Tips and Tricks to See If Your DAO Passes the Treasury Health Check

Article by Jake and Stake | Cover by Dippudo

Welcome to Bankless Publishing’s Crypto Basics Series. We’ll be shipping all of our introductory web3 content on Mirror each Monday, enabling users to curate a web3 reference library by minting NFTs on Optimism.

DAOs are organizations that use tokens to incentivize certain behaviors. People often work for DAOs in exchange for these assets (stablecoins, DAO governance tokens, or the blockchain’s native cryptocurrency, like MATIC or ETH); and all DAOs that offer any form of remuneration need a treasury. Without a treasury, DAOs won’t be able to pay contributors and fund projects. Unless a DAO has missionary-like contributors, it will be hard to get incentives off the ground.

That is why it is important to understand a DAO’s treasury; it helps to determine their positioning in the larger crypto economic landscape:

-

Does the DAO have a sufficient number of stablecoins? If they don’t, they’ll be selling tokens and diluting holders in order to operate.

-

Does the DAO hold a small number of governance tokens? If so, they will have less power to vote for crucial growth initiatives.

Sometimes DAO treasuries can be hard to identify because the assets may be spread out across multiple contracts. Uniswap, for example, has five treasury addresses according to openorgs.info.

This article will give you some tools to use when digging into DAOs and their treasuries; and highlight some details to pay attention to when analyzing the health of a DAO.

DAO treasuries matter — not just to investors, but to users and contributors too.

Identifying the Assets

DAO assets can be categorized into four components:

-

The DAO’s governance token

-

Stablecoins

-

The blockchain’s native cryptocurrency

-

Tokens of other DAOs as a result of partnerships

DAO Governance Tokens

DAOs use their governance tokens to incentivize users to participate in the protocol; that could involve providing liquidity, voting, or investing. These are often “Governance” tokens, but we’ll refer to them as “DAO tokens”. Like equity in an early stage start-up, DAOs will have a lot of tokens but not a lot of other assets. Often DAO tokens can be traded away for start-up capital or used to pay contributors.

Because of DEXs, these tokens are very liquid. If token emissions are very high, contributors will often sell them for stablecoins. Unless there is an equally powerful mechanism to increase demand, holders will sell them before prices fall further — due to increased supply.

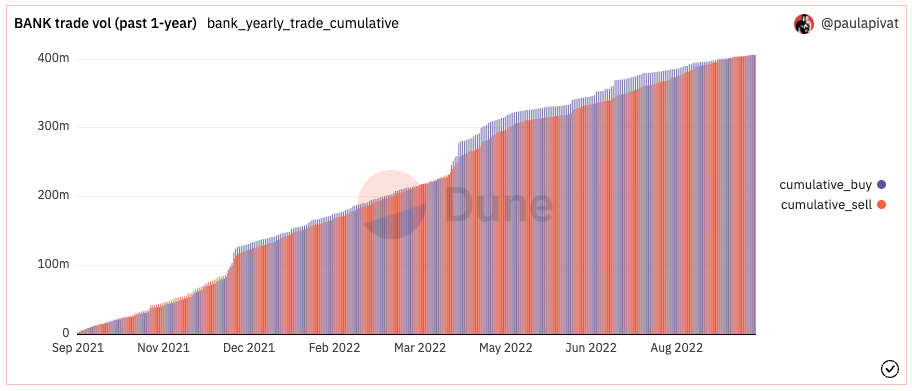

We’ve seen this behavior with holders of BANK tokens. Here is the BANK trading volume over the past year:

Dune graph by paulapivat

Zoom in on the last 30 days and you will see more granular market dynamics:

Dune graph by paulapivat

DAO tokens should be considered the crypto-equivalent of stock, and should be discounted as a part of the DAO’s assets. DAOs can issue new tokens or change the contract. Businesses do not list stock as an asset on their balance sheets, neither should DAOs list governance tokens. Companies do not count unissued shares as assets because they could arbitrarily inflate their balance sheet by authorizing more shares without selling them, does this improve the financial position of the company?

DAO treasuries matter — not just to investors, but to users and contributors too.

