The creator economy is living up to its expectations in early 2022. Simply looking at the number of jobs available with the keyword “creator” on LinkedIn demonstrates that many companies need these native content creation skills across multiple platforms. Individual creators now have more options than ever to monetize their craft. While the creator economy is still a hit-driven business and its structure needs continuous development, it is far from experiencing a crisis; it’s very much alive and kicking.

The majority of content creators rely on brand partnerships and influencer marketing for income. Passive income streams come mostly from programmatic advertising, enabled by platforms like YouTube, Spotify, and Brave Browser. Outside of China, live commerce is working in some countries such as Thailand, and the Philippines, while it’s still finding its footing in Indonesia despite heavy investment. The creator-driven merchandising business championed by Spring and many local imitators is showing signs of success. Linktree managed to carve out a space of its own as a social identity aggregator for creators.

However, true creators-turned-entrepreneurs are still a rarity. Video superstars like Mr. Beast, who has teams big enough to open multiple businesses, prove to be exceptions rather than the rule. Nusseir Yasin (Nas Daily), Raffi Ahmad, and Jerome Polin are examples of super creators who have established multiple businesses in Southeast Asia, but they are literally one-in-a-million finds.

In any hit-driven business, the winner-takes-all mentality remains true. There is no shortage of sponsorships, joint venture offers, and equity funding for a superstar creator. Everyone wants to be associated with the biggest or best fit in their niche. A great opportunity for many new ventures exists in lifting the middle class of creators. By providing credit ratings based on social media metrics, business management tools, entrepreneurship education, and direct monetization, creators will be able to transition from ‘hobbyist’ to ‘professional.’

NFTs

In the Web3 world, the most successful method of monetizing a content creator’s fans, audience, and communities has been through the use of art-based Non Fungible Tokens (NFTs). As a result, NFTs have grown in popularity so much that they have increased the gas fees of Ethereum and pushed the NFT marketplace OpenSea to become the third biggest app on Ethereum. Most readers would have heard of the Bored Ape Yacht Club or Cryptopunks, the two most famous profile picture NFTs (PfPs) at the moment. These jpegs are traded and valued based on their rarity and social prestige. Owning these NFTs is analogous to belonging to a social club, with the authenticity of the ownership viewable by all thanks to the blockchain’s immutability property. Thus, anyone can jump on Etherscan and view who owns any NFT on Ethereum.

A defining feature of the Web3 ecosystem is the ability to track and pay trailing commissions. The smart contract allows the original creator to set a tax on all token trades, including NFTs, which will be paid back to the creator’s wallet. This allows artists, creators, and rights holders to continue to benefit from the long-term appreciation of their artwork. This should be sufficient to motivate the creator economy to learn and invest in Web3.

The creators of these NFTs are often pseudonymous and sometimes established artists. Prior to the popularity of NFTs, visual artists faced significant difficulties monetizing their work online. Besides, why would anyone pay for content they can enjoy for free? As it turns out, the missing link was proof of ownership or patronage. Just like anyone can view a jpeg or a print of the Mona Lisa, only one can claim ownership of it, attracting millions of visitors to the Louvre each year.

NFTs allow emerging artists the opportunity to shine and make a positive social impact. Take, for example, Valeria, a 14-year-old artist who, with her father David, sold out a 10,000 NFT generative collection titled GirliesNFT in late January. The collection focused on underrepresented women in the NFT and Crypto space. The sale included rights to the underlying art for personal and commercial use, excluding merchandise. The mint price for the collection was 0.04 ETH. At launch, she earned 9800 x 0.04 ETH = 392 ETH, approximately $1.2 million. Meanwhile, 200 was reserved for giveaway and gifting, 5% of sales were donated to Girls, Inc., a non-profit organization.

Most social media influencers are naturally knowledgeable about NFTs. With their vast and engaged audiences, it’s a natural move for most influencers to tokenize their viral videos. Multiple platforms and services exist to facilitate the process of creating NFTs, such as TikTok. TikTok itself has partnered with Immutable X to launch and endorse its own viral video NFT platform. While true fans may wish to purchase or gift these NFTs, the real utility of viral video NFTs would be derived from the streaming royalties that they can generate from programmatic advertising and subscription revenue.

