Key Takeaways:

- The market’s collapse is caused by the chain reaction of stETH depeg and Celsius’s user asset freezing.

- With $200B evaporated, people need better tools to identify the systematic risks hidden in DeFi.

- An investigative and interactive data platform backed by a consistent and coherent data model framework is essential for the public to scrutinize the potential peril in the market.

For the first time in over a year, crypto’s global market cap dropped below $1 trillion as $200 billion was wiped off.

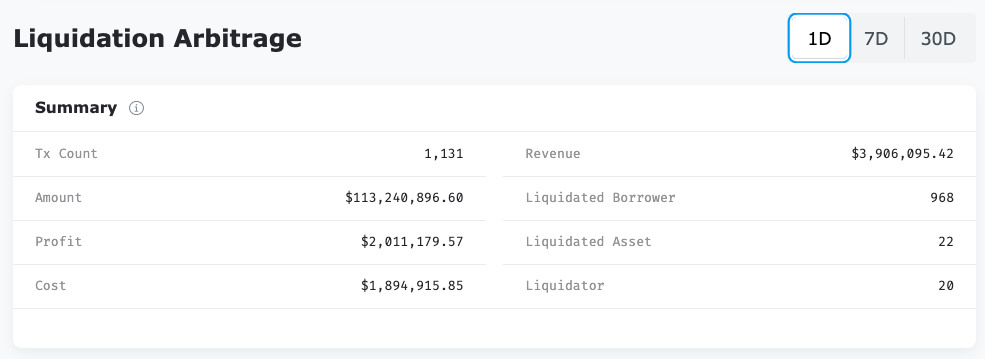

Last night, on AAVE and Compound, around one thousand borrowers’ assets got liquidated. The total amount reached about $100M, resulting from recent market volatility.

During the last seven days, ETH has dropped over 37%. Meanwhile, over the previous 24 hours, the rate of stETH to ETH had fallen to the lowest point of 0.9268 ETH.

The downward trend has been severe during the last few days, as shown in the charts below captured from Coinmarketcap.com.

The crash set off a chain reaction, pun intended.

Celsius Network, which has over 1.7 million customers and was valued at $3.5 billion last year, managing $11.8B as of May 17, is freezing all withdrawals and transfers. How serious is this? Here is the opinion of Larry Cermak, the VP of Research at The Block.

At the moment of this writing, according to Larry Cermak, the top 15 wallet addresses owned by Celsius still have over $1.55 billion in different assets, among which 74% of all $wBTC on Maker is in Celsius’s Maker vault, according to @TheDeFiDan. Celsius added more BTC as collateral to avoid being liquidated, which is $544.4M in total, lowering their liquidation price of wBTC to $16,852.

According to aQua, before the top-up, once the price of BTC reaches its 200WMA (Weighted Moving Average), which is $22.4K, the liquidation mechanism would be triggered for Celsius and many other borrowing protocols, which would further worsen the market crash, cascading into another round, or the worst-case scenario, rounds of rounds liquidations, as the result of the chain reaction.

Now that Celsius has some room to breathe, the crypto world in general as well, but not for the thousands of borrowers whose over-$113M assets got liquidated during the last 24 hours. Especially last night, at 20:46:34 EST, the price of BTC was $22,325.2, lower than its 200WMA.

How to Address the Volatility?

The most ironic part is that this systematic risk presenting itself in front of us is precisely what drove people to build DeFi to avoid. Yet here we go again. Celsius, as one of the biggest CeFi in the DeFi world, has been in the eye of the brooding storm, which gives rise to some philosophical-level of questions:

- Do the profit-seeking and risk-avoiding essences of (certain) human beings naturally breed centralized institutions like Celsius, which eventually thwart the utopia of decentralization?

- Or is this just a big speed bump reminding us to be careful while we are still driving in the right direction?

WE the BUIDLERS are glass-half-full people. Otherwise, we would not reach where we are now. I would assume, therefore, that you, as I am, have a strong belief in the future and regard the current predicament as a problem we can and are going to solve.

Part of the problem is data fragmentation. Assets flow freely across protocols, not the data among different protocols with varied dimensions. As a result, a daily trader has no capable tools with proper methodologies to integrate all the information. Whatsmore, most of the current presentation of the data provides no interaction for users to carry out an exploratory analysis. As a result, most of the existing data tools are insufficient for investors to make informed decisions.

To facilitate users making well-informed choices, in April, we released the Liquidation module showing the comprehensive data and detailed asset flows of the liquidation transaction. Behind the scene is our consistent and coherent data analysis framework combining structural, behavioral, and network analysis.

Let’s walk through our liquidation data of yesterday to reveal what’s been happening during the Night of Liquidation, hopefully, the last, not the first in the foreseen future.

