Bridge to Mainstream & Crypto economy

作者:CompoundWater 複水 ; Contents Also Contribute to MatrixDAO

Contents

-

What is StableCoins? -

Why People Use/Rely on StableCoins? -

How Stablecoins Can Help Some Current Crypto Market Issues? -

Different Types of Stablecoins -

What Top 5 Stablecoins Backed By Look Like? -

Quick History of Stablecoins -

Problems Of "Old" Stablecoin -

Cyrpto-Backed Decentralised Stablecoin - DAI -

Algorithmic Stablecoin - UST -

Problems Of Algorithmic Stablecoins -

Tradeoff Idea for Algorithmic Stablecoins - Frax, Fei -

New Era of Stablecoins - Non Pegged Olympus(OHM), (3,3) Game -

Conclusion-Stablecoin Futures -

Reference -

Feedback

[Update] UST crash to $0 at 20220512 → UST崩盤始末與思考借鑒

What is StableCoins?

Stablecoins are cryptocurrencies that attempt to peg their market value to some external stable asset such as fiat currency (USD, EUR etc), gold and commodities collateralization (backing) or through algorithmic mechanisms of buying and selling the reference asset or its derivatives.

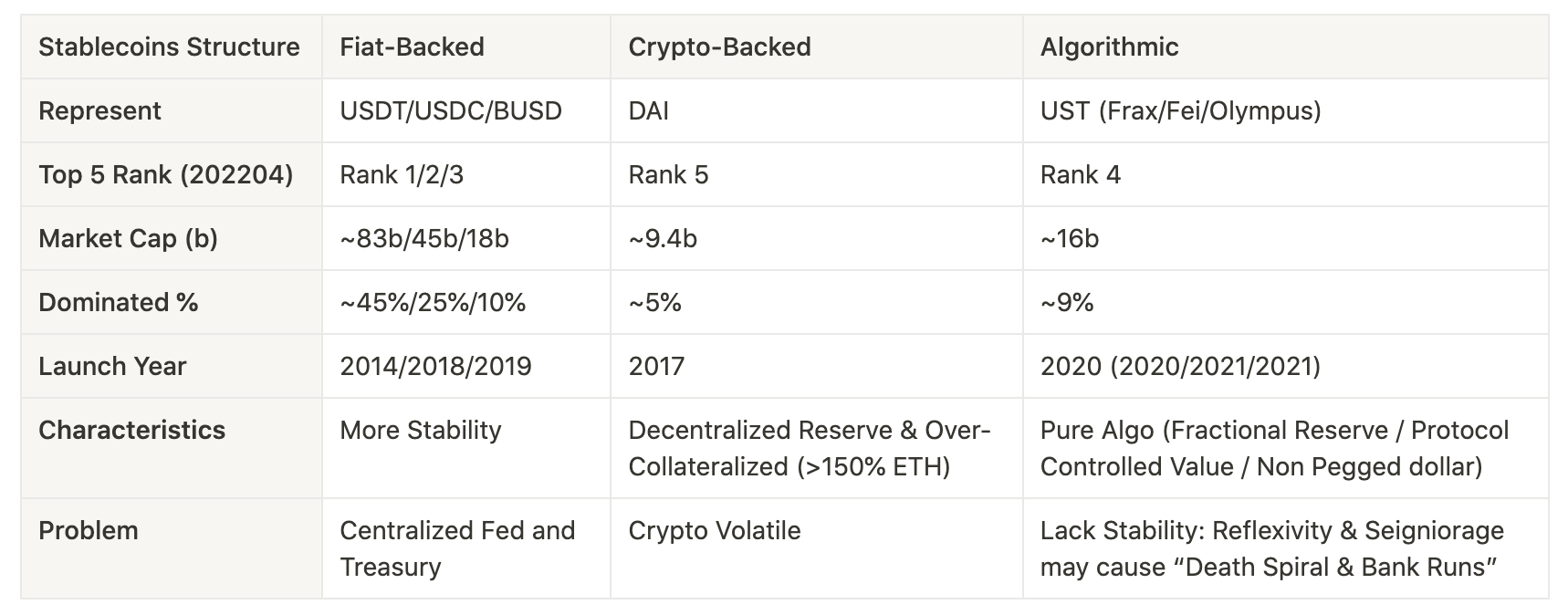

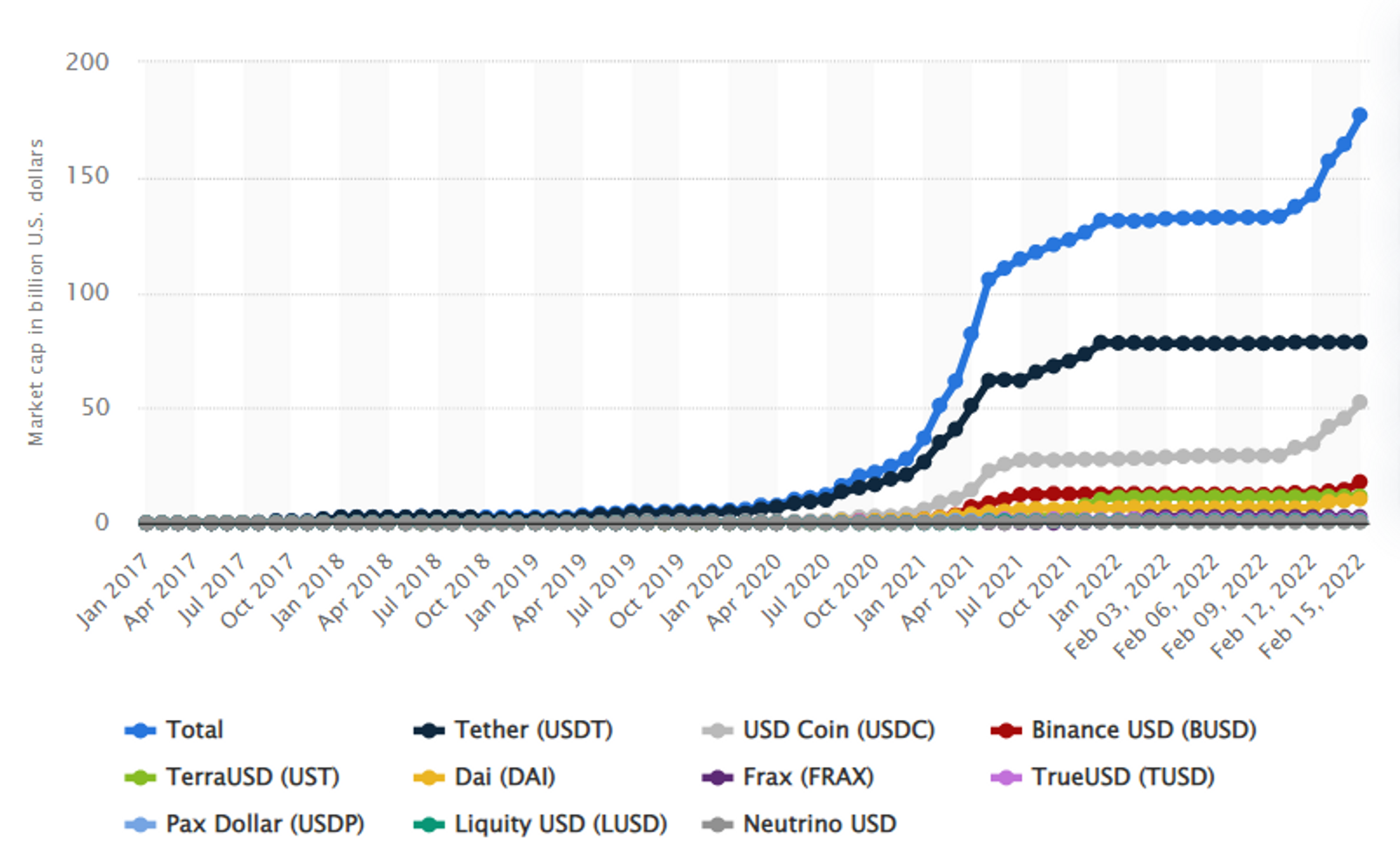

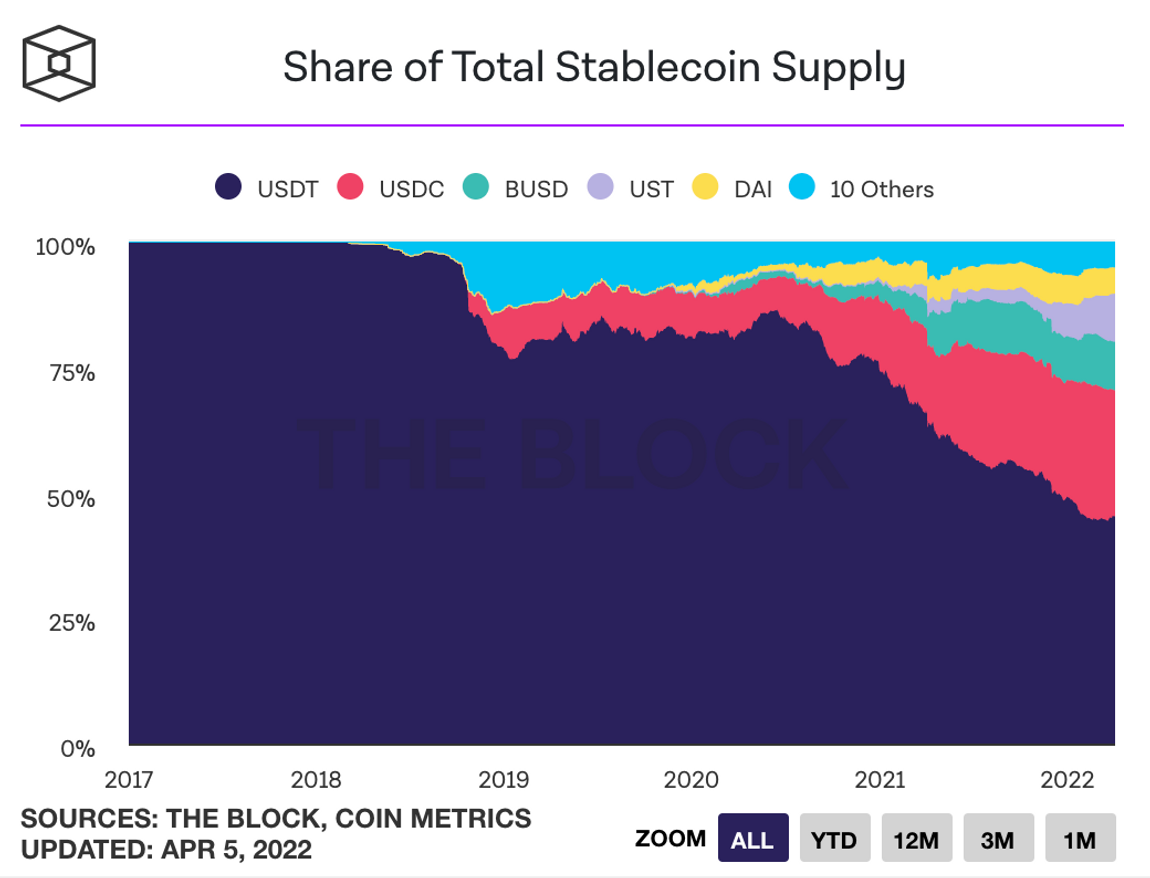

- Market capitalization of the 10 biggest stablecoins from January 2017 to February 16, 2022 (in billion U.S. dollars)

- The market cap of stablecoins multiplied over the course of 2021, surpassing 100 billion U.S. dollars by the summer. Currently, 5 biggest stablecoins: USDT > USDC > BUSD > UST > DAI

Why People Use/Rely on StableCoins?

-

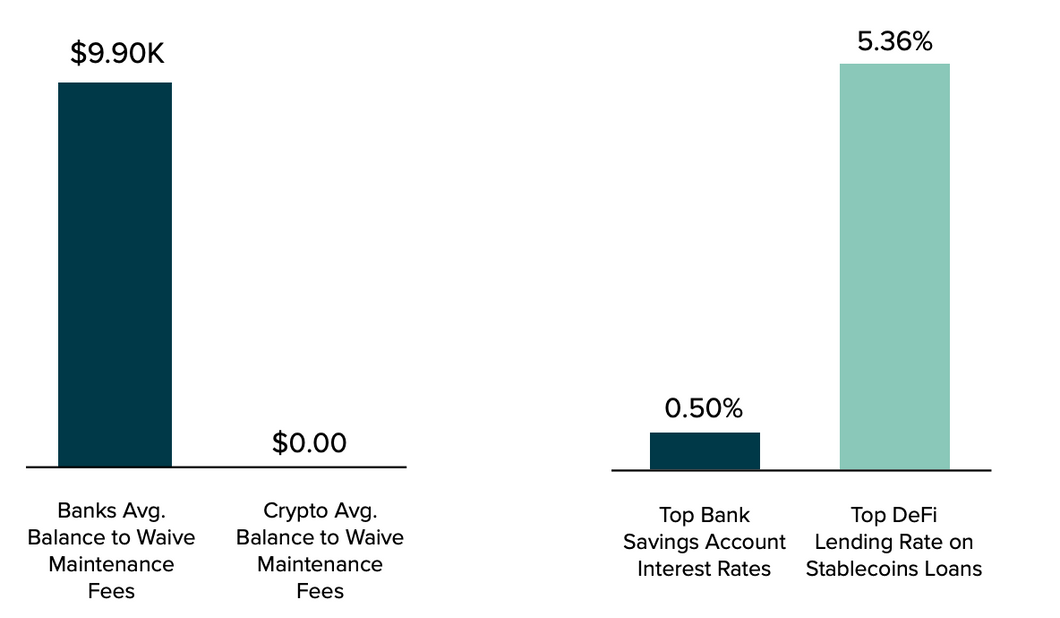

Stablecoins are global, open, and accessible to anyone on the internet, 24/7. They’re fast, cheap, secure to transmit and digitally native to the Internet.

-

It allows people to trade faster without having to rely on slow traditional fiat transfers.

-

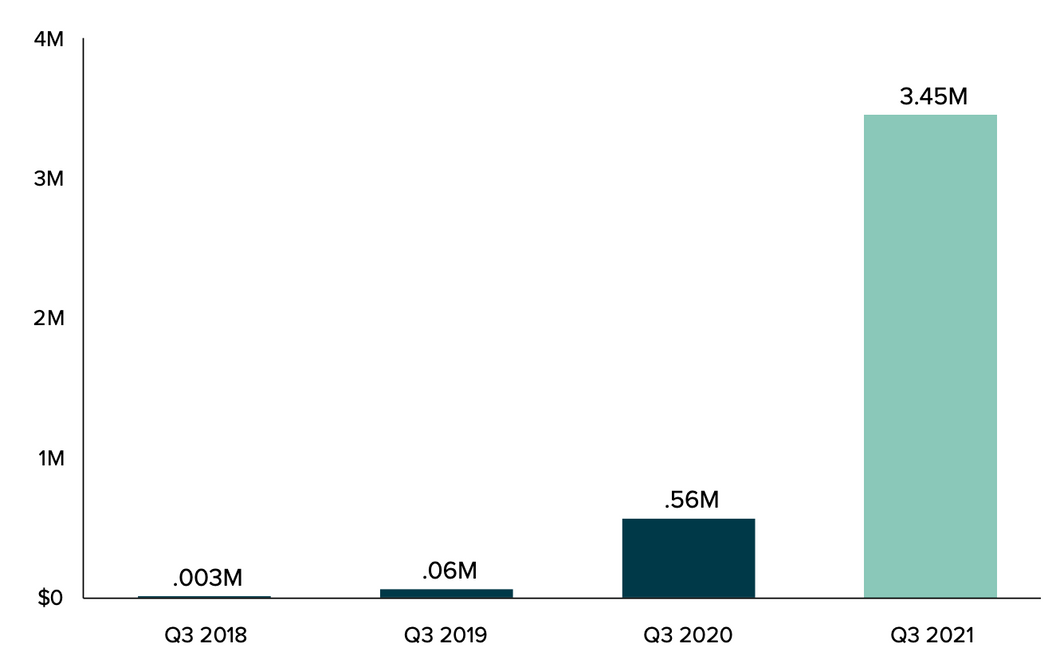

As the crypto market and decentralized finance (DeFi) has grown rapidly, more people use stablecoins to yield high interests and trade, while some crypto derivatives traders use it as collateral. And now more stablecoin issuers are looking at payments, remittances, and serving as gateways in and out of crypto for banks, asset managers, and other financial institutions.

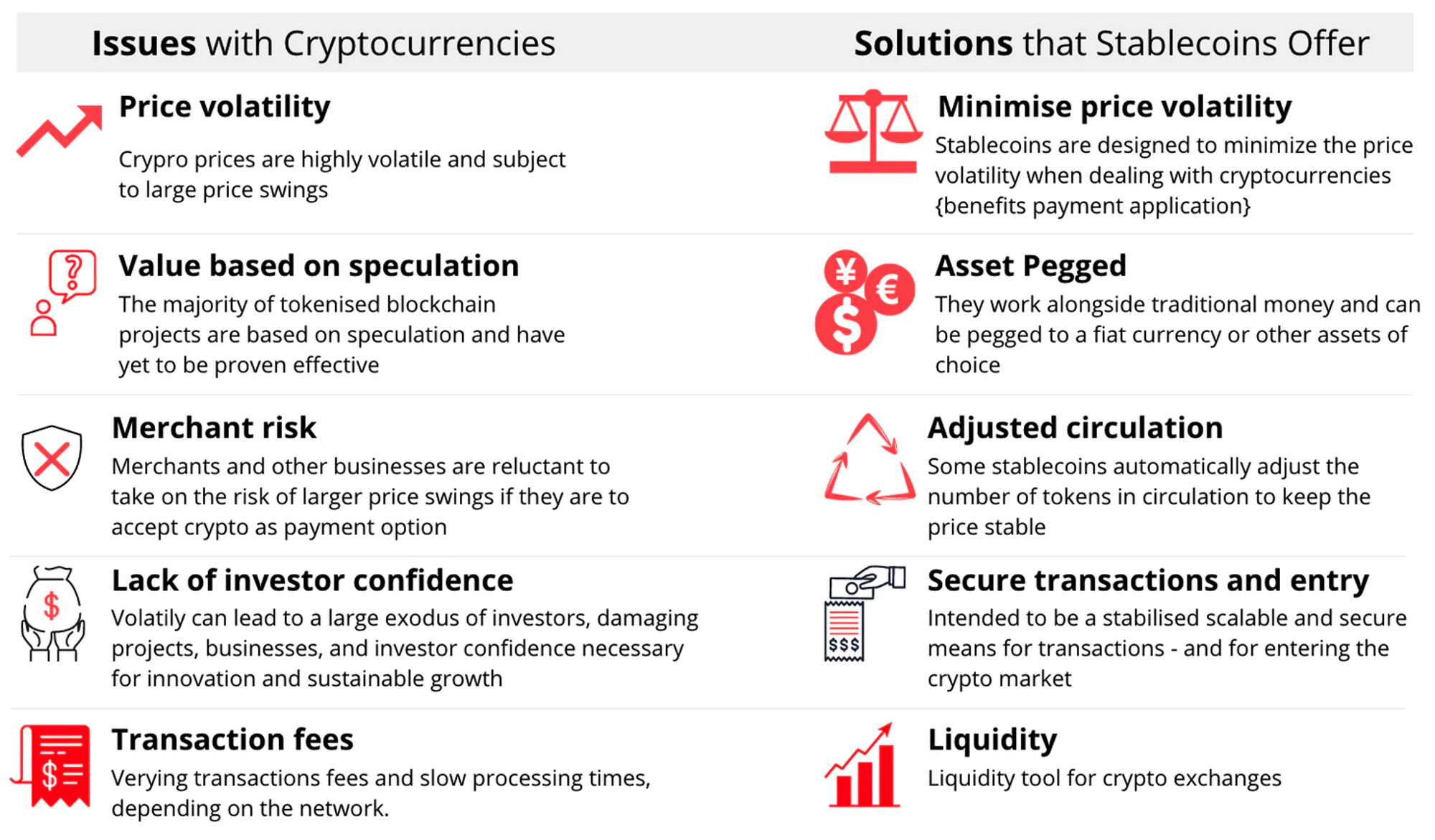

How Stablecoins Can Help Some Current Crypto Market Issues?

Different Types of Stablecoins

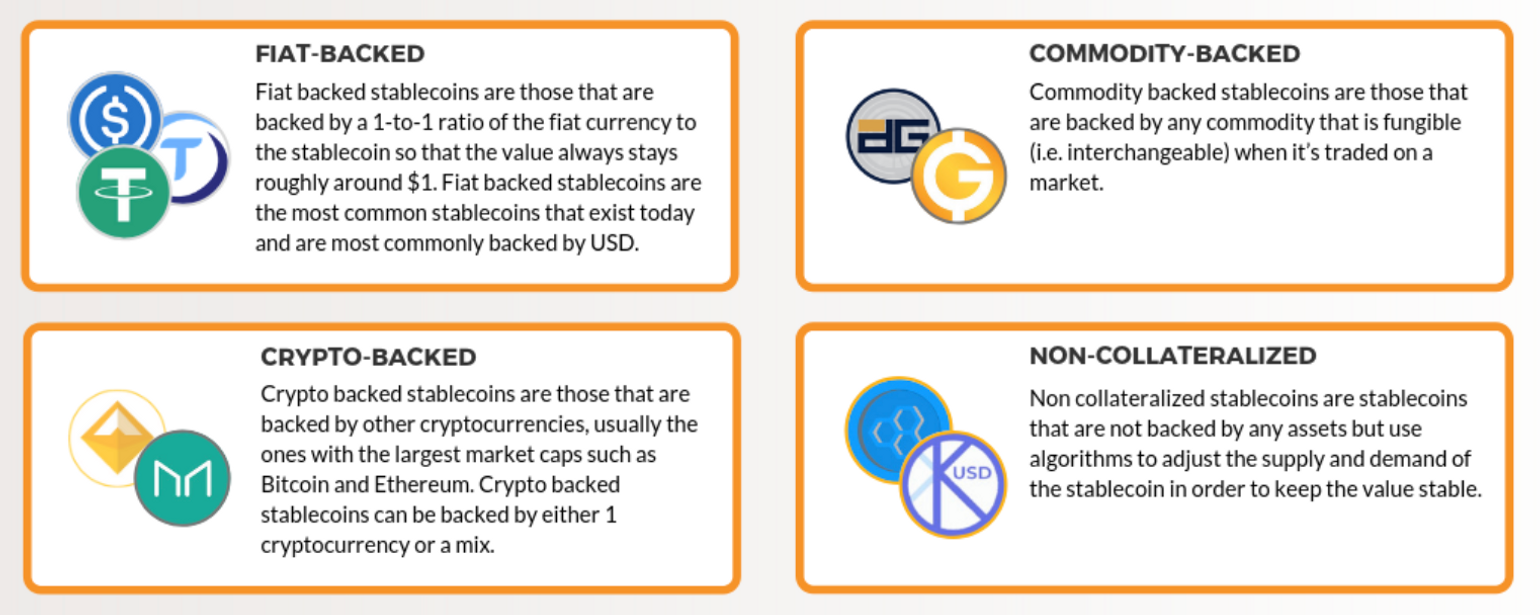

There are four general types of stablecoins base on collateral that it could be backed by. The purpose of them is all to ensure price stability.

-

Fiat-Backed: “Centralized” Stable Coins / Backed by Fiat Currencies, Collateral-backed

→ Tether ($USDT), TrueUSD ($TUSD), USD Coin ($USDC), Paxos Standard ($PAX)

-

Commodity-Baked: Commodity-collateralized stablecoins are backed by other kinds of interchangeable assets, such as precious metals and gold.

→ Digix Gold (DGX), Paxos Gold (PAXG),Tether Gold (XAUT)

-

Crypto-Backed: “Decentralized” Stable Coins / Backed by Crypto Assets, Collateral-backed

→ MakerDAO ($DAI), Bitshares ($BitUSD), Celo, Reserves ($RSV)

-

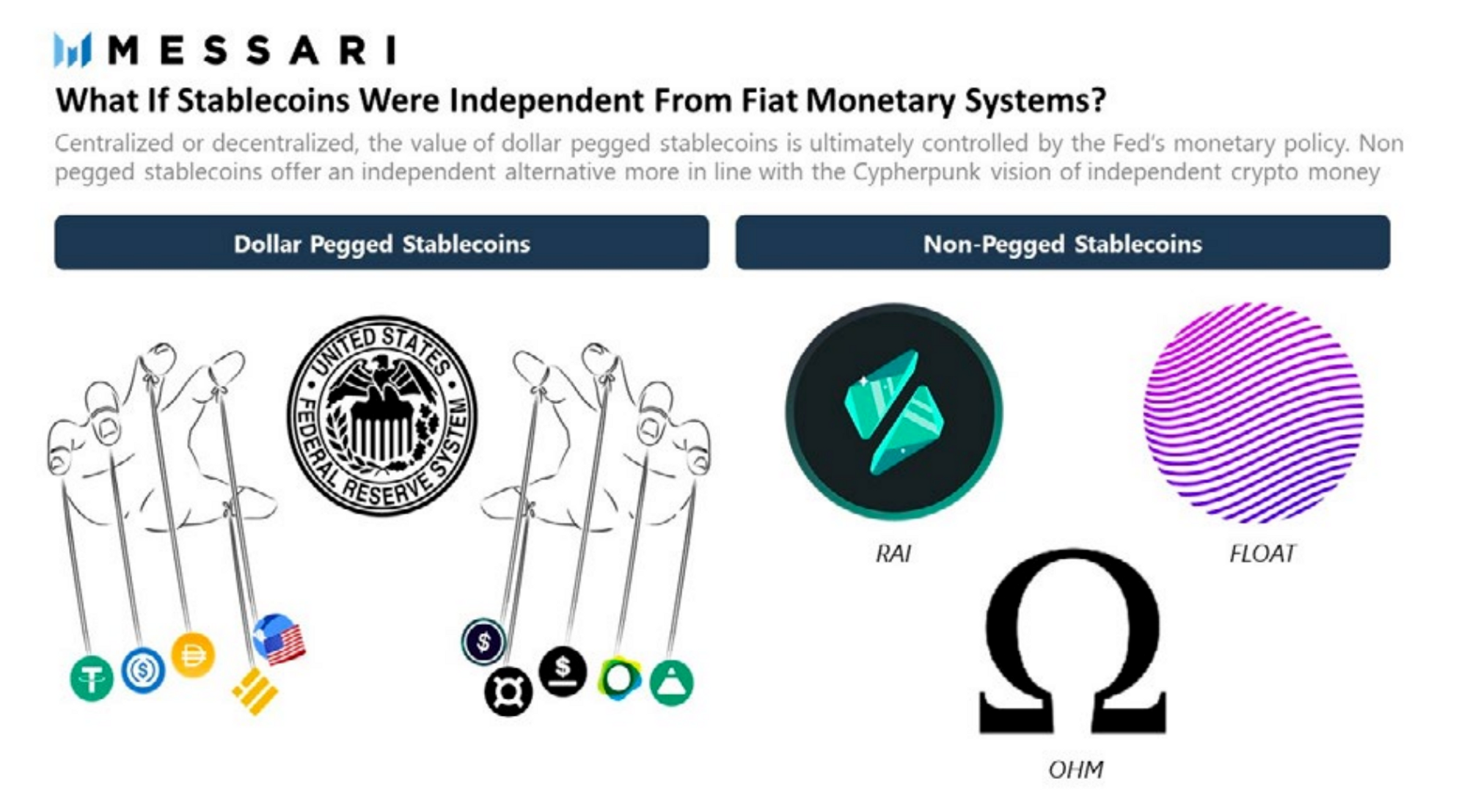

Non-collateralized: Seigniorage Shares / Decentralized Bank / Algorithmic Mechanisms