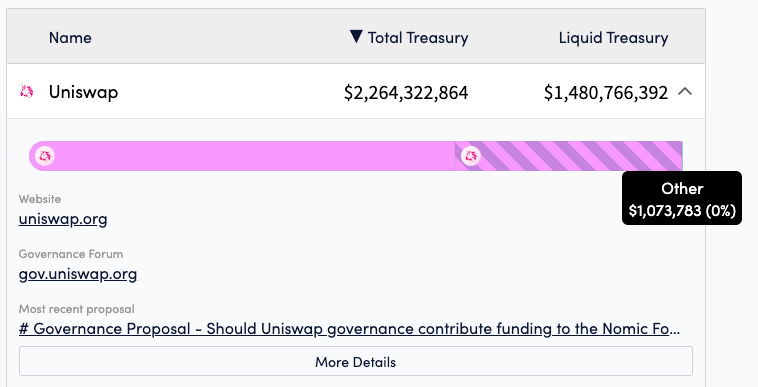

Uniswap is a well-known example of a protocol with a large treasury but little token diversity. The vast majority of Uniswap’s $2 billion treasury holdings are UNI tokens. But discounting UNI tokens (~1.47 billion), and unvested UNI tokens ($790 million) shows a clear picture of their financial position:

Source: openorgs.info

The solid pink represents vested UNI tokens while the striped pink represents unvested tokens.

If there’s a market downturn or some kind of hack that pushes the project to distribute funds, selling the DAO token will dilute existing holders and could create enormous downward price pressure. Most DEXs don’t have the liquidity to handle large token sales. Hasu notes in A New Mental Model for DeFi Treasuries:

“[…] imagine that Uniswap tried to sell as little as 2% of its treasury. When executing this trade via 1inch, which routes the order to many on- and off-chain markets, the price impact on UNI would be almost 80%.”

Treasuries would do well to hold more than just their DAO token.

Stablecoins

The second most common asset held in DAO treasuries is stablecoins. If you need a primer on stablecoins, the DeFi Download has your back. Stablecoins like DAI, FRAX, USDT, and USDC maintain a 1~1 ratio to the dollar. Most are backed by off-chain assets — at least in part.

Stablecoins serve to reduce treasury volatility. Crypto-native assets are very volatile and subject to large price movements. Even bitcoin and ether are subject to market movements, trading like risk-on assets.

DAOs should aim to keep at least some stablecoins in their treasury. These stablecoins can be used to pay contributors and hedge any market or DAO-specific events.

For example, Maker accumulated $7 million of net earnings from 2018–2020. Maker used these funds to buy and burn MKR tokens as a part of their protocol outline. But on Black Thursday (March 12, 2020), Maker failed to liquidate underwater positions due to network congestion and accrued bad debt totaling $6 million in losses.

Some of the debt was paid with DAI in the MakerDAO treasury while the rest was covered through the sale of MKR tokens at depressed prices. Maker eventually bought back and burnt these tokens, costing them 3 million DAI.

If they had instead held that 7 million DAI and used it repay the bad debt, Maker would have $1 million left over, an additional $3 million, and the MKR token supply would not have changed at all.

“Or put another way, Maker could have seen up to $4 million in additional value accrual by holding a larger treasury.” Hasu (A New Mental Model for DeFi Treasuries)

If a DAO hopes to survive for years to come, it must be able to weather bear markets and black swan events. It cannot hope to do this using the DAO token alone. If they do, they’ll end up selling their tokens at the bottom (at worst) and buying those tokens back at the top (at best). Stablecoins often serve to de-risk the treasury.

Note: Be mindful of which stablecoins are in the treasury. If you were holding UST during its de-pegging event (May 7), the value of those tokens would’ve fallen 65% by May 9 and 95% at the time of writing.

Blockchain-native Cryptocurrency

You can also find the blockchain’s native asset in DAO treasuries. These tokens are used to pay for transactions on the token contract’s network. Most tokens run on Ethereum and Polygon, so DAOs set up on these chains have ETH and MATIC respectively.

It makes sense to hold some of those assets in case fees get abnormally expensive, and DAOs are usually tightly aligned with the protocol they’re deployed on. Although these assets are different from the DAO token, there’s often a high correlation between them because they’re part of the same industry. If your goal is stability, buying the blockchain’s native asset should usually be done by dollar cost averaging; unless you expect your native asset to fall in price.