An Inspection of the Night

Around 22:00, we noticed the abnormality in our Liquidation module. By then the summary of the 1-day data showed the amount as $100M. When we sent out the first tweet to notify our Twitter audience at 22:10, the amount grew to $125M. $25M in 2 minutes.

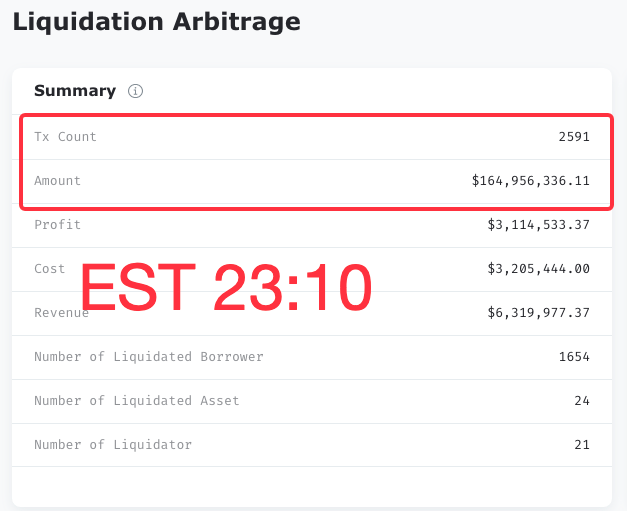

The number kept climbing in the next hour and finally died down after 23:00. At 23:10 EST, it was stable around $165M.

What were the biggest liquidations?

Here are the top 10 largest liquidations of last night, ranging from $3M to $5.2M. All the liquidated assets are WETH, and 9 out of 10 happened on Compound.

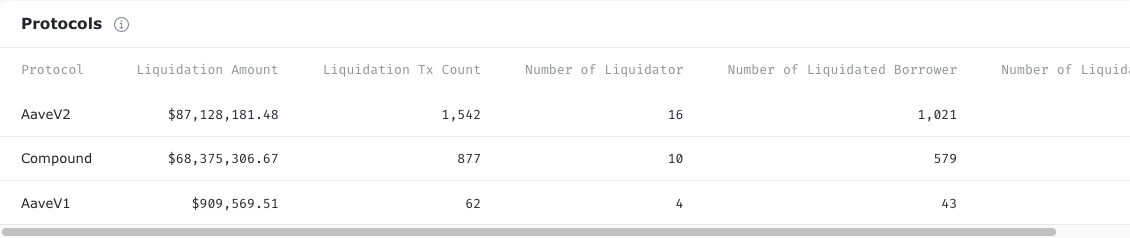

How many assets were liquidated regarding different protocols?

The majority of last night’s deal occurred on AAVE v2: over $87M. Almost $68.4M was on Compound. And $1M shy was done on AAVE v1.

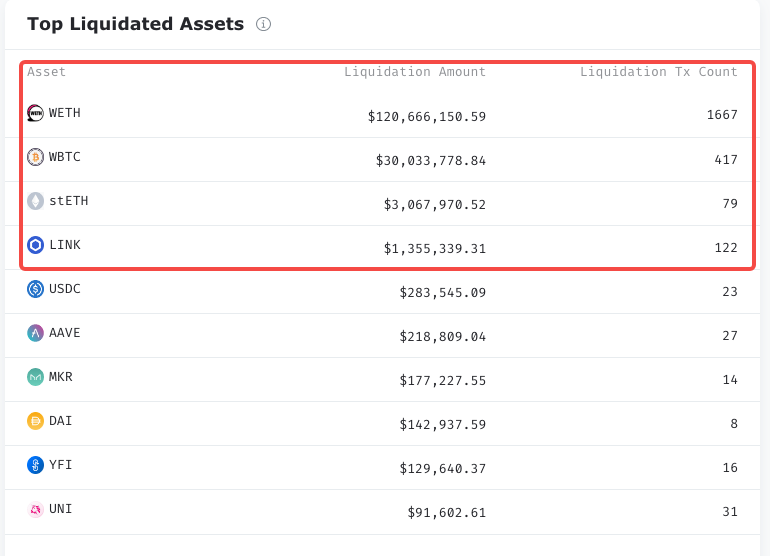

What about assets?

Here are the top ones: $120M WETH, $40M WBTC, over $3M stETH, and over $1.35M LINK.

Who’s the top liquidator of the night?

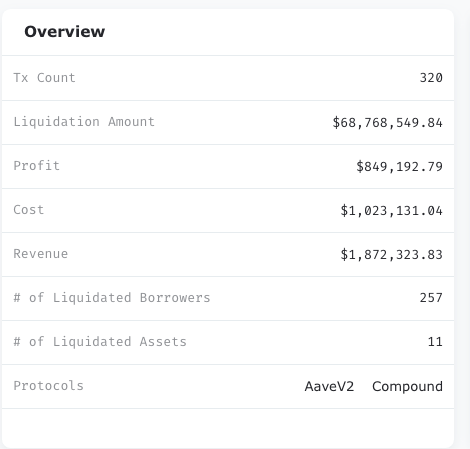

This is the top dog that liquidated nearly $69M and reaped about $850K on 320 transactions from 257 borrowers. Its footprints covered both AAVE v2 and Compound and spread among 11 assets.

