Shigeru, CGV Research

Nowadays, Web3 is no longer an armchair theory or an Internet buzzword. It is perceived by many people as the technological revolution that subverts the Internet.

However, looking around the world, few Web3 applications have a host of users. Probably the only renowned Web3 application with the most users is Bitcoin.

— Jack Dorsey, a former Web3 advocate and Twitter founder who converted the first tweet into NFT, claimed that “You don’t own web3. The VCs and their LPs (limited partners) do. It will never escape their incentives.”;

— Moxie Marlinspike, founder of Signal, an encryption communication application, discovered that Web3 may be a false proposition, after developing two DApps;

— PandaDAO, which raised 1900ETH, started the dissolution process less than one year after its founding, just because “the core work of the community is to vote, and there is no time to do other things”…

Currently, it is fair to say that the world of Web2 is definitely better than that of Web1. Many people wonder if the world of Web3 is better than that of Web2.

It makes no sense without users. The natural selection of users determines the prosperity of the Web3 world or not.

In the Web2 world, Facebook has more than 3 billion global users, YouTube and WhatsApp have more than 2 billion users, and WeChat and Tik Tok have more than 1 billion users.

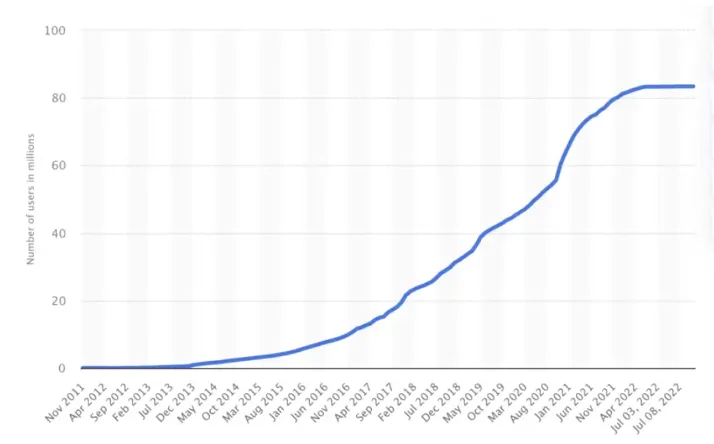

According to the data of TripleA, a cryptocurrency payment company, there were more than 320 million users of cryptocurrency and Web3 worldwide in 2022, which was about 4.2% of the global population. If we compare the current user volume of Web3 with that of the Internet, we can find that the current development stage of Web3 is roughly equivalent to the Internet in the late 1990s. Andreessen Horowitz (a16z) predicted that Web3 might have 1 billion users in a short time.

So, what are the areas in which applications will attract billion of Web3 users?

Stay away from “pseudo-Web3 applications” dressed in Web3

Discard the false and retain the true. Not all so-called Web3 applications are authentic.

In the field of GameFi, there are many “pseudo-Web3 applications”.

Literally speaking, GameFi, consists of two parts, namely game, and finance. In a nutshell, it means that game players earn cryptocurrency by playing games. Famous GameFi games such as Axis Infinity, DeFi Kingdoms, etc., fail to impress 3 billion game players around the world, and gradually move towards a death spiral with the recession of the encryption market.

Taking Axie Infinity as an example, since 2021, by allowing players to “Play-to-Earn”, it has been advocating that “blockchain games can promote a fairer global economy and provide people around the world with more opportunities”, which has been favored by the market. However, 14 months later, most people stopped playing the game. They generally felt angry, and anxious. Some even lost thousands of dollars.

A healthy GameFi project has a well-established ecological mechanism of internal and external circulation, such as obtaining external benefits through commercial cooperation. As for the GameFi projects that rely on the Ponzi model for user growth, the income earned by early users comes from the principal invested by late users. If the income of the project cannot keep up with the growth rate of the debt, the collapse is only a matter of time.

Similar problems exist in the field of NFT, which is dominated by avatars and profile pictures (PFP).

In the past, PFP was almost synonymous with NFT. When mentioning NFT, you may think of the boring ape head that costs several million dollars a piece. However, without functional support, effective incentives, and healthy circulation of the creator economy, the vast majority of PFP projects have little value, and they only seek the recognition of a group of users to support their value. Compared with the market peak at the beginning of 2022, the overall transaction volume of the NFT market has dropped by more than 90%, the mainstream PFP projects have dropped by 60–70%, and other projects are even more miserable.