Strategic Token Swaps

Another item to look at is other DAO tokens in the treasury. These tokens represent partnerships between DAOs and grant voting rights in each others’ governance processes.

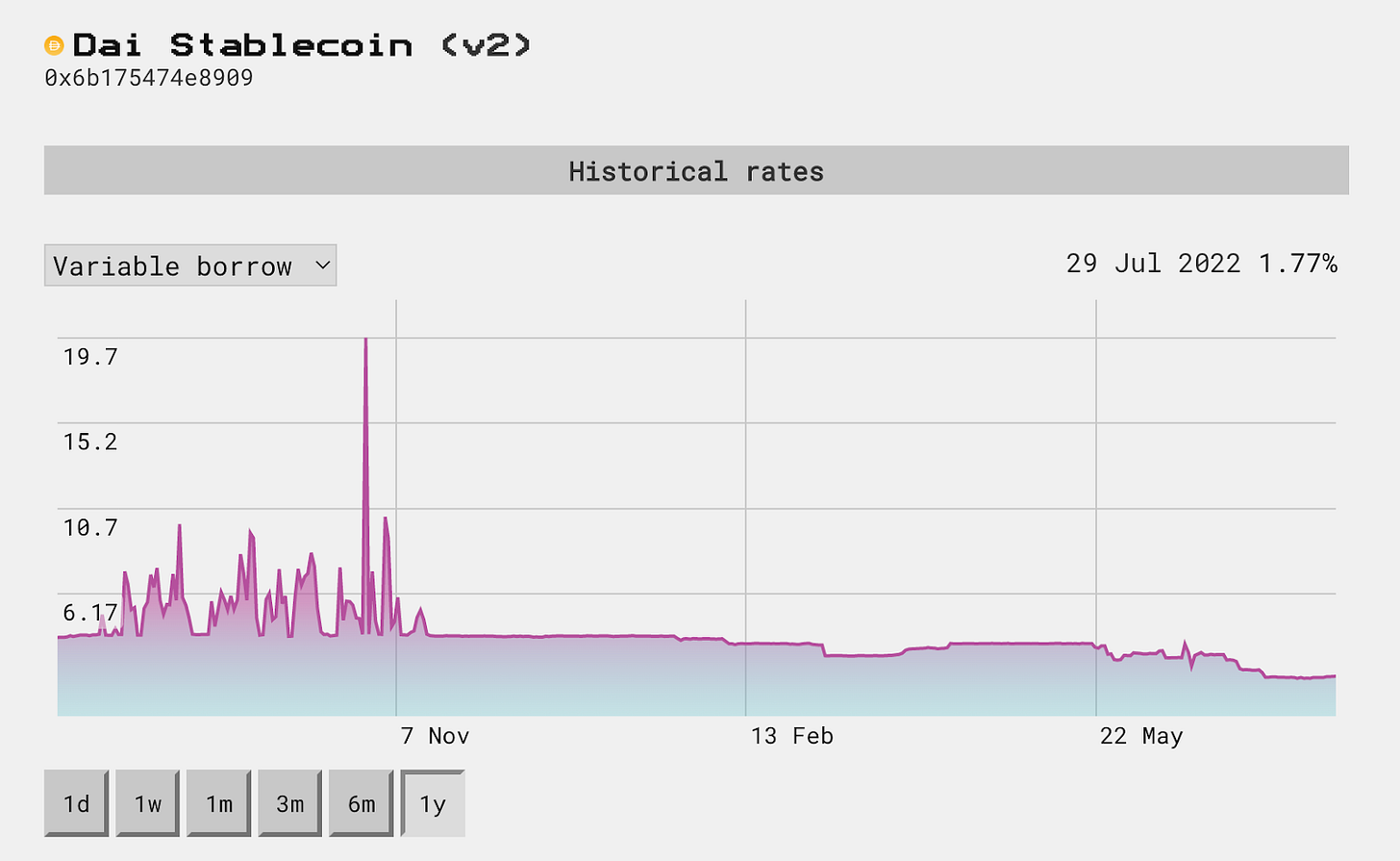

One of the most strategic partnerships was between Maker and Aave in their collaboration to implement the DAI Direct Deposit Module (D3M). The module works by allowing Maker to deposit liquidity directly into Aave’s DAI pool. Subsequently, Maker influences DAI’s supply to stabilize loan rates, making it more attractive to borrowers.