In addition, TikTok as a platform does not offer a passive income stream for creators; however, YouTube does. Whether or not the content creator uploads the TikTok videos that end up on YouTube, they all generate streaming royalties that can be linked to specific viral videos. These royalties serve as a passive income stream for thousands of creators, allowing them to make a living while focusing on their content creation.

Social Tokens

Social tokens exist as the proof of backing of creators in their early days. In theory, investing in these social tokens at their launch price should increase in value over time as the creators get more followers. These creators would then grant exclusive access to content reserved for token holders.

In the music world, RAC has been an early supporter of NFT and crypto assets. He has launched his own token, $RAC, whose holders can access a Web3 enabled site for exclusive access to music and content. He tweeted one of the best explanations of why NFTs are relevant: "NFTs are about making the content free while making ownership scarce." On the same Twitter thread, he addressed multiple criticisms of NFTs:

- On ecological concerns & climate impact of NFT: generally a moot point with chains moving to Proof of Stake

- On NFTs being scams: Yes, some are scams. Yes, there's theft of artwork going on. Generally, this misunderstanding happens with all new technology.

- On making a living: RAC has made more income from 5 collectors than his millions of Spotify listeners per month.

This is the most important point: if NFTs allow artists and content creators to make a better living, we should all support them because we all benefit from their work.

Metaverse

The metaverse has existed long before Web3. Its origin can be traced back to the original massively multiplayer online role-playing games (MMORPGs) in the 70s, from text-based BBS games, through the 90s AOL era games such as Neverwinter Nights, and to Blizzard’s World of Warcraft, which was launched in 2004 and is still popular today.

Minecraft, Roblox, and Fortnite are the most popular multiplayer games of the Web2 YouTube era that are also considered metaverse worlds. These games enable the player to create mini-worlds within them and generate revenue. YouTube gamers and streamers of these games are some of the biggest in the world, thanks to the platform’s robust YouTube Partner Program.

Roblox has expanded the possibilities for creator monetization beyond streaming revenue and skin sales by enabling developers to launch their own minigames within the Roblox metaverse. These games can then charge users a fee in the Robux currency. Using the games’ Developer’s Exchange, they can cash out Robux to USD.

By incorporating the metaverse into Web3, community-driven platforms such as Sandbox and Decentraland are opening up ownership of these worlds to their communities of users. Not only can users purchase in-game currency as a form of cryptocurrency, but they can also own land and items within these worlds. These users are then encouraged to be creators of their own world, with the option of creating their own cities and charging a fee for access, games, and selling NFTs.

Many leading content creators have taken the lead in developing their own metaverse worlds. Raffi Ahmad, a prominent Indonesian influencer, is collaborating with the VCGamers gaming community to create RANSVerse (pictured).

GameFi

In 2022, video gamers can make a living in three ways: as esports pros, content creators, or play-to-earn gamers (GameFi). Moreover, the GameFi movement combines blockchain gaming and DeFi technologies (decentralized finance).

Web3 advancements have enabled games to create Non Fungible Token assets (NFTs) that are tradeable outside of the game and in the open marketplace. These games have enabled players to make a living out of the assets generated by the game and sold on the open market for fiat currency. The cost of joining the games can be high, creating an opportunity for gaming guilds to facilitate new gamers through asset lending and revenue sharing agreements.

Axie Infinity is one example of a successful blockchain game with an in-game economy that affects the players' lives in the real world economy. The game has 2.5 million daily players and a player can generate about US$200 per day. It is in the top 3 of Ethereum app in terms of gas fees burned per month, just behind OpenSea and Uniswap.

Hundreds of games with similar economies and tradable assets are currently in development. All games require one thing in common: a gaming community. In order to be successful, the games must be able to onboard and retain players in the economy. Who better to create these communities of gamers than the gaming content creators?

Pacific Esports is an esports team owner who has launched her own gaming guild Pacific Axie with over 150 scholars. Revenue earned via the guild is split with each gamer scholar. The barriers to entry for creating a guild are capital outlay and the ability to form and manage a community of gamers. The latter is a natural skill common to most successful content creators in gaming or other verticals.