The same is true of the once-popular Metaverse projects. Compared to Roblox’s 202M monthly active users, Minecraft’s 141M monthly active users, Sandbox and Decentraland only have 200k and 56k monthly active users, respectively. It seems that Decentraland and Sandbox are overvalued.

It can be said that in addition to the above fields, there are a large number of “pseudo-Web3 applications” in DeFi, DID, DAO, Sociafi, and other fields. They may be the products of the capital bubble or the historical heritage of the technological growth cycle, which cover up the true value of Web3 applications.

It’s time for us to seek the value essence of Web3

From the perspective of the first principles, let’s explore the essence of Web3 to gain insight into its next development direction.

Web3 is generally regarded as the industry form closest to “value Internet”. In fact, Web3 is not a simple upgrade based on Web1 and Web2. Its core is to build a new network with decentralization, value co-creation, and distribution according to the contribution, thus giving users real data autonomy.

So, how should we define “Web3 application”? Based on the views of the industry, CGV Research team reckons that the Web3 application is based on blockchain technology, takes Token as a tool or medium, and addresses users’ actual needs as the starting point to support users’ interactive operations, thus realizing the creation, distribution, and circulation of value.

Obviously, the Web3 application is not a panacea for all issues, nor is it suitable for any scenario. If you develop a Web3 application to cater to the trend of Web3, it will be in vain.

What are Web3 applications suitable for and not suitable for?

This is a question that should be on the minds of anyone investing in Web3. I quite agree with Alex Xu of Mint Ventures that the underlying value of Web3 lies in its unlicensed and global nature, providing a free market with unprecedented scale and boundaries. The open source of code and the verifiability of data offer a lower cost of trust in this unprecedented and prosperous free market.

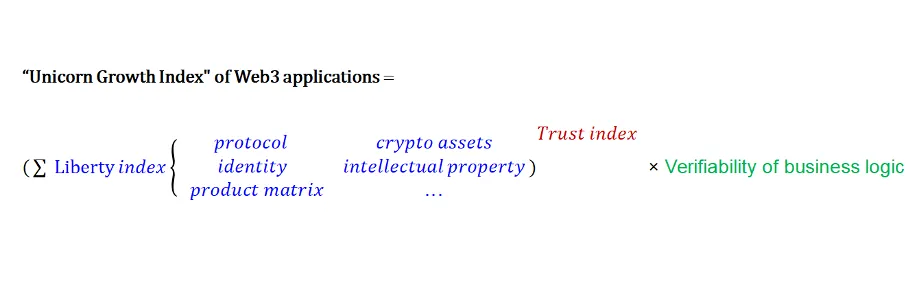

Therefore, “liberty” and “trust” are the core advantages and essential values of Web3.

In terms of Liberty, it includes the free combination and migration of assets, agreements, identities, product matrices, intellectual property, and other fields; with respect to trust, based on the tamper-proof, transparent and open characteristics of blockchain technology, Web3 has established a new trust relationship different from the traditional trust that relies on justice, violent authority, customs, and culture.

If a Web3 application suitable for a business scenario is not well designed in terms of “Liberty” and “trust” and has no business planning, it will encounter major challenges in future operations.

For example, projects that transfer real assets on the chain (such as synthetic assets, STO, etc.) do not get rid of the original credit system (based on the law, government’s asset identification), so it does work well in Web3 field; as for crypto native Web3 assets, their business flows can all be operated on the chain, which has the dual advantages of Liberty and trust.

In addition to giving full play to Web3’s advantages of “Liberty” and “trust”, the ability to have basic business logic ensures the sustainable operation of Web3 projects.

Looking back at StepN, a phenomenal Web3 application in 2022, although its attempts to solve various issues related to product growth, IPO fundraising and corporate governance with a set of X-to-earn economic models deserve some credit, it encountered a tremendous recession in the later stage. The biggest issue of StepN is similar to that of GameFi mentioned above, that is, the project’s business model is not sound and does not create much extra-ecological value. It turns forward debt (NFT sales revenue) into cash proceeds, weakening the value creation ability of the project.