→ TerrraUSD (UST), Frax, Fei, Olympus(OHM), Rai Reflex Index(RAI)

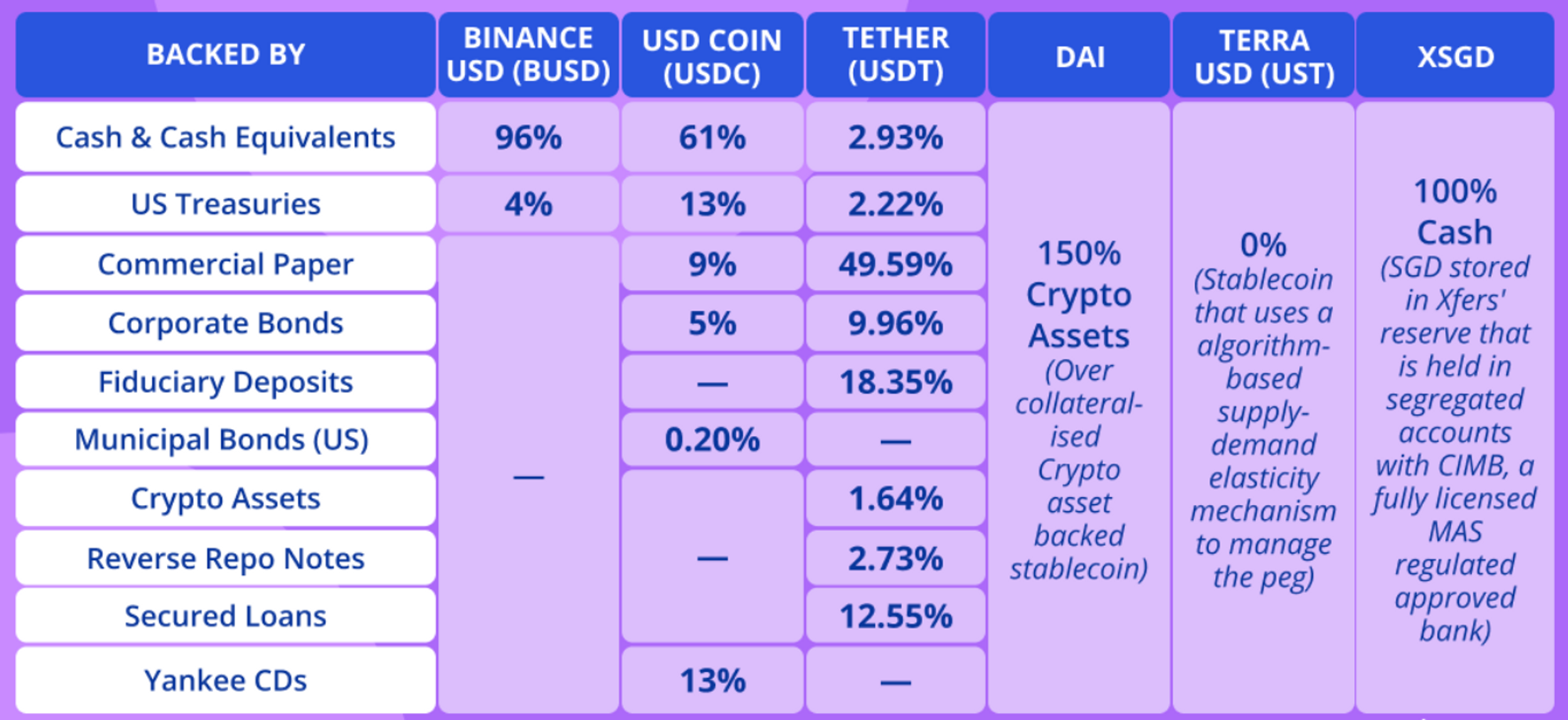

What Top 5 Stablecoins Backed By Look Like?

Currently, 5 biggest stablecoins are USDT > USDC > BUSD > UST > DAI

Quick History of Stablecoins

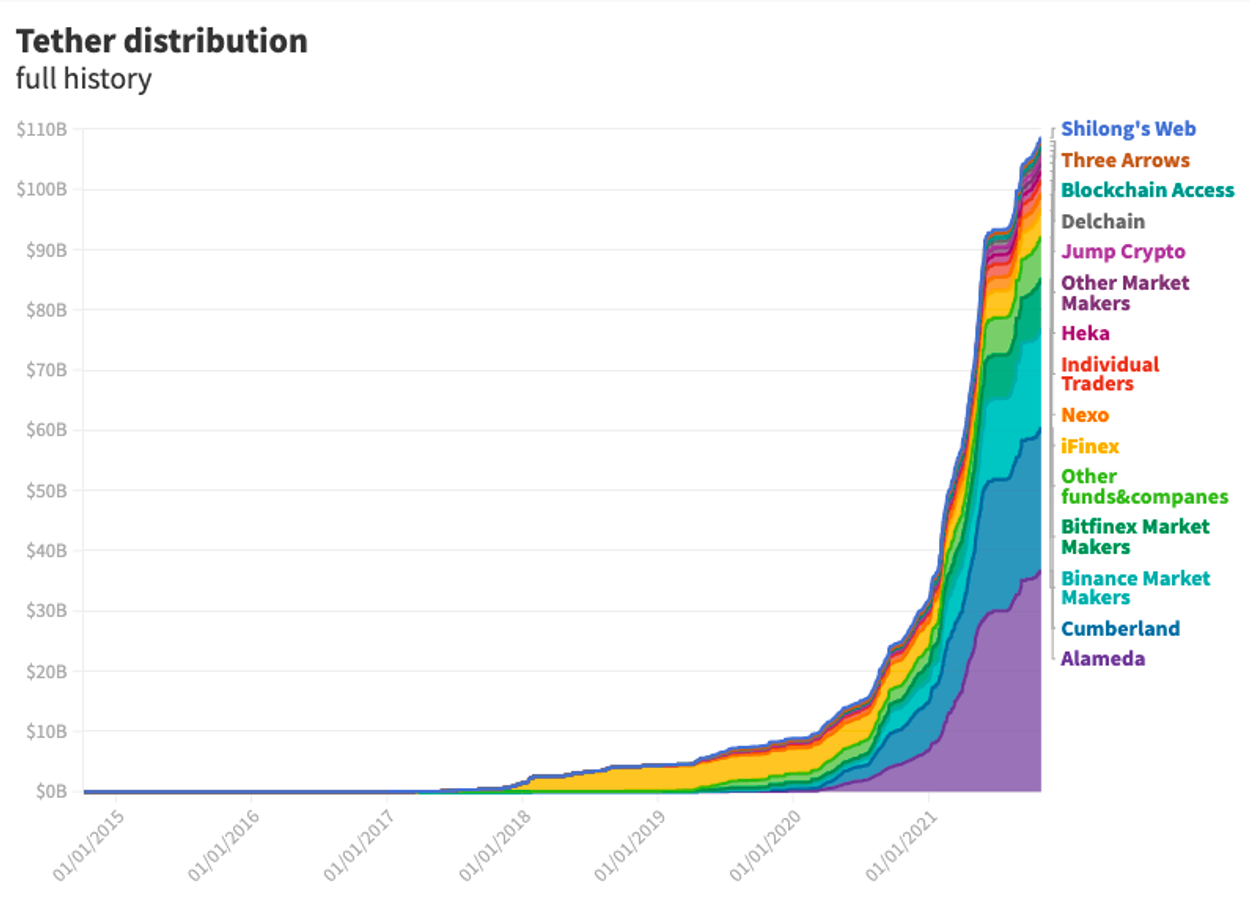

Stablecoin history may defined start with Tether (runs USDT began in 2014).

USDT

If cryptocurrency was an engine, Tether (USDT) is one of its pistons.

-

Its model was simple and promised that for every USDT there would be an actual redeemable dollar in the bank “somewhere”.

-

Tether is also called ultimate digital eurodollar, a lot of people trust USDT not because they believe its reserves are fully backed, but because some kind of market consensus they have to trust Tether, and system has worked fine so far.

-

Tether has published two audits of their reserves at 2021, try to reduce concerns that the company is running a fractional reserve. Some big issue related to Tether like 2016 Bitfinex hack paid off.

-

We still can see there’s a lot of legit companies (like Alameda, Cumberland, Binance etc.) that work with them at scale. USDT remains the reserve trading currency for most of the world’s largest exchanges and trading pairs.

-

It’s not particularly close - USDT is an order of magnitude more liquid than second and third large stablecoin, which is USDC and BUSD.