Source: Aavescan

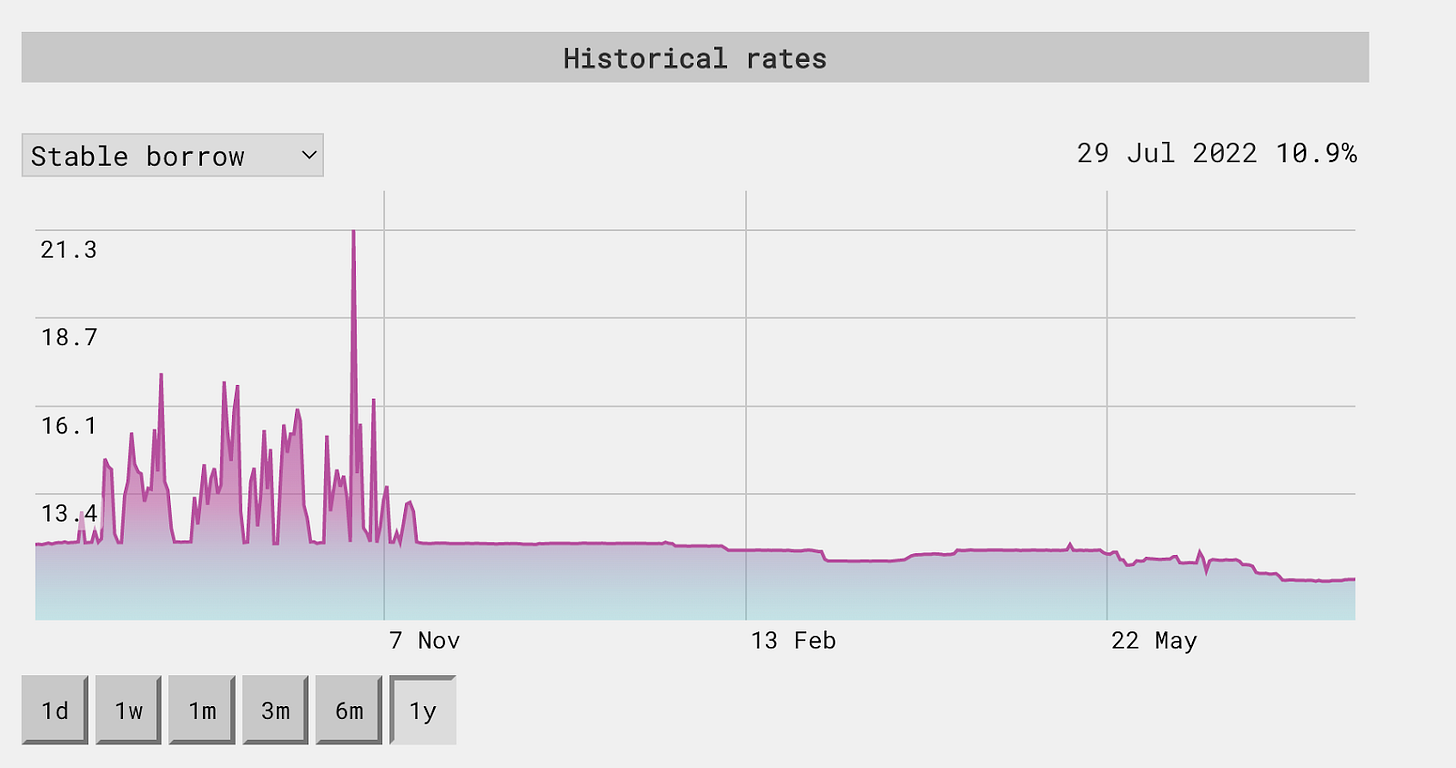

The efforts have been effective. Since its launch in November 2021, DAI variable borrow rates have stabilized to a range of 1.7% to 3.8% on Aave. The results are similar for the stable borrow rate.