You can also examine its transaction distribution on the page, showing here how many liquidations are distributed in which profit range.

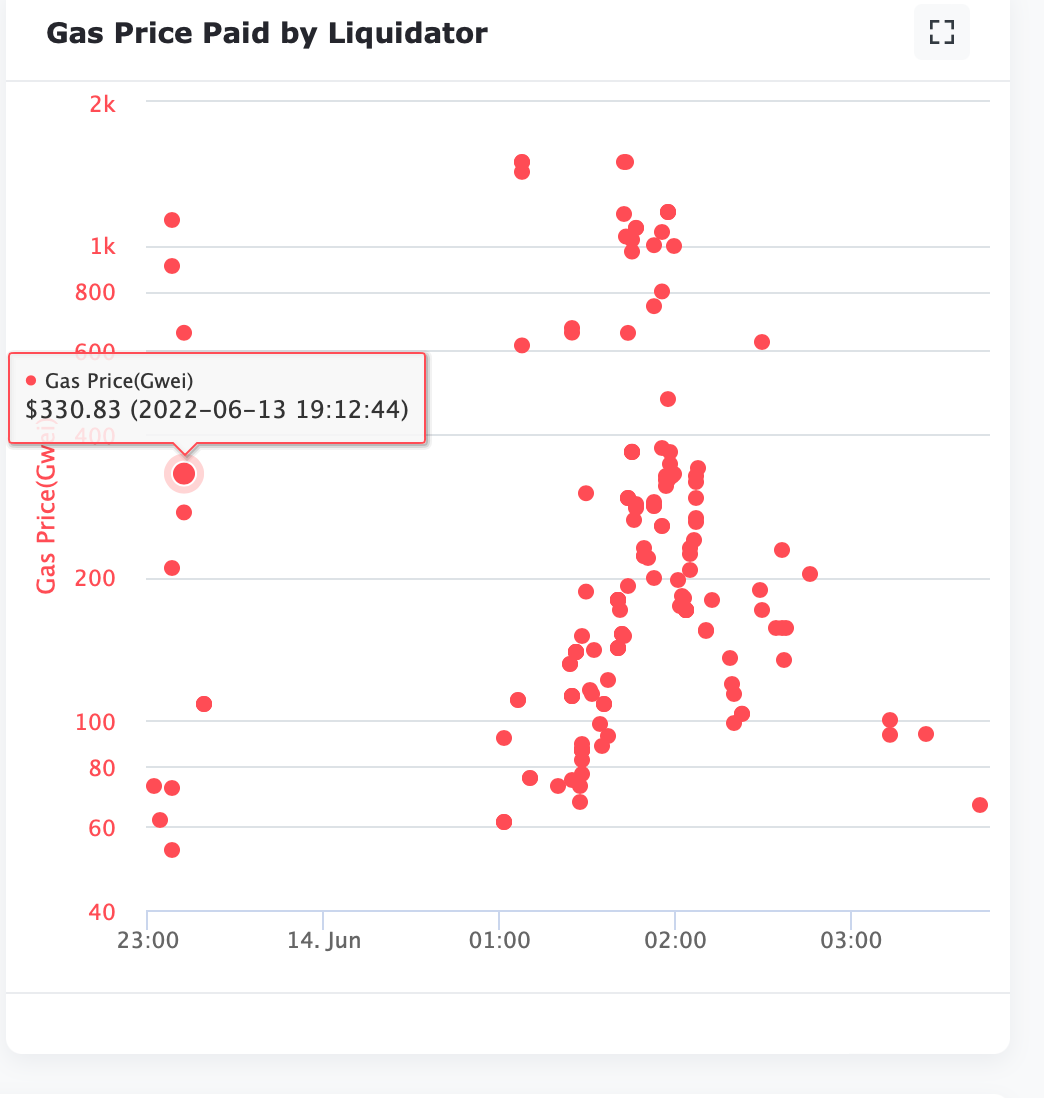

What about its cost? The gas price chart would give some idea.

Which is the most profitable liquidation?