Therefore, the CGV Research team argues that the success of Web3 applications lies in the digital elements of “Liberty” and “trust”, and the verifiability of business logic, which are indispensable. In this regard, the team proposes the “Unicorn Growth Index” of Web3 applications:

Six types of Web3 projects that have the potential to grow into “unicorns”

1.Mobile crypto digital wallet

Liberty index: ☆☆☆☆

Trust index: ☆☆☆☆

Business model verifiable index: ☆☆☆☆☆

Web3 Unicorn growth index: ☆☆☆☆☆

The crypto digital wallet has two attributes, namely asset account, and identity symbol. The first step for users to access the Web3 world is to create a crypto digital wallet. Whether it is to create an account in a centralized exchange, register a decentralized wallet or purchase a hardware wallet, users need a wallet to access Web3.

In 2009, Bitcoin enabled the existing asymmetric key pair technology to be used to write to the public database, thus creating the first “crypto wallet”; In 2016, MetaMask was officially launched, which opened the door to dApps. It is unlike previous wallets and platforms that focused on interacting with crypto assets such as Bitcoin.

Number of global wallet users from November 2011 to July 11, 2022 (Unit: million) Data source: https://www.statista.com

With the development of crypto assets, wallets have undergone changes in different stages: from single-asset wallets and single-chain wallets to multi-chain multi-asset wallets, from single transfer and collection to blockchain ecological aggregation service platform, which generates mobile wallets, public-chain ecological wallets, transaction platform wallets, asset custody wallets, hardware wallets, identity wallets, and other sub-tracks.

In addition to the traditional business model of attracting users and developing the fund deposit function, crypto wallets provide value-added services (wealth management products, PoS mining, trading, asset aggregation, market information, etc.), as well as advertising and other ways to increase revenues.

We are optimistic about the development of mobile crypto wallets and have the opportunity to become the data flow and distribution platform of Web3 applications, which will ultimately promote the paradigm shift of the entire Web3 track from “wealth creation effect” to “daily application”.

Mobile crypto digital wallets worth attention include:

Metamask: (@MetaMask) 30+ million monthly active users. Lightweight Ethereum open-source wallet is also a kind of APP wallet; It has the function of testing Ethereum smart contract and supporting the most complete Dapp; it can be compatible with hardware wallets such as Ledger and Trezor.

TrustWallet: (@TrustWallet) an unmanaged mobile multi-chain crypto wallet that has more than 58 million users and supports more than 8 million tokens and various gateways to thousands of Web3 dApps.

**BitKeep: **(@BitKeepOS) 8 million users worldwide, the largest Web3 multi-chain wallet in the Asian market, adopts various security mechanisms such as hot and cold separation, offline signature, and supports 80+ mainnets, one-click cross-chain transactions, and other functions.

2. “Play-and-Earn” game

Liberty index: ☆☆☆☆

Trust index: ☆☆☆☆☆

Business model verifiable index: ☆☆☆☆☆

Web3 Unicorn growth index: ☆☆☆☆☆

Just like the importance of games to the Internet economy, crypto games have been regarded as the optimum driving force for the growth of users of the Web3 ecosystem.

Although crypto games have a huge potential market, it is not interesting for most players. Currently, GameFi or P2E (Play-to-Earn) is the most common crypto game. Their biggest advantage is to offer players the opportunity to earn money. But the simple incentive to make money through play is not necessarily a sustainable model. If the cycle is extended to half a year or longer, you will find no successful practice project.

To play Web3 games, we still have to respect the game attributes and pay attention to the fun, which is the real value.

As the market fever wanes and user interest shifts, Web3 games have a new trend of Play-and-Earn. On the one hand, Web3 games draw on the Free-to-Earn model of traditional games, so that everyone can participate for free and some players can make money; On the other hand, Web3 games create complete on-chain games and autonomous worlds. The core logic of games is on the chain, and they will adopt the open architecture, autonomous existence, and combination in the future.

Unfortunately, the typical representative of the “Play and Earn” game has not yet appeared. Who will be the next Axis Infinity and StepN needs to be tested by history.