Source: Aavescan

In the process of doing so, Maker earns AAVE tokens as a part of Aave’s liquidity mining incentive program, giving Maker a voice in Aave’s governance process. DAOs can also choose to spend extra cash to buy votes in the governance processes of other DAOs and the implications can be far reaching, given enough stake.

With the growing number of DeFi projects in the wild, the overhead of learning about each project’s governance intricacies and second-order effects are large. Most DAOs will only vote if there are ecosystem-wide implications or if the proposal influences the voter in particular, so intervention is minimal.

Theoretically, they can serve as “Mutually Assured Destruction” (MAD): if you dump my tokens, I’ll dump yours; but we don’t foresee this happening in the near future. If anything, the trading of governance tokens increases overlap between contributors and can foster better collaboration in the spirit of open-source development.

Financial Sustainability

In order to be financially sustainable, DAOs should generate more revenue than they expend. This means analyzing out-flows and in-flows, often discounting the DAO token.

Reporting

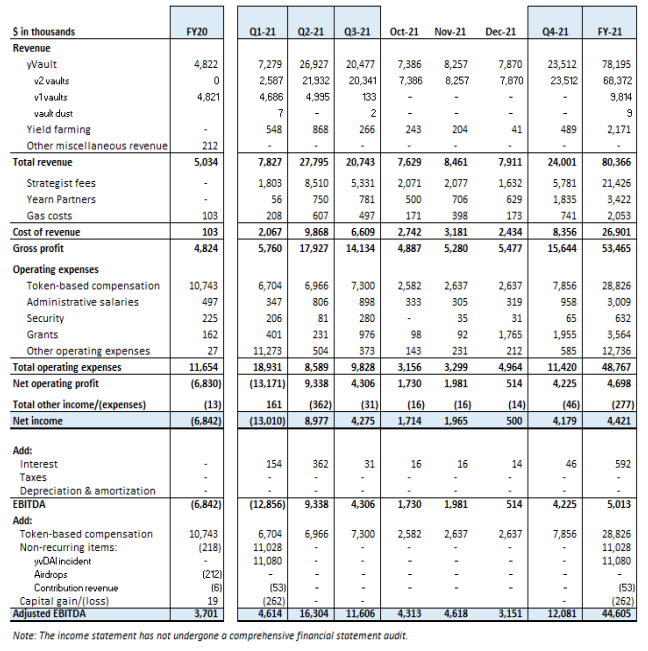

Looking through a DAO’s financial report is a good way to determine a DAO’s financial health. Yearn has quarterly reports that denote income, expenses, and operating margins:

Source: Yearn

From the statement you can see that Yearn has grown their gross profit following 2020, and compensation and administrative costs are also increasing. Many DAOs have put together financial statements; so contributors, users, and investors can understand the organization.