-

Although, USDT’s share of stablecoin market cap declined from 80% to 50% in 2022, Tether’s structural importance to crypto exchange settlement seems intact.

USDC / BUSD / TUSD etc.

But for those who want more regulatory confidence than USDT

Turn to the CENTRE Consortium’s USDcoin (USDC). The USDC was created by Circle and Coinbase and is fully backed by US dollar and can be traded for the USD on a 1:1 ratio. There are many others like this type of stablecoin, such as Binance USD (BUSD) and TrueUSD (TUSD).

Problems Of "Old" Stablecoin

So how to achieve truly decentralised stablecoin?

A currency ultimately pegged to and controlled by the Fed and Treasury, limits our ability to build a truly sovereign monetary system and seems defeat the entire purpose of having decentralized stablecoin in the first place.

Cyrpto-Backed Decentralised Stablecoin - DAI

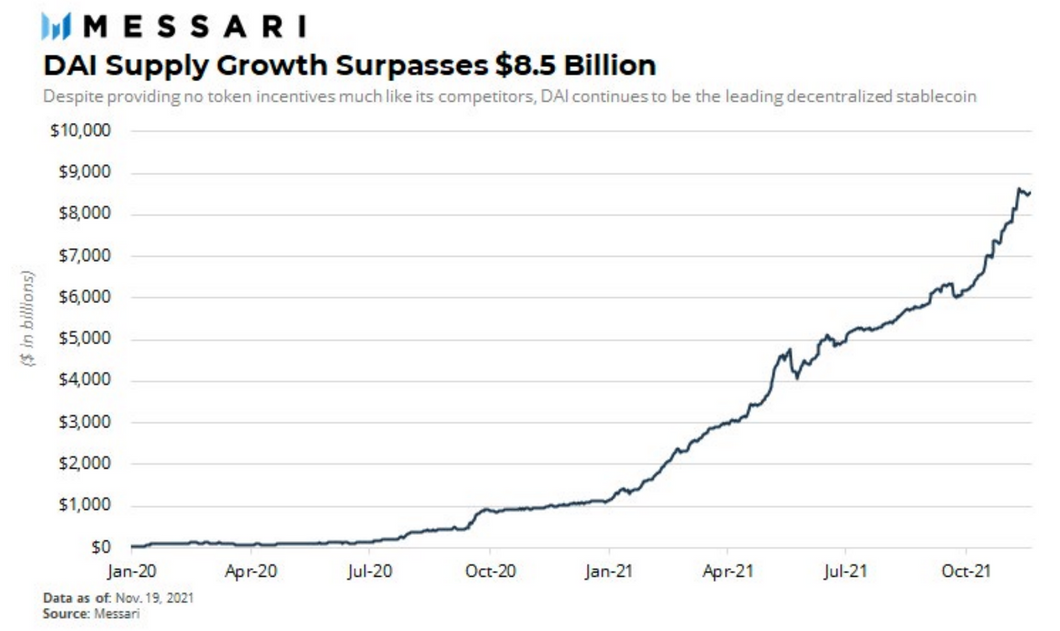

The next important phase comes from cyrpto-backed decentralised stablecoins

Such as leading one MakerDAO’s DAI, an over-collateralized but more decentralized stablecoins. DAI began as a stablecoin collateralized only with ETH, the cryptocurrency that runs the smart contract chain Ethereum. This required it to be seriously over-collateralized, at a minimum 150% or higher.

Despite full of new stablecoin competitors, DAI is still the most widely integrated decentralized stablecoin in the crypto market especially at chain Ethereum and with its four year well track record of stability. Also DAI supply surpassed $8.5 billion at 2021.

But as we know cryptocurrencies are pretty volatile, when extremely situation happen and collateral drops way below the 150% collateralisation ratio, MakerDAO’s smart contracts will automatically liquidate the loans. So is there any other way of building decentralised stablecoin?

Algorithmic Stablecoin - UST

Another important phase from non-collateralized (or algorithmic ) decentralised stablecoins

These algorithmic stablecoins are not backed by any collateral. Instead, the price of these stablecoins is managed by an algorithm that controls the supply/demand of these stablecoins.