While games are still exploring how to strike a balance between the entertainment experience and the financial incentives, the capital is betting on the market. In May 2022, a16z launched a $600 million fund dedicated to investing in Web3 gaming startups, mainly in three areas: game studios, consumer applications that support the player community (take Discord for example), and game infrastructure providers. Superficially, the three fields are scattered, they only have one goal, to create real Web3 games.

It is worth noting that the next generation of “Play-and-Earn” games, projects related to Web3 game industry, may be created by them:

**TreatureDAO: **(@Treasure_DAO) a decentralized game platform and distribution platform that meets the needs of independent developers through perfect infrastructure and ecology, and forms an economy by accumulating players’ activity content. Currently, it is the №1 game and NFT ecosystem on Arbitrum, with more than 100,000 players.

SkyArk Studio: (@SkyarkS) an AAA blockchain game studio, which launched on-chain and asset-only series of games such as SkyArk Chronicles, as well as the exclusively developed NFT game engine. The engine allows NFT to be interoperable, editable, and evolvable, and helps players use NFTs in different games with different gameplays.

Bedlam: an electronic sports game center, a platform for creating and hosting personal game identities (performance statistics and content) for Web3 games. Users can participate in leagues or tournaments and follow their favorite teams.

3.Phydigital application

Liberty index: ☆☆☆

Trust index: ☆☆☆☆

Business model verifiable index: ☆☆☆☆

Web3 Unicorn growth index: ☆☆☆☆

In terms of crypto native and Web2 brands in fashion and entertainment, Web3 offers opportunities to bring digital and real-world objects and experiences to their audiences. The new popular pairing of the physical world and the digital world has coined a new term “phydigital”.

“Phydigital” (“Physical” plus “Digital”) integrates physical environment or physical objects and digital or online technology-driven experience. It was first proposed by Momentum, an Australian marketing agency, in 2013.

We reckon that, in a broader sense, physical projects with digital performance and digital projects that affect the physical environment or physical objects can be taken as phydigital applications. They represent a broad category of Web3, enabling blockchain developers to figure out new approaches that combine the physical and digital worlds.

In 2022, Tiffany, a luxury jewelry company, launched “NFTiffs” to the holders of CryptoPunks, with a physical version of the diamond pendant. 250 NFTiffs sold out within 20 minutes after their debut and created $12.5 million of revenue for the company. The creation of this “phygital” project is an innovative business attempt by luxury goods to Web3.

In December 2021, NIKE announced the acquisition of RTFKT, a virtual fashion brand, and regarded it as the fourth largest independent brand in addition to Nike, Jordan, and Converse. It can be seen that Nike has raised NFT construction to the level of brand strategy. RTFKT is building a physical shoe, which employs Nike’s electronic shoelace Adapt technology. Consumers can exchange corresponding physical shoes after purchasing virtual ones.

NBA Top Shot is a blockchain collection game jointly created by NBA, NBPA, and Dapper Labs. It aims to turn the highlight moments of NBA games into tradable digital game cards. In other words, the paper card exchange that fans used to need to do offline can take place anywhere, anytime online.

In addition to the above FMCG and luxury goods, the physical card business of the financial category is trying to connect with Web3. Visa and Mastercard jointly develop cryptocurrency debit cards with different Web3 companies. For example, Blockchain.com will cooperate with Visa to launch a debit card, which is associated with the client’s crypto account. There are no fees for the transactions of this debit card and users can get 1% cryptocurrency cashback.

By integrating the physical and the digital world, phydigital drops are no longer used to buy items for display, but to produce more things by combining various parts of the real world and the virtual world to create unique experiences.

In the initial stage, phygital products integrate physical and virtual products. With the convenience of social sharing and DIY derived from virtual products, we can get a glimpse of the great potential generated by the combination of phygital and Web3.

At present, the providers of phydigital application solutions that deserve attention include:

RTFKT Studios: (@RTFKT) it adopts the latest game engine, NFT, blockchain certification, and augmented reality, and applies manufacturing expertise to create unique sneakers and digital artifacts.

Dapper Labs:(@dapperlabs**)**it is the company behind the well-known projects CryptoKitties, NBA Top Shot, NFL All Day, UFC Strike, and Flow blockchain. It uses blockchain technology to develop NFT and new forms of digital engagement for fans around the world, paving the way for a more open and inclusive world that starts with games and entertainment.