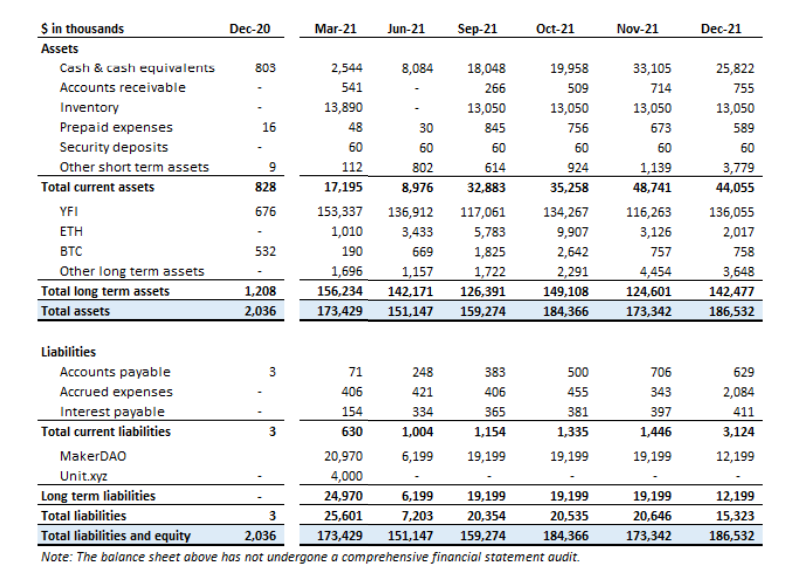

Often, these reports provide more insights than pure data. They include the categorizations of expenses that include the purpose of spending, token buybacks, and upcoming changes to the protocol/organization. Yearn noted in their most recent report that their largest cash expense was allocated to “Strategists”: developers that oversee and manage Yearn vaults; but they expect to move away from a salary for the Strategists and instead institute a profit sharing model for all DAO contributors. Yearn also notes their assets and liabilities.

Source: Yearn

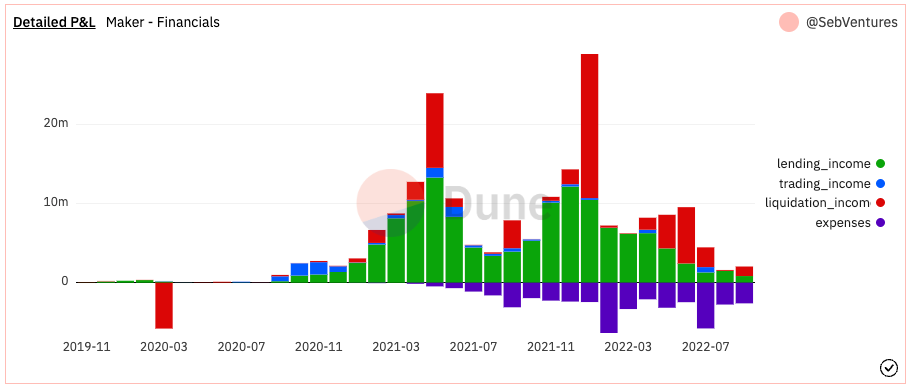

However, these statements are subject to human intervention and error. An alternative is to create a dashboard of real-time blockchain data. Maker has a dashboard to display real-time P&L data.

Source: Dune (SebVentures)

Asset In-flows

The equivalent of income for companies, DAOs should determine how much they’re earning from fees and other investments. Asset in-flows can materialize in a variety of forms:

-

Protocol Fees

-

Membership purchases

-

Yield farming rewards

Researchers can utilize the Maker Dashboard and identify how Maker categorizes income. The Dune SQL commands are publicly available, so users can run the commands themselves and double-check their accounting.

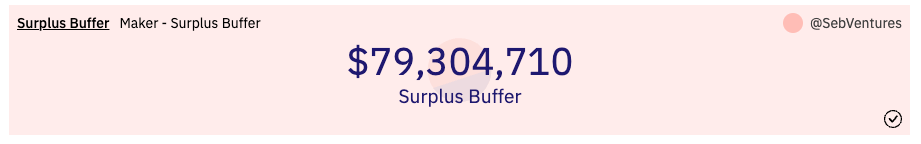

Dashboards can hold a variety of income data that’s specific to the protocol itself. For instance, Maker has a Surplus Buffer that accounts for revenue generated from Stability Fees.

Source: Dune (SebVentures)

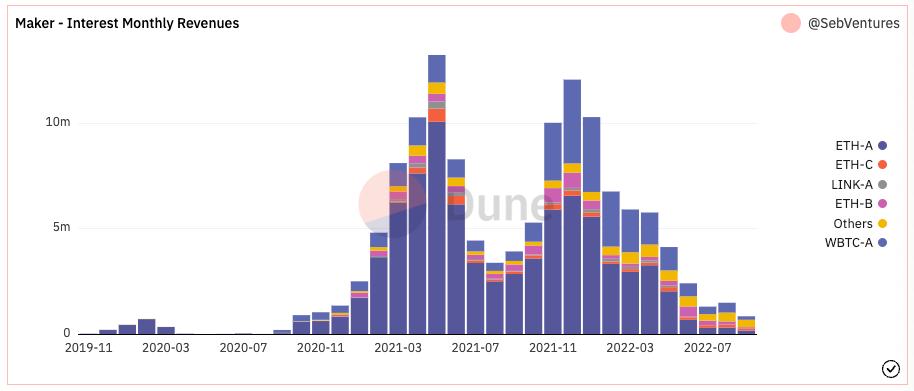

And they break out monthly interest revenues by asset type:

Source: Dune (SebVentures)

Dashboards are a useful way to identify income from different products. Maker has several revenue streams that are broken down in the dashboard above. The Peg Stability Module, Real World Assets, and Liquidations are included. Dune is great for this sort of thing, and is essential for doing this kind of analysis yourself, but it does take some SQL knowledge.

