Welcome to a new edition of the Buffer Digest, our weekly protocol briefing. We're thrilled to provide a recap of our achievements from the past week and exciting announcements. Also, we'll share our future strategies for expanding the project and fostering community growth.

TL;DR

-

Numbers: Key Stats of the Week, Platform Updates, Airdrops and Fees Burn

-

An Exciting Update to V2.5 Testnet: Gasless Account Registration and Creation, Forex and Commodities Trading Pairs

-

V2.5 Feature Highlights: for Limit Orders, Early Close, Private Trading

-

Ecosystem News: A feature by Across Protocol

-

Market Commentary: Decline in BTC and ETH Volatility, Term Structure Steepens, Market Showing Resilience to Macroeconomic Factors and a Focus on Sector-Specific News

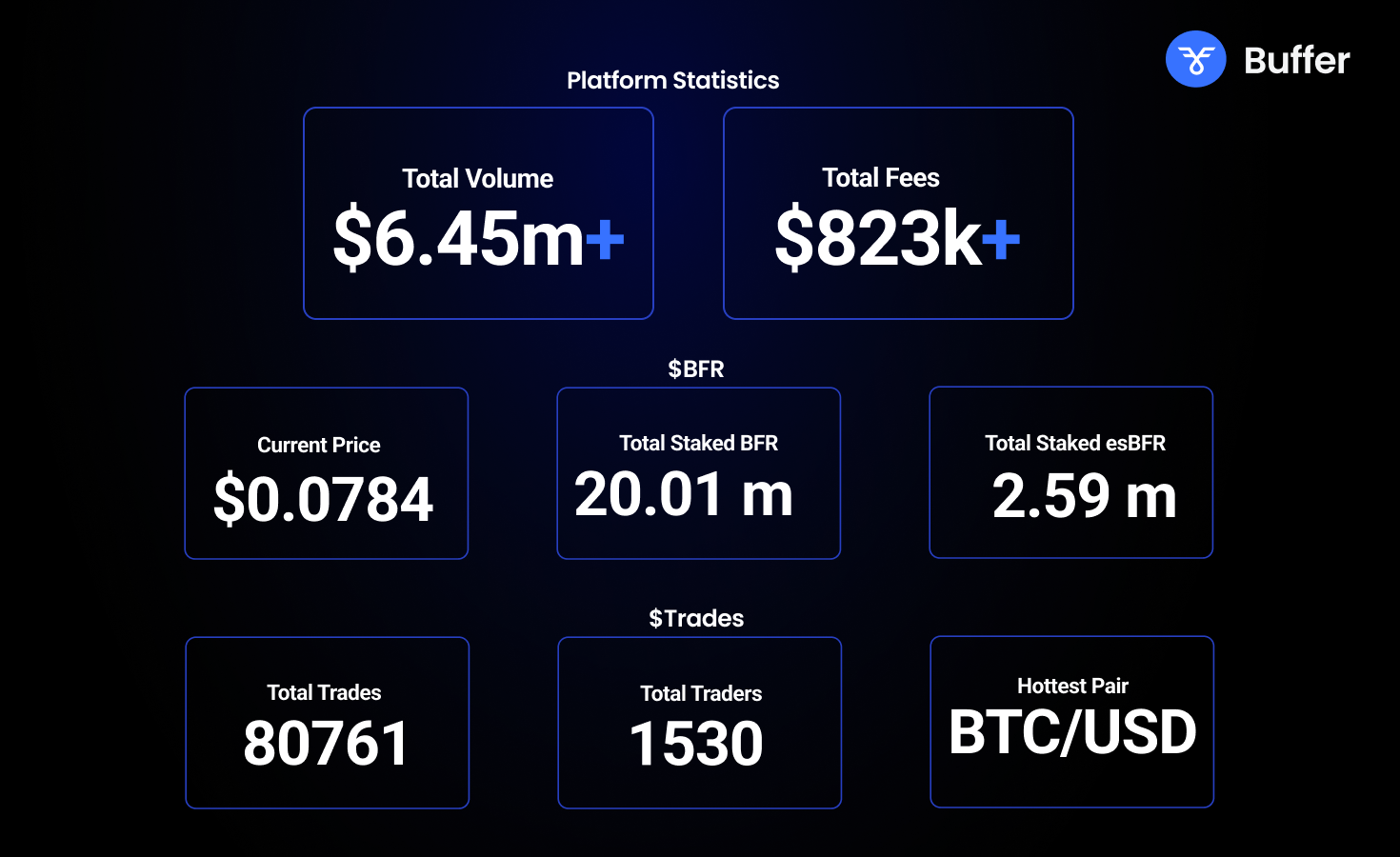

Key Stats for this Week:

Platform Updates:

Updated APRs:

Fee Burn:

- 1075 $BFR burned

Airdrop #6 to $BFR stakers:

Exciting Updates to v2.5 Testnet

Gasless Account Registration

With the new update, we have completely abstracted gas payments from the user flow on Buffer.

Prior to this update, the user still had to sign and pay for gas for 1 Click trading account registration and asset spend approval.

This is made possible with the EIP 2612 permit that allows the trader to grant contract allowance through an off-chain "permit" message. This eliminates the need for a separate approve() transaction. Besides seamless UX, it also can help users reduce their approval footprint, allowing them to interact with dApps more safely.

Note: on the testnet version, users might have to pay AETH for claiming USDC from the faucet. This action is exclusive to the testnet, the mainnet will be truly 0 gas, 0 approvals everything!

New Markets on Testnet:

Commodities:

-

XAG/USD

-

XAU/USD

Forex:

-

GBP/USD

-

EUR/USD

V2.5 Feature Highlights - Continued

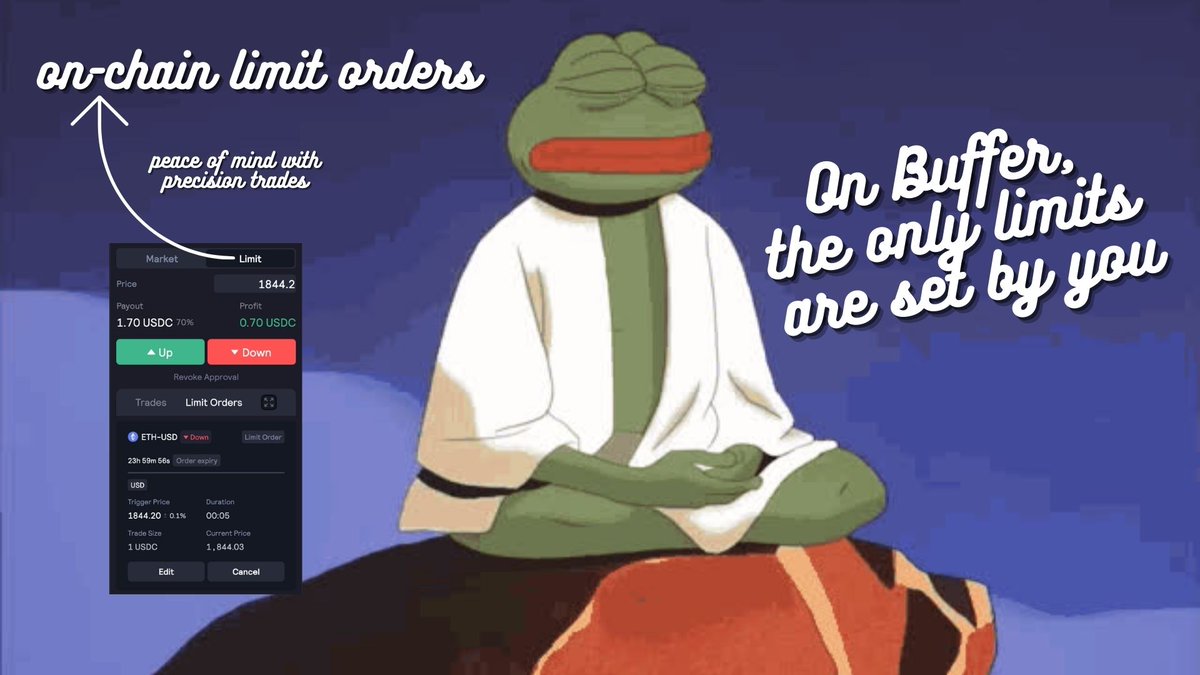

Limit Orders

Limit orders are a way to enter or exit a trading position at a price specified by the trader, all without any extra wallet approvals.