4.Web3 growth stack application

Liberty index: ☆☆☆

Trust index: ☆☆☆☆

Business model verifiable index: ☆☆☆☆☆

Web3 Unicorn growth index: ☆☆☆☆

Web2 embraces Web3, which will facilitate the breakthrough in Web3 and attract huge incremental users. According to statistics, 43 of the top 100 brands in the world, including Starbucks and others, are testing the alternative use cases of Web3 and NFTs.

Major Brand Flagship NFT Collection Launches Source: Messari

Shayon Sengupta of Multicoin Capital first proposed the concept of “Web3 Growth Stack”, that is, product managers and marketing personnel use Web3 technology to build tools to acquire, attract and retain clients. The great advantage of Web3 Growth Stack is the ability to tightly couple in-application events with on-chain payments. Web2 products cannot deliver value to users in real time, but Web3 products can and may even fundamentally expand the design space for growth tools and advertising models.

Previously, Starbucks announced the launch of the Starbucks Odyssey, an NFT membership program. Consumers can participate in Odyssey series of travel activities, mainly including interactive games and fun challenges. After completion, consumers will receive a collectable Digital Journey Medal (NFT) as the reward.

The Digital Journey Medal can be traded as NFTs, upgrading participate-to-ear to collect-to-earn and improving user stickiness and repurchase; Starbucks members have NFTs, which means that the data is uploaded on the chain. Other brands (cooperative or competitive brands) can perform various airdrops for these members, which has evolved into airdrop-to-ear. The more active the members are, the more NFTs they have, the more airdrops they will get, and the stickiness and repurchase of users will be improved.

The essence behind the Starbucks NFT membership program is to follow the user-centered philosophy, where users take back data ownership and gain more value.

Now, more commercial brands are paying close attention to how Starbucks develops and practices in the future; If it works, we will see the great enthusiasm of major brands for the release of the NFT reward points system.

Starbucks has 27.4 million members, Nike has more than 300 million members, and Pizza Hut has more than 80 million members… These brands use the “Web3 Growth Stack” to transform Web3, which may be the fastest way to create Web3 applications with one billion users.

“Web3 Growth Stack” applications that deserve special attention include:

Blackbird: (@blackbird_xyz) a Web3 platform specially designed for the tourism and hotel catering industry. It is committed to establishing direct links between restaurants and guests through loyalty and membership services. It integrates loyalty and member-related products to provide rewards for dining frequency, consumption, etc.

**Layer Infinity: **(@RensOriginal) a Web3 platform established by e-commerce brands. It helps traditional consumer brands easily migrate to Web3, and release NFTs compatible with the Metaverse, which can be bound with physical products. In addition to tracking the authenticity of products and exchanging physical objects, each NFT can be linked to various practical NFTs.

5.Web3 social application

Liberty index: ☆☆☆

Trust index: ☆☆☆☆

Business model verifiable index: ☆☆☆☆☆

Web3 Unicorn growth index: ☆☆☆☆

The social platform has a large number of users, portraits, and behavior data, which contains the huge business value. The most valuable Internet products in the world of Web2 are best illustrated by the valuations of giants like Facebook, Twitter, TikTok, etc.

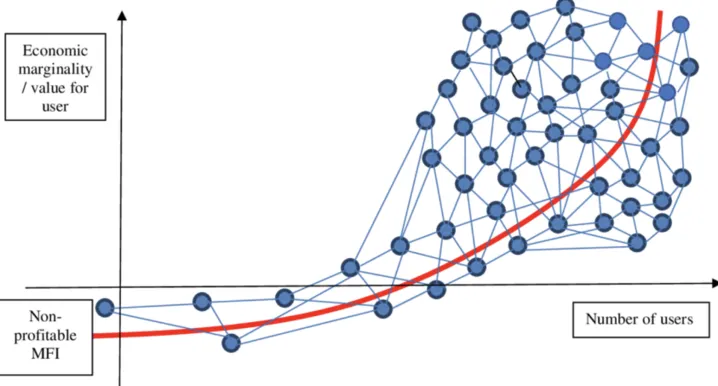

According to Metcalfe’s law, the value of a social network is proportional to the square of the number of users. The more users, the greater the value of social platforms, and then the user growth curve explodes at a single point.