Asset Out-flows

Often, these details can be found in governance proposals and financial reports, not solely by looking at the DAO’s treasury. Expenses will include paying salaries, profit sharing, security audits, or grants.

In order to be financially sustainable, DAOs should generate more revenue than they expend

A similar model to traditional finance can be used to look at these expenses. Some questions to ask:

-

What is the DAO’s burn rate?

-

How much is spent and where are those funds going?

-

How is spending increasing or decreasing?

-

Does this spend positively affect the DAO’s long-term roadmap?

DAO spending should line up with the mission statement of the DAO or otherwise fuel growth.

It can be difficult to identify and categorize DAO spending, so paying close attention to the DAO’s governance proposals, identifying transactions from the treasury, and going through financial statements is crucial.

Note: Some DAOs will spend funds on multiple projects at once and give those teams the freedom to use their grant as they like, making spending even more difficult to identify and collate.

Exploring DAO Treasuries

ENS Treasury

Source: DeepDAO

ENS has the majority of its holdings in the ENS token, but there’s a sizable amount of ETH. Users have to pay ETH to buy ENS domains.

Lido Treasury

Source: DeepDAO

The majority of Lido’s treasury is in their governance token: LDO. As a liquid staking derivative provider, they’ll earn quite a bit of ETH as well. Their treasury is more diverse with DAI being the 3rd largest asset holding.

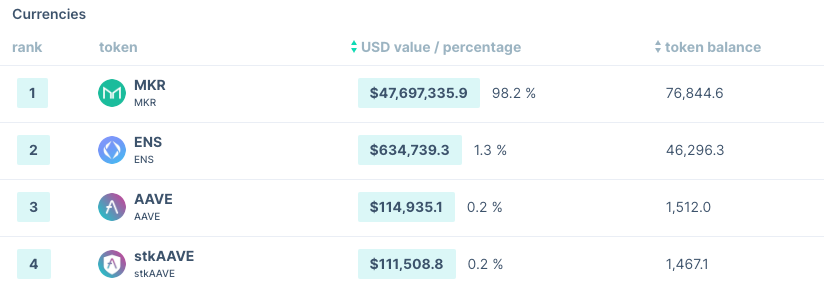

MakerDAO Treasury

Source: DeepDAO

MakerDAO again has a large amount of governance tokens MKR, however what’s not noted here is its holdings in stablecoins, particularly USDC and DAI from the peg stability module (PSM). It’s important to understand how each product affects the protocol’s total holdings. This understanding will allow analysts to determine where tools fall short.

Bankless Treasury

Source: DeepDAO

BanklessDAO has a more diverse treasury than some of the examples above, with BANK composing 80% of the DAO’s treasury. Still, notice the lack of stablecoins. In the event of a bear market, BanklessDAO doesn’t have the funds to purchase BANK tokens or otherwise maintain purchasing power for projects in the event of downturns.

