How to Avoid the Pitfalls and Trapdoors of NFT Mania

Article by kalex1138.eth | Edited by ThePsychGuy | Cover Art by Dippudo

Welcome to Bankless Publishing’s Crypto Basics Series. We’ll be shipping all of our introductory web3 content on Mirror each Monday, enabling users to curate a web3 reference library by minting NFTs on Optimism.

NFT Safety Checklist

Whether you’re a complete rookie in the NFT space or a seasoned veteran, a framework for filtering the good NFTs from the bad is an essential instrument in any investor’s toolbox.

Not sure if an NFT is worth the investment? Are you considering that it may even be a scam? Run it through the NFT Red Flag Checklist™* to see how it stacks up.

Since the NFT space is still in its infancy, and changing daily, this article will be updated as new red flags are introduced within the community. With that in mind, it’s probably worth bookmarking this article, my fellow metaverse traveller. You wouldn’t want to risk a run-in with an NFT highway robber.

You see? The knowledge that this article provides is equivalent to the crop that the banker’s gonna use to whack the hell out of those red flag scammers. You’re welcome.

Obvious NFT Red Flags

We’ll start with the obvious red flags first:

Anonymous creators with no prior experience, credibility, or success in the space

Anonymity is commonplace in the NFT space. Some want to be anonymous buyers, others anonymous creators. Anonymity isn’t a red flag in itself. Popping up with no prior experience, no work to demonstrate, and no one to vouch for your credibility, that’s a risk. Light red flag here.

Unexciting art

Do you like the artwork? No? Then why purchase it? If you don’t like the art, what are the odds that you’ll flip it for a profit because someone else thinks it is exciting? Flipping or not, if you don’t like the art, don’t buy it.

Fiverr/outsourced art

Have you been into NFTs for more than a week? If yes, then you almost certainly know about this epidemic sweeping the NFT ecosystem. Countless projects have outsourced their art to freelancers. The result is always the same; uninspired, cookie cutter, flat, generative profile pictures. These nightmares usually reside on Solana, Cardano, Harmony One, or Tezos.

Celebrity endorsement

If a celebrity is the #1 name or influencer behind a project, it may not bode well. A number of celebrities have allowed their projects to stagnate. Others have performed rug pulls. Projects with a celebrity at the helm warrant increased scrutiny, not less.

High price at mint

To date, few projects have justified a mint above 1 ETH. Granted, this doesn’t apply to 1/1 pieces which can plausibly do so. Generative projects may one day justify this price, but what has held true so far is that high-priced mints aren’t a guarantee of high-priced returns. As for chains other than Ethereum, compare that crypto’s price to ETH prices to make sure you’re not overpaying.

Unoriginal knockoff of a popular project

Derivatives of popular projects are a dime a dozen. Many fall for slight variations on popular collections. Unless it’s adding real value, new utility, or a creative take on the original project, it’s unlikely to gain traction as a distinct set.

I’m aware that OpenSea doesn’t have charts like this. Sue me. I’m trying to save you from losing money on rubbish NFTs and you’re telling me a little creative license isn’t due to me?

Unfulfillable/unrealistic roadmaps

Intentional or not, far too many project roadmaps fall into this category. Maybe the project creators are naive. Maybe the innovation they’ve promised in the roadmap is beyond their capabilities. Maybe the promise is contingent on a sold-out mint, or consistent secondary sales revenue.

When reviewing roadmaps, you should be asking yourself whether the promises made are realistic. If a promise seems ambitious and the project seems to be breaking new ground, be careful. You should vet the team to see if they’re able to make good on those promises. If they seem like they’re biting off more than they can chew, it’s time to start asking questions on Discord and/or Twitter.

Weak roadmap

On the flip side, an uninspiring roadmap filled with fluff and few innovations is almost equally as blunderous. If holders have little to look forward to, a sell off is expected. Underpromising, maintaining enthusiasm, and then overdelivering is a delicate art that few projects have mastered. Projects that forego a roadmap do NOT fall into this category.

“Finished” utility

Some projects will promise ready-to-go utility prior to minting a single NFT. Sometimes this promise comes in the shape of staking or other reasonable milestones for early lifecycle projects. Other times, it comes with doctored evidence that a video game has already been created and will be ready to deploy as soon as the mint is completed.

“Take that with a moon-sized grain of salt.”

This is a massive red flag and is typically indicative of scams. Video games can take ages to complete. If the video game isn’t the sole focus of the NFT (a la Axie Infinity or Crabada) and is mentioned as a sort of post-mint bonus, take that with a moon-sized grain of salt. Contradictory as it may seem, the more polished a game appears at this stage, the more likely the project may be a scam. Keep on the lookout for other types of “finished” utility in the future as scams adapt.

Too many mints

10,000 tokens to a given project was run-of-the-mill a few months ago. Now, with the NFT market highly saturated, many decent projects have seen their mints go unfinished. If a project launches with 10,000 mints (or more!) they better have a good reason for doing so. Only the most in-demand projects should truly consider launching with 10,000 or more tokens. Though this is almost certainly subject to change, the current golden number of mints appears to be between 3,500 and 8,888. Anything more magnifies the market’s oversaturation.

If the mint began weeks or months ago, and it still hasn’t sold out, or gone past the 75% mark, that’s a red flag. It doesn’t mean the project won’t bounce back at some point, but it is worrisome. Keep in mind, however, that some projects take some time to get running. The Doge Pound, for example, didn’t complete its mint for roughly a week.

Too few mints

Scarcity for scarcity’s sake is unlikely to reap the benefits NFT creators think it will. This of course refers to generative projects and not 1/1 projects which usually gain value from their singularity. Projects that curb their mints to fewer than 3500, or prematurely cut short their mint in order to revitalize communal enthusiasm, are shooting themselves in the foot. Both actions are poor signs of the future growth and sustainability of the project.

The Doppelgӓnger Problem

The uniqueness of a given NFT within a collection is tantamount to the aesthetics of the art itself. If a generative NFT collection has too few properties, clones and lookalikes are expected. I call this the Doppelgӓnger Problem. To combat this, some projects have started generating batches of NFTs before the mint and then comb through the collection to ensure that no two NFTs are identical.

Though they may not have a name for it, lots of NFT collectors are wary of this issue. People don’t want a profile picture that has a doppelgӓnger. Those projects that still fall into this trap today are either clueless about, or apathetic to, the NFT collector’s maturing perceptions of what defines a good project.

Uniqueness is key. Projects ignore this issue at their own peril.

Take these MekaVerse NFTs for example. Can you spot the difference? Yeah, me neither.

Asking questions of the admins/creators gets you silenced

Decentralized systems, by their nature, should engender more scrutiny of authority, not less. Now, if you’re being an ass, your ban may be justified; but if you’re asking genuine questions about the project and you get banned, or stifled, that’s a major red flag.

Hostile Discord, mods, or creators

Maybe the mods aren’t silencing you, but the overall feel within the community is one of hostility. Whether this is directly due to the actions of the mods, or whether it’s through their lack of enforcing healthy community guidelines, the mods are blameworthy. A hostile community isn’t likely to grow to its fullest if it is alienating users.

Botched mint

If you’ve been in the NFT space for a while and you’ve participated in a handful of mints, you’re probably a survivor of a botched mint. Despite best intentions, mints can quickly become a train wreck as they succumb to any number of technical difficulties. This isn’t necessarily an unrecoverable red flag. However, some projects have yet to recover from their botched mints.

Fake follower counts

Paying for Twitter followers isn’t a new phenomenon. It should come as no surprise that scammy NFT projects are buying their Twitter followers.

One simple way of looking out for fake followers is to check how responsive and active their community is on Twitter. Are they getting lots of engagement on their posts? Is that engagement from users who appear to be real people? If not, then perhaps their follower count isn’t real. Another method to employ is a tool such as Follower Audit which allows you to check for real followers from fakes by inputting a Twitter handle.

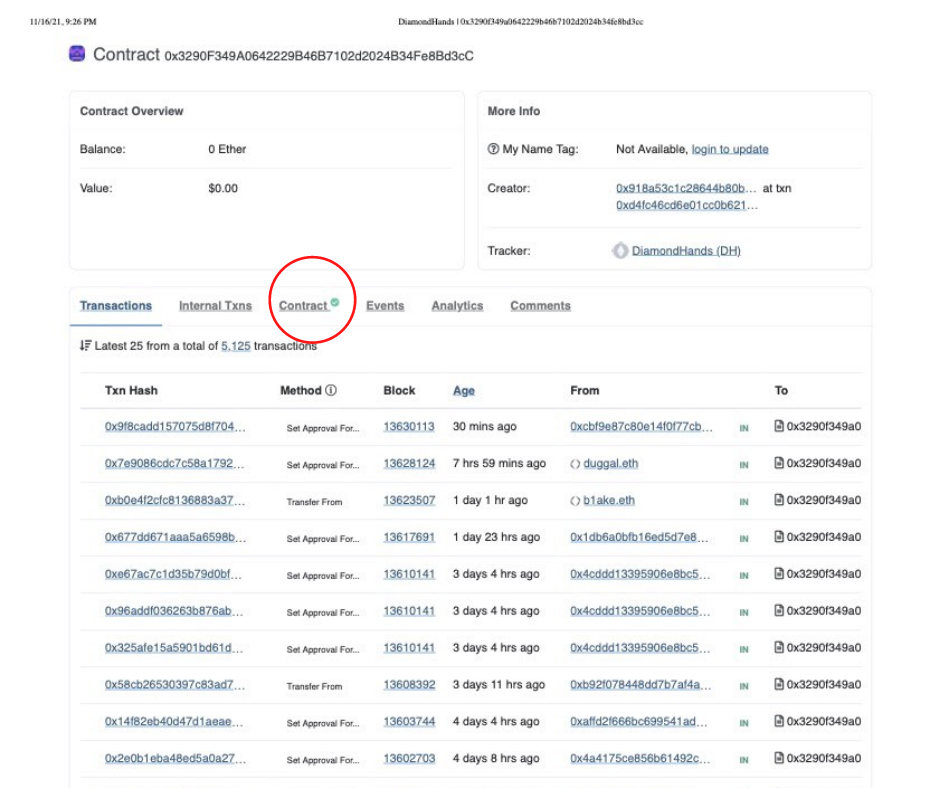

The smart contract isn’t verified on Etherscan

Some minters may prefer to mint directly from the Etherscan contract. If doing so, you should ensure that the contract is in fact verified through Etherscan, an Ethereum block explorer. Once there, you should check to see if the contract has a verified checkmark next to it, like the contract below. If there isn’t a checkmark in that spot, proceed with caution!

Etherscan is host to lots of other data that may help you in your NFT journey. Exploration is encouraged!

Unverified NFT artist

This is a light red flag. We have to give artists the opportunity to put themselves out there, right? Now, if the artist is verified as an already-established NFT artist? That’s a green flag. This doesn’t have to be the case one hundred percent of the time, but for generative pieces, this is a plus.

If the artist shows up on SuperRare, Foundation, Rarible, or other reputable NFT marketplaces, this can add significant credibility to the project. It may give you some insight into what kind of artwork you can expect from the series prior to the mint.

It may also give you insight into what to expect from any airdropped NFTs promised on the series’ roadmap. Just make sure to check the artist’s individual socials to verify that they are indeed attached to the project. More than once an artist has falsely been reported to be the artist behind a project.

Shilling in your DMs

I get it, you want to market your project and stick out from the hordes of other doge or ape NFTs out there. Bit of advice? Stop shilling your projects in my DMs! If you do so, you’ve guaranteed that I’m never going to buy an NFT in your project.

To the optimistic investor who wonders if perhaps some of these projects are legitimate, understand that, at best, it’s a really bad look for a project. At worst, it’s a scam that will empty your entire NFT collection the second you click on the link. You tell me if entertaining that optimism is worth the risk?

Unlimited mints

If a project allows for unlimited mints or it arbitrarily decides to extend the mint number, that’s a big ol’ red flag. Also, if they don’t cap the mint number for whitelisted users, that’s a no-go. If they allow more than ten mints per person, that’s a red flag. Less than five mints per person and the project earns itself a green flag.

Why is this so important?

-

Allowing a small group of people to mint disproportionately large percentages of a collection flies in the face of community members not on the whitelist. This is particularly true for those who were invested from the beginning and want a fair chance at participating in the mint.

-

Second, it stands in contrast to the overarching decentralized ethos of the crypto community.

-

Third, the more disseminated a project’s stakeholders, the better.

-

Fourth, the extended mint means they can change the max supply, leading to the devaluation of any NFT you mint in the future.

Promise of fixed floor price or ROI

If a project promises to stay above a certain floor price, or guarantees a specific return on investment, that’s a big red flag. It shows that their priorities are not on the art or the project’s potential utility, but on profit. Not a good look. An even worse offense– silencing holders who sold their NFTs below the fixed floor price. Massive red flag.

Typos on website and marketing

This isn’t to say that there aren’t scams out there that look legitimate, but if there are lots of typos and incorrect grammar, enough to raise a red flag in your gut, you may want to trust that feeling. With that said, plenty of projects from non-native English speakers have typos but have proven successful and longstanding.

Claiming the NFT will be the next blue chip

Let the product speak for itself damn it. The NFT community will determine what qualifies as a blue chip. The project’s creators won’t.

This is the NFT equivalent of that person from high school who hits you up with that whole “I’m gonna get you to financial freedom, just like what [insert random pyramid scheme] did for me” pitch.

Percentage of holders

If there are a few whales holding most of the NFTs, it may be best to steer clear. Projects with above 50% unique holders are in the clear. Projects below 30% unique holders may be risky. Even if it’s a legitimate project, this isn’t the healthiest look.

Giveaway Fraud

Are giveaways taking place on Twitter or Discord? Scour socials to see if the giveaway is authentic and the winners are actually receiving their prizes.

Poor ownership of mistakes

Mistakes happen with NFT projects; how they are dealt with speaks volumes. If those involved with the NFT, no matter what role they fill, treat their community poorly, particularly if they themselves made a mistake, that’s a big red flag. Even if short term gains are to be had, blue chip status is unlikely to be around the corner for that project. At least unless the community can forgive and forget the mistake(s).

Counterfeit NFTs

Counterfeit NFTs abound. If you think an NFT may be counterfeit, use Tiny Eye reverse image search to see if the seller doesn’t have ownership of the image.

Dwindling activity

Is creator activity diminishing on Discord or Twitter? Check their activity on both platforms to see if they’re slowing down. This may be a sign that they’re looking to move onto another cash grab, or that they will disappear with whatever profits they’ve made, ending any further roadmap development.

Orchestrated whitelist

If the project is cherry picking and choosing who they want to be a part of the whitelist behind the scenes, that’s a form of nepotism. It should have no place in a community that advocates decentralization and trustless systems. Certain projects will be upfront about this–others won’t. Regardless, it’s a red flag.

Stored off-chain

Unless it’s stored on IFPS, or preferably on-chain, then it runs the risk of being tampered with or stolen by whatever centralizing power hosts the NFT. On-chain is king.

Sellers vs. buyers

If buying on secondary, is the number of sellers high compared to the number of items in the series? If yes, people may not have confidence in the project and may be looking for a way out.

Leaked metadata

When a reveal period is taking place, unscrupulous creators, and insiders, can get access to leaked metadata. This allows them to poach the rarest NFTs in a series at average prices, before prospective sellers even know what they’ve minted. Stealing your early investor’s money? One of the worst looks a project can have.

Conclusion

Now that you have the tools and the knowledge to avoid those pesky highway robbers, I urge you to take to the road and explore the wonderful world of NFTs! Have a red flag you think I missed? DM me on Twitter @kalex_1138 and I may add your red flag to the article (with due credit of course).

*Trademark pending. Except, you know, it’s not.

A version of this article was originally published by Bankless Publishing on December 17, 2021.

Author Bio

kalex1138 is an ex-academic writing about all things blockchain.

Editor Bio

ThePsychGuy is a grad student of psychology who is interested in behavioral dynamics across Web3. He enjoys the philosophy of decentralization.

Designer Bio

Dippudo spends most of his time in front of a computer and has a natural interest in finance. He started contributing to Bankless DAO and is now working on numerous other projects within the DAO and The Rug News as a designer.

BanklessDAO is an education and media engine dedicated to helping individuals achieve financial independence.

Bankless Publishing is always accepting submissions for publication. We’d love to read your work, so please submit your article here!

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains.

Other Articles in the Crypto Basics Series

Decentralized Ledger Technology 101 by The Crypto Barista

The 101 on NFTs, A Briefing by Lanz

4 Simple Steps To Join a DAO by Samantha Marin

Towards Better Token Distribution by Paul Hoffman

Cryptocurrency Wallets 101 by ijeblowrider

How To Learn Solidity by oxzh