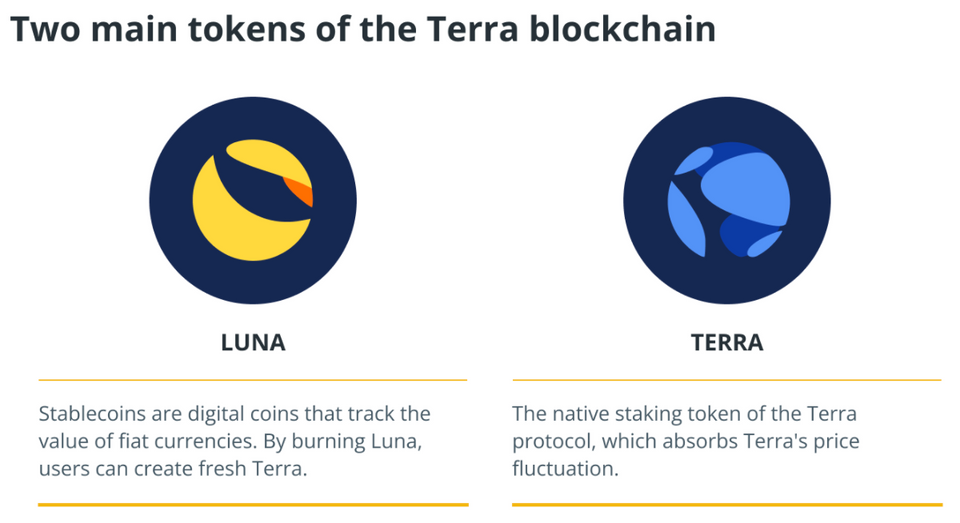

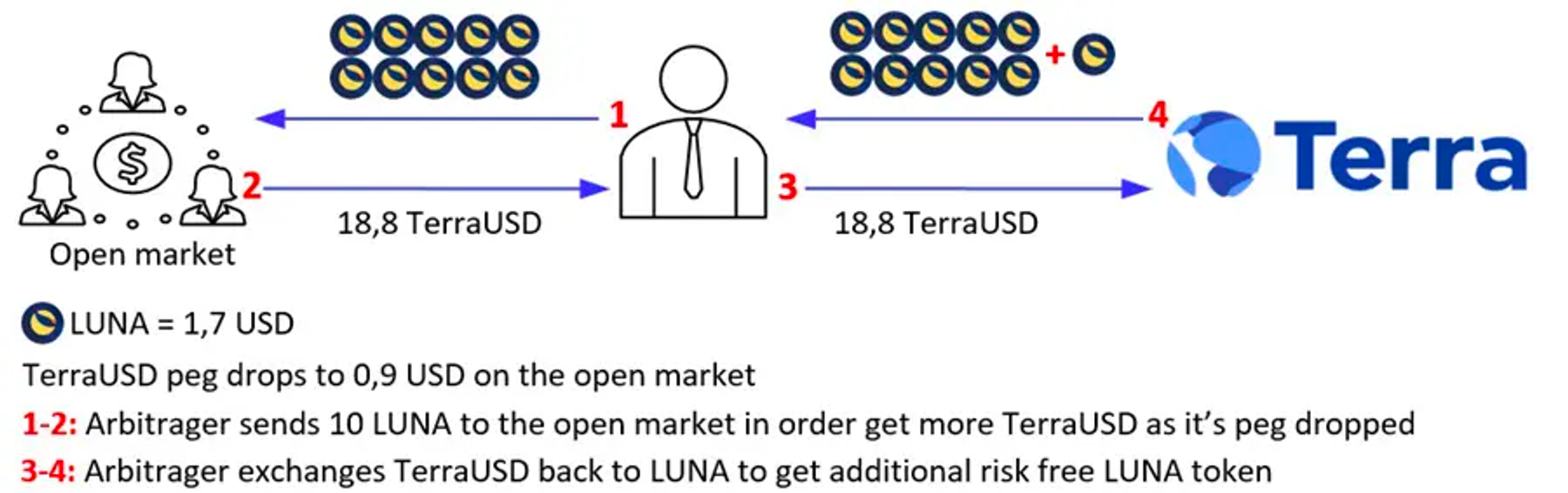

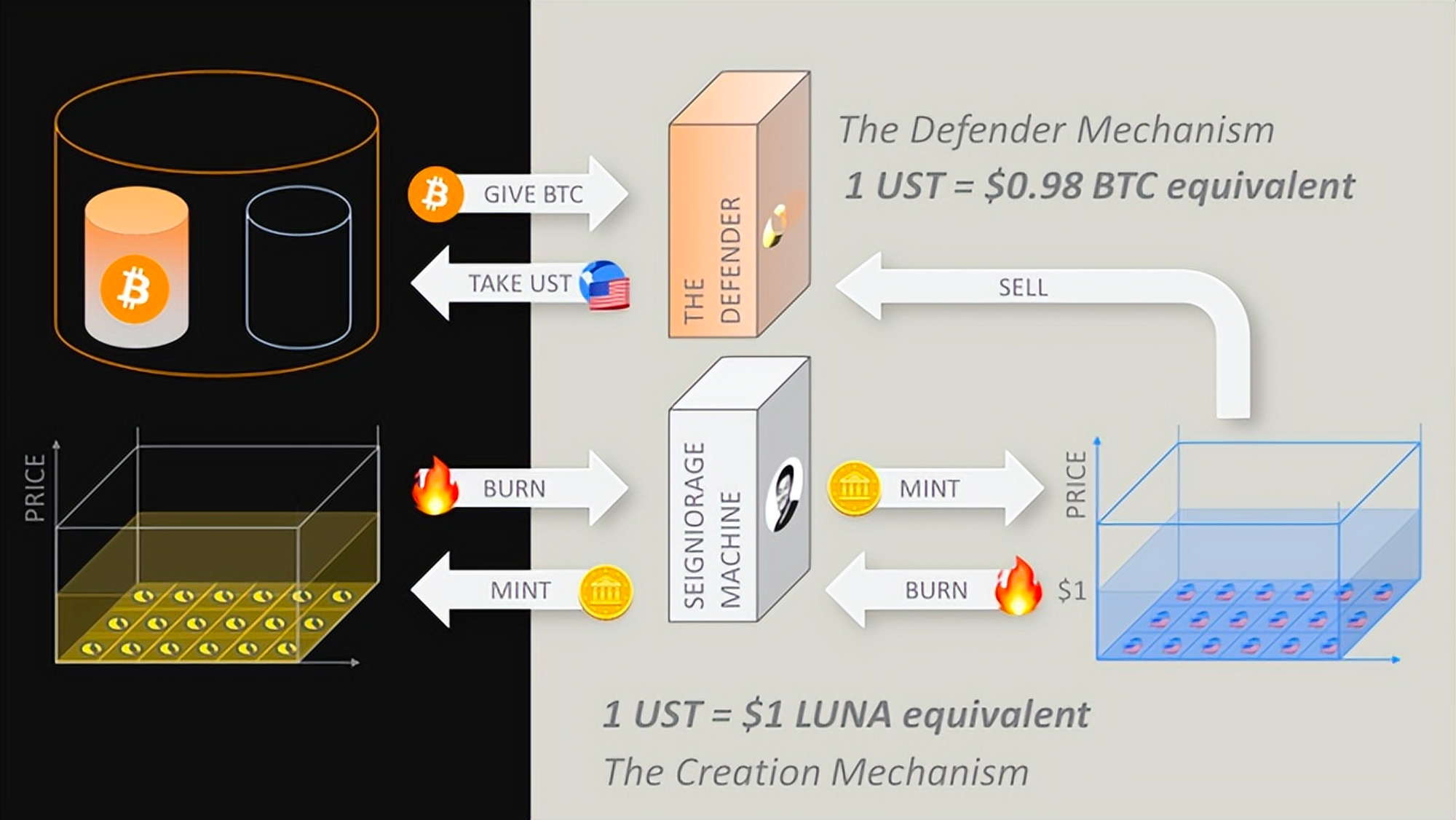

Such as famous and fastest growing one TerraUSD (UST), an algorithmic stablecoin built on the Terra blockchain protocol. But how UST’s algorithmic mechanism works to target the price peg of US$1?

Here is brief concept: “ It revolves around two cryptocurrency tokens UST and LUNA.

1 UST =$1 LUNA equivalent.

-

Expansion: when the value of UST is worth more than US$1 (supply small, demand high), the protocol incentivizes users to burn Luna and mint UST.

-

Contraction: when the value of UST falls below US$1 (supply high, demand low), the protocol incentives users to burn UST and mint Luna.

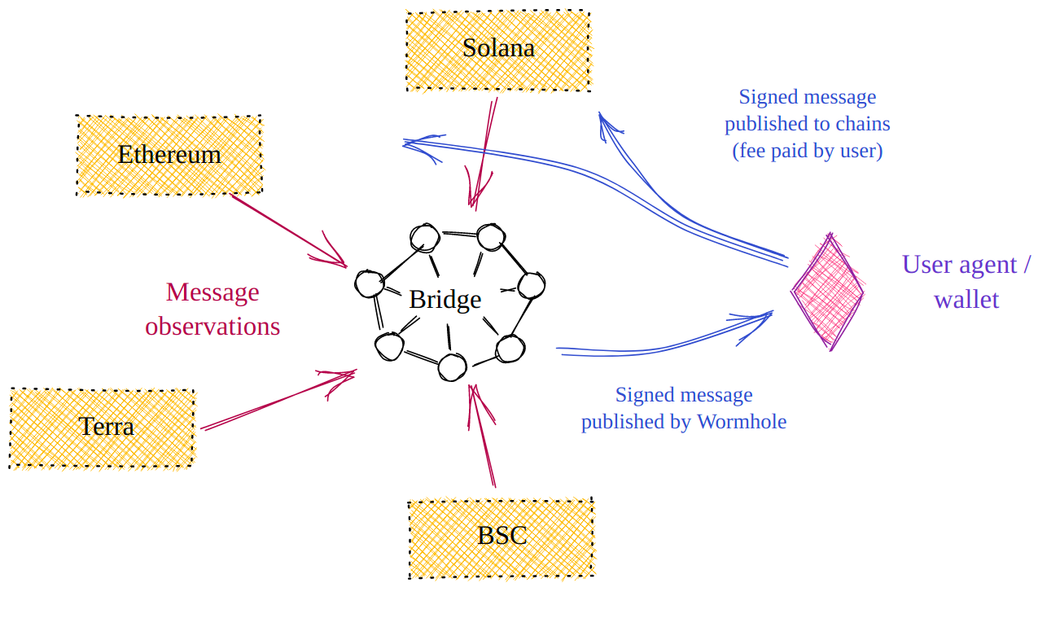

In addition, UST is building its own ecosystem on Terra and aggressively expanding multichain (to like Ethereum and Sonana). Terra is marching in this direction while compared to DAI continues to serve primarily as an Ethereum reserve.

Problems Of Algorithmic Stablecoins

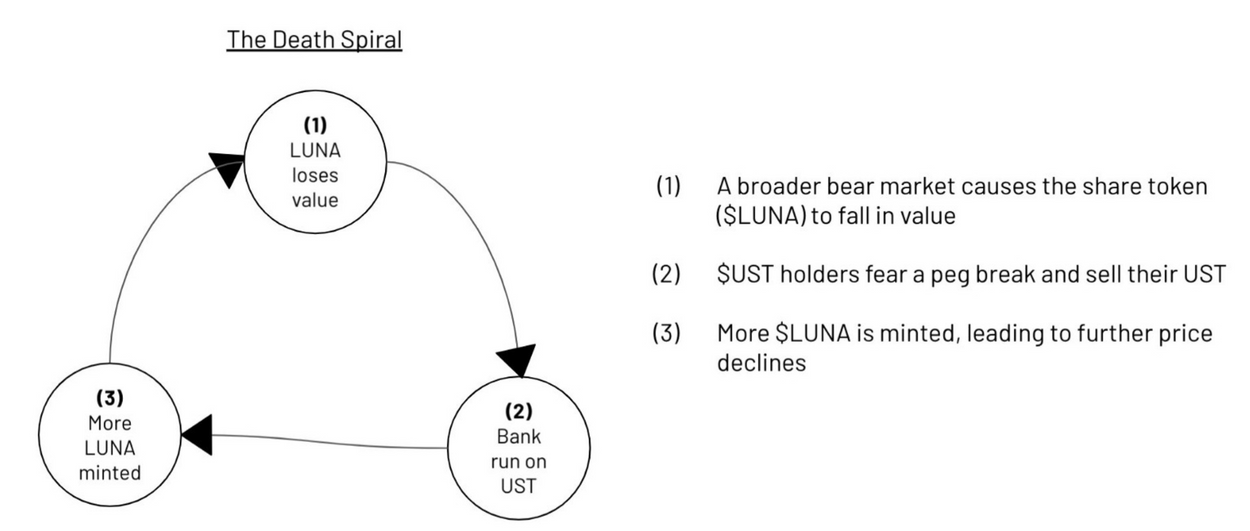

Heavy Redemptions & Death Spiral & Bank Runs & Black Swan

Algorithmic mechanism sounds simple and effective, but show up an obvious question: “Stability”. Successful price stability for algorithmic stablecoins is not at all assured, since it is determined solely by collective market psychology.

Two common Inherent characteristics at algorithmic stablecoins:

- Reflexivity / Seigniorage, in these systems are only worth something if enough people believe (cause positive feedback loop) that the system will survive, but when heavy redemptions hit quickly, it crushes confidence and chills reinvestment in the share tokens, causing a death spiral and the lack of collateral backstop means the bank can legitimately go to zero, or we called “bank runs”

Let’s see a real important case at May 2021 TerraUSD (UST) stablecoin crash. The main reason is that “the sharp price declines in LUNA were compounded by the sell-off of LUNA due to large amounts of liquidations on @anchor_protocol. Redemptions from LUNA → UST exceeded $80 million at times (The system is designed to handle $20 million of redemptions (UST → LUNA)), which forcing UST to trade at a way discount on multiple venues.”

But recently interesting part is that although UST is a pure algorithmic stablecoin, Terra has bought about $1.4 billion in Bitcoin and try to fund reserve UST. Terra CEO Do Kwon said “Bitcoin Can Weather Any Loss of Peg to Stablecoin”. This is worth to think what’s next step of UST and others algorithmic stablecoins to keep its stability.