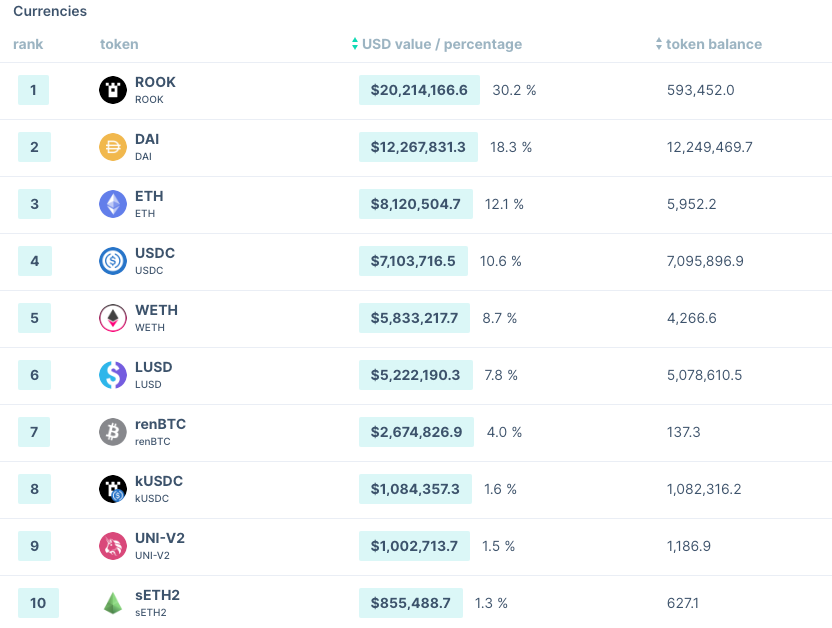

Rook Treasury

Source: DeepDAO

One of the most stand-out counterexamples, Rook has an incredibly diverse treasury with its top 5 holdings having a 30% share or less. This kind of runway will help Rook continue to operate into the future and survive downturns, bear markets, and black swan events.

Towards a Healthy DAO Treasury

DAO treasuries give investors, contributors, and users compelling insights into the health of the organization. They can signal a DAO’s strength and foresight, but this information should be taken with nuance. Some DAOs have various projects that earn revenue not noted in the DAO’s balance sheet, and spending is of great benefit for growth and long-term sustainability.

DAOs should keep treasury diversification in mind when planning into the future. If the DAO token is highly correlated with other assets in the treasury, it can still be negatively affected by market movements; and DAO tokens will not always hold their value, so diversifying into different assets can help DAOs maintain momentum. DAOs can hold LP tokens to generate revenue or index tokens to this effect.

If you’re looking to use a tool to help you manage and diversify your DAO’s treasury, there are a variety to choose from: Yearn, Balancer, and Llama just to name a few.

It’s crucial to understand DAO treasuries, whether you’re a contributor, investor, or user because it affects long-term success. You can see how DAOs are spending, what income looks like, and how much runway they have. In an open financial world, everyone has view-access to the balance sheet, and it’s an important part of understanding where web3 is going.

A version of this article was published by Bankless Publishing on November 18, 2022.

Author Bio

Jake and Stake is a writer and editor at BanklessDAO. He is the former Writers Guild’s Governance Coordinator and he founded and co-coordinates the DeFi Download newsletter, with a background in software engineering and cybersecurity.

Designer Bio

Dippudo is a pseudonymous individual who spends most of his time in front of a computer and has a natural interest in finance. He started contributing to Bankless DAO after falling down the crypto rabbit hole in the middle of 2021.

BanklessDAO is an education and media engine dedicated to helping individuals achieve financial independence.

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains.

Bankless Publishing is always accepting submissions for publication. We’d love to read your work, so please submit your article here!

Other Articles in the Crypto Basics Series

Decentralized Ledger Technology 101 by The Crypto Barista

The 101 on NFTs, A Briefing by Lanz

4 Simple Steps To Join a DAO by Samantha Marin

Towards Better Token Distribution by Paul Hoffman

Cryptocurrency Wallets 101 by ijeblowrider

How To Learn Solidity by oxzh

Ultimate NFT Red Flag Checklist by kalex1138.eth

Four Factors That Make a DAO Sticky by Peter Jones

14 Blockchain Basics by Hiro Kennelly

The Beginner’s Guide to Promoting NFTs by Monique Danao

DAO Governance Primer by EthHunter

The Three Pillars of Discord by Daryl, Lanz, and Roy

DEX Aggregator Basics by oxdog

A Beginner-Friendly Approach to Evaluating NFTs by Marc Bisbal Arias

7 Tips for Avoiding DAO Burnout by Frank America

The Importance of Self Custody by theconfusedcoin

DAI a Different Stablecoin by Jake and Stake

7 Etherscan Basics by Hiro Kennelly

DAOs Are Playgrounds for Growth and Development by siddhearta