DAOs

The easiest way to understand Decentralised Autonomous Organisations are to see them as a group of people with a mission and a shared bank account. To be a member of a DAO, investors purchase the governance token of each DAO which then gives them a voice in the direction of where the projects supported by the DAO’s funds should go. ConstitutionDAO and the Ethereum Name Service are some of the more famous DAOs in recent memory.

The Great Wave is a Singapore based DAO with the collective mission of building a new sustainable ecosystem for artists, fans, developers and investors. Members of the DAO invest in the $WAV token to be staked for voting rights on which music releases to back and promote. Local musician Charlie Lim and manager Clarence Yap are driving the project which has raised USD$700,000 to date.

There are other similar music collectives such as the MODA DAO, backed by international music managers. Their mission is to tackle the very complex world of music rights management and using audio fingerprinting technology on a blockchain to help with microlicensing and tackle disputes and infringements.

Scams

Without a doubt, public interest in the Web3 creator economy is growing exponentially. However, the real question is, at what cost?

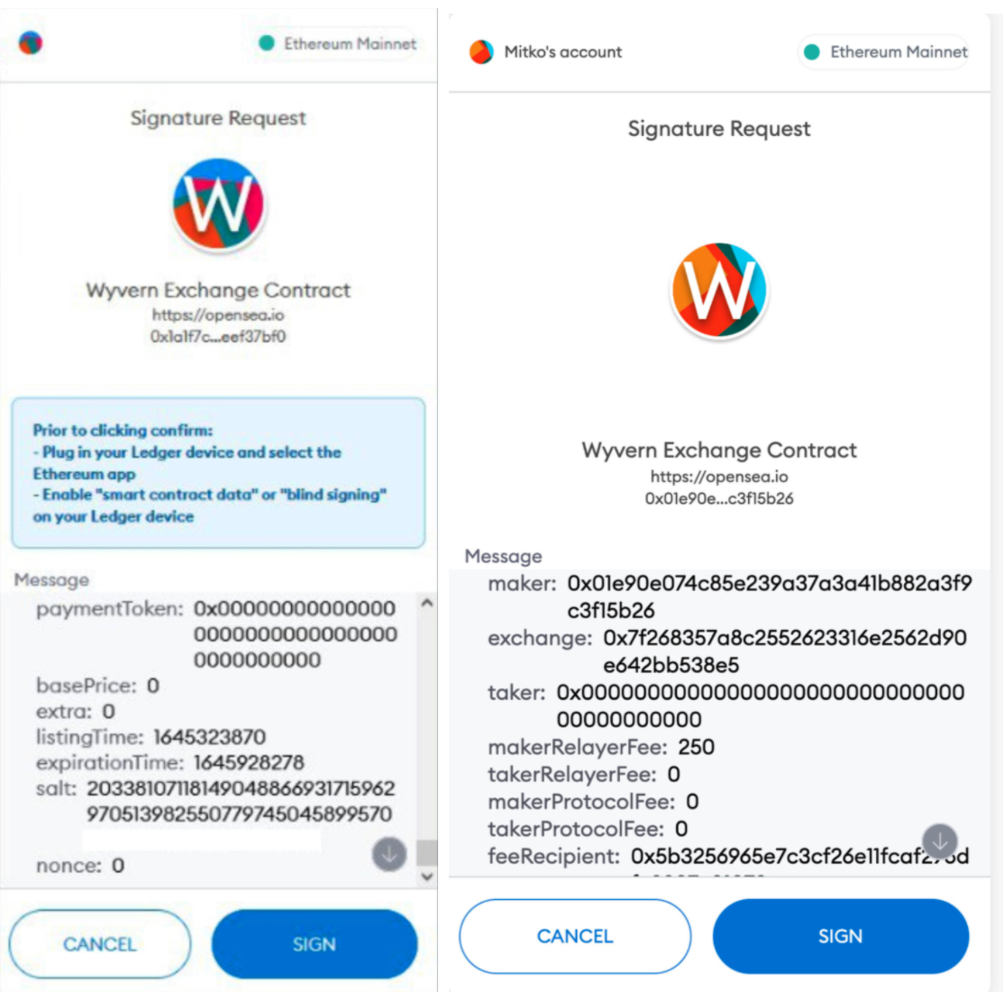

Smart contract exploits, phishing hacks, password loss, fantasy roadmapping, and wash trading are some of the issues that creators face on a daily basis.