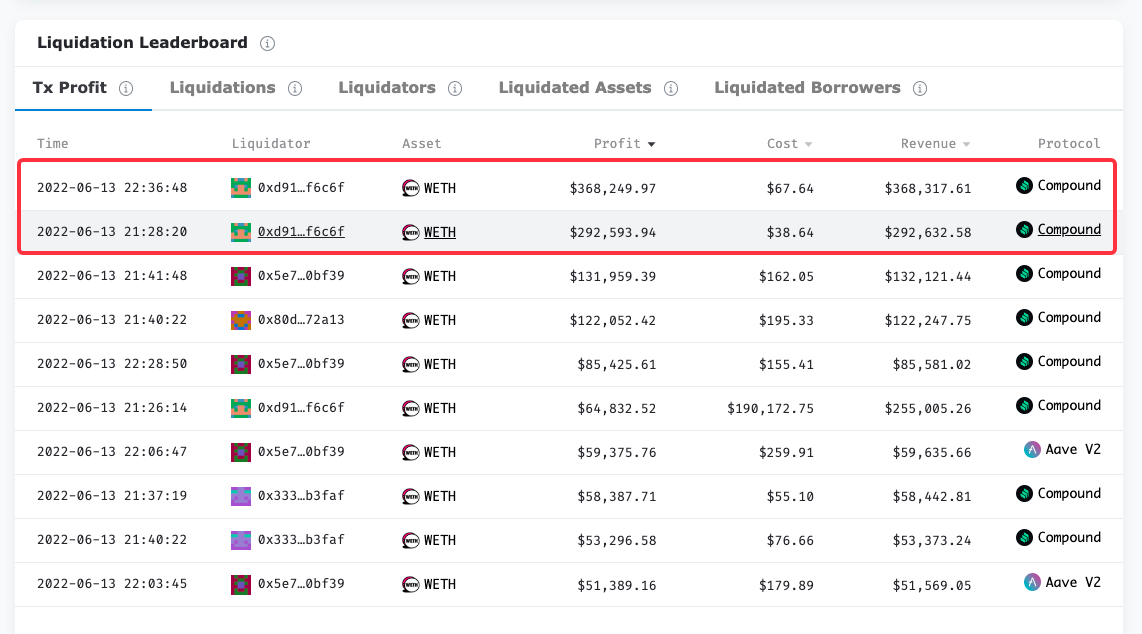

According to the profit leaderboard below, it was done by the top dog, who earned a profit of $368K under the cost of $67. The 2nd belonged to it as well.

Wonder how the most successful one gets done?

Click the row, and you can inspect the detail, including debt asset and its amount and the asset flow in the chart. We can tell that the liquidator repaid the debt with over $4.9M worth of USDT and received over 244K cETH as a return.

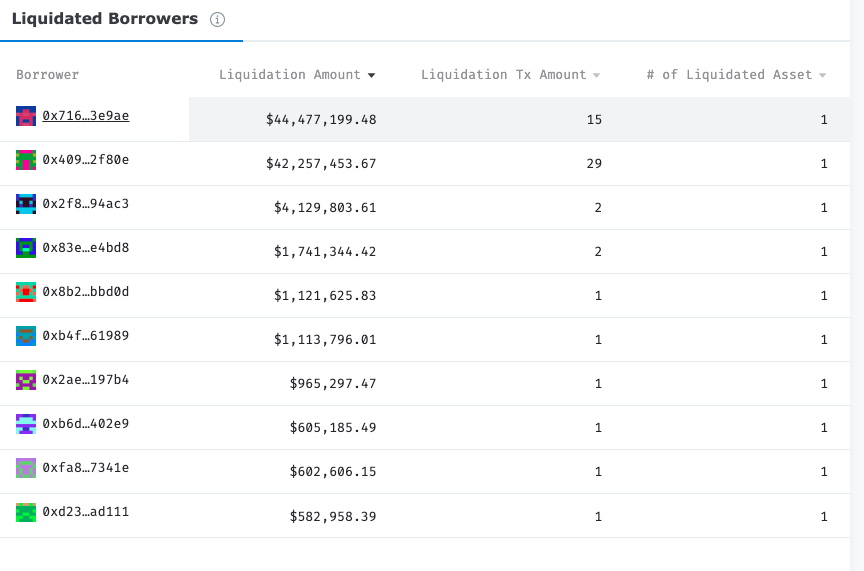

The profit leaderboard above also displays the top 10 liquidators, whom you can examine one by one, and the top liquidated borrowers regarding liquidation amount.

All these data cover the big picture of the liquidation market, the performance of different protocols, the liquidator details, and the liquidation asset transfers. In addition, different levels of data are integrated to leverage users to conduct exploratory analysis on the eventful night with interactive approaches.

How to Help the 1 Billion User?

The collapse is not the first time and definitely won’t be the last time. Even with all the backlashes, the user base of Bitcoin is still predicted to have 1 billion users by 2030.

How can we help this 1 billion crowd? First, the industry needs to provide capable tools for the community to enable them not only to identify the systematic risks but also to discover potential sustainable investments. Failing to do so would drown users in myriad types, quantities, and dimensions of data and keep them trapped forever in the dark forest of DeFi before they swear off cryptos.

Follow us via these to dig more hidden wisdom of DeFi: