fewer tokens invested.

A provider (LP), for example, consumers may choose to commit their money to a stablecoin/stablecoin pair in the $0.99 — $1.01 range. As a result, traders will have more liquidity near the midpoint, and LPs will receive higher fees at that point.

Liquidity Bins

The liquidity is divided into many bins, each with its own pricing. Individual bins, each carrying one of the pair’s tokens, function as constant sum pools (or both).

Then what is the difference about the formula?

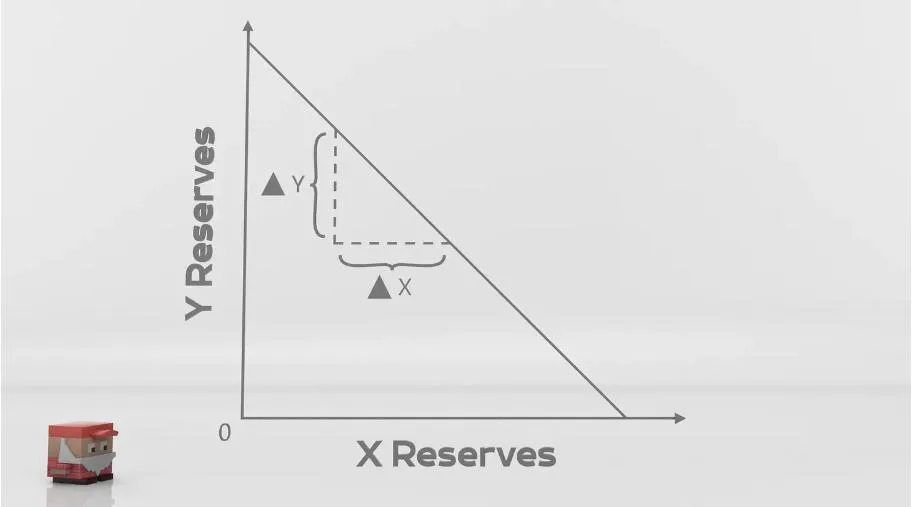

The answer is P*x+y=L with** ( X and Y are the numbers of tokens in the bin **with P as price and L as total liquidity).

The pricing parameter of the bin and the total liquidity reserves stored in the bin completely determine the bin curve. The Y reserve intercept, as depicted, represents the entire liquidity (L) of the bin, whereas the slope is dictated by the bin price (P).

Then does it reduce the risk of price impact?

Yes, the liquidity book consolidates liquidity from all bins into a single structure. When the liquidity in the current bin runs out, the price shifts to the next one. The price impact happens only when the bins are changed since each bin.

How does the Liquidity book work?

Liquidity Book offers unparalleled versatility and flexibility. To meet all tactics, it features four liquidity shape pre-sets Normal, Spot, Max (Uniform), and Bid-Ask. To maximize your yield-generating activities, you must first understand the basic approach given. The basic tactics are explained here; you can deploy and manage many strategies to meet your investment objectives.

Normal

It distributes liquidity along the “bell curve,” just like order book exchanges. This strategy allows you to earn fees on both price increases and price drops while concentrating liquidity around predetermined price points.

Advantages:

- Perfect when the market is sideways

- Fund efficient

Disadvantages:

- Risk of impermanent loss when the market volatility

- Need to rebalance around the current price to keep the efficiency

Spot (Uniform)

Spreads the liquidity throughout a given range or deposits it totally within a single bin. Having all liquidity in one bin allows consumers to take advantage of the “leverage” provided by discrete liquidity.

Advantages:

- Suitable for stable pairs.

- Can be considered when choosing a volatility pair to earn more fees.

- Higher efficiency than normal

Disadvantages:

- Face the biggest loss when the price leaves the bins

Max (Uniform)

This operational paradigm is identical to traditional exchanges (x*y=k) . When complete liquidity is assigned to all existing bins in the spot option section depending on its absolute level.

Advantages:

- Less risky

- Perfect for passive LPs

Disadvantages:

- Lower efficiency than others

Bid-ask

The bid-ask spread resembles the spread on an order book exchange, allowing LP to capture fees as the market volatility.

Advantages:

- Perfect when catching volatility

- Allow users to use Dollar- Cost averaging

Disadvantages:

- Higher risk than others

- Requires rebalancing to maximize the outcome

- Does not earn fees while inactive

Difference between Uniswap and Liquidity Book

The UniSwap V3 was released on May 5th, 2021, with the Concentrated Liquidity mechanism. After a year, TraderJoe launched a new mechanism under the same name. So, what makes TraderJoe V2 different from Uniswap V3? We will have a breakdown of the three biggest differences:

Tick and Bins

in Uniswap V3, concentrated Liquidity is implemented by partitioning all available pricing space with ticks. Users can select any two ticks and give liquidity in the range between them.

In contrast, **Liquidity Book **divides the price range into discrete bins. The liquidity providers then select the bins into which they want to deposit their funds.

For example:

- In Uniswap, you want to provide liquidity in AVAX at 10 dollars, the Uniswap will pick the tick that is closest to the 10 dollars which is $1-$9 tick or $11–20$ tick.

- In Liquidity Book, each bin represents each price, if you want to provide liquidity in AVAX at 10 dollars, the Liquidity Book will correspond to only one particular bin which is $9.99 bin or $10.03 bin

Fungible receipts and NFT receipts

Uniswap V3

The liquidity positions in Uniswap are represented by ERC-721 NFTs. This complicates interactions with protocols designed primarily for use with ERC-20 tokens. NFTs also make it difficult, time-consuming, and costly to manage liquidity situations.

For example, if you provide liquidity ETH/USDC pool from the range of $1500 — $2000, you will receive an NFT representing the position. However, when you want to move your position, you have to withdraw liquidity > pay gas > resupply again > pay gas again.

Liquidity Book

In the liquidity book, liquidity position acts similarly to standard fungible ERC-20 tokens. Users can manage and implement their own strategies or rely on other platforms that are built on top of the Liquidity Book.

For example, if you provide liquidity AVAX/USDC at $20 bin, you will receive an LP token that represents the position. You can use that LP token for staking, and yield farming on another platform.

Volatility accumulator

According to some research,** 50% of Uniswap v3** depositors have negative returns owing to Impermanent Loss, which happens when the prices of assets in the pool diverge from their initial values. As many as three-quarters of all liquidity providers lose money on some of the pairs when compared to merely keeping tokens in their wallets.

On the other hand,** the Liquidity Book** tracks how many bins a swap passes and how much time has gone since the last swap to calculate immediate market volatility. Every bin moves a switch performs reflects a set price increase/decrease; no external data inputs are required for this evaluation. The accumulator ramps up when significant swaps occur in quick succession. When activity slows, it begins to decay, and if no swaps occur within a certain interval, it resets. This allows users to adjust the fees to reduce the impermanent loss when facing volatility.

Conclusion

In general, these are two AMMs that have attracted the attention of the community due to their new technology and a huge amount of capital. To confirm which project is more potential at this stage is impossible because it is too early. However, at the present time, it can be seen that Liquidity Book has a slight advantage over Uniswap due to its prior development and benefit to users. Although Liquidity Book has a few pairs right now, they probably expand more as shown by collapsing with other big projects ( Steakhunt,…)