Diagram of Metcalfe’s law Source: MicroFinTech: Expanding Financial Inclusion with Cost-Cutting Innovation

Therefore, the pain point of innovation in social projects is that it is “easy to defend but difficult to attack”. Once a user network is established through a certain paradigm, it is impossible for the latecomers to surpass it.

For the social platform in the Web3 era, the decentralized technology based on the blockchain makes the user’s creative content, social relationship data, identity, and reputation achieve decentralization and composability. People will have absolute control over their social data, thus forming a user-centered social network.

However, the development of Web3 social applications is still at an infant stage. Web 3 products cannot support the billion-level daily user volume of Facebook, WeChat; Web 3.0 products have a higher threshold, but their product experience is poorer than Web2 products.

Besides, most Web3 social products only meet the on-chain social and financial needs of crypto native users. Products that meet on-chain and off-chain social and financial needs may stand out in the future. After all, social is more than just online data interaction. It should be linked to video entertainment, games, music, fitness, and other aspects of our lives.

CGV Research believes that the key characteristics of the next generation of Web3 social applications should include: 1) the cost acceptable to the user; 2) The product experience close to or better than Web 2, and lower threshold for use; 3) cost acceptable to the user data synchronization (both on-chain and off-chain can be integrated); 4) design continuous incentive mechanism through tokens or NFTs; 5) mature community vitality, high user activity, and stickiness.

Overall, social applications are the most promising but the most difficult field for Web3 applications. How to expand infrastructure and implement a sustainable economic model is the current focus and pain point. For the Web3 social applications, we need to take a longer view.

Web3 social applications worthy of attention include:

**Lens Protocol: **(@LensProtocol) an open and composable Web3 social media protocol that allows anyone to create unmanaged social media materials and build new social media applications. Users are free to develop and own the content they create by owning the corresponding NFTs.

**Mask Network: **(@realMaskNetwork) a portal that helps users transfer from Web 2.0 to Web 3.0. It integrates privacy and social networking, a cross-border payment network, decentralized file storage and sharing, decentralized finance, and governance (DAO). It allows users to encrypt their messages on social media platforms, such as Twitter and Facebook. Besides, it has the functions of sending and receiving cryptocurrency red packets, ITO, uploading, and saving decentralized files.

**Galxe: **(@Galxe) a collaborative credential infrastructure that is designed to create user profiles based on the user’s blockchain behavior. Brands and projects can use these Web3 digital credentials for better promotion, such as gamifying their loyalty system, launching marketing campaigns, acquiring users, etc.

6. Creator economy application

Liberty index: ☆☆☆☆☆

Trust index: ☆☆☆☆☆

Business model verifiable index: ☆☆☆☆

Web3 Unicorn growth index: ☆☆☆☆

For many people, the creator economy is a big concept. Its content includes texts, pictures, music, videos, and other forms, each with a different growth logic.

From the perspective of the industry, CGV Research deems that the creator economy refers to the economic form in which independent content creators (such as bloggers, social media KOL, photographers, etc.) publish their original content through digital carriers such as texts, videos, audios, and other channels via platforms or communities, and gain profits.

The creator economy has two key characteristics: first, creators can turn data flow into cash by acquiring fans and followers with unique contents; second, creators can build tools and infrastructure to create or manage content.

According to the Influencer Marketing Hub, 50 million people worldwide participate in the creator economy. By the end of 2022, the market size of the global creator economy reached US$104.2 billion.

However, the current creator economy system has serious income inequality, with a large portion of creators’ earnings being paid to third parties as service fees. On Spotify, each song played once by a paid account only generates a copyright fee of $0.004; only 0.33% of YouTube creators earn full-time income; and only the top 1% of authors on Amazon earn $1,000 in a month. In addition, problems such as the lack of content management rights and vicious competition are commonplace in the current creator economy system.

Web3 is a new generation of Internet based on blockchain infrastructure, which has made the biggest difference between the creator economy and the previous ones. In addition to consumption and creation, users own and freely use the data content created by themselves.