[Update] UST crash to $0 at 20220512 → UST崩盤始末與思考借鑒

Therefore, in the absence of true early or sustain demand for algorithmic stablecoin, it need to create that demand through incentives to people or speculators. That speculation will grow reflexivity, but the more reflexive a stablecoin is, the less stable it is. Perceived risk of a future liquidity crisis in the protocol will get bigger. So is there still have any idea for algo-stablecoins ?

Tradeoff Idea for Algorithmic Stablecoins - Frax, Fei

After a hype cycle in Q4 2020, algorithmic stablecoins crashed violently and entered a short disillusionment in 2021. Some tradeoff idea show up: “Fractional Reserve Models” and “Protocol Controlled Value” may have improved algorithmic stablecoins

“Fractional Reserve Models” (pioneered by Frax Protocol)

-

Build upon the idea that there is some kind of sweet controlled ratio between overcollateralized and pure algorithmic stablecoins.

-

Provide more confidence in the peg compared to purely algorithmic models and dampen reflexivity during periods of contraction.

-

Since Frax’s launch, it’s reached $2.x billion in circulation, and has maintained a tight peg throughout the year, including the May 19, 2020 huge crypto market crash case.

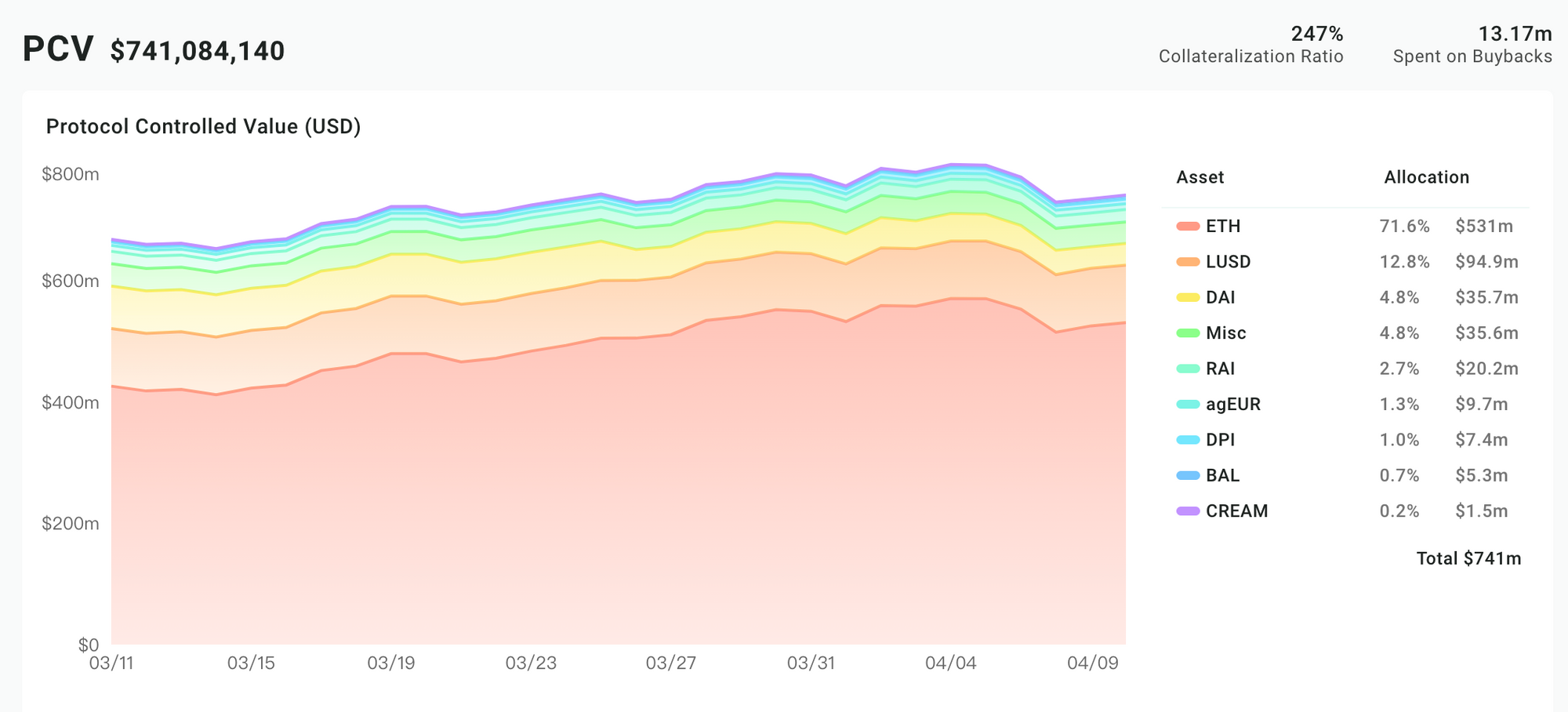

“Protocol Controlled Value” (pioneered by Fei Protocol)

-

What spotlight is that Fei protocol owns the assets users deposit to the system, not the individual LPs of the vault’s collateral.

-

We can think it is like a depositor-governed bank:Fei can do almost whatever it wants with its treasury assets maybe like deploy its capital into lending and staking pools across DeFi or buy other reserves.

-

So far, it looks like this flexibility has created organic demand and PVC hit around $700m for its stablecoin. But It’s unclear if these ideas will be enough to challenge DAI for decentralized stablecoin supremacy, but the iterations in this type of stablecoins worth to observation.

New Era of Stablecoins - Non Pegged Olympus(OHM), (3,3) Game

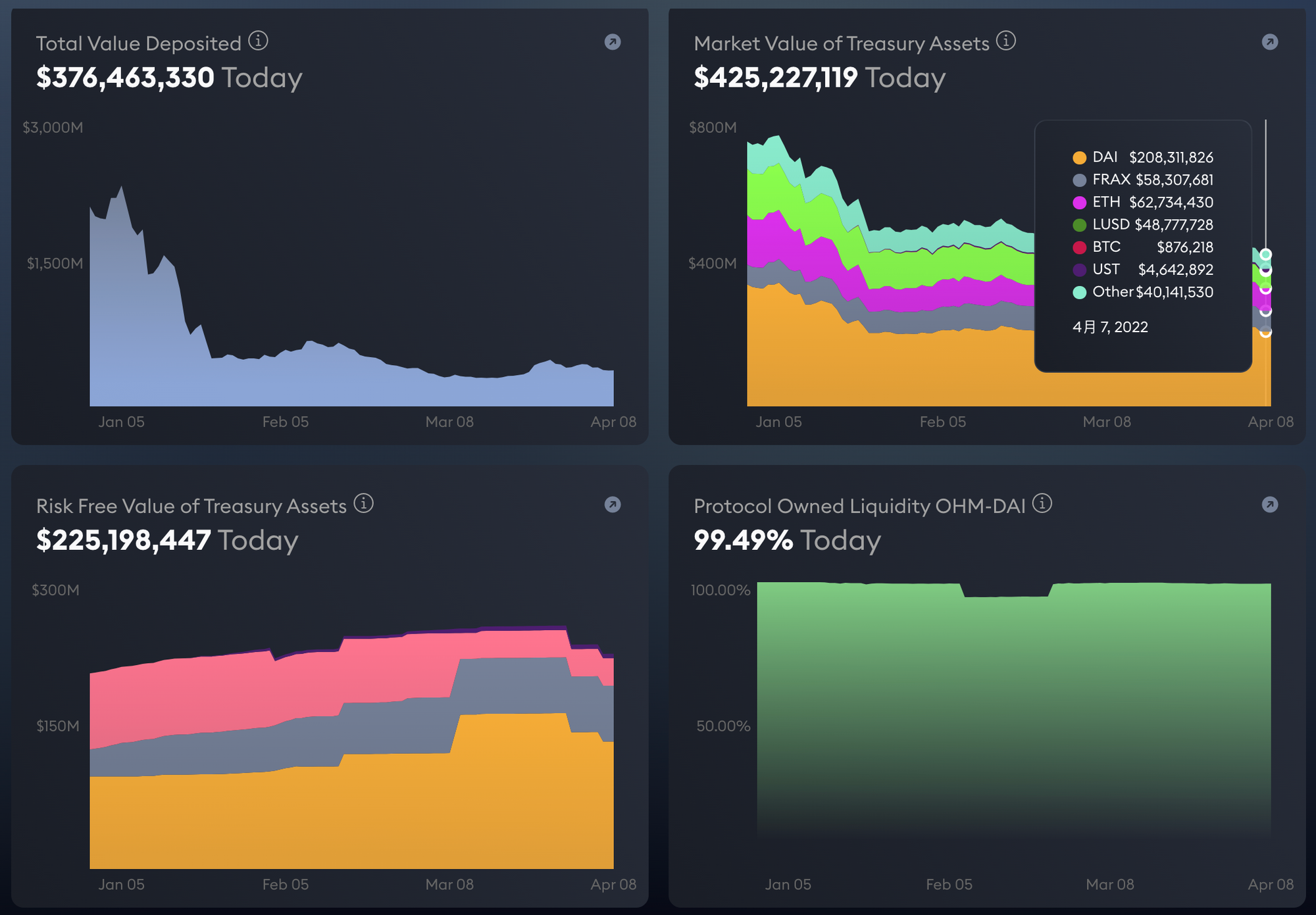

Olympus it’s goal is to achieve price stability while creating a floating market-driven price stablecoins, and eliminating its dollar dependence which are unpegged to fiat currencies.