If and when the market reaches your target, your order will be executed automatically. The maximum expiration for limit orders on Buffer is 24, and this has been edited as long as the order is in the queue and the target price has not been reached.

Limit orders are mostly utilized by traders who want to execute their trades at a desired price range without constantly having to monitor market volatility.

It is also a way to hedge risk & ensure losses are minimized by capturing sale prices at specific levels.

Early Close

Designed to enhance the trading experience - the early close feature is your greatest ally when it comes to position management.

You can choose to exit a position early to either lock in gains or minimize losses in a single click.

A position can be closed early by clicking ‘early close’ on an open position in the ‘Trades’ tab directly below the trading dashboard.

Alternatively, you can also click on the ‘Close’ button on the ‘Trade’ activity dashboard.

Private Trading

Private trading will be a default mode for all active trades on Buffer v2.5. This feature protects hardworking traders from malicious strategy mining by copy-trading bots.

A system that allows you to monetize your position data is in the works and will become available in later updates.

v2.5 is already live on Arbitrum Görli Testnet.

-

Check it out:http://testnet-v2.buffer.finance

-

Password: BuffellowsGo!

Ecosystem News:

Can we take a moment to appreciate the latest feature on Buffer Up/Down trading by Across protocol…

Across Protocol is the fastest, cheapest, and most capital-efficient cross-chain bridge.

Why do we at Buffer Finance wholeheartedly recommend Across Protocol to our users?

The answer lies in its relentless pursuit of capital efficiency:

-

Across continuously optimizes to lower gas fees (bundled transactions)

-

Its decentralized relayer network drives down fees for the end users.

Market Commentary

The cryptocurrency market, particularly Bitcoin (BTC) and Ethereum (ETH), is currently more responsive to sector-specific news rather than macroeconomic events. This has led to occasional spikes in volatility.

Volatility Trends:

-

Both realized and implied volatilities (RV and IV) for BTC and ETH declined last week.

-

A sudden drop in prices on Tuesday caused a brief surge in volatility, but stability was quickly restored.

-

Following the Federal Reserve's 25bps rate hike, BTC's short-term IV dropped, while 30-day contracts remained stable.

-

Despite IV being low, it's not considered cheap when compared to RV, with the 7-day Volatility Risk Premium (VRP) hovering around 7–11 vols.

Term Structure:

-

The term structure for BTC and ETH became steeper in contango, especially at the front end, driven by persistently low realized volatility.

-

The long end also dipped, with bursts in IV quickly suppressed by large-scale selling of straddles and calls.

-

Both BTC and ETH term structure richness reached levels not seen since the start of the year.

Skew Term Structure:

-

Bitcoin's skew steepened with increased front-end puts and long-term call premiums, indicating long-term optimism.

-

Ethereum's skew saw a rise in front-end put premiums but a decrease in long-term call premiums, leading to discounted rates for long-term Ethereum calls compared to Bitcoin.

Trading Activities:

-

Trading peaked mid-week with significant flows involving zero-cost risk reversals and custom structures.

-

For Ethereum, block trades were prominent, with notable trades in various call spreads and custom strategies.

-

Despite major sales and purchases, the overall positive net flow remained undisturbed.

Over the past week, BTC and ETH have shown resilience to macroeconomic factors like interest rate hikes, focusing more on industry-specific influences. The volatility landscape underwent significant changes, with a decrease in both RV and IV. Trading activities reflected these shifts, with the market adopting more complex strategies.

And that’s a wrap for this week’s digest, next on the cards is the long-anticipated release of the lookbacks upgrade for guaranteed order execution.

Stay tuned, it’ll be worth the wait!

About Buffer

Buffer Finance is a non-custodial exotic options trading platform that provides defined-outcome and fast-paced trading across both crypto and non-crypto markets, including forex, commodities, and indices.

Buffer simplifies the intricacies of options trading, allowing DeFi-native traders to trade multiple assets entirely on-chain without the added complexities of liquidation, funding rates, or scam-wicks.

Website: https://buffer.finance/

Telegram: t.me/bufferfinance

Twitter: twitter.com/Buffer_Finance