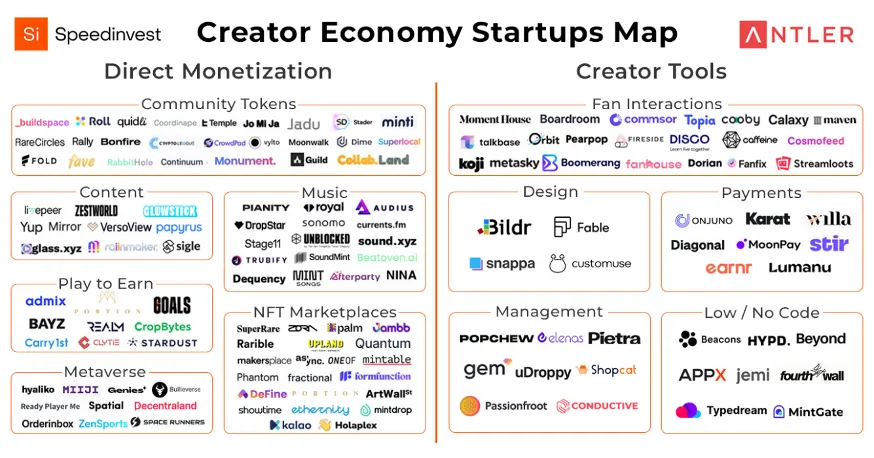

List of global creator economy startups Source: Speedinvest

According to this logic, Web3 will bring three paradigm changes to the “creator economy”: 1) redistribute the value and rights of the platform to creators through independent mechanisms such as tokenization and smart contracts; 2) provide composable and trustable perspectives for people who want to start creating; 3) for the first time, users have the opportunity to gain rewards and own part of the Internet value.

The application scenarios of Web3 creator economy projects include content creation, NFT issuance and trading, community building, fan motivation, and asset management. A complete value chain has been formed to help creators use content, NFT, and social tokens to closely connect with fans.

Of course, it should be reminded that the starting point of the Web3 creator economy is not about grabbing data flow, but abandoning the competition for users’ attention and highlighting productivity. Only by providing better content, can higher revenue be achieved.

Web3 creator economy applications worthy of attention:

**Mirror: **(@viamirror) it combines content publishing with web3 technology, stores content in Arweave, and publishes it to fans by connecting wallets. Besides, all posts on Mirror are mintable, turning fans into collectors;

**Rally: **(@rally_io) YouTube’s Web3 alternative. It is a platform for creators and their communities to build their independent digital economy. It prioritizes creators and allows them to promote interaction with the community around social tokens.

Bill Gates once said: “most people overestimate what they can do in one or two years and underestimate what they can do in five or ten years.”

Now it seems that the Web3 market with 1 billion users is still far away from us. But nothing is impossible, it is only a matter of time.

As a Web3 practitioner, the only thing we can do is to provide better Web3 services to all corners of the world and all aspects of everyone’s life through the constant building, thus making this day come earlier.

Note: This article is a CGV research paper and is for reference only. It does not constitute any investment proposal.

About Cryptogram Venture (CGV): A Japan-based research and investment institution engaged in crypto. It has participated in early investments in Republic, CasperLabs, AlchemyPay Graph, Pocket, and Powerpool, as well as the Japanese government-regulated yen stablecoin JPYW, etc. CGV FoF is the limited partner of Huobi venture, Rocktree capital, Kirin fund, etc. Currently, CGV has branches in Singapore, Canada, and China.

References:

https://a16z.com/2020/12/07/social-strikes-back-fastest-growing-apps/https://multicoin.capital/2023/01/11/the-web3-growth-stack/https://www.robinsloan.com/lab/notes-on-web3/https://future.com/power-of-social-community/https://medium.com/ixfi/SocialFi-what-is-it-and-how-does-it-affect-social-media-as-we-know-it-8c28c023a00dhttps://twitter.com/jolestar/status/1589830650659753986https://coinyuppie.com/SocialFi-the-key-technology-changing-the-globalization-of-the-blockchain-industry/https://medium.com/coinmonks/what-exactly-is-SocialFi-is-this-a-new-cryptocurrency-trend-1d2bf209dd99https://blockcast.cc/news/an-overview-of-the-SocialFi-ecosystem-social-dao-and-governance-tools/