Photo by Harry Gillen on Unsplash

What Happened

On November 22, a big whale (ponzishorter.eth) was found trying to short CRV. A large amount of CRV was borrowed from Aave and sold off. The price of CRV fell rapidly. But soon came the white knight. Michael Egorov, the founder of Curve added 20 million $CRV asset to avoid its price falling. After that, the battle ended with the debt of the shorter (@avi_eisen) who borrowed more than 92 million CRV in Aave being liquidated.

Here are the lending profiles of @avi_eisen and Curve founder @newmichwill. It can be seen that after the liquidations, Avi’s debt dropped significantly.

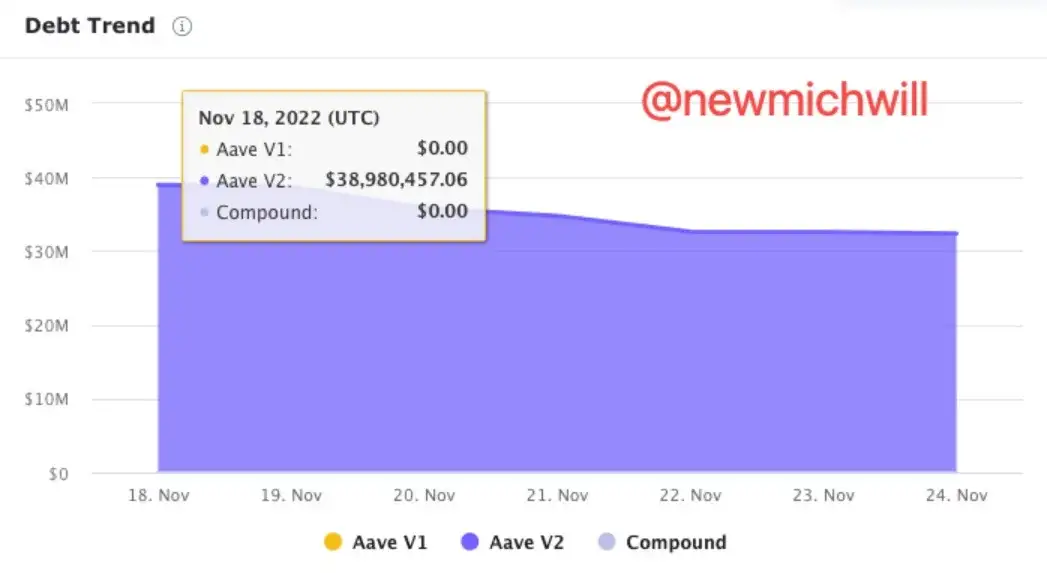

To make the whole story clearer, the following is the action and timeline of both sides in the battle. From 17 to 23 of November, @avi_eisen borrowed a total of $37,583,795.15 worth of CRV (possibly with multiple leverages involved), trying to lower the price of CRV, but he underestimated the CRV held by the Curve founder. In response, @newmichwill deposited $14,896,307.65 worth of CRV, reducing the possibility of CRV’s illiquidity.

This story has been talked about on social media for a while, so what we really want to tell is the story of liquidation transactions after this battle, which we found quite interesting.

Liquidations Overview

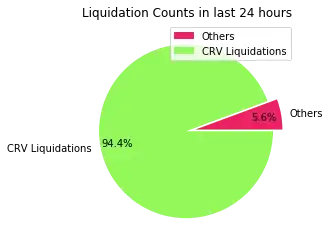

The CRV battle seems to have come to an end on 24 Nov. The event brought a surge in liquidation transactions. In the 24 hours from 22 to 23 Nov, basically, the vast majority of liquidation transactions were CRV liquidation transactions.

But during the process, there were about three hours of silence. In these three hours, no CRV liquidation transactions occurred. We don’t yet know what happened, but we will follow up on this. If any of you have leads on this, please feel free to leave a comment.

Who Are the Top Liquidators

We spotted 21 liquidators and 300+ transactions included in CRV liquidation.

The top liquidator obtained over $23.1 million worth of USDC, covering the debt of $22.4 million worth of CRV and making $728K million net revenue. The profit of 19 transactions the liquidator made was between 1K and 10K. And you can also check out the gas prices paid for these profitable liquidations.

However, liquidations with huge amounts may not come with huge profits. Sometimes there are even painful losses. The address ranked sixth in liquidation amount lost $5000+.

And don’t forget that it is still possible to be sandwiched during the liquidation. We found some sandwich attacks that occurred when the liquidators were busy digging for treasure. Like in this transaction, the attacker got around $30 (though not much).

How Did It Work

We were curious about:

- Where did the CRV come from?

- Where did it go?

- How did these liquidation transactions works?

After scanning these 300+ CRV liquidation transactions, we found that these transactions mainly involved the following pools. And about 12% of these transactions used flash loans from dYdX.

These transactions powered by flash loans seem to be larger in amount and follow a similar pattern. Let’s take one of these transactions as an example, and let me break it down for you. See the details of this transaction here.

- Initially, the liquidator borrowed 140,251 WETH by Flashloan from dYdX (Step 0).

- Swapped WETH for 214,807.5856 CRV from Curve Pool (Step 1 to 4).

- Liquidation on Aave for 158,983.6439 USDC (Step 5 to 8).

- Swapped USDC for 141.0548 WETH from Uniswap V3 pool (Step 9 to 10).

- Paid the miner (Step 11 to 13).

- Repaid the flash loan (Step 14).

We also found 6 other patterns in these liquidation transactions. Some are simple but clever, and some are not so worthwhile.

- The liquidator had all the CRV needed, and he could finish the liquidation directly. See the details here.

2. No CRV.

USDC >>> WETH (UniV3 Pool) >>>CRV (Curve Pool) >>> Make the liquidation in Aave >>> Rake up the profits in USDC

See the details here.

3. No CRV. Only UniV3 pools.

USDC >>> WETH (UniV3 Pool:0x8ad…/UniV3 Pool:0x88e… ) >>>CRV (UniV3 Pool) >>> Make the liquidation in Aave >>> Rake up the profits in USDC

See the details here.

4. No CRV. UniV3+V2.

USDC >>> WETH (UniV2 Pool) >>>CRV (UniV3 Pool) >>> Make the liquidation in Aave >>> Rake up the profits in USDC

See the details here.

5. No CRV. UniV3+SushiSwap

USDC >>> WETH (UniV3 Pool) >>>CRV (SushiSwap) >>> Make the liquidation in Aave >>> Rake up the profits in USDC

See the details here.

6. No CRV. SushiSwap+UniV3

USDC >>> WETH (SushiSwap) >>>CRV (UniV3 Pool) >>> Make the liquidation in Aave >>> Rake up the profits in USDC

See the details here.

Fun facts

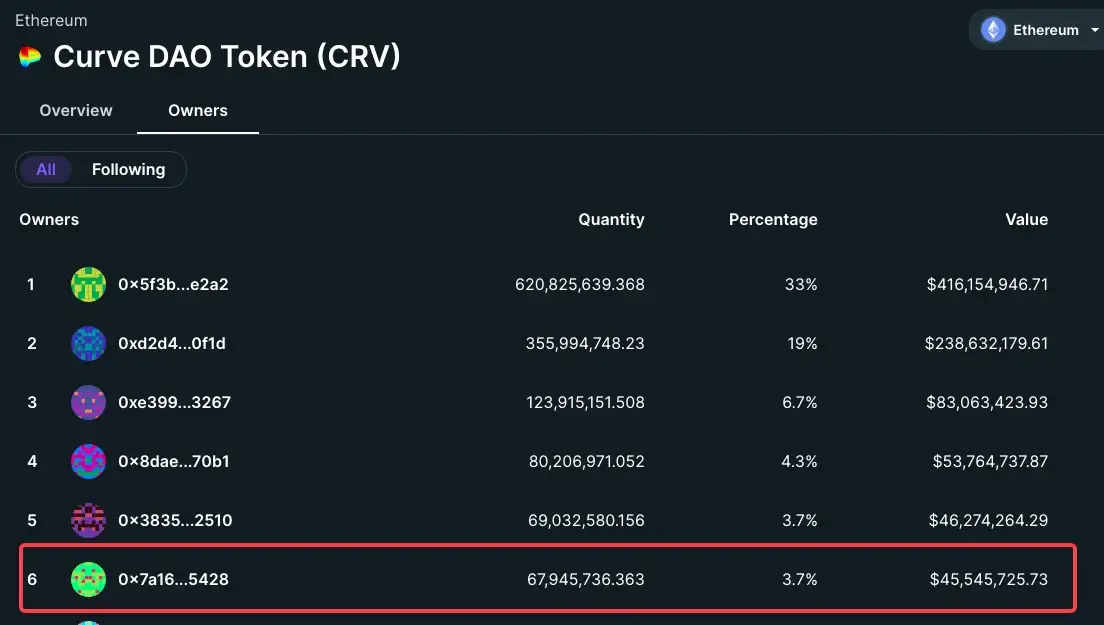

- Here’s the CRV in Curve founder @newmichwill’s wallet after the battle. For the moment, he’s the 6th biggest owner of CRV.

- The bad things come in succession. We found Avi had been sandwiched before he got liquidated and lost $190. See more info about the sandwich here.

What’s Next

During this battle, Curve also released the white paper for its new stablecoin. What impact has this battle had on CRV, has it also affected its new stablecoin, and what changes and opportunities will the Curve bring to the DeFi world? EigenPhi is working on it and will soon publish an in-depth report on Curve. Stay tuned.

References