CFOs are responsible for optimizing capital structures, allocating financial resources, forecasting future performance, and more. The modern CFO works well for C-Corps, but we’re shifting towards decentralization. As DAO treasuries accumulate billions of dollars of assets, we need to ask the question: “What does the CFO look like in a decentralized economy?”

TLDR: DAO treasuries are massive (nearly $10B), but today they are not capital efficient. This negatively impacts protocol growth and stakeholder utility maximization. Tools are being built to manage treasuries, but we need operators to make the decisions and execute. It’s time to rethink the CFO from first principles.

A brief history on the CFO

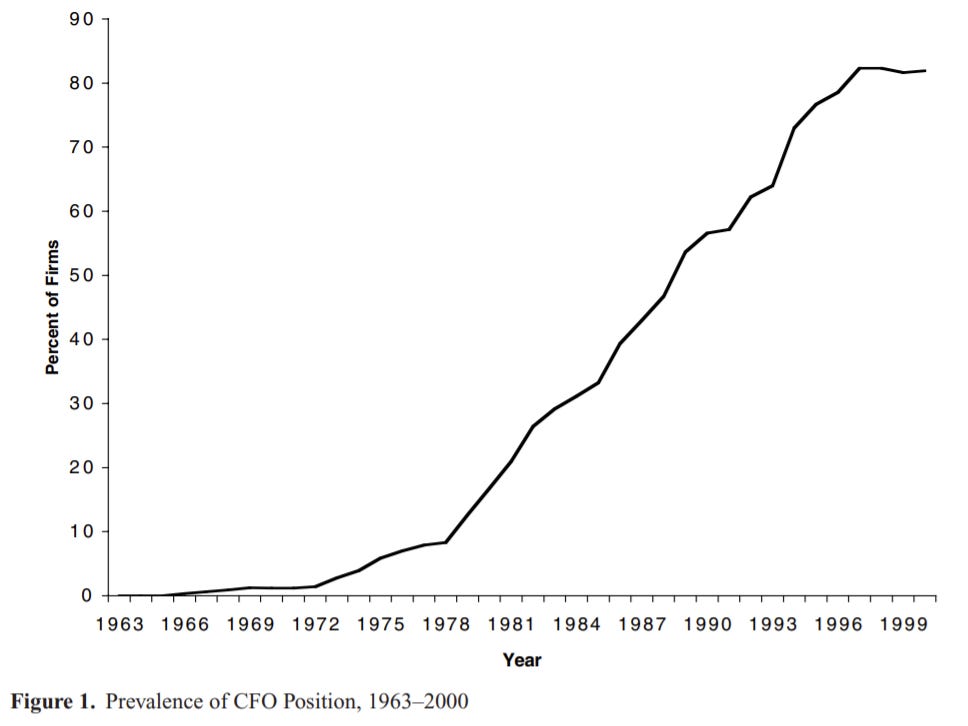

CFOs are a relatively recent creation. Up until the 1970s, financial governance was largely limited to bookkeeping. Then came regulation. In 1976, the SEC issued a mandate requiring increased reporting for large public companies. Increased visibility drove financial scrutiny. Markets realized that optimized financial planning (ie managing cost of capital and allocating capital towards highest ROI opportunities) could help a business grow faster and more efficiently than competitors. Thus, the modern CFO was born.

What are DAOs?

Short for Decentralized Autonomous Organization, a DAO is an internet-native entity governed by a decentralized ownership base and enforced by transparent smart contracts. Democratization of voting rights to all token holders reduces risk of incentive misalignment. Once a decision is made, it is enforced by code (ie smart contracts), reducing the risk of corruption and non-compliance.

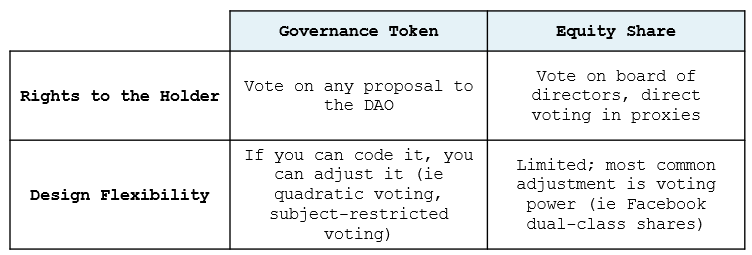

The mechanism for governing DAOs is a governance token. Let’s compare a governance token to a traditional share in a C-Corp:

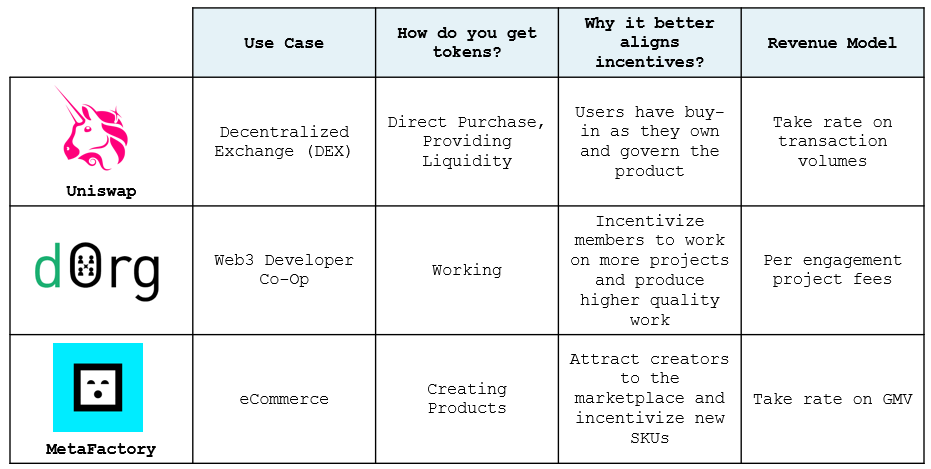

Because the release of tokens can be managed entirely by code, DAOs can create flexible token distribution schemes. This allows projects across a variety of use cases to improve incentive alignment as they optimize for certain business metrics (ie revenue). A few examples below:

What are the issues with DAO financial management

Revenue generating DAOs have nearly $10B sitting largely untouched in their treasuries. Regardless of whether you believe the funds should be deployed faster or slower, the status quo is not capital efficient. These funds could be used for marketing, educating regulators, building partnerships, product development, dividends, acquisitions, etc.

This is the result of coordination failure. I’d posit several drivers of this failure:

This is not a new problem, people have discussed it before. Projects are building toolkits to better manage a DAOs finances. Parcel launched a toolkit for payouts, token buybacks, and more. Llama is building tools for DAO treasury management, including cash flow visualization and DAO-to-DAO token swaps. Index is launching slippage minimization solutions for treasury diversification. The toolkit is emerging, now we need the 'CFO’ to operate.

Who, or what, should be the CFO of a DAO?

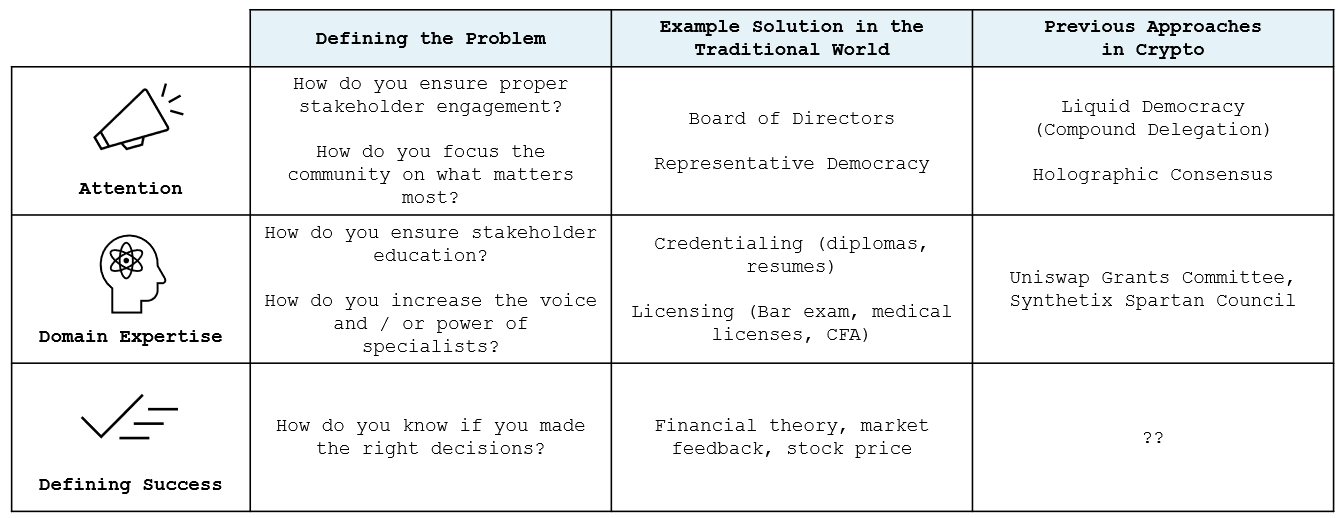

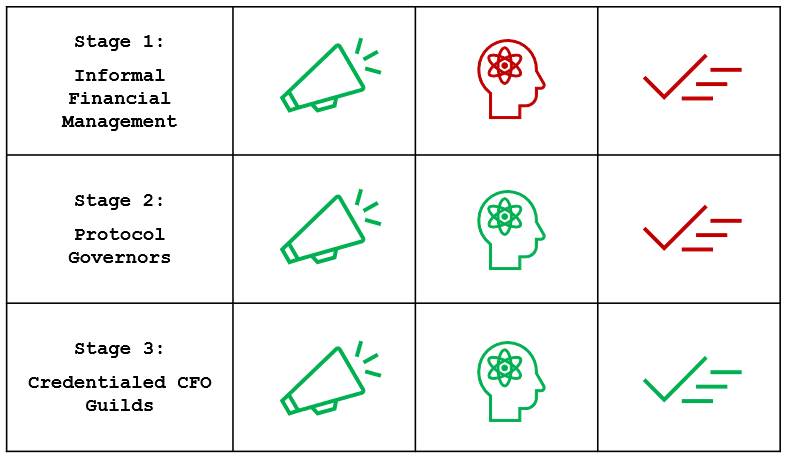

The solution needs to a) intelligently manage stakeholder attention, b) optimize for domain expertise, and c) create feedback loops for constant improvement. All this needs to be done while maintaining decentralization to ensure resilience and minimize corruption.

The progressive decentralization of the DAO CFO is underway. We’re somewhere between stage 1 and stage 2 today.

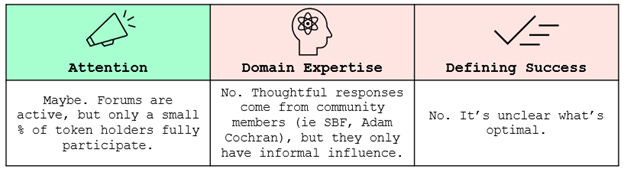

Stage 1: Informal Management. Community members or small groups of members launch proposals to the DAO. They lobby for a proposal’s merits through forums and Discord conversations.

Recent Example: Sushi Phantom Troupe. A proposal was made from VCs to the community to purchase $60M of tokens from the project’s treasury.

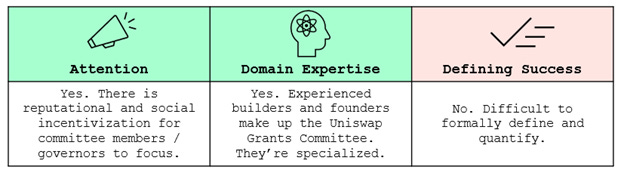

Stage 2: Protocol Governors. Formal working groups are created to focus attention and talent on financial initiatives. These “governors” can be elected by the DAO (by an owner committing their tokens to an individual) or automatically selected through a pre-coded mechanism. Terms can be fixed or flexible. Candidates can make proposals to DAOs to become a governor (inbound) or DAOs can actively recruit governors to their DAO (outbound). Governors can come as individuals or as guilds (with individuals dedicated to financial planning, reporting, M&A, etc.). It’s likely many permutations are attempted at first, but over time standards form for protocol financial governance structures.

Recent Example: Uniswap Grants. A committee strategically allocates a portion of the treasury to fund new projects. This is loosely parallel to a CVC.

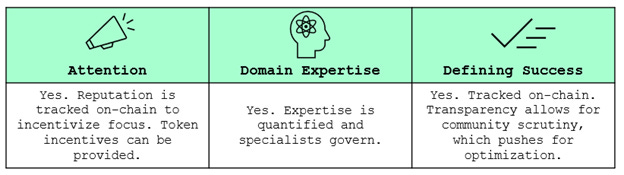

Stage 3: Credentialed CFO Guilds. Reputation of financial governors turns from informal to formal. This could take several forms. DAO members could start evaluating performance of their financial governors through votes, creating an on-chain approval rating. Independent collectives could form as public goods to audit a governor’s track record. Financial governors could begin earning badges signaling their education (ie online courses, rabbithole.gg-like financial training, etc.) and experience levels (ie earning a Compound financial planning badge or a MakerDAO acquisitions badge). The quality of financial governors becomes transparent and quantifiable. Governors can inbound ideas to a protocol as an activist investor would propose a strategic financial shift to a public company, and the DAO votes based on the governor’s track record. Alternatively, marketplaces could form for protocols to recruit financial governors. An on-chain reputational data visualizer forms, resulting in a decentralized LinkedIn of sorts.

Concluding thoughts

Ownership, corporate governance, and the way we work will meaningfully change over the coming decades. The decentralization of the CFO is just one of many examples. Structure will form to manage the complex systems we’re creating. Looking to the past doesn’t have to create skeuomorphic outcomes. We can analyze today’s structures from first principles to accelerate our progress towards the decentralized economy.

Note: None of the above is investment advice. All views are my own.