February has been another great month marked by utility-driven partnerships, including our recent collaboration with Gamma Strategies.

What utility does the partnership bring - what is Gamma Strategies, and how can you leverage the partnership for a hands-off LPing experience with low price impact, & minimal impermanent loss?

Let’s figure that out in this blog post.

What is Gamma?

Gamma strategies is essentially a non-custodial, permissionless active liquidity manager specifically for concentrated liquidity AMMs, including Uniswap v3 style DEXs, QuickSwap v3, Zyberswap, etc.

The main innovation around Uniswap v3 allowed LPs to choose price ranges, which lowered price impact that simply LPing on full range liquidity AMM. Although this was revolutionary in terms of capital efficiency, LPs were essentially left to monitor their positions to re-adjust the price ranges whenever the underlying price moved outside of the set price range. This is where Gamma comes in.

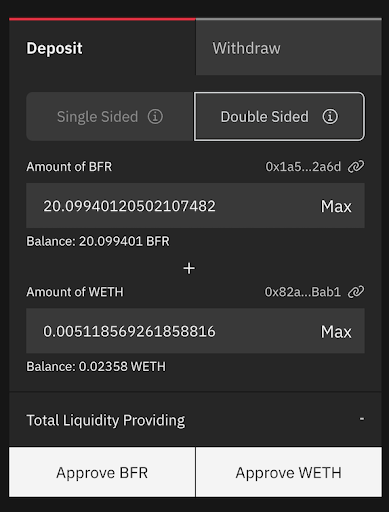

From the user perspective - you supply liquidity by depositing assets in the ratio determined by the strategy. Then, these assets are deployed to Uniswap v3 allowing for passive LP, relying on gamma to manage liquidity ranges.

What is the Buffer x Gamma Partnership?

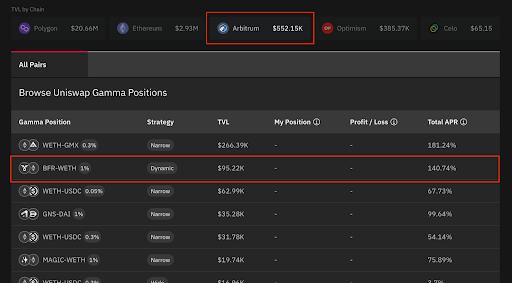

Under this partnership, Gamma has launched support for managing a liquidity position for Uniswap v3 on BFR-wETH.

To summarize:

-

Accrued fees will be compounded back into the position regularly on behalf of LPs compounding yield.

-

Auto-rebalancing allows for a truly set & forget LP experience

If you’re curious to learn more about the strategy employed to generate a fee APR of 137.16% on BFR-wETH, jump to the next section - “Dynamic Strategy.” If you are more of a hand-off, learn-and-try type, jump to the “how to provide liquidity to the BFR-wETH pool” section.

Dynamic Strategy

The BFR-wETH pool utilizes Gamma’s Dynamic Uni v3 management strategy. What does that mean? Let’s take into account Gamma’s recent article explaining the dynamic strategy:

Gamma’s wide-range strategy caters to long-term liquidity providers and their risk preferences. It takes into account high volatility and rewards in the selection of ranges. At the same time, their narrow-range strategy caters to short-term liquidity providers and their risk preferences. The narrower ranges will earn more in fees and rewards but likely incur more losses in a high-volatility environment.

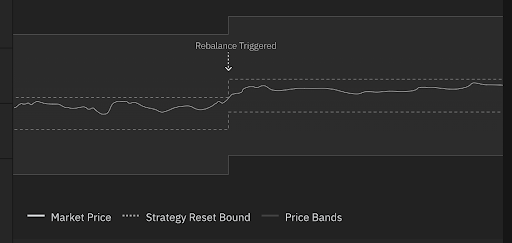

Under Gamma’s dynamic range strategy, both wide and narrow LP positions are automatically rebalanced when certain rebalance triggers are met. In the case of the BFR-wETH pool, a liquidity range is set at 10% and 1,000% of the current price, and rebalance triggers are set at 7.5%. When the price moves from 7.5% of the distance from the current price to either the lower or upper range, the position will be automatically rebalanced in a new range of 10% and 1,000% of the current price.

How to provide liquidity to the BFR-wETH pool?

To activate liquidity management for your BFR-wETH UniV3 position, follow these 4 simple steps:

Step 1: Go to https://app.gamma.xyz/dashboard on Arbitrum.

Step 2: Choose the BFR-wETH pair from the list and click to view the strategy details:

Step 3: Supply liquidity in BFR & wETH. (first-time users might have to approve their tokens on Gamma first before depositing)

Step 4: Approve your LP tokens, and you’re done!