As more people enter this space, another sinister side emerges: NFT Thefts. The internet is replete with horror stories about creators who have gotten the short end of the stick. Imagine scrolling through Twitter only to find your artwork as the prize of an NFT giveaway that you had nothing to do with. Alternatively, you could have your entire YouTube video ripped and minted as an NFT.

Even the iconic BAYC collection, frequently featured in the news, is not immune to Web3 criminals. Every time some Hollywood heavy-hitters discuss NFTs, BAYC knockoffs quickly appear on OpenSea.

Indeed, OpenSea recently explained its struggles with NFT theft by reporting that 80% of all free mints (a recent feature) were “plagiarized works, fake collections, and spam.”

Unfortunately, decentralization and anonymity are dual-edged swords. Intellectual property infringements and copyright violations appear to be included in the package (for now, at least). This is also a significant reason why NFTs rarely receive favorable coverage outside of the crypto and Web3 communities.

Towards the end of last year, Deviant Art sent 90,000 alerts of possible frauds or scams in NFT marketplaces. Thus, the platform continuously monitors the work of its digital artists and currently scans about 4 million new NFTs every week. However, marketplaces such as OpenSea appear to be teeming with bots capable of automatically adding hundreds of plagiarized NFT listings. As a result, artists suffer significant losses due to these activities since someone else profits from their work.

Therefore, platforms must enable significantly stronger gatekeeping protocols to prevent the sale of stolen work and plagiarized content. In the coming months and years, tackling the theft of creative output will be one of the most significant challenges in this space.

Predictions

The Web3 creator economy is growing at a breakneck pace, and creators who can master key aspects can quickly gain an edge in superserving their audiences. If we are in the midst of a crypto winter at the moment, digital assets with real utility or royalty streams, such as music, viral videos, or GameFi items, have a great chance of surviving and thriving through an extended downmarket.

With the proliferation of NFT marketplaces coming out for every major blockchain, big exchanges like Coinbase and Binance are in an excellent position to create a multiChain NFT exchange with instant crypto onboarding for new users. FTX recently announced the GameFi-as-a-service initiatives, in which gaming companies can collaborate and leverage an API to avoid developing their own blockchains. Indonesian gaming community startup VCGamers launched a token and positioned themselves similarly.

Asia will be the leading region for web3 apps build for the masses. With governments friendly to crypto ventures in Southeast Asia, Korea, Japan, India, we often see next generation development originating from the region. Originating from India, Polygon is one of the most promising layer 2 scaling solutions. Exchanges FTX and Binance are based in Hong Kong. Enjin, Coinmarketcap, Nansen and many crypto focused VC funds are based in Singapore. Indonesia has sprouted successful NFT projects such as Monaverse and Karafuru. The Philippines is ground zero for the GameFi movement epitomized by Axie Infinity and Yield Guild Games.

Startups such as Ethlas are building bridges for the web2 casual gamer to try web3 games, with the ability to play as a guest without connecting a wallet. Odyssey DAO is a learning movement with the goal of onboarding 1 million people on to web3. Yuga Labs creator of Bored Ape Yacht Club launched the $ape currency days ago and released a trailer for plans to expand the BAYC metaverse with gaming elements and cross IP collaborations with other top NFT collections.

Ultimately, all artists and creators are anticipating the ‘iPhone’ moment. That super app that will make Web3 usable by the masses. The Web3 creator economy doesn’t need any more evangelists; it simply needs to be foolproof, with Web 2.5 bridges potentially closing the gap for the majority of fans.

Conclusions

The top question for content creators remains; how can they make a living out of their craft, when content is expected to be free? Web 3 helps answer that question by inviting communities to be part owners of a creator’s body of work. The ability to participate in future works of creators did not exist in web 2, but in web 3 the fans are enabled to be long term investors of creator careers.