Just like how central banks manage their currencies using reserve assets (i.e USD, Gold, etc), Olympus DAO manages $OHM using reserve assets (i.e DAI, BTC, ETH, FRAX, etc).

Protocol Own Liquidity characteristic with bonding mechanism, this mechanism concept is similar to FEI; the key difference is that FEI keeps a dollar peg, and Olympus allows its token to float (or called Non-Pegged). Technically, the price floor for OHM is 1 DAI, but practically the treasury value is added to the price.

But why Olympus so success? may credit to this social meme strategy

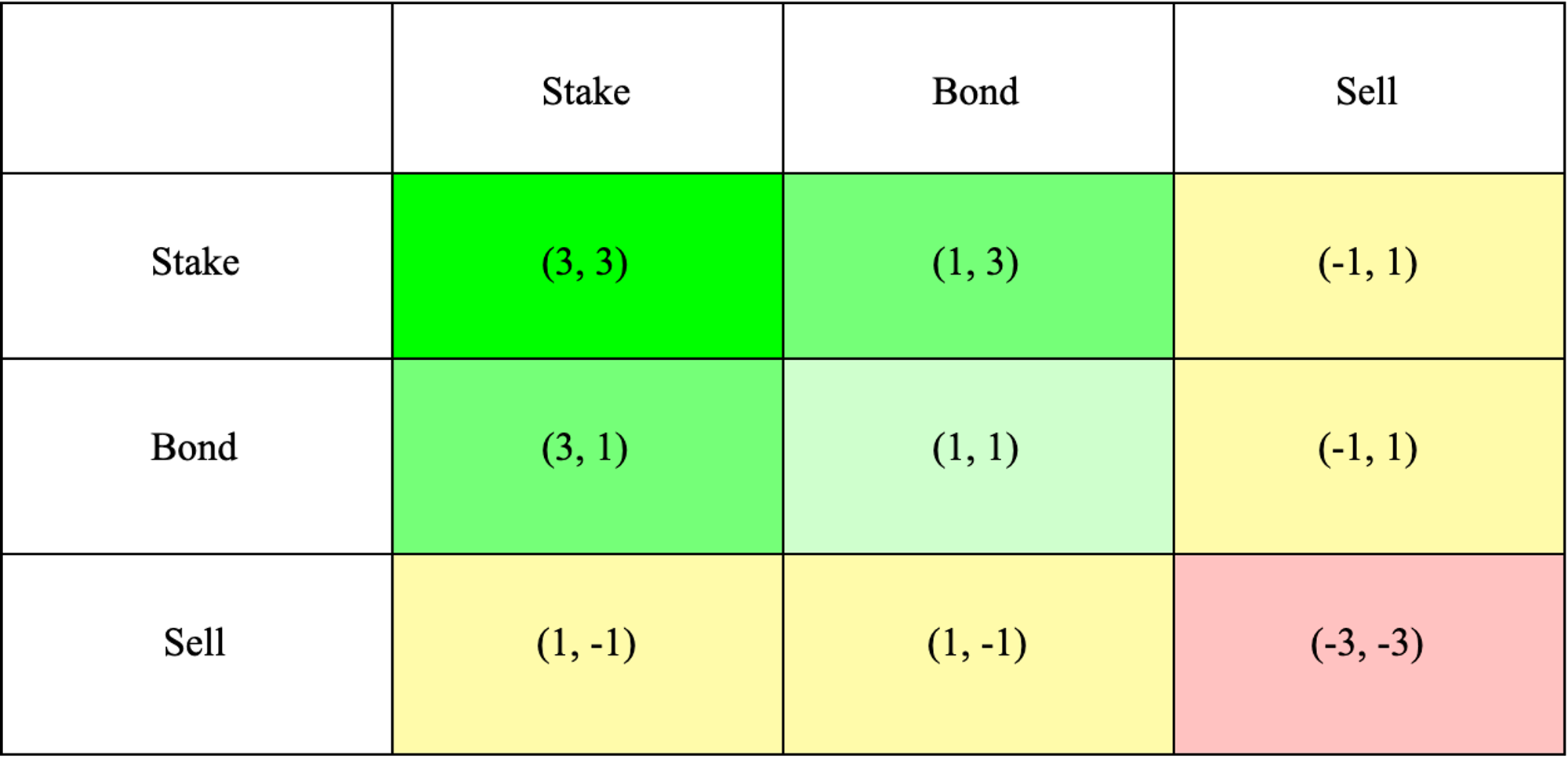

The (3, 3) Meme — Game Theory of Olympus

The game theory had been powerful for a while at 2021- in eight months since its fair launch, Olympus has accumulated $3.5 billion in market cap. The dominant OHM staking strategies are to cooperate. Either to the moon (3,3) or tomb (-3,-3) together?

The simplest model of Olympus has two players with three possible actions: Stake: Players are most likely to stake when they anticipate an expansion in supply and/or price. Bond: Players are most likely to bond when they do not have a strong directional bias but don’t anticipate significant downside. Sell: Players are most likely to sell when they anticipate a contraction in supply and/or price.

Olympus in their game theory article said “Together produces optimal outcomes, so I urge you not to get involved unless you intend to stick around for the long term. Don’t be that guy who sold Bitcoin at $50 to buy back at $20.”

Perviously, OHM staking (3,3) rewards were known for incredibly high above 8,000% APY and more. With the success of Olympus sparked a whole avalanche of forks on other blockchains.

Current situation, Olympus seems start to lack of market consensus, but it is definitely a new era of stablecoins at 2021.

Stablecoin Futures

“UnRegulated Decentralised” vs “Regulated Central-Bank Like Decentralised” Stablecoin

What will the future for stablecoins looks like? While we cannot say what the next milestone in the stablecoin world will be, it is definitely that many exciting developments will unravel in the years to come. But we can think something that the original idea of bitcoin was to create a decentralized and distributed payment system. It’s also the purpose of having decentralized stablecoin in the first place.

So that still has a lot work to do and expect! 🙂

Reference

-

Stablecoin-Market-Capitalization Chart. Retrieved from Statista & CoinGecko & TheBlock

-

Crypto-Theses for 2022. Messari. URL: https://messari.io/pdf/messari-report-crypto-theses-for-2022.pdf

-

A Report on Decentralized Finance (DeFi). Grayscale. Nov 2021. URL: https://grayscale.com/wp-content/uploads/2021/11/Grayscale_DeFi_Report_Nov2021.pdf

-

How to DeFi (Advanced). CoinGecko. May 2021. URL: https://store.coingecko.com/products/how-to-defi-advanced

-

Nakul Gupta. Stablecoins: Bridge to Crypto economy. Cryptechie. July 11, 2021. URL: https://www.cryptechie.com/p/stablecoin

-

Tether Papers: This is exactly who acquired 70% of all USDT ever issued. Protos. Nov 10, 2021. URL: https://protos.com/tether-papers-crypto-stablecoin-usdt-investigation-analysis/

-

Joel Koh. Ultimate Guide to Stablecoins: USDT vs USDC vs BUSD vs UST vs DAI vs XSGD. Seedly. Sep 21, 2021. URL: https://blog.seedly.sg/best-stablecoins/

-

Robert Sams. A Note on Cryptocurrency Stabilisation: Seigniorage Shares. Oct 24, 2014. URL: https://blog.bitmex.com/wp-content/uploads/2018/06/A-Note-on-Cryptocurrency-Stabilisation-Seigniorage-Shares.pdf

-

Dennis Z. 2019 Stablecoin Review Everything to Know about Stablecoin Landscape. Mar 28, 2019. URL: https://metisdao.medium.com/2019-stablecoin-review-679988a6eb6b

-

Haseeb Qureshi. A Visual Explanation of Algorithmic Stablecoins. Investor at Dragonfly Capital. April 28, 2021. URL: https://medium.com/dragonfly-research/a-visual-explanation-of-algorithmic-stablecoins-9a0c1f0f51a0

-

Benjamin Simon. Stability, Elasticity, and Reflexivity: A Deep Dive into Algorithmic Stablecoins. Insights. Dec-11, 2020. URL: https://insights.deribit.com/market-research/stability-elasticity-and-reflexivity-a-deep-dive-into-algorithmic-stablecoins/

-

The Intern. Wormhole V2 for Terra — The UI Walkthrough. Oct 20, 2021. URL: https://medium.com/terra-money/wormhole-v2-for-terra-the-ui-walkthrough-595ca6649ae8

-

The Game (Theory) of Olympus. OlympusDAO. Mar 16, 2021. URL: https://olympusdao.medium.com/the-game-theory-of-olympus-e4c5f19a77df

Feedback

Contents Also Share to Kikitrade Community

轉載請註明出處與作者

聯繫郵件:nctu.frank@gmail.com

更多關於我: CompoundWater複水

IG/TG/YT/FB/Linkedin/Twitter: 頻道搜尋 @compoundwater

歡迎自由斗內支持(ERC20): 0xc2Ac7F93D54dfbf9Bf7E4AeD21F817F